Last night I addressed some of the bovine excrement coming out of the White House regarding the release of the June Consumer Price Index Summary by the Bureau of Labor Statistics. The short version: the “experts” were wrong in their forecasts and they are wrong in their explanations. “Spin” does not change the reality that rising consumer price inflation hits consumers squarely in the wallet.

Righ or wrong, however, the view that the Federal Reserve takes of June’s inflation numbers will have significant impact on what happens next. The Fed’s interest rate manipulations, while yet to have discernible impact on inflation, have already changed the outlook for prospective homebuyers, as higher mortgage rates make buying a house that much more expensive; what the Fed does next is of importance to consumers on Main Street just as it is to investors on Wall Street.

It is worth assessing Wall Street’s reaction to yesterday’s inflation news, and gauge where Wall Street might think the Fed is headed next in their efforts to tamp down consumer price inflation. While hardly a crystal ball allowing one to see clearly into the future on Fed rate hikes, investor sentiment still gives us meaningful clues as to what is coming.

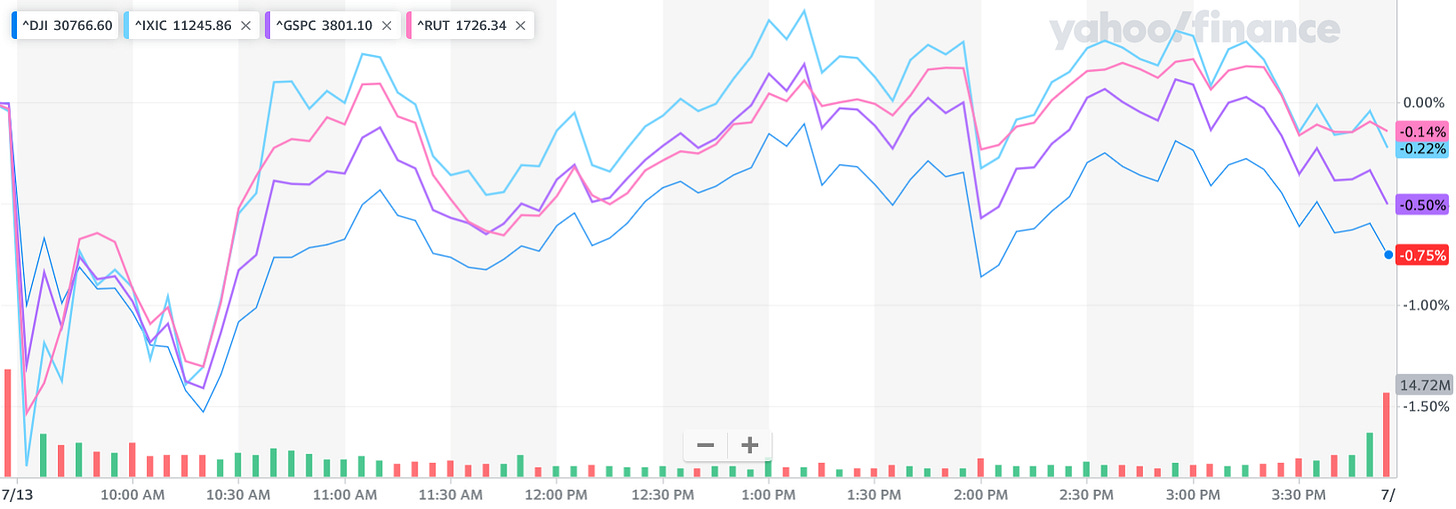

Stock Markets Did Not React Well

Predictably, the stock markets dropped right off the bat on the news, with the Dow Jones index dropping a full percentage point within the first half hour of trading.

While there as a general rising trend through the remainder of the trading day after the initial morning declines, all the major market indices ended down on the day.

The Dow Jones Industrial Average dropped 208.54 points, or 0.67%, to 30,772.79, while the S&P 500 dipped 0.45% to 3,801.78. The Nasdaq Composite slipped 0.15% to close at 11,247.58.

Clearly, Wall Street was not happy with the June inflation numbers, although the stock market reaction overall was rather muted. Overall, the stock market is slowly coming around to the reality of recession, and that the Federal Reserve’s course is largely already set.

“There’s no spinning this, other than the Fed has to get more aggressive near term and crush demand. That cements a recession now,” said Liz Ann Sonders of Charles Schwab. “I think a recession is an inevitability.”

However, as the rising trend during the latter half of the trading day indicates, Wall Street is guardedly hopeful that the economy is at or near peak consumer price inflation.

