Initial Jobless Claims Jump To 237K

More Signs The Job Market Is Weaker Than Is Being Reported

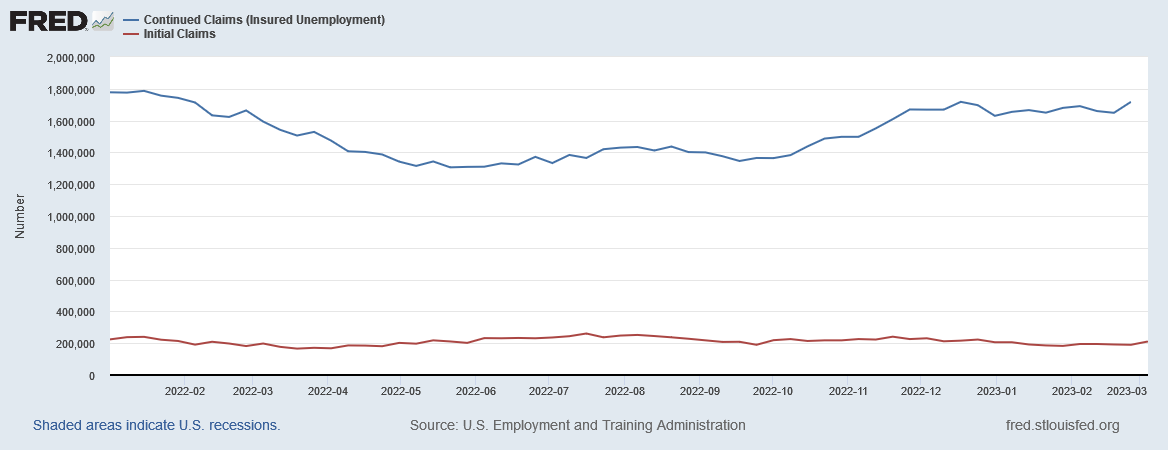

Initial jobless claims jumped to 237,513 last week on an unadjusted basis, while continuing claims rose to 1,975,193 for the week before (continuing claims always lag by one week).

The advance number of actual initial claims under state programs, unadjusted, totaled 237,513 in the week ending March 4, an increase of 35,357 (or 17.5 percent) from the previous week. The seasonal factors had expected an increase of 11,791 (or 5.8 percent) from the previous week. There were 219,875 initial claims in the comparable week in 2022.

On a seasonally adjusted basis, the initial claims rose 21,000 from the previous week to 211,000, with continuing claims rising to 1,718,000.

Wall Street was not expecting the jobless numbers to be quite so high.

Economists polled by The Wall Street Journal had estimated jobless claims rose slightly to 195,000 last week.

Partly this is due to their dogged adherence to the narrative of tight labor demand:

Worker filings for U.S. unemployment benefits jumped more than 10% last week but remained historically low as demand for labor outstrips the number of people looking for work.

The data, as usual, tells a different story.

As both the seasonally adjusted and unadjusted data illustrate, continuing claims have been trending up since last fall—which even Wall Street concedes is an indication people are having more difficulty finding a job.

But if we index the jobless claims to the first of the year, we also see that the jump in initial claims was the largest spike year to date, in a single week erasing a broad downward trend in initial claims.

By indexing the 4-week moving averages to the first of the year, we also see that the likely inflection point for initial jobless claims came at the beginning of February.

With the BLS Employment Situation Summary due out tomorrow, the jobless claims are pre-emptively throwing considerable shade on any strong jobs numbers that might be claimed, and further undermining the strong data in the ADP National Employment Report and the BLS Job Openings and Labor Turnover Summary report.

Rising jobless claims and longer duration for periods of unemployment are the polar opposite of what a labor market where demand outstrips supply would produce. They are exactly what a stagflationary recession would produce.