Holiday Cheer Is No Substitute For Investment

China Continues To Hemorrhage Foreign Direct Investment

As I noted earlier, there is no denying that China’s Lunar New Year holiday is proving to be a welcome shot of good economic news for the Middle Kingdom.

There is also no denying that the surge in aggregate travel, tourism, and consumption spending throughout the holiday period is unlikely to catalyze greater domestic consumption in the longer term. That simply has not been the historical norm for the holiday upticks in consumer spending.

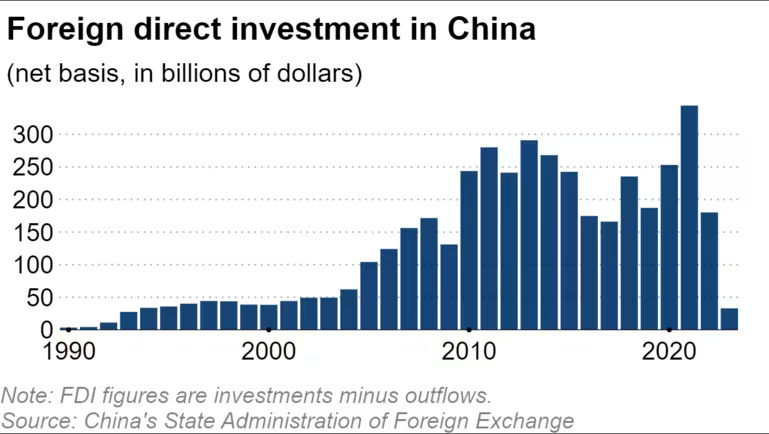

And there is no denying that China’s economic picture outside of the growth of holiday spending is grim, if not downright apocalyptic. The latest indicator of China’s ongoing economic collapse is the steep decline in Foreign Direct Investment (FDI), which China’s State Administration of Foreign Exchange (SAFE) reports is at a 30-year low.

Investment in China by companies based abroad has sunk to the lowest level in 30 years, according to official data released on Sunday, in a sign that foreign corporations are leaving China due to tougher crackdowns on spying and U.S. sanctions.

China's foreign direct investment totaled $33 billion on a net basis in 2023, according to the State Administration of Foreign Exchange, down about 80% from 2022. The figure was positive as new investment surpassed outflows. But FDI declined for the second straight year and is less than 10% of the peak of $344 billion marked in 2021.

There is no word for an 80% decline in foreign direct investment in the space of a single year other than “collapse”. Non-Chinese companies are not only curtailing their new investments in China, but are steadily repatriating the earnings from previous investments.

The magnitude of China’s FDI collapse is driven home by the reality that it has taken just two years to undo nearly 30 years of investment growth.

According to the latest data released by SAFE, since hitting a peak in 2021 of $344 Billion, China has shed more than 90% of Foreign Direct Investment assets by the end of 2023. $22.5 Billion (RMB1.6 Trillion) of that outflow came just in 2023 alone.

