As a general rule, one should never make too much out of a single day’s trading on any stock exchange. There are simply too many aspects of financial markets that cannot be reduced to quantifiable relationships.

However, even a single day’s trading can tell us much about prevailing market sentiment. What the past two days of trading tell us about Wall Street’s sentiments regarding JP Morgan’s firesale purchase of First Republic Bank is that Wall Street remains unhappy with the acquisition.

As I noted yesterday, it is the opinion both of JPMorgan head Jaime Dimon and more than a few financial market analysts that the merger heralds the end of the banking crisis.

With the systemic issues behind the collapse of Silicon Valley Bank and now First Republic Bank ongoing, does this mean there will be more bank failures to come?

Certainly Jaime Dimon does not think there will be.

In speaking with Wall Street analysts Monday morning, JPMorgan Chase (NYSE:JPM) Chairman and CEO Jamie Dimon said, "This part of the crisis is over," adding that JPM's acquisition of First Republic Bank (NYSE:FRC), will help stabilize the banking system. That refers to the deposit withdrawals at U.S. regional banks.

Analysts at Bank of America share that sentiment.

JPMorgan Chase's (NYSE:JPM) acquisition of First Republic Bank (NYSE:FRC) "should likely end forced sales of banks due to deposit flight," said Bank of America Securities analyst Ebraham Poonawala in a note to clients on Monday.

With these thoughts in mind, it is worthwhile to consider how bank stocks have fared since the merger was announced in the wee hours of Monday morning.

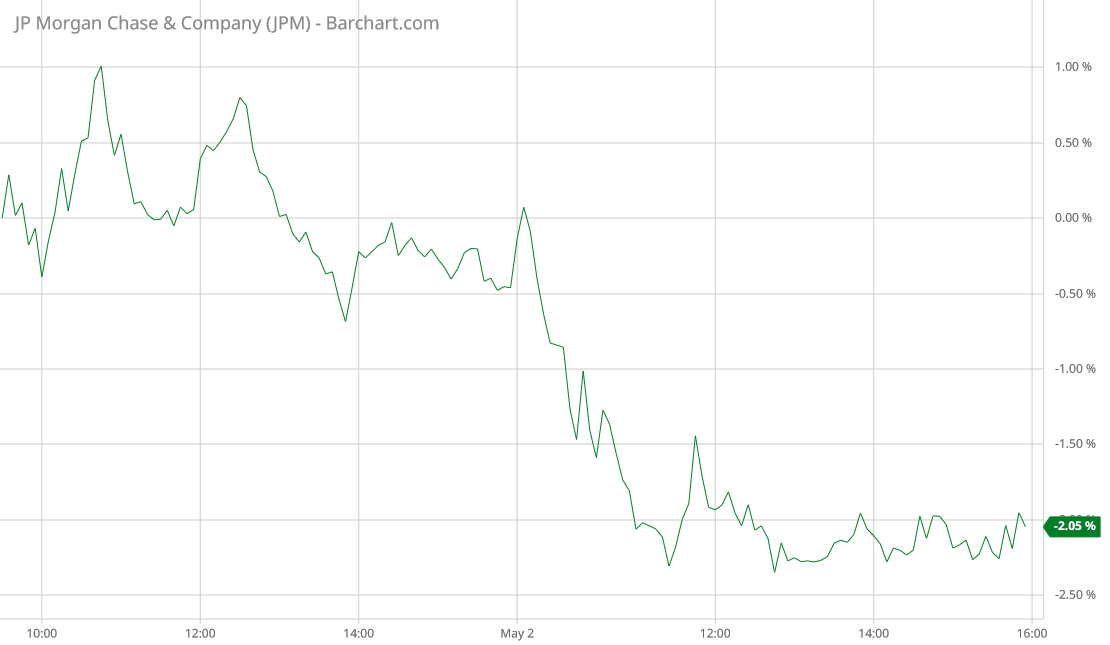

JP Morgan’s stock has shed roughly 2% of its previous value over the past two days.

Bank of America, the nation’s 2nd largest bank by total assets, lost over 4%.

PNC, which was in the hunt for First Republic Bank as late as Sunday, also lost more than 4% of market value.

