Is China Turning The Corner?

A Surge In Travel and Tourism During The New Year Holiday Is Giving Rise To A Lot Of False Hopes

China has been desperate for some economic good news, lately, and finally got some.

After months of consistently negative press about deflation, a bursting property bubble, a shrinking industrial sector, China’s Lunar New Year holiday finally delivered the surge in travel and tourism, as well as consumer spending more broadly, that analysts and China watchers have been waiting to see.

In a sign that Chinese consumer sentiment has improved, there was a resurgence in travel over China’s Lunar New Year holiday. According to official reports, more than 61 million rail trips were made on the first six days of the national New Year holiday, a +61% increase in the same vacation period in 2023 and the highest in data compiled by Bloomberg News in the last five years. The main question is, will the pickup in consumer spending point to a sustainable improvement in the Chinese economy?

According to state media reports citing the Ministry of Finance, hotel sales on Chinese e-commerce platforms surged more than 60% from a year earlier. However, some analysts remain concerned that this year’s increase in holiday travel cannot be counted on as an early indication of economic improvement. HSBC Holdings Plc said even though spending by Chinese consumers exceeded expectations, surpassing 2023 was a “low bar” given the country was still contending with a rampant outbreak of COVID-19 at the time.

Nor was the spending spree confined to travel expenditures. In Shanghai, the consumption rebound included both local residents and tourists.

The Chinese New Year holiday in Shanghai saw a remarkable rebound in consumption as various leisure activities appealed to local residents as well as overseas visitors.

According to UnionPay's payment data, the total consumption of inbound visitors from February 9 to February 16 jumped 21.6 percent from a year ago to 15.5 billion yuan (US$2.1 billion) and the number of payments reached 144.5 million times, a 41.8 percent surge from a year ago.

Yet the question remains: can China build any forward momentum toward lifting its economy out of the deflationary doldrums in which it has been mired for months, if not years? Will the holiday spending surge be sufficient to ward off looming “Japanification” for the Chinese economy?

Unsurprisingly, the data gives less cause for optimism than the narrative.

While the early reports on China’s Lunar New Year holiday spending have been unreservedly good, it would be difficult to overstate just how important it is for Beijing that those reports be unreservedly good. In the current state of affairs, China needs some positive economic sentiment even more than it needs positive economic data.

Economic data released just before the country went on holidays showed China’s consumer prices fell last month at the fastest pace since 2009, piling pressure on the government to support the country’s stumbling economic revival.

Deflation is also weighing on corporate earnings, fuelling a sharemarket meltdown that prompted President Xi Jinping last week to sack his top markets regulator to try to halt the slide.

“The economic situation facing Chinese households has worsened as government support measures have failed to stabilise the economy. We think that households are less willing to consume and invest, giving rise to a self-sustaining downward spiral,” Barclays said.

So grim has been the economic news in China of late that Beijing earlier this month took the remarkable step of abruptly replacing the head of its securities regulatory agency in the hopes of halting an extended stock market decline.

China has ousted the head of its securities watchdog, replacing him with a veteran regulator with a reputation for tough action as policymakers struggle to stabilise the country’s sharemarkets.

The cabinet has replaced Yi Huiman as chairman of the China Securities Regulatory Commission (CSRC) with Wu Qing, who has led the Shanghai Stock Exchange and served as a key deputy in Shanghai’s municipal government, the official Xinhua news agency said late on Wednesday.

Even with such measures, heading into the holiday consumer confidence in China was definitely on the wane.

Consumer confidence in China has been waning recently due to its ongoing property crisis and slumping stock market. The slide in consumer confidence has also undercut sales of big-ticket items. According to the China Association of Automobile Manufacturers, Chinese passenger car sales fell by 26% in January compared to December. Gary Ng, senior economist at Natixis SA, said it remains to be seen if the increase in consumer spending over the new year holiday is sustainable, saying, “It is uncertain if this can fully offset the consumption shift away from durable goods, and the downgrade trend for some residents.”

The lack of consumer confidence is hardly surprising, given that decline and deflation have been stalking virtually every sector of the Chinese economy.