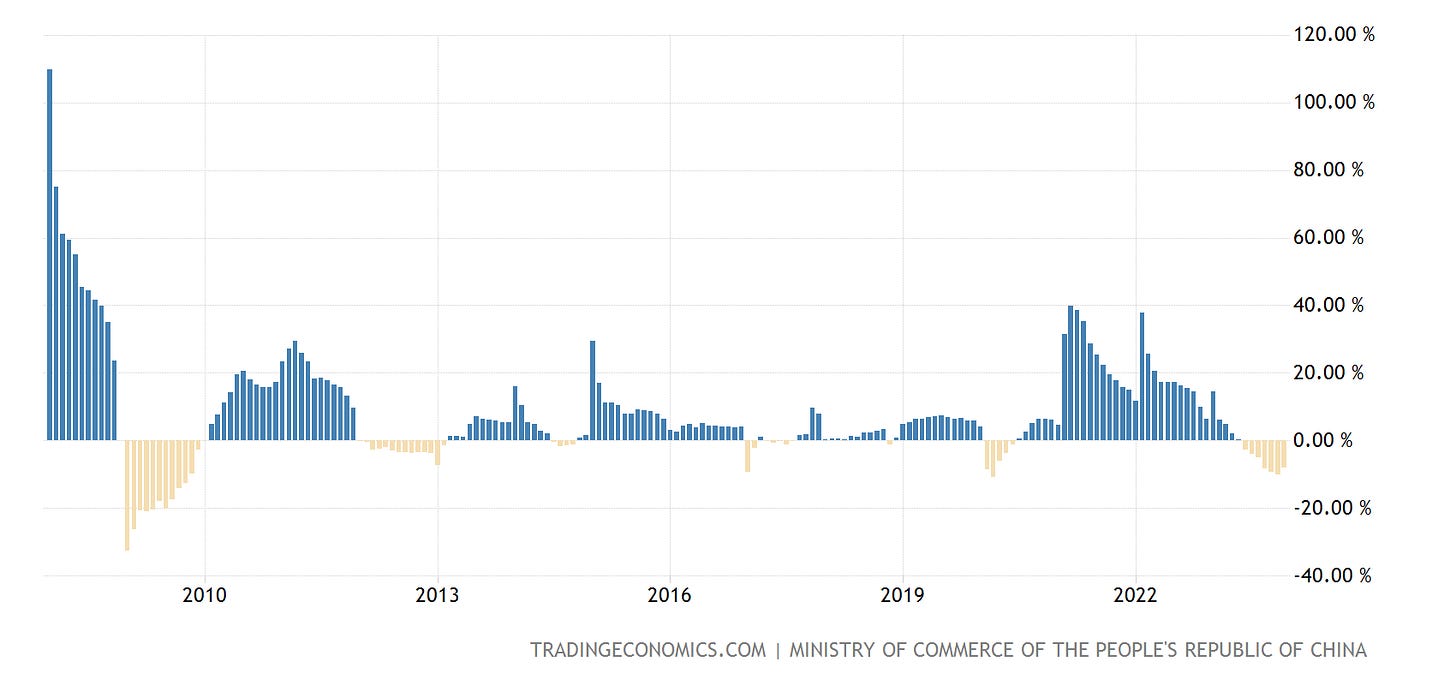

While SAFE is reporting data that is considerably more extreme than the Ministry of Commerce, even that data shows China is experiencing the most dramatic outflow of capital at least since the 2008 Great Financial Crisis.

Foreign direct investment (FDI) into China fell by 8% year-on-year to CNY 1.13 trillion or $157.1 billion in 2023, signaling foreign investors have not fully returned to the mainland after Covid-19. New actually utilized foreign capital shrank in manufacturing (-1.8%) and services (-13.4%). Conversely, it increased in high-tech manufacturing (6.5%), namely medical equipment and instruments (32.1%) and electronics and communication equipment (12.2%), technological achievement transformation services (8.9%), construction (43.7%), and R&D and design (4.1%). Investment in high-tech industries accounted for 37.3% of total investment. FDI climbed from France (84.1%), the UK (81.0%), the Netherlands (31.5%), Switzerland (21.4%), and Australia (17.1%)

As a result of these outflows, even the Ministry of Commerce data shows an 8% decline in overall FDI for 2023.

Nor is the investment outflow limited to just direct capital investment. Foreign companies are also repatriating their earnings from prior investments in China, and have been for some time—so much so that in the 3rd quarter of 2023 China experienced its first-ever deficit in direct investment liabilities, much of which was attributed to earnings repatriation.

"Some of the weakness in China's inward FDI may be due to multinational companies repatriating earnings," Goldman Sachs wrote, adding China's interest rate differentials with developed countries also played a part.

"With interest rates in China 'lower for longer' while interest rates outside of China 'higher for longer', capital outflow pressures are likely to persist."

China’s economic and geopolitical challenges—e.g., rising tensions with the United States and with Europe—are making it an increasingly less attractive place for global firms to want to do business, and they are expressing their view of China by pulling their money out of the country.

Indeed, “capital outflow pressures” are actually increasing, for while much of the rest of the world’s central banks have been raising rates, the People’s Bank of China has been cutting rates, and on Tuesday reduced a key lending rate for homebuyers yet again.

China's move to slash borrowing rates for homebuyers underscores how authorities are trying to prop up a weak housing market with few tools at their disposal.

The People's Bank of China lowered the five-year loan prime rate, a mortgage benchmark, by 25 basis points on Tuesday to 3.95% from 4.2%. Shanghai-listed stocks rose in response to the move.

