Arguably, today there is some good news on the inflation front. At least, market prognosticators might want you to think it’s good news.

The Bureau of Economic Analysis released its gauge of Personal Income and Expenditures for May, which is showing inflation cooling off somewhat.

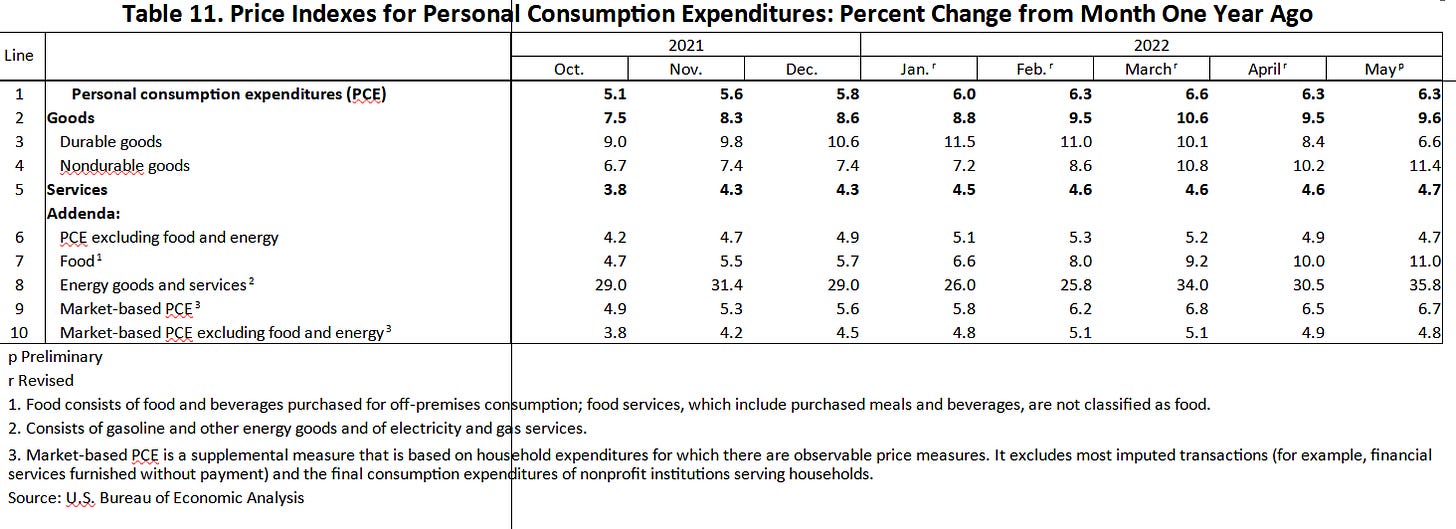

The PCE price index for May increased 6.3 percent from one year ago, reflecting increases in both goods and services (table 11). Energy prices increased 35.8 percent while food prices increased 11.0 percent. Excluding food and energy, the PCE price index for May increased 4.7 percent from one year ago.

The headline PCE price index number holds steady from April, suggesting that inflation got neither worse nor better overall during the month.

The core PCE index (ex food and energy) was even better, posting a 0.2% decline from April, from 4.9% to 4.7%

Inflation Is Better, But Still No Joy In Mudville

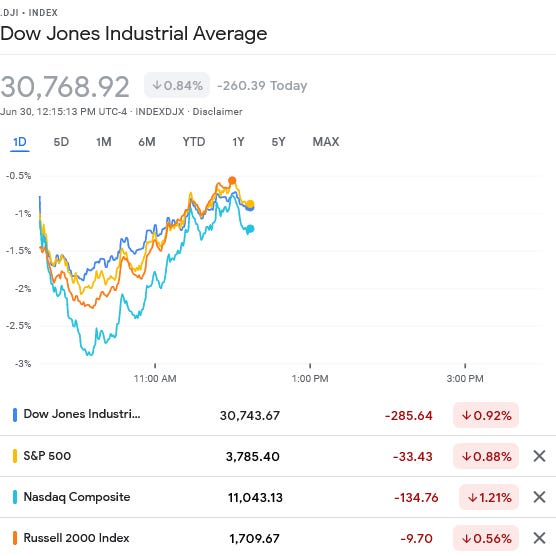

Notionally, cooling inflation is a good thing. However, as of this writing the market response has been tepid to negative, with the major US market indices having dropped initially at the opening bell, although a rising trend is underway.

The lack of joy in Mudville is even being acknowledged by the financial media, which characterizes the inflation data as “better-than-expected” but notes the lack of a general market rally on the news.

Better-than-expected inflation data confirmed speculation that price pressures are peaking, but did not improve market morale significantly, as the rapid slowdown in personal spending will create headwinds for the consumer-driven economy. While the directional PCE improvement is welcome, it is unlikely to prompt the Fed to deviate from its plans to front-load interest rate hikes at upcoming meetings, at least for now, with the central bank steadfast in its commitment to return inflation to 2%.

The cooler inflation numbers seem to be initiating a mild “safe haven” reaction, as the 10-Year Treasury yields have declined roughly 0.10% since market open as of this writing.