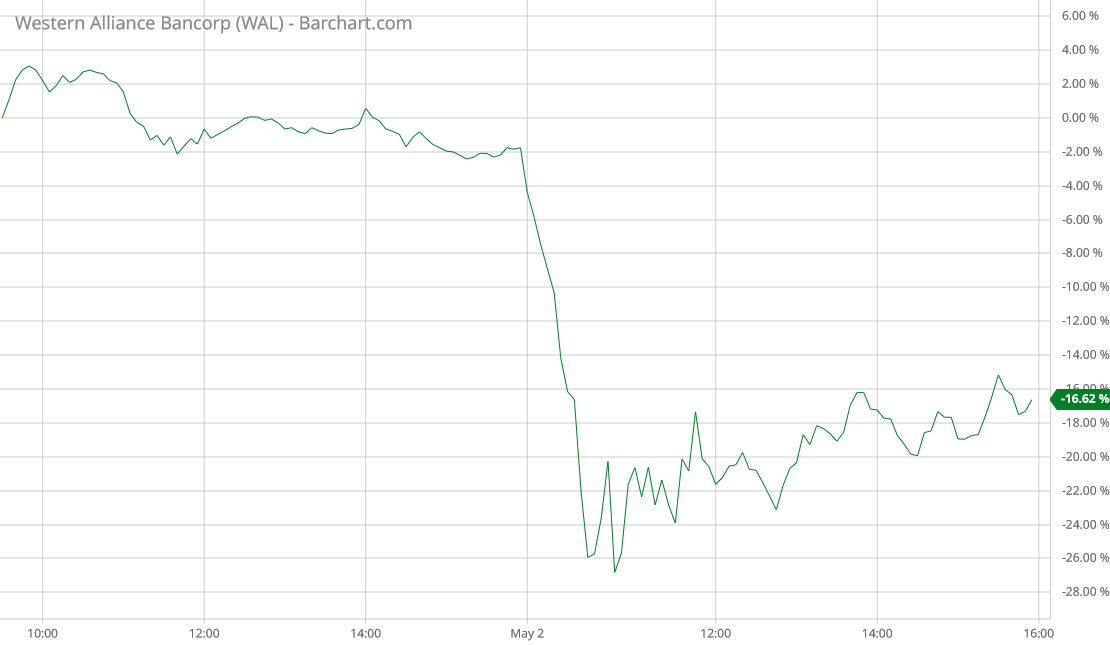

Western Alliance Bancorp, which I have speculated may be one of the next banking dominoes to fall, declined by over 16%.