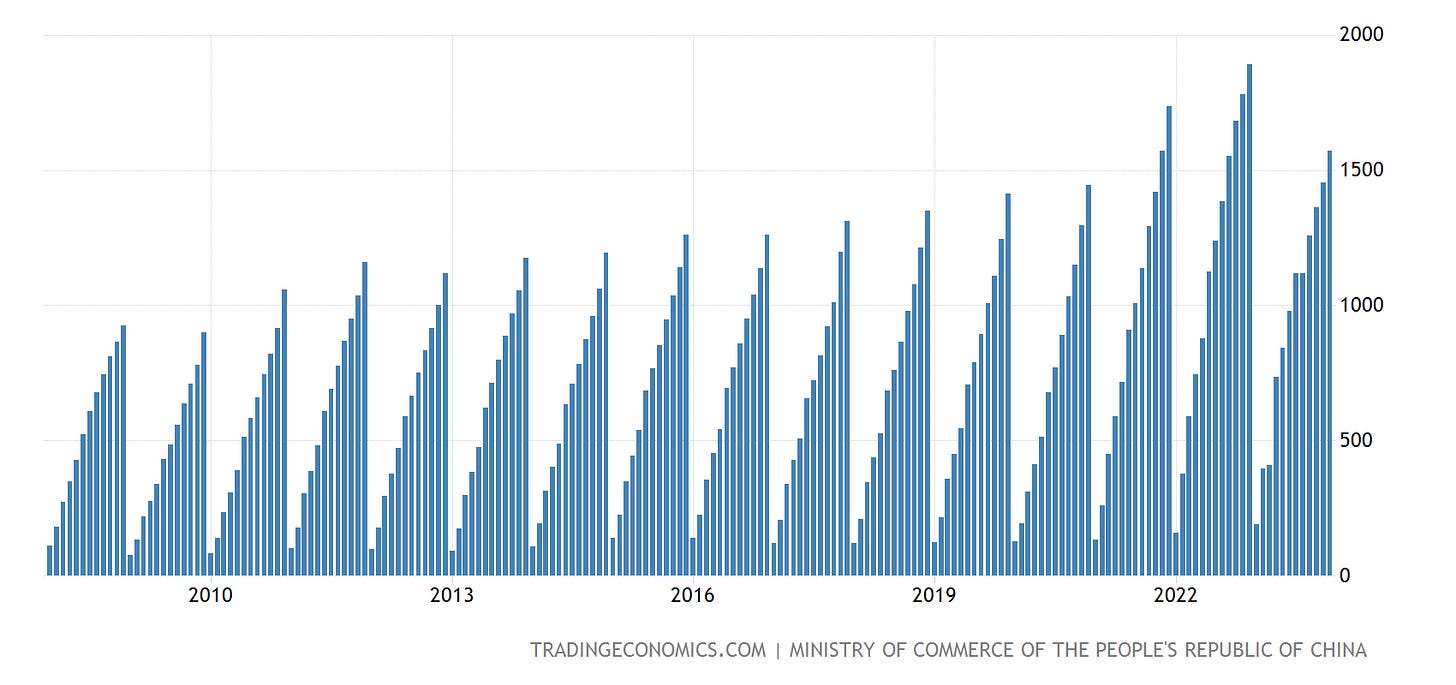

Continued downward pressure on interest rates by the PBoC is intended to spur lending and in particular homebuying, with a view towards stabilizing China’s imploding property markets.

The move was another step in China’s broad campaign to prop up a crumbling housing market and support an economy battling deflation, slowing exports and moribund consumer confidence.

Investors reacted to the news with a shrug. China’s benchmark CSI 300 index was slightly lower in morning trading, while the Shanghai Composite Index was barely changed. China’s stock market is in a yearslong slump, as foreign investors have shifted elsewhere and small investors in the country have lost their nerve.

The problem with the lower rates is that they make Chinese investments less attractive than other options in the globalized financial marketplace. Thus, even without the rising geopolitical tensions between China and the US, and China and Europe, foreign capital is likely to leave China simply to chase higher yields. In a high-rate global economy, low-rate China is just not that attractive an investment for global capital.

This is an existential problem for China. Investment is the basis for tomorrow’s revenue. Investment is the foundation for the future of any economy (or business’ or individual’s fortunes). Without investment, it is not possible for anyone or any nation to have any meaningful prospects for an economic future.

Foreign direct investment is a measure of how other nations apprehend a country’s prospects for its economic future. Nations which offer the best opportunities for economic growth and return on that investment will inevitably attract investment capital from other nations. Conversely, nations with dim prospects for economic growth and return on investment will inevitably experience a withdrawal of that same capital from other nations.

China’s Lunar New Year holiday spending is good news for today, and will be throughout the holiday period. That spending will be a welcome boost to an economy mired in deflation and stagnation.

Unfortunately, as the foreign direct investment data has been showing, that good news is simply not likely to extend past today. Investment is tomorrow’s economic news, and the pace at which China is shedding investment from abroad makes the economic news for tomorrow not at all good.

Money is leaving the Chinese economy, and thus that money will not be available to aid in resuscitating the Chinese economy. Without money, all any economy can do is collapse—which is what China’s economy is increasingly doing.

These numbers are truly staggering. The phrases that immediately come to mind are, “fasten your seat belt, it’s going to be a bumpy ride” and “last one out please turn off the lights”, not to mention my previously posted “abandon ship!”.

It’s also going to be “every man for himself”. Where will the Chinese, multinational corporations, and others park their money for safekeeping? It’s not all going into Swiss bank accounts. How much will be invested in the New York Stock Exchange, American real estate, and the multinationals’ other foreign manufacturing plants? Which Southeast Asian nation will be seen as the preferred investment opportunity, and which African nation will benefit most from the reallocation of investment funds? How will all the economic turmoil affect the dozens of elections held in the world this year? And what draconian measures are the CCP going to implement in a futile attempt to stave further outflow of funds?

We are in for not only a tumultuous year, but a completely unpredictable one. Peter Nayland Kust is the man to help us make sense of it all as it unfolds. Thanks in advance, Peter!

Any chance, in your expert opinion that this is a prewar move?