Inflation Data Show Trump Is Wrong on the Economy — But Right About the Fed

Prices Climb, Fed Faces Heat to Cut Rates

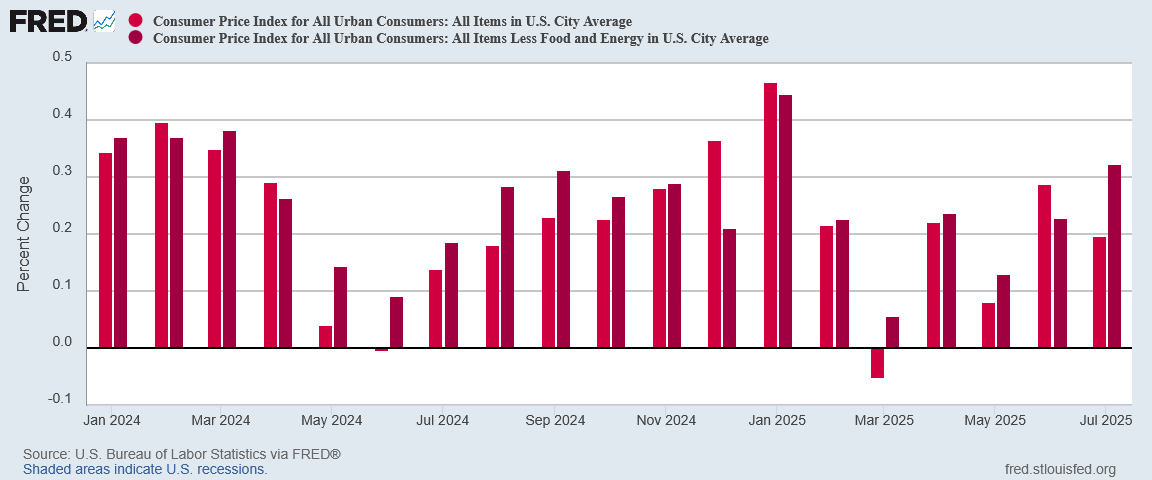

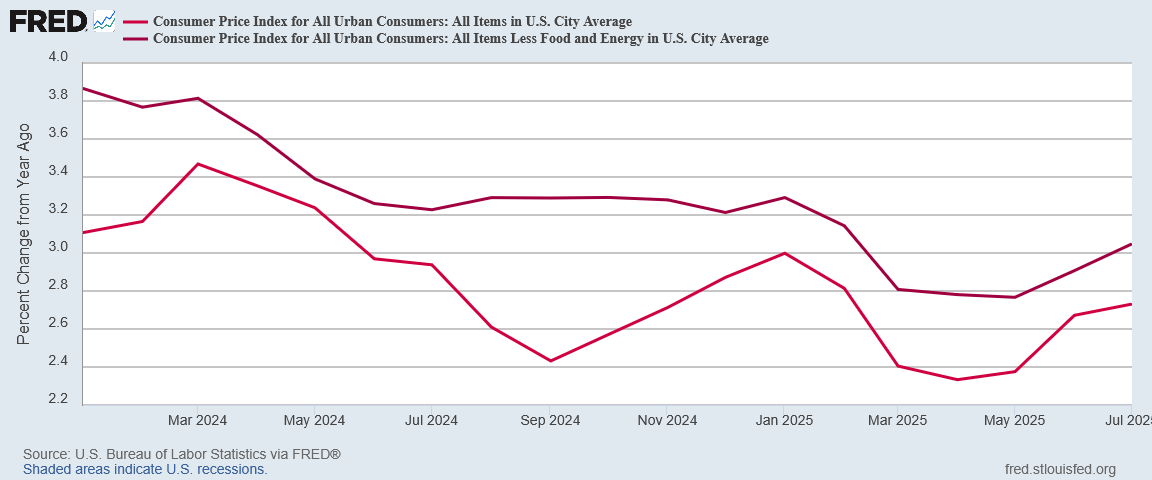

Consumer price inflation continues to heat up in 2025, with core consumer price inflation month on month rising for the second straight month in the July Consumer Price Index Summary.

While rising inflation cuts against President Trump’s narrative of a robust US economy, the meagerness of that rise completely shreds Fed Chairman Jay Powell’s narrative of tariff-driven hyperinflation. Tariffs are likely pushing prices up, but only by a very small amount.

