Labor Stumbles Despite Cheery Jobs Numbers

For Workers, The June Jobs Report Isn't a Win, It's A Setback

To call the June Employment Situation Summary a pleasant surprise would be something of an understatement. Far from the grim results of the corollary ADP National Employment Report, the Bureau of Labor Statistics reported unexpected job growth.

Total nonfarm payroll employment increased by 147,000 in June, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in state government and health care. Federal government continued to lose jobs.

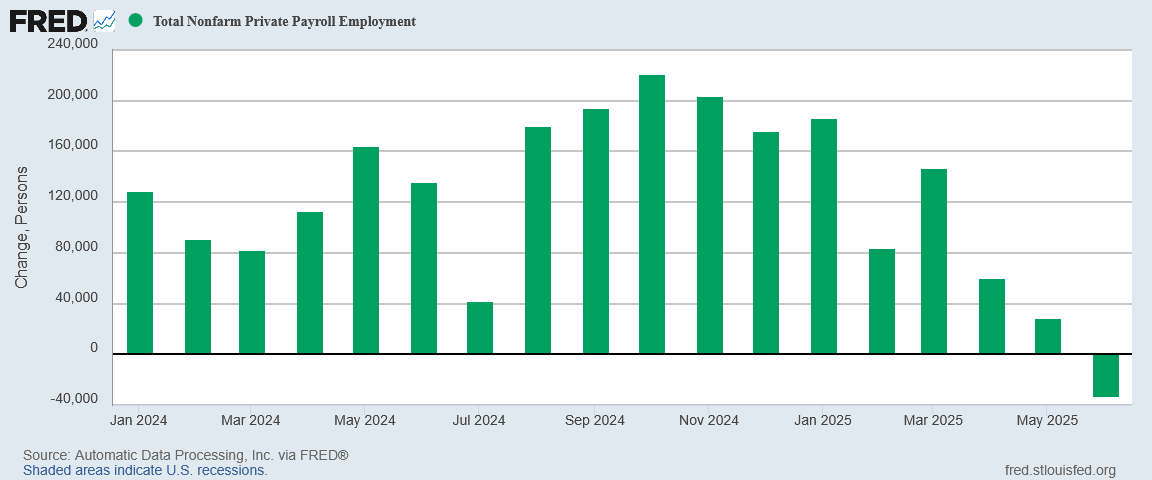

Given the 33,000 jobs lost on the ADP jobs report, for the BLS to report 147,000 new jobs in the US for June is a bit of news almost too good to be true.

Unfortunately, “too good to be true” is exactly what that number is. While the media on all sides are happy not to look past that top-level number, when we peel back the layers of data we find—surprise!—more Lou Costello Labor Math and more bad news for American workers.

This jobs report isn’t a win for workers, it’s a setback.

Contents

More Lou Costello Labor Math

Not only is the 147,000 jobs reported on the June jobs report far better than the ADP numbers, it even bests May’s results by a few thousand jobs.

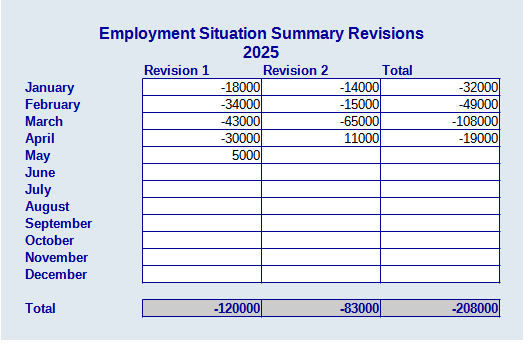

Adding to the positive nature of the report is the addition of 16,000 jobs to April and May’s numbers.

The change in total nonfarm payroll employment for April was revised up by 11,000, from +147,000 to +158,000, and the change for May was revised up by 5,000, from +139,000 to +144,000. With these revisions, employment in April and May combined is 16,000 higher than previously reported.

However, these positive corrections still leave the initial job numbers reported by the BLS overstated by some 208,000 jobs for 2025.