As Father Time drew the curtains on 2023, the one thing that was indisputable about China’s economy was that it was in a seemingly unstoppable state of collapse. The stimulus measures attempted by Beijing had to date proven utterly unsuccessful at reversing declines in manufacturing and real estate, as well as persistent consumer price deflation.

Heading into the Lunar New Year holiday, Chinese consumers simply did not have much if any reason to feel confident about their economic futures.

Yet while the general trajectory of China’s economy prior to the Lunar New Year has been down, there remained at least a cadre of economists and China watchers certain that rebound was due at any time.

While analysts and China watchers acknowledge that China has been in a deflationary phase, there is still a prevailing narrative of “rebound” and “recovery” being just around the corner.

China’s economy first entered deflation last summer, with prices falling at a faster pace since then. Its factories have also cut prices, with the latest producer price index pointing to a 2.5% drop in annual prices in January, after a 2.7% fall in December.

However, ING’s chief economist, Lynn Song, said it was worth noting that the latest data may be skewed due to the fact that lunar new year falls in February, rather than January, this year. It means that household demand for food such as pork could bounce back once next month’s data takes the holiday season into account.

“While a far cry from the above-target inflation levels seen in many other economies, these numbers do not imply China is stuck in a deflationary spiral,” Song said.

“Considering the more favourable base effects for February’s data, we see a high likelihood that January’s data could mark the low point for year-on-year inflation in the current cycle,” she added.

Indeed, for this same cadre, there has been a growing expectation that the New Year holiday would the start of a broader and long-lasting economic “rebound.

To be sure, the early reports suggest that the holiday is providing at least some sort of economic “bounce”. By February 10, “cross-regional” trips were reported to be up even over 2019 levels.

Chinese travelers have made more than 230mn “cross-regional” trips as of Tuesday, the most recent figures available, for the new year break, the ministry of transport said on Friday. This was up 5.8 per cent compared with the same period in 2023 and up 1.1 per cent compared with 2019, before the pandemic.

One major aspect of this year’s holiday season that makes the data important: this is the first year since the initial outbreaks of COVID in Wuhan, China, where COVID has not been a factor in holiday travel. Even though China officially ended its Zero COVID policies in 2022, the wave of COVID infections which swept through China immediately afterwards extended Zero COVID’s dampening economic effects through the 2023 Lunar New Year holiday season.

Thus it is important to look not just to year on year data patterns, but to examine economic impact of the 2019 holiday season with the 2024 holiday season.

It is being reported that, so far, this year’s holiday season, ushering in China’s Year of the Dragon, is by some measures exceeding 2019.

China’s Year of the Dragon opened with a surge in consumer spending and travel during the holiday period, marking a boost for the country’s sagging economy.

The country’s culture and tourism ministry said there were 474mn domestic trips during the eight-day lunar new year festival, up 34 per cent year on year and 19 per cent on pre-pandemic levels in 2019.

Consumption spending is also apparently enjoying a holiday “surge”.

As the Spring Festival holiday ended, car trunks across China bulged with not just luggage, but also love and local specialties gifted by parents to their returning children. Online, netizens shared photos and videos of their overflowing trunks, sparking lighthearted comparisons and discussions about the bittersweetness of departures.

Beyond the usual haul of groceries like vegetables, meat, eggs, and flour, some have taken this tradition to the next level.

In a recent video that gained traction on a video-sharing platform, a car was spotted with two woven bags hanging from the rear trunk, each containing two live ducks. The video sparked widespread interest, accumulating over 100,000 likes, and netizens even claimed to have seen the same car on the highway, jokingly stating that "it seemed like two ducks had fallen off halfway."

The driver of the car surnamed He explained that on Feb 14, as they were returning from their hometown in Hunan province to Zhejiang province for work, their trunk was filled with various local specialties from their parents, including cured meat, steamed pork, pickled long beans, and eggplants. Concerned about the ducks potentially getting suffocated, they decided to hang four live ducks in bags at the back of the car. Addressing speculations that two ducks were left behind, He clarified, "Upon reaching Jiangxi, we gave two to relatives, and the remaining two are still being raised at home."

