Headline Numbers Say Inflation Has Peaked. Warning Signs Say More Is Coming

Enjoy The "Cooler" Inflation. It's Not Likely To Last

From Wednesday’s suprisingly “cool” July Consumer Price Index report, to yesterday’s cooling Producer Price Index, to yesterday’s Import and Export Price Index, the headline numbers are all saying the same thing: consumer price inflation in this country is heading down at last.

But will the downward trend last? Underneath the headline numbers there are a number of warning signs that suggest more inflation is yet to come.

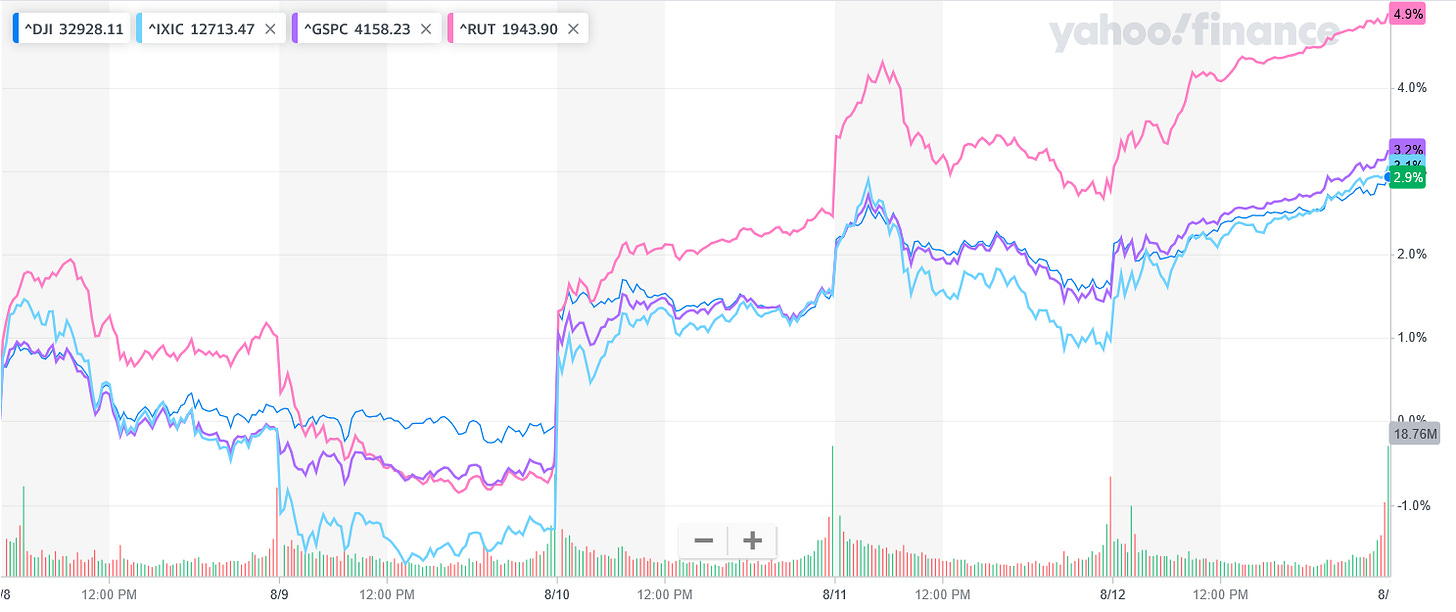

Wall Street Celebrates Lowered Inflation Anyway

Staying true to its usual casino compulsive gambler nature, Wall Street looked at the headline numbers on inflation, shrugged off the warning signs, and ran the markets up to end the week on a high note, with the Dow Jones, S&P 500, and the Nasdaq all up considerably for the week.

Bond yields gave a muddled reaction, with the lower end of the yield curve almost uninverting, with the 1 Year and 2 Year Treasury yields just a fraction of a basis point apart.

The upper end of the yield curve managed to decline on the day yesterday, leaving the 5 Year and 10 Year Treasury yields more deeply inverted than at the start of the day’s trading.

Overall, Wall Street was pleased to celebrate the headline numbers on inflation this week and ignore everything else.

Food Price Inflation Is Still Rising

As I noted previously in discussing the July Consumer Price Index Summary, one CPI component that did not see a decrease in inflation was food. Food price inflation actually rose to the worst it’s been in decades.

It is important to note once again the distortion that inflation inflicts on an economy. Even as overall consumer price inflation dropped by 0.6%, food price inflation actually increased—to the highest level in forty years.

While it is possible that consumer price inflation overall may have peaked in June, it is certain that food price inflation did not.

Even in the Producer Price Index, food price inflation surged in July, rising at a rate not seen since the 1970s.

Prices paid to US producers for finished consumer foods jumped nearly 16% in the year through July, the biggest surge since 1974, according to Labor Department data released Thursday. A good chunk of that was due to a 44.2% rise in the cost of eggs, plus substantial increases in the prices of fresh and dry vegetables as well as beef and veal.

