Corporate media’s eternal challenge in pushing its propaganda is persuading Wall Street to go along with the latest narrative, even when the numbers don’t match.

The latest exemplar of this is the reporting surrounding last week’s unemployment data from the Department of Labor, which showed that initial jobless claims fell by 3,000 on a seasonally adjusted basis.

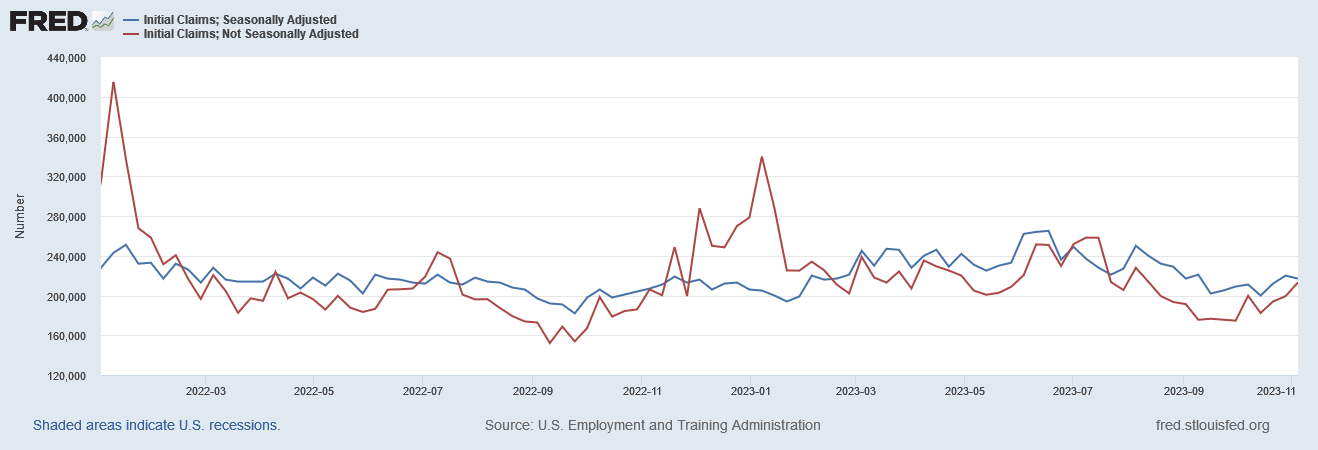

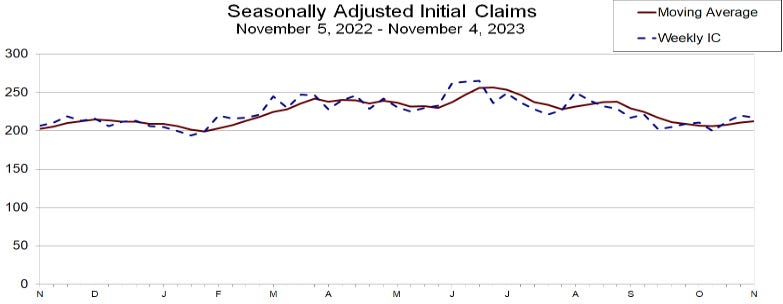

In the week ending November 4, the advance figure for seasonally adjusted initial claims was 217,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 217,000 to 220,000. The 4-week moving average was 212,250, an increase of 1,500 from the previous week's revised average. The previous week's average was revised up by 750 from 210,000 to 210,750.

Straight away we are faced with the reality of suspect data, because the jobless claims only “fell” because the prior week’s data were revised upward, coincidentally by the same 3,000 claims.

Without that correction, jobless claims would not have fallen at all.

Even so, the latest claims data printed 2,000 claims higher than the 215,000 that had been anticipated. Wall Street was predictably disappointed by this, even as corporate media presented the data as proof of a still-resilient jobs market.

Claims still show a very low number of job losses and indicate the economy is stable, but businesses are hiring less and the labor market appears to have cooled off a bit. One complication is the UAW auto strike. It may have inflated claims lately.