Not All Good News

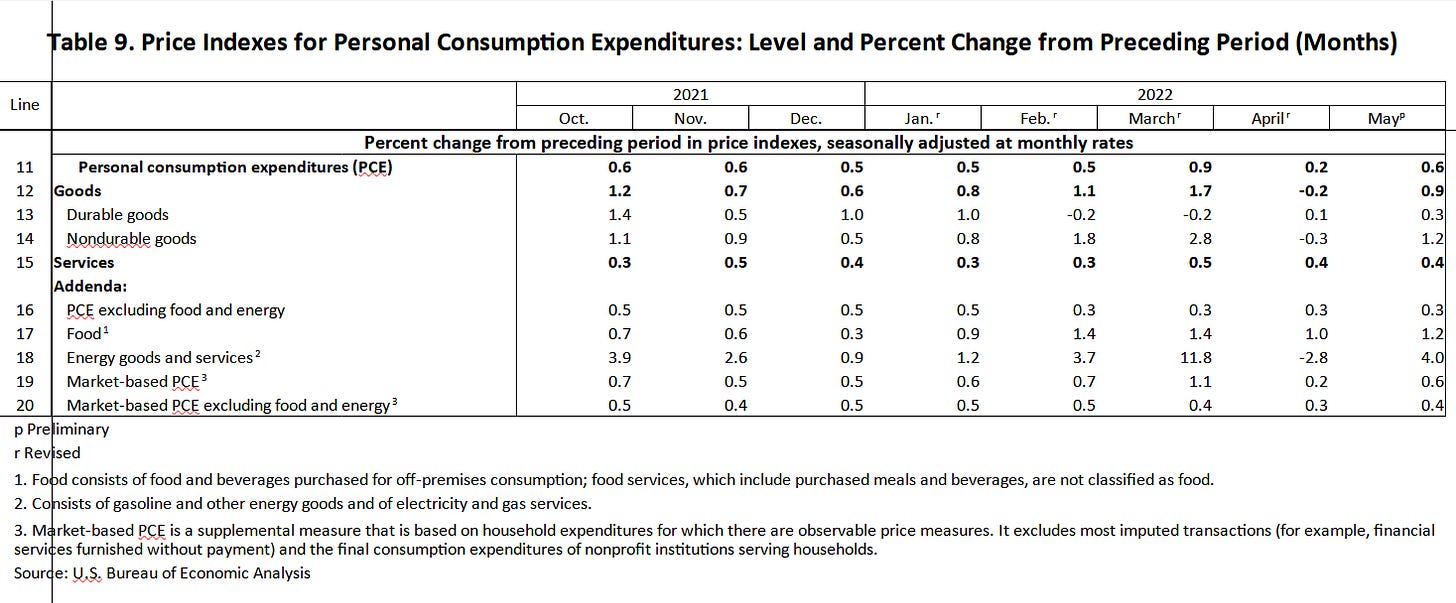

While the narrative is predictably focusing on the headline PCE number, once again when looking at inflation numbers we must assess the internals of the BEA report to appreciate the distorting effects inflation has on an economy.

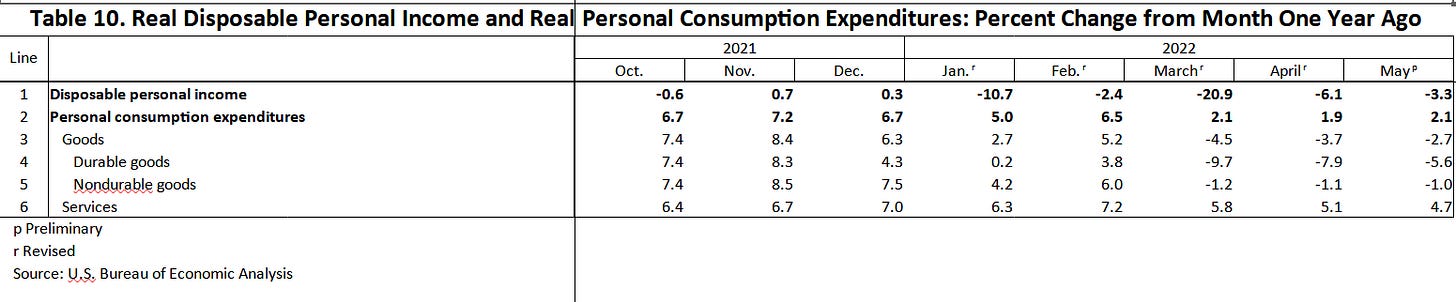

While inflation notionally is “cooler” in this report than before, the report also shows that while disposable personal incomes fell in May, personal expenditures rose year-on-year (-3.3% income decline vs 2.1% expenditure rise).

Perhaps most disconcertingly from a perspective of overall economic impact, however, is the fact that durable goods expenditures in May fell 5.6%, while services expenditures rose 4.7%. People are buying fewer “things” and spending more on service-related items.

Moreover, while headline PCE rose “only” 0.6% in May, PCE for goods rose 0.9%, and food rose 1.2% for the month. Energy and related services rose 4% month-on-month.

Inflation is only easing if you don’t look at the items most important to consumers: what to eat and how to fill the gas tank. For real people, inflation is still very much a real problem.

Spending Patterns Are Shifting. Economy Is Still Contracting

The PCE report shows that spending patterns in the overall economy are shifting, and indeed we may be nearing a point of “peak” inflation. The decline in overall spending on goods is very much in sync with the potentially deflationary signal of slowing inventory builds, as I touched on previously.

Yet inflation is not done, and certainly does not appear to be done in the very vital areas of food and energy (which the “experts” conveniently like to disregard when pontificating on inflation).

While the narrative arc in the media will undoubtedly be that inflation is cooling (and subtle pressures will likely begin building for the Fed to reverse course on interest rate hikes), the data offers no real support to such an interpretation. Inflation still has a ways to climb before it will begin to trend downward.

The times will get more “interesting” before they get less.

Oh man, I completely forgot! Did anyone check to see how much we will be saving on hot dogs this Monday?!

Agree 100%...The times will get more “interesting” before they get less.