The CPI print itself got straight to the point: core inflation was up month on month, but headline inflation was down.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in July, after rising 0.3 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

The index for shelter rose 0.2 percent in July and was the primary factor in the all items monthly increase. The food index was unchanged over the month as the food away from home index rose 0.3 percent while the food at home index fell 0.1 percent. In contrast, the index for energy fell 1.1 percent in July as the index for gasoline decreased 2.2 percent over the month.

However, headline inflation actually cooled month on month, from 0.29% in June to 0.2% in July.

The dip in headline inflation came on the strength of easing food price inflation and yet another flip to energy price deflation.

The headline figures are very much the mixed bag for July, as year on year both headline and core inflation notched increases.

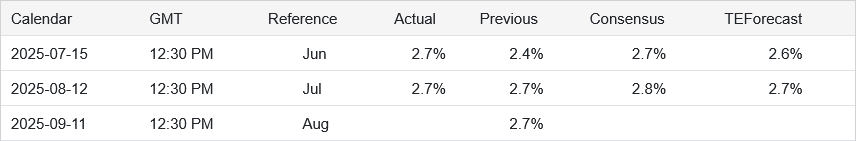

Rounding out the hit-and-miss nature of the data, the year on year print matched the forecast at Trading Economics and beat the Wall Street consensus by 0.1pp.

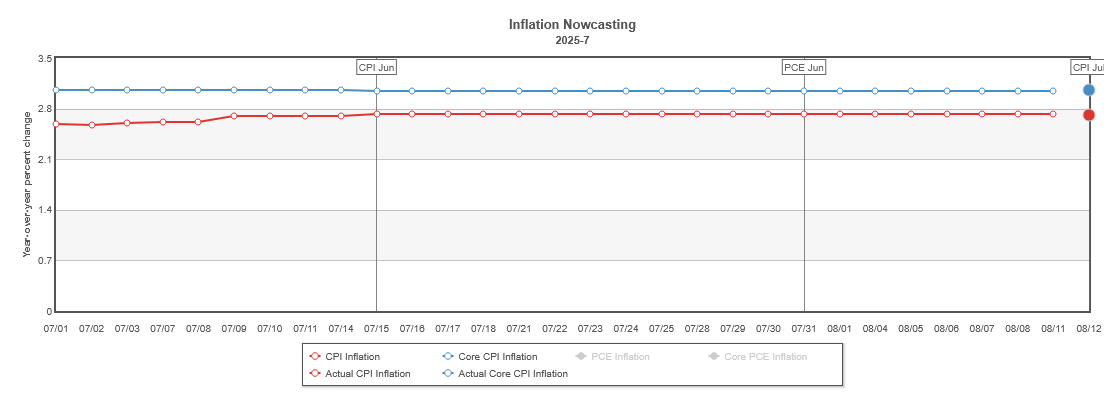

The Cleveland Fed’s inflation nowcast was almost right on the money for July.

Is this inflation print good news or bad news? As with so many things economic, the answer to that question is heavily influenced on the context and perspective. Wall Street was pleased that the inflation print came in under forecast, even if core inflation was printing hotter than last month. Equities reflected Wall Street’s approval of the data.