“The market is starting to believe that truly this is the peak number and that there are enough inputs that have rolled over that we could start to see inflation numbers subside in the coming months,” said Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management. “If you look at the history of when we’ve had these inflation spikes, stocks tend to bottom when the market believes that inflation has topped out.”

Bond Markets Were Emphatic: Recession Is Here And Getting Worse

How bad do bond markets view the current economic outlook? Badly enough that virtually all of the short term Treasury Bonds have now inverted with the 10-Year Treasury—meaning the yields (effective interest rate) on shorter term bonds exceeds that of longer term maturities. Under normal conditions, the amount of interest the market demands rises as the period of indebtedness increases.

Currently, the opposite is happening. Bond markets are demanding higher interest rates for the short term and less interest farther on out.

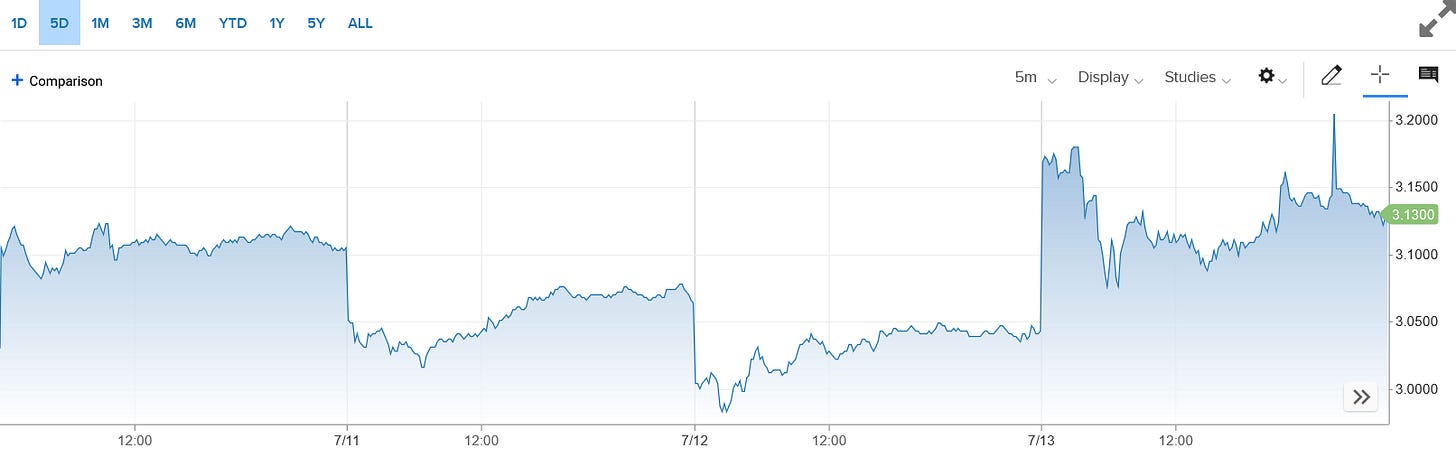

The 1-Year Treasury, which actually inverted with the 10-Year on Tuesday, started yesterday by spiking above 3.2% before ending just below at 3.19%.

The 2-Year Treasury also spiked, although not quite as high as the 1-Year, only flirting with 3.2% late in the day before closing the trading day at 3.13%.