With both the CPI and PPI showing rising food price inflation year-on-year, it seems improbable there will be a downturn in food price inflation next month at least.

Depending on the performance of other CPI components in coming months, food price inflation may yet push overall consumer price inflation back up again.

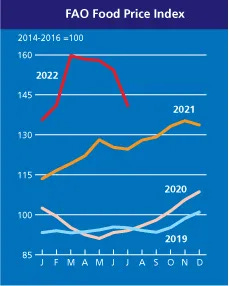

Inflation Still Rising Globally

While the headline numbers from this week’s inflation reports do suggest the US has reached “peak inflation”, inflation data from elsewhere in the world tells a somewhat different story. Rising inflation, not peak inflation, is very much the global norm at the moment.

Even though the FAO’s Food Price Index has retreated in recent months, global food prices (and thus global food scarcity) are still considerably higher than in 2021.

Global inflation is only going to exert upward pressure on US consumer prices for the near term, even if the internals of the US economy are leading towards reduced inflation.

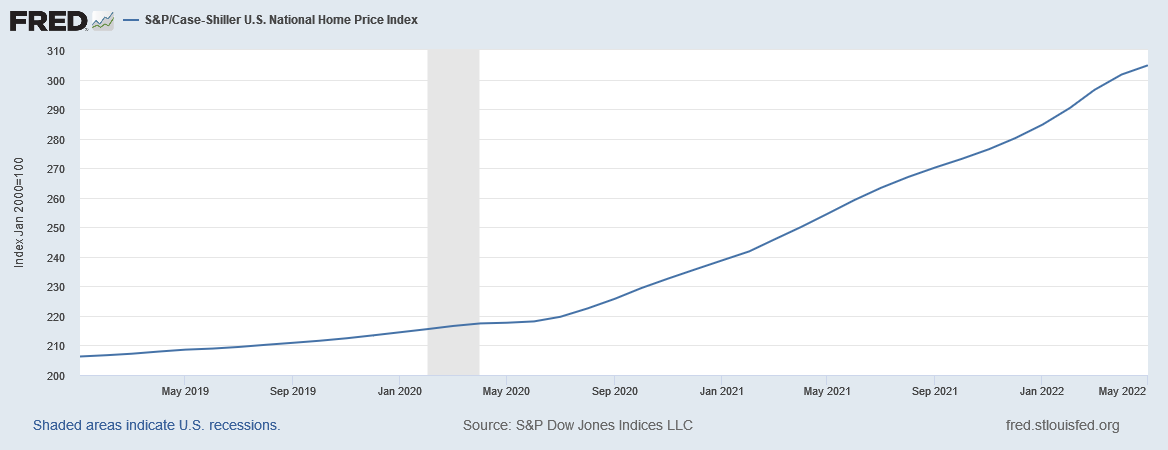

Housing Prices Continue To Surge

One internal of the US economy that is not yet leading towards reduced inflation is shelter. Currently, Manhattan apartment rents are surging even as they set new records monthly.

Median rent for an apartment in Manhattan climbed to $4,150 a month in July, surging 29% from a year ago, according to a monthly report from brokerage firm Douglas Elliman and Miller Samuel Real Estate Appraisers and Consultants. It is up 2.5% from June.

The average rent, which crossed over the $5,000 a month threshold last month, also hit a record high of $5,113 a month.

In southern California, low vacancy rates are translating into higher rents.

“In many of the SoCal markets, there has been a longstanding challenge in delivering new housing,” said real estate economist Carl Whitaker, research director for Dallas-based rental market tracker RealPage. “The lack of supply relative to local housing demand means limited vacancy.”

Vacancy rates this spring ranged from 2.5% in Orange County to 2.7% in the Inland Empire and 3.2% in L.A. County, according to a Southern California News Group composite of three leading apartment indexes — RealPage, CoStar and Moody’s Analytics-Reis. That’s up slightly from last winter, but it’s still well below the region’s average of 4-5% during the decade preceding the pandemic.

Even though shelter has been increasing at a slower pace than the rest of the Consumer Price Index, the continued surge among apartment rents indicate shelter will continue to exert upward pressure on consumer prices.

Even housing prices, which are tracked separately through the Case Schiller Home Price Index, show upward pressure on prices overall.

Inflation Is Receding, Except For Those Parts That Are Climbing

While Washington, Wall Street, and the corporate media are pleased to crow about “cooler” inflation based on the headline numbers, underneath those headlines are a number of data points which are giving off strong warning signals of more inflation yet to come.

There remain considerable systemic upward pressures on consumer prices in the US. Moreover, the systemic pressures do not include the possibility of supply-side shocks, perhaps due to rising tensions with China, or supply disruptions from China’s economically suicidal Zero COVID strategy, or perhaps from supply shocks emanating from the Russo-Ukrainian War.

Wall Street should celebrate the “cooler” inflation while it lasts. There are considerable reasons to suspect that it won’t.

Markets may turn on a dime, but inflation....