Online spending likewise appears to be enjoying a fairly dramatic surge.

The average daily consumer spending on Meituan’s online platforms during the holiday period jumped some 36% from the same period last year, according to a report from the delivery giant. The report didn’t give the actual value of consumption, but said it exceeded pre-Covid levels in 2019. There was also strong growth from restaurant spending in the first five days of the Chinese New Year break, with overall order volume from groups rising by 161% from last year.

While there will undoubtedly be a few revisions to the initial estimates and reports, at present we are left with a view of the Lunar New Year holiday as being very good for the Chinese economy.

Will it be “good enough”? Will it produce the long-awaited “bounce”? Unfortunately, not all of the current data paints this same rosy picture of China’s economic present. Additionally, the historical data argues against any meaningful “bounce” happening.

One item to remember when assessing China’s travel data is that, at least per a CNN analysis, while overall spending is up, individual spending—and in particular spending per trip—appears to be down.

China has reported a record upsurge in travel and consumption during a longer-than-usual Lunar New Year holiday season, touting the gains as signs that the world’s second largest economy is regaining its footing thanks to the government’s supportive policies.

But according to CNN calculations based on official data, the average tourism-related spending per trip was below pre-pandemic levels, as consumer confidence remains weak amid deflationary pressure.

Nor is CNN the only outlet making such reports. Similar findings were discussed by the Wall Street Journal as well.

Still, travelers appear to have grown more budget-conscious about their travels, a worrying signal for an economy facing deflationary pressures.

The average traveler spent 9.5% less than in 2019, a steeper decline compared with the 2.5% drop recorded during last year’s National Day holiday, a sign of “consumption downgrading,” economists from Goldman Sachs wrote Sunday.

Foot traffic at major shopping malls was 8% lower from a year earlier, according to Nomura calculations based on mobility data from Chinese technology giant Baidu—despite a low base of comparison as a wave of infections roiled the country after the scrapping of all curbs in early 2023. Apart from hotels and airfare, most consumer goods prices, including pork, remained weak, Nomura economists wrote.

While spending may be up in the aggregate, individual consumer behavior is reported as being, on average, considerably more restrained than in 2019. Thus the improved consumption data does not reflect an improved level of consumer confidence.

Moreover, China’s own National Bureau of Statistics does not provide an historical perspective which allows much hope for the holiday spending surge to generate a long-lasting bounce.

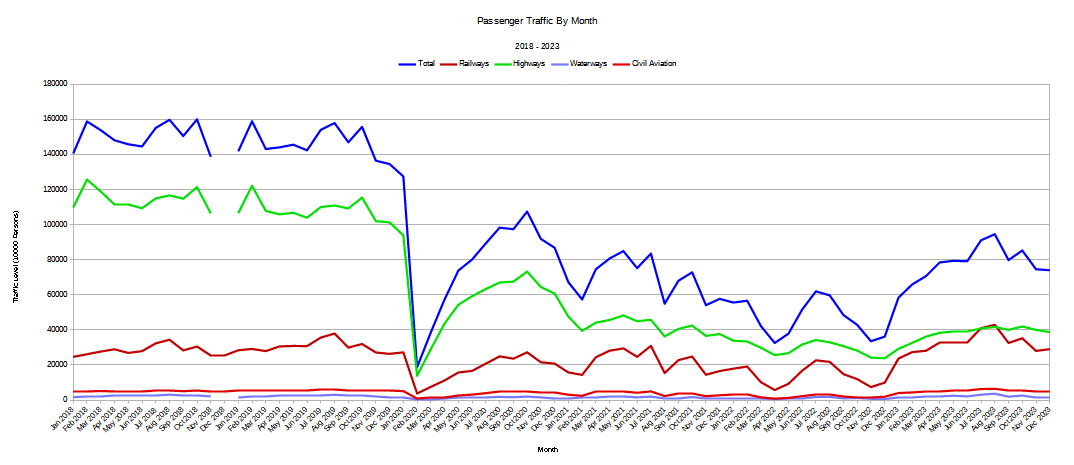

When we look at passenger travel in China since 2018, we see that the holiday surge generally recedes in the subsequent months.