Corporate media might think the jobless claims reflect a “stable economy,” but Wall Street seemed less certain.

Wall Street clearly did not buy into the narrative, with the stock market closing down on the day on Thursday.

Prior to Thursday, the stock market had been mostly holding its own last week.

Corporate media might not want to admit the claims data is yet another data point making the case for the US economy being in a deepening recession, but Wall Street does not share that reluctance. The numbers are unimpressive and Wall Street was clearly unimpressed.

Where corporate media loses the narrative thread is that it insists on highlighting the change during the most recent week.

The number of Americans filing new claims for unemployment benefits edged down last week, signaling that layoffs remain low even as the still-strong job market shows some signs of cooling.

Yet this narrative ignores that, for the month, initial jobless claims actually rose.

Even on a weekly basis, the unadjusted jobless claims data shows a rising trend in recent weeks, not a falling one.

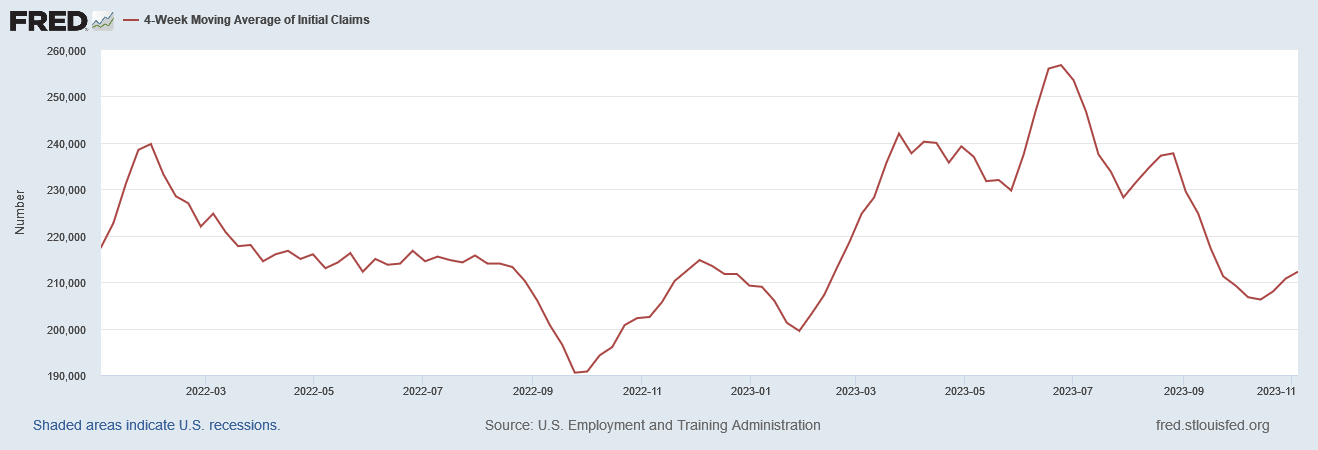

Moreover, the four-week moving average on initial claims also shows a rising trend, and one that is already 10,000 claims above where it was 12 months ago.

This most recent decline in jobless claims is not part of a larger macro trend showing a decrease in claims, but is rather a blip against a backdrop of a larger macro trend showing an increase in claims.