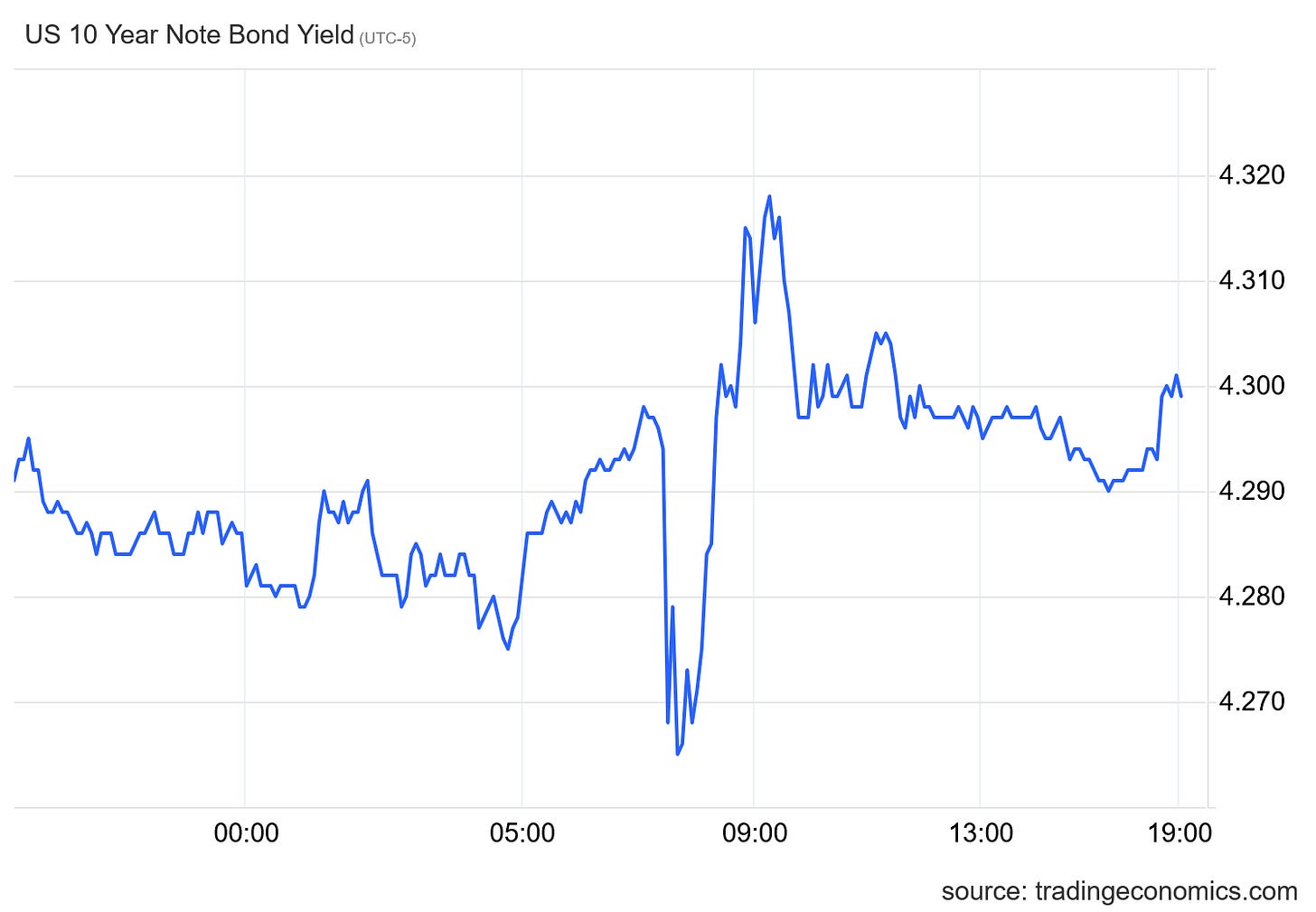

Treasury yields spiked on the inflation report’s release before easing back throughout the trading day.

Wall Street was pleased, but perhaps not overjoyed.

The “good bad news” nature of Wall Street’s reaction is not hard to fathom. Although inflation is rising, it is doing so only incrementally, far from the significant increases anticipated for months by the Federal Reserve. Coupled with Friday’s controversial but disappointing jobs print, the pressure is mounting on the Federal Reserve to finally trim the federal funds rate when the FOMC next meets in November. On the strength of the inflation numbers the probability of a 25bps rate cut in September rose to nearly 95% at CME Group.

The numbers were certainly good enough for White House Press Secretary Karoline Leavitt to take a small victory lap on X.

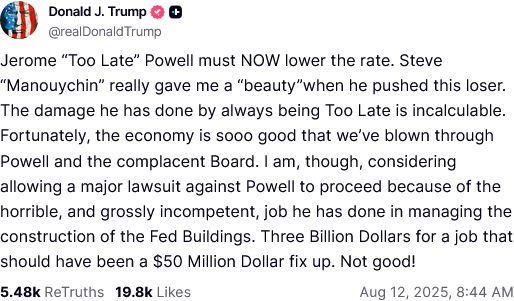

For his part, Donald Trump took to Truth Social to take social media pot shots at his latest favorite target, Fed Chair Jay Powell.

Wall Street may or may not agree with Donald Trump’s take on Jay Powell, but Wall Street is definitely in agreement with Trump’s repeated calls for lower interest rates.

Does the underlying data support Trump’s optimistic view of the economy?

Trump’s case is certainly bolstered by energy prices moving down yet again last month.

While food prices did not fall, they did rise more slowly, allowing headline inflation to cool somewhat.

Energy price deflation comes as no surprise, as oil prices have largely returned to where they were before the Twelve Day War back in June.