Even when we look at total passenger-kilometers traveled, we do not see much evidence of the holiday travel period producing a longer lasting increase in travel.

Travel simply does not beget travel, not even in China.

While retail spending may be on the upswing during the holiday period, since 2018 there has been only one year where post-holiday spending continued to increase (2020). Every other year has seen a post-holiday spending decline.

2020, of course, was the first year of the COVID “pandemic”, and the first year of the draconian lockdowns which would metastasize into Zero COVID. In every other year since 2018, total retail sales have decreased in the first months. There is zero indication this year will deviate from that historical pattern.

Online sales show a similar post-holiday decline in consumer spending.

In no year is there any indication of travel, tourism, and consumer spending during the holiday period—all of which generally trend up—generating any sort of longer-lasting spending growth.

Therein lies the difficulty in accepting the prognosis that the Lunar New Year will be sufficient to turn China’s deflating economy around. The current data does notargue very well in favor of that possibility. History argues very strongly against the possibility.

In most years since 2018, travel has ticked up during the holiday period, and ticked down afterwards.

Even when one goes by Passenger-kilometers, there is no indication of a holiday spending spree morphing into a longer-lived upward trend. Quite the contrary: the holiday surge in travel usually leads to a post-holiday decline in travel, tourism spending, and overall consumer spending.

None of which is to say that such an event could not result in longer-lasting periods of higher consumer confidence, higher consumption spending, or increased real estate activity. Such an outcome is possible at the very least.

China is going to have a few good news cycles to bolster its economic outlook. That much seems almost certain. There will be good news related to the Lunar New Year holiday.

Yet the holiday period will end, and with it the increase in travel, tourism, and consumer spending. Barring some other stimulus to the economy, whether from te government or from some other source, when that holiday-induced spending ends, the broad-based decline across the Chinese economy will continue.

The Chinese government is trying to paint an optimistic picture, but there’s some qualitative data not being provided by the CCP. More people are traveling, albeit on a tight budget, but WHY? How many are traveling during the Lunar New Year because they fear that this year will be their last chance to visit relatives before they can no longer afford to do so, or will no longer be allowed to travel? How many are traveling to say permanent goodbyes to relatives because they are going to try to leave China? When people are driven by such emotional top priorities, they will see their beloved friends and relatives one last time even if they have to go into debt to do so.

https://www.theepochtimes.com/china/ccp-tightens-exit-controls-amid-sharp-increase-in-citizens-fleeing-china-5589479?utm_source=ref_share&utm_campaign=copy

https://www.theepochtimes.com/china/chinas-largest-ever-mortgage-rate-cut-may-not-matter-5591007?utm_source=ref_share&utm_campaign=copy

Sure, some of this is anecdotal and biased against The CCP, but reports like these help to flesh out the picture of what’s actually happening in China. The larger data, as you have repeatedly shown us, Peter, indicates that China is in deep, long-term trouble.

I was just musing on the trajectory of decline in the old Soviet Union. After WW2, the populace was very proud that they had defeated the Nazis, and most pulled together to rebuild the USSR and make communism work. But by the end of the 1960s, it was clear that it wasn’t working at all. By the seventies, the rate of alcoholism in Russia was soaring. By the eighties, the rate of alcoholism in Soviet males was so alarmingly high that the Authorities tried to limit consumption of vodka (that policy didn’t go over well). The USSR had become a nation of dispirited, hopeless people who were mired in despair. And then the whole Soviet mess collapsed!

No matter how many economic statistics came out regarding wheat production or new factories built,the most telling statistic emerging from the USSR was the skyrocketing alcoholism rate. Any psychologist, sociologist, or man on the street could see it’s significance.

I believe a similar trajectory is happening in China now. We’ve seen the cultural trend of ‘lying flat’, then ‘let it rot’. Now the new cultural buzzword is ‘run’. Wow!