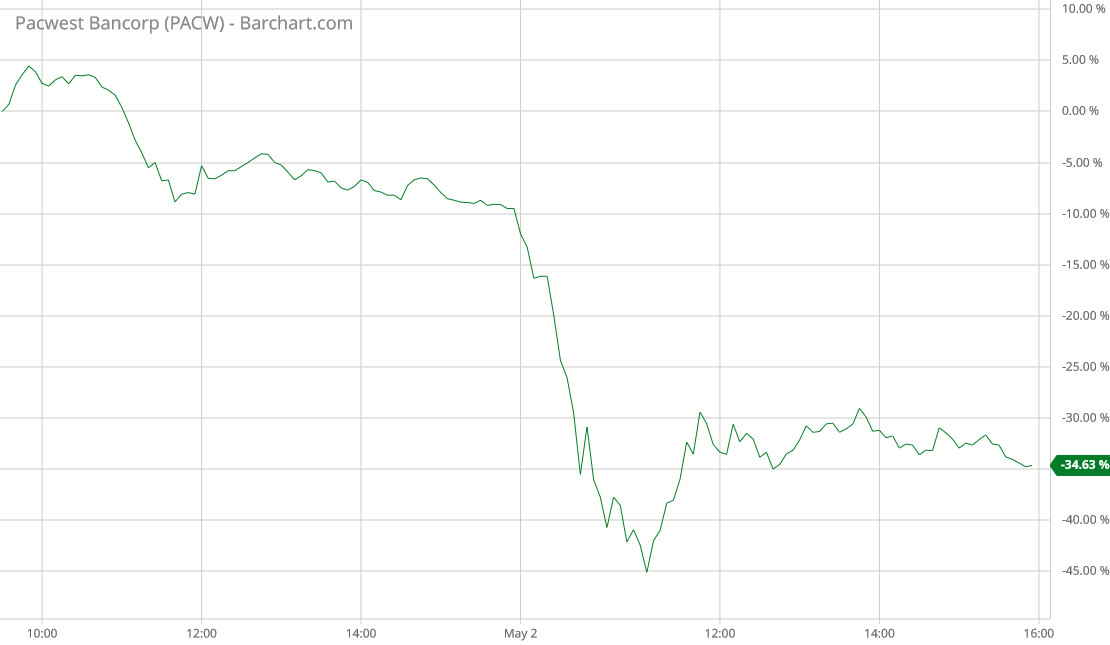

PacWest Bancorp, another possible bank domino teetering on the edge, has fallen by over 34%.

Even Wells Fargo, the nation’s fourth largest bank, which has sat on the sidelines throughout the First Republic fracas, shed over 4% of market value.

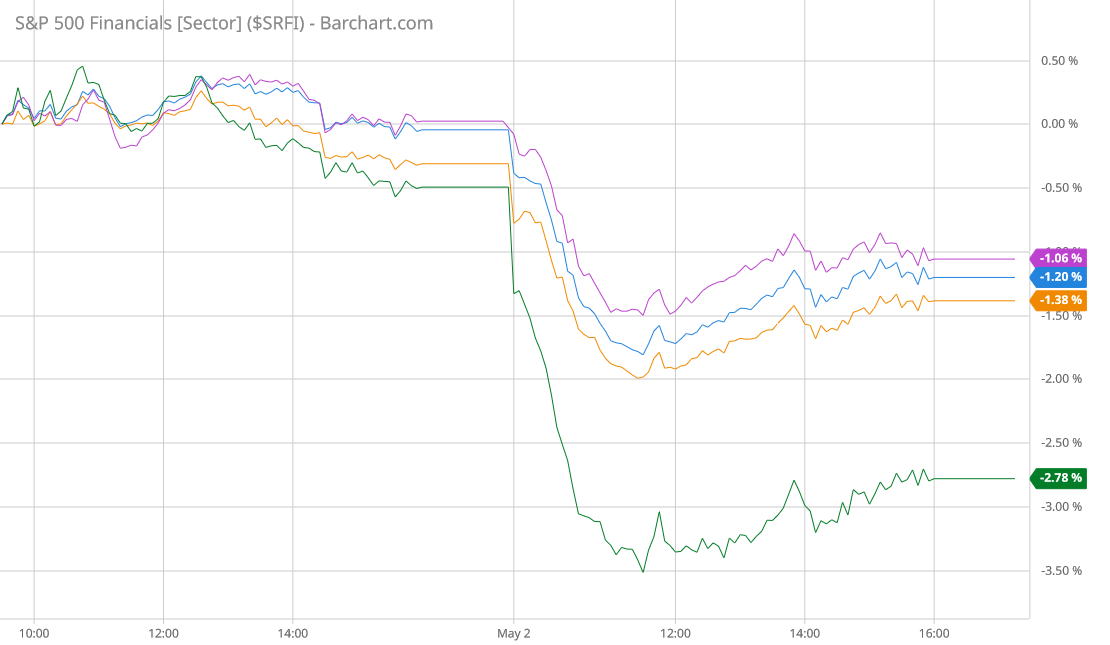

Overall, the S&P 500 Financials Index lost 2.78% over the past two days, which is more than double the declines of the major market indices over the same period.

It will be several days if not weeks before the impacts of First Republic’s collapse has been fully digested and priced in by Wall Street. Yet it is clear just from the stock movements of the past 48 hours that Wall Street is not giving any premium to the merger. There is no bank that is viewed as coming out ahead here—not JPMorgan, not Bank of America, not Wells Fargo, not PNC, and certainly not First Republic, nor Western Alliance, nor PacWest.

Wall Street is not at all persuaded the First Republic firesale is the end of the bank crisis. At the moment, it is waiting for the other shoe it is firmly convinced is about to drop.

If shareholders didn’t like JPMorgan’s move to acquire parts of First Republic, why did Dimon do it? Is it part of a long-term strategy to get additional market share and strength, or did Dimon do it solely because he was afraid of a larger banking crisis if he didn’t? It seems like there are true assets acquired, but is everyone convinced now that those assets are going to plummet in value?