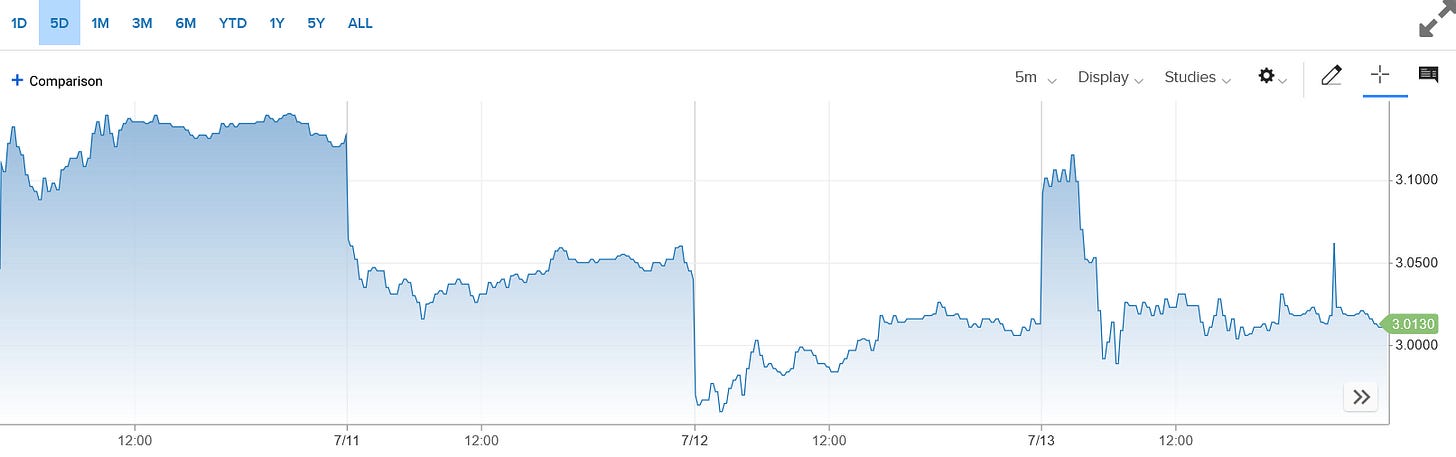

The 5-Year Treasury, after jumping up initially, ended the day unchanged at 3.013%.

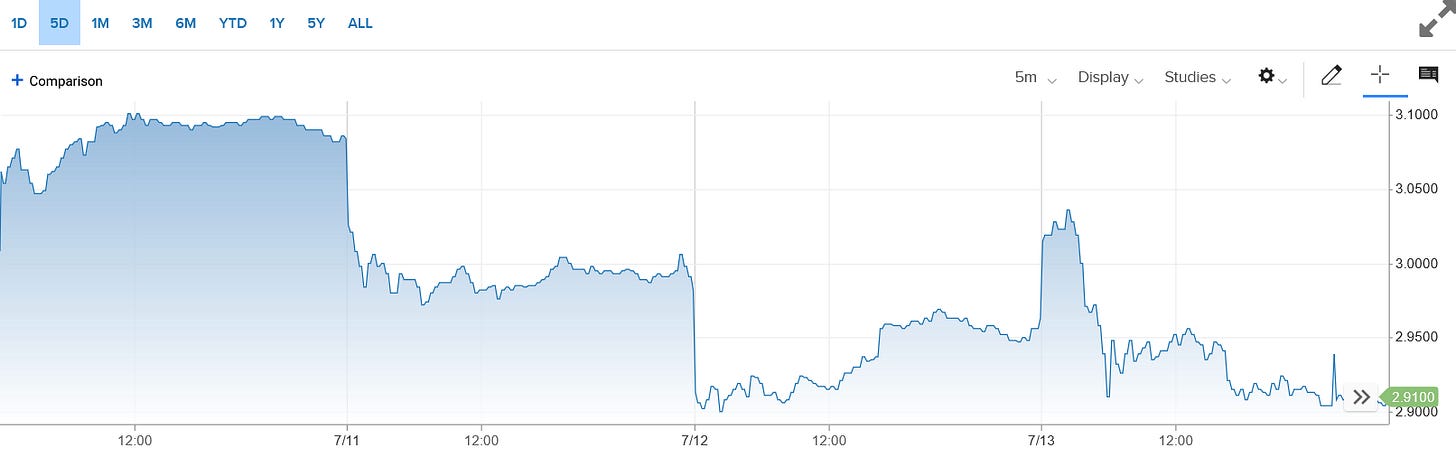

As for the 10-Year Treasury, it actually fell on the day to a yield of 2.91%.

Take careful note of the closing yields for the various maturities here:

1-Year: 3.19%

2-Year: 3.13%

5-Year: 3.013%

10-Year: 2.91%

Not only have the short-term bonds inverted with the 10-Year Treasury, they have inverted with each other. Bond investors are expressing the worst sentiments about the economy over the next year, with the expectation of gradually improving conditions over the next few years. Whether by econometric analyses or gut instinct, bond investors are pricing in a recession that is both deep (and about to get very deep) and long. Welcome to the 1980s.

Global Concerns Not As Great?