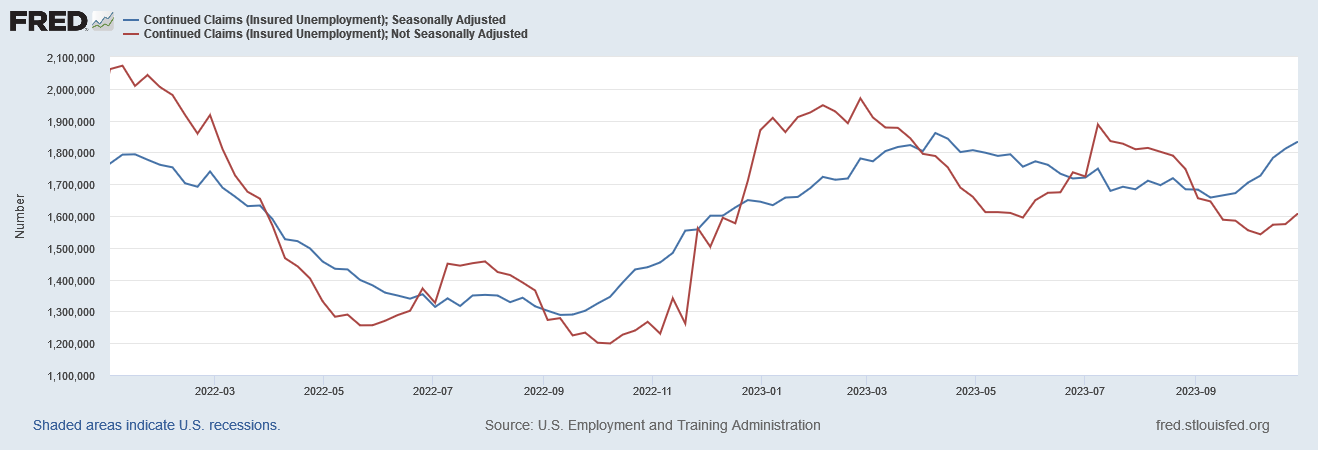

The continuing claims data is not much better. Continuing claims have been on the rise for over a month, for both the seasonally adjusted and unadjusted data.

Additionally, the four-week moving average on continuing claims has been trending upwards since October of 2022.

No matter how corporate media tries to spin the numbers, the reality is that unemployment is trending upward in recent weeks and even months.

The unadjusted continuing claims data also reveals something else that is significant: continuing claims are trending higher in the current 52-week period than in the prior one.

Whether by accident or design, the seasonal “adjustments” succeed in blurring this reality significantly.

We should note, however, that this same discrepancy does not appear when looking at the unadjusted vs seasonally adjusted data on initial claims.

However, in all instances, the macro trend for the past few weeks has been the same: jobless claims are on the rise.

The jobless claims data also indicates the upcoming October JOLTS report is going to show a net decrease in hiring with an increase in total separations. As of September, total hires and total separations were both down.

Despite the corporate media narratives, the reality of the Department of Labor data is that jobless claims are on the rise, both for initial claims and continuing claims. More people are ending up out of work than are ending up hired.

The Federal Reserve may wish to believe the data shows a resilient jobs market, and Wall Street always wants to drink the Fed Kool-Aid. However, the jobless claims data once again contradicts that preferred narrative. The jobs market is not resilient, but significantly damaged.

No matter which metric one considers, the reality is the same: the labor market remains far more toxic than tight.

The Federal Reserve and the corporate media both are wedded to the narrative that the US economy is not in a recession. That narrative, however, completely ignores key data like jobless claims, which instead show the US economy to be falling deeper and deeper into recession. Far from showing strength, the jobless claims data shows underlying—and worsening—weakness.

As always, never accept the narrative at face value. Always look for the data, do your own research, and form your own conclusions.

I’ve noticed an anomaly this summer and I’m wondering if other people are seeing it where they live. Sure, it’s anecdotal, but if many people are seeing it, it may add up to something.

I live in a lovely part of town, full of lakes and parks and one-of-a-kind 1920s homes that have been lovingly restored. For the past 24 years, I’ve walked almost daily through these neighborhoods and admired the extensive gardening and landscaping that people have continuously created. Then suddenly this summer, I’ve walked past whole blocks where people have let their lawns go to seed, their flower gardens die, their landscaping fall into ruin. I’ve wondered, how much of this is because people are struggling with inflationary expenses? How much is because they are vaccine-injured and not able to do the work to maintain their yards? How much is because they are dispirited and no longer care about creating beauty for their neighbors? Sure, we’ve had a hot summer with some drought, but not enough to account for the die-off I’m seeing. How about you other readers - are you seeing signs of difficulty like these? Do you think it is a sign that things are much worse than the government is telling us?

Been very busy the past few days and haven’t had time to read your posts. Will try to catch up soon.