Commodities prices are also testing the floor set after the Twelve Day War.

However, the easing of energy and commodity prices raises the likelihood that the Liberation Day tariffs are at last starting to be reflected in consumer prices. Despite the downward trend in energy and commodities prices, the price index for durable goods remained elevated relative to its February 2025 lows.

With inputs (energy and commodities) trending down, that durable goods price inflation is printing noticeably warmer than it has for over a year is increasingly likely a consequence in part of Trump’s tariffs.

Nondurable goods prices, on the other hand actually fell in July.

Even service price inflation eased in July.

Still, while the likelihood that tariffs are contributing to consumer price inflation has increased, that contribution is still minimal at most. If tariffs are pushing prices higher they are doing so only marginally, which is not the outcome the Federal Reserve has been saying would occur.

Certainly the rise in inflation for July has not been so great as to prevent weekly wages from closing a bit more of the post-COVID gap between wages and prices.

Wages still need to grow more relative to prices to fully recover from the 2022 hyperinflation cycle, but in July they notched a little bit of that growth. With wages improving relative to consumer prices, a marginal uptick in durable goods from tariffs is hardly the consumer price apocalypse the Federal Reserve has been dreading.

Further weakening the case that tariffs are a major inflation threat, the inflation report itself noted that an uptick in shelter price inflation was a primary driver in the overall inflation print for July.

Given last week’s turmoil over the BLS’ Employment Situation Summary, we must ponder the reliability of the inflation data, given that it also is a product of the Bureau of Labor Statistics.

If the jobs data is tainted, what are the odds that the price data is likewise tainted?

While the accuracy and reliability of price indices has been forever a topic of debate among economists, when independent indices show similar trends, we may reasonably have more confidence in those indices. In the case of consumer prices, independent measures such as the American Institute for Economic Research’s Everyday Price Index, although it displays greater volatility than the CPI, in recent months has shown broadly similar trends.

Although the constant caveat with all price indices is that “your mileage will vary”, the EPI does suggest that trends in consumer prices reported by the Consumer Price Index are not outside the bounds of a reasonable assessment of current consumer prices.

At present, we may maintain confidence in the “official” inflation data because there are not strong signals from other sources to say that we should not. Pricing data is such that if there were a major problem with the CPI itself, we should expect to see at least some signals. At present, we do not.

The July inflation report does very little to support Donald Trump’s glowing assessments of the US economy. Inflation did heat up in July, and that is generally considered a negative for an economy. We are, in all probability, starting to see a marginal influence of the Liberation Day tariffs in higher consumer prices, even though that influence is far from what has been projected by the “experts” at the Federal Reserve and on Wall Street.

Yet by undercutting President Trump on the economy, the July Consumer Price Index report positively kneecaps Jay Powell on interest rates. Trump may be wrong on the health of the US economy, but he is not wrong to saddle Powell with the moniker “Too Late.” Both the jobs and the inflation data have for the past few months shown that Powell should have already cut the federal funds rate at least once.

The July inflation print does nothing to alter that assessment of Powell’s stance on interest rates. He really is “too late” on interest rates, and the economy is very likely suffering as a result. Certainly job growth is languishing, and an easing of interest rates could do much to encourage more job creation. While tariffs are proving that they are indeed an inflationary pressure on consumer prices, they simply are not much of one, and certainly not enough of one to warrant the Fed’s outsized concern over possible future price increases.

The July Consumer Price Index Summary thus ends up being a perverse political win for Donald Trump. The report proves him wrong on the economy—but it proves he is less wrong than Jay Powell.

If the winning spot in a race to the bottom is coming in last, Donald Trump beats Jay Powell.

What was your experience of consumer prices in July? Did you see prices rise, fall, or hold steady? Please let me know in the comments or drop a note in chat.

Thank you for hard data, Peter (even if the BLS input is suspect). You know, on balance, however analysts quibble over the data, things aren’t doing too badly. We’ve certainly lived through worse times.

But I’m unsure of what to make of Trump’s threat of a major lawsuit against Powell. It will cost Powell money to defend himself, and it will cost him even more if he loses. But what do you make of the threat - that it’s primarily to intimidate him into doing what Trump wants? Is there some Fed rule that he must resign immediately if he loses the lawsuit? Is the threat meant to intimidate the rest of the Fed’s board to replace Powell themselves? You certainly understand these types of machinations better than I do, Peter, so I’m interested in your assessment…