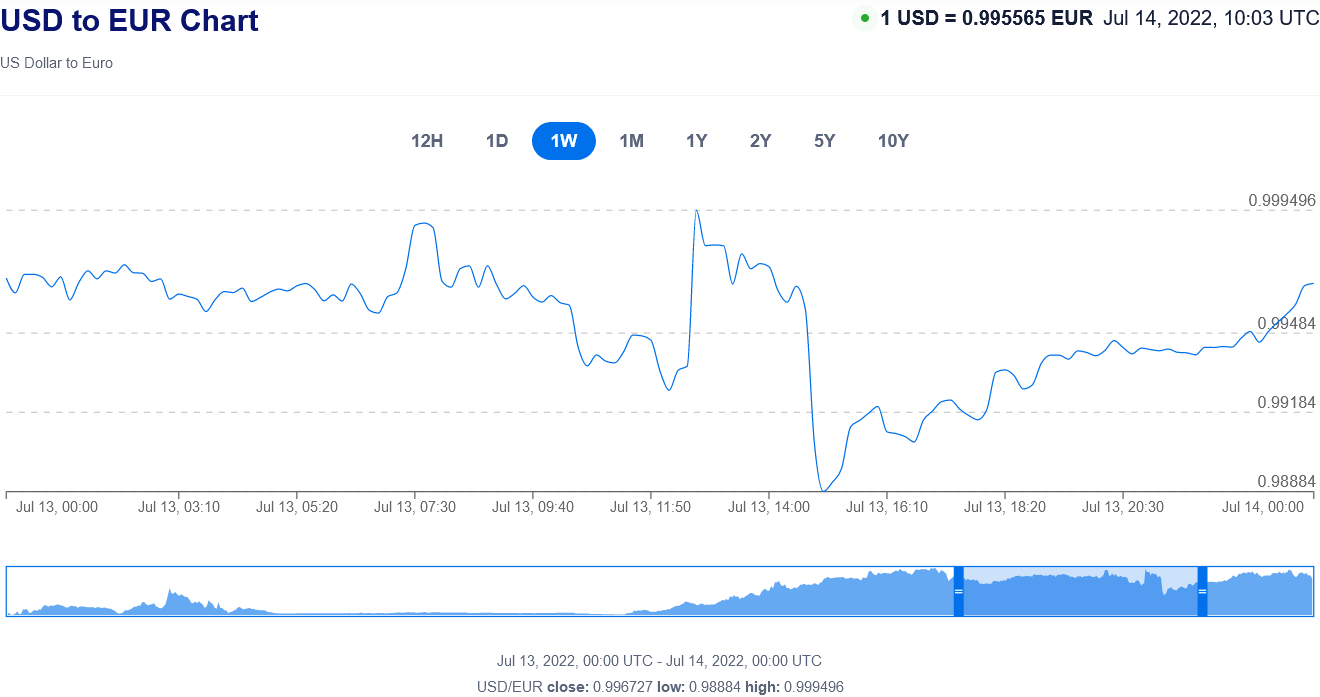

It is perhaps a gauge of the equally grim global economic outlook that yesterday’s inflation numbers did not spark a currency flight away from the dollar.

The dollar did drop modestly against the Chinese yuan yesterday, from 6.72904 CNY to 6.72112, although the initial reaction just after the inflation report came out was to increase against the yuan.

Against the euro the dollar barely changed, going from 0.996927 to 0.996727 EUR.

While global currency markets can hardly be said to be pleased with the state of inflation in the US, as of yet they have yet to punish the dollar for it. Whether that changes depends mightily on how global economic events unfold. Given China’s lackluster results from its expansionist monetary policies of recent months, the US economic outlook, while bad, is hardly the worst in the world—which says quite a lot about the state of the global economy (none of it very good)!

Where Does That Leave The Fed?

