June Data Shows Prices Rising Across The Board

Tariffs or Not, Inflation’s Back and It Hurts

As I noted yesterday, the June Consumer Price Index Summary was not good news.

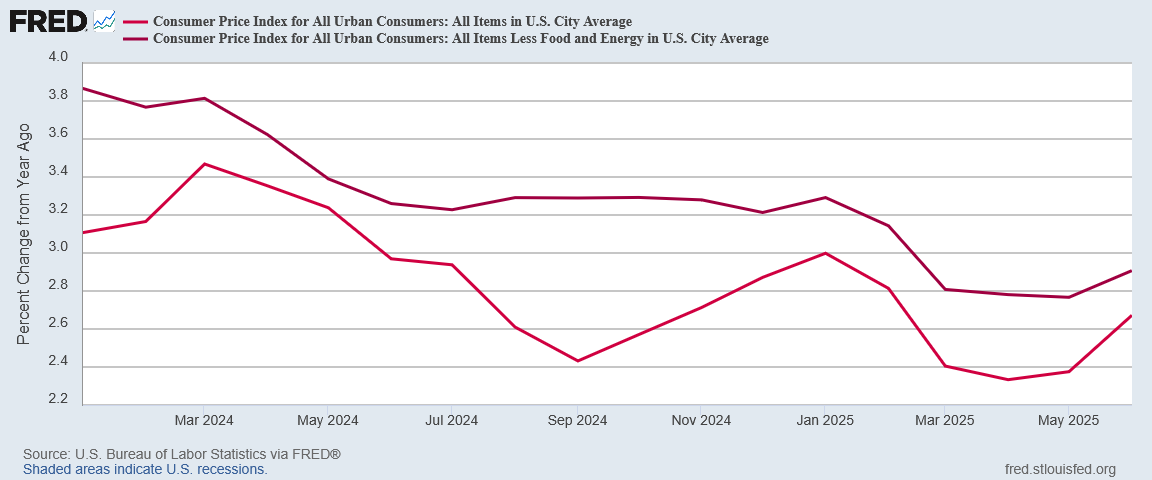

The all items index rose 2.7 percent for the 12 months ending June, after rising 2.4 percent over the 12 months ending May. The all items less food and energy index rose 2.9 percent over the last 12 months. The energy index decreased 0.8 percent for the 12 months ending June. The food index increased 3.0 percent over the last year.

While core inflation came in below forecast, that is cold comfort against the reality that both it and headline inflation printed higher than in May.

While it is still too soon to call this a trend reversal from the disinflationary trend the US has enjoyed since the start of 2024, the June data moves uncomfortably far in the wrong direction.

The month on month numbers offer no comfort at all, with headline inflation heating up more than core inflation for the first time in months.

The increase in headline inflation is unsurprising, however. As I surmised earlier this week, energy price inflation returned for June.

That was coupled with an uptick in food price inflation.

The two increases together are what produced June’s hotter than expected headline inflation print.

Core inflation, while printing below forecast, still managed to spark some fears about the Liberation Day tariffs finally having the much ballyhooed adverse impact.

The June data still reflects only the initial impact of Mr. Trump’s global trade war. Economists expect price pressures to intensify over the coming months, especially if new tariffs the president has threatened against the European Union and a host of other countries in recent days are imposed on Aug. 1 as planned.

Up to this point, inflation has been more muted than feared when Mr. Trump returned to the White House. That has emboldened the president and his top advisers to dismiss the latest set of warnings from economists about the damage steep tariffs could have on consumers and businesses across the country.

We will have to wait for the June import and export prices to come out in a few days to determine how accurate that assessment is. While not an impossibility, without specific interrogation of import price data, such a conclusion is at the very least premature.

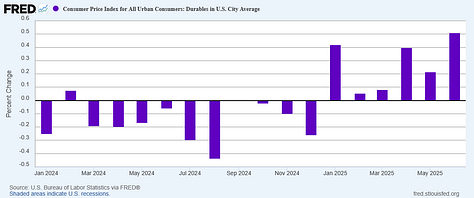

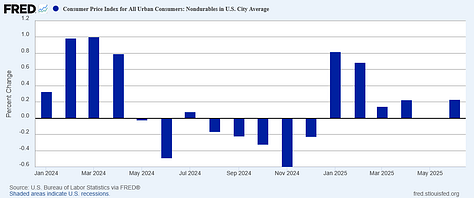

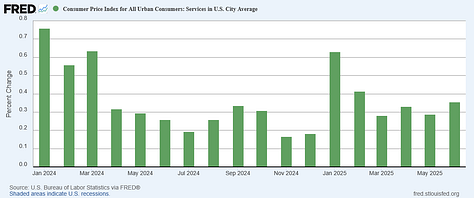

At the same time, there is no denying that inflation was up significantly for both durable and non-durable goods, as well as services.

Tariffs would certainly explain such a broad-based price rise.

However, with commodities up on the month as well as energy, we should not jump to the conclusion that tariffs are the sole or even the primary driver of rising prices.

Energy prices are up. Commodity prices are up. Consumer prices are therefore up, and across the board.

Shelter was one of the few areas where the disinflationary trend month on month was sustained in June.

Despite such positive outliers, the reality of June is that prices rose, and rose more than wages. Even goods-producing wages managed to lose ground to inflation in June, at both the hourly and weekly measurement levels.

Every price increase that is not matched by a wage increase is by definition economic damage to the worker—which is to say to the consumer, for they are one and the same. The June inflation report shows price increases that are not matched by wage increases. That is the reality of consumer price inflation in six months into the Trump Administration 2.0.

Inflation is getting hotter across the board. There is no amount of spin to be done in any media outlet that is going to make that economic good news.

What was your experience of consumer prices in June? Did you see prices rise, fall, or hold steady?Please let me know in the comments or drop a note in chat.

Thank you are answering my question from yesterday regarding core inflation, Peter. Apparently, its slight decrease is not much help.

So now I’m pondering the decrease in shelter costs. At first glance, one would conclude that it’s the effect of deportations, as I’ve read that around one million illegals have self-deported, plus all those affected by the efforts of ICE. But then again, is that data going to be showing up yet? I would think that it would take another month or two before the deportation data will be affecting shelter costs. Meanwhile, I keep reading that construction costs continue to rise (mostly due to materials), and new homes aren’t selling. (This makes sense, because if construction costs make new homes even less affordable, sales will wither.) So maybe the two factors - rising construction costs and deportations - pretty much cancel each other out in affecting shelter costs.

My question to you is: have you seen any data comparing the timelines between the two? It could be significant, because if the deportation data hasn’t shown up yet we could be getting additional lowering of shelter costs in coming months. Thanks, Peter, you seriously smart analyst!