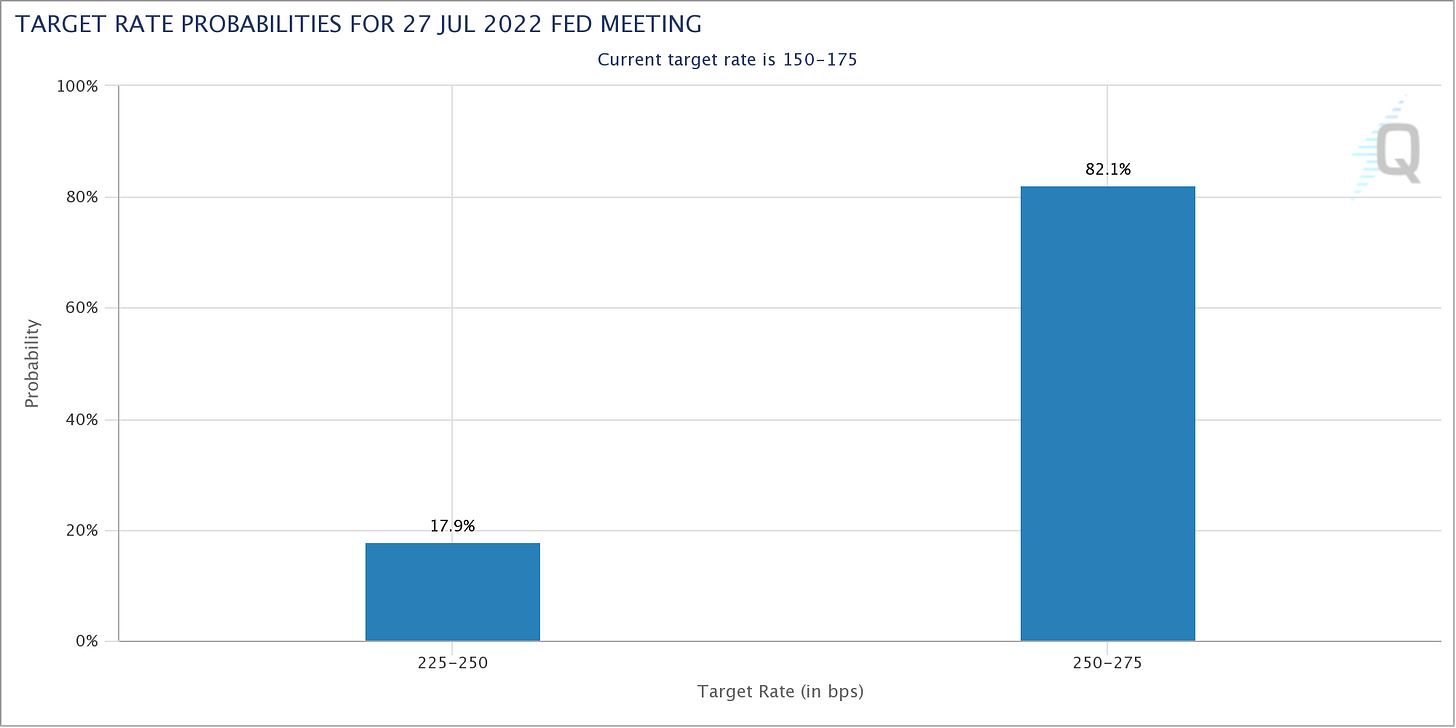

Notionally, investor sentiment both here in the US and globally is acquiescing to another large interest rate hike when the Federal Open Market Committee (the rate setting arm of the Federal Reserve) meets at the end of the month. With short term yields pricing in such a rate hike, even though the expectation is for some rate easing down the road to address an ongoing recession, the way is being cleared for the Fed to make as much as a full percentage point increase in the Federal Funds rate.

Financial derivatives marketplace CME Group is currently pricing in over an 82% probability of a full percentage point (100bps) hike in the Federal Funds rate, with around 17% probability of “just” a 75bps hike.

If the Fed does follow through with a full percentage point hike, it will not comes as a shock to the markets.

Yet the market expectations are also a constraint upon the Fed, particularly in the global arena. It is my developing thesis that while the Fed can ignore stock market declines and bond yield increases up to a point, the need to defend the dollar’s notional status as currency hegemon compels it to act somewhat aggressively on inflation. Global currency markets may not have punished the dollar for US inflation yet, but neither are they rewarding the dollar with additional strength against other currencies. The markets may be coming to accept an aggressive 100bps hike by the Fed, but that acceptance is also an expectation.

At this juncture, it will be difficult for the Fed to not follow through with a 100bps rate hike.

What this means for consumers is that consumer-centric interest rates are likely to increase. Consumer credit overall can be expected to decrease (as it already has done in recent months). Mortgage rates may reverse their recent downward trends in response to the push upward in debt yields (although it is still indeterminate whether the actual outcome will be an increase or merely a slower decrease as housing markets themselves cool off).

Eventually, the Fed’s rate hikes will achieve their stated intent to, to quote investment broker Liz Ann Sonders cited above, “crush demand”. Eventually the rate hikes will choke off consumer credit and curtail consumer spending—exactly as they are designed and intended to do.

Choking off consumer demand will curtail consumer price inflation. Instead of consumers paying more to buy less, the Federal Reserve will ensure consumers simply do not buy at all.

I don't correspond with near as many people overseas as I used to, but many of these folks are still "counting on the US" to pull the planet out of the worldwide "depression."

So many of these folks are very smart, clearly see the problems in their home countries, Central Europe, Scandinavia, Indo-Pacific, South America, but are counting on "US" to not bail them out, but restore sanity to the global system!

They disagree with me when I point out that it is the globalist system that is the problem.

Peter, I refer them both to you, and to "The Last Refuge" (Sundance), but I don't know if they actually read anything more than the quotes I send them.