Those positive revisions are where the good news ends and Lou Costello Labor Math begins.

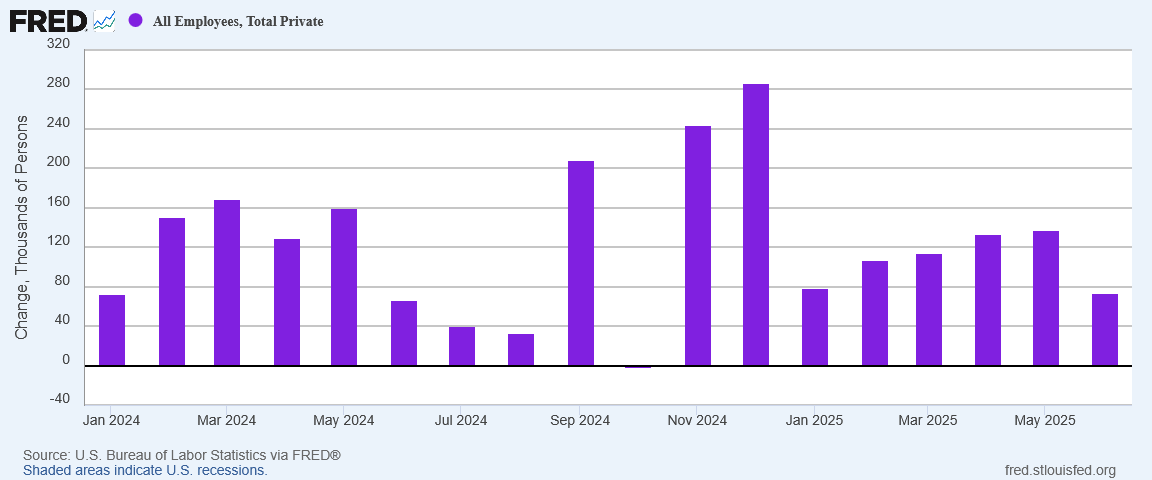

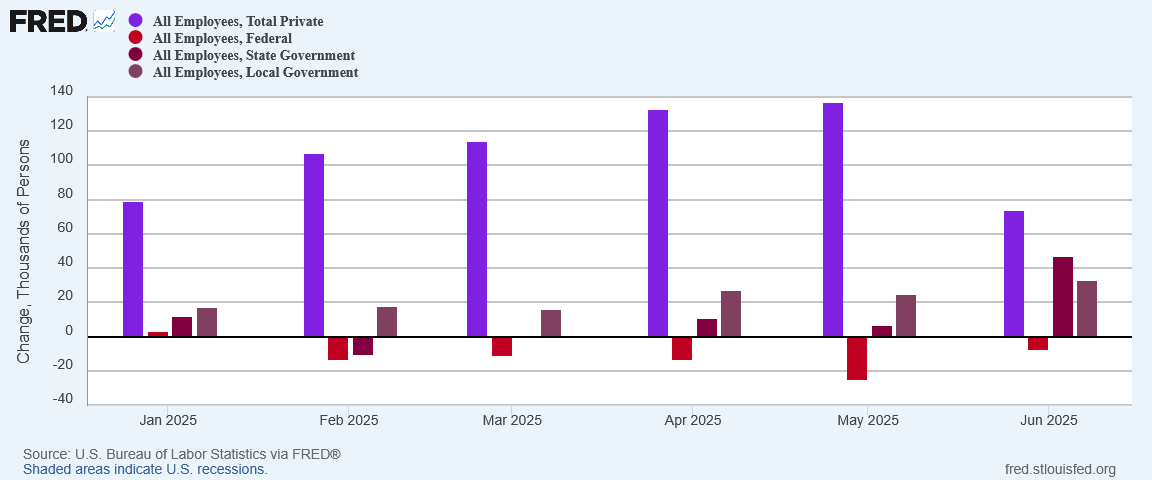

When government jobs are excluded from the BLS data, the number of jobs created falls by half, to just 74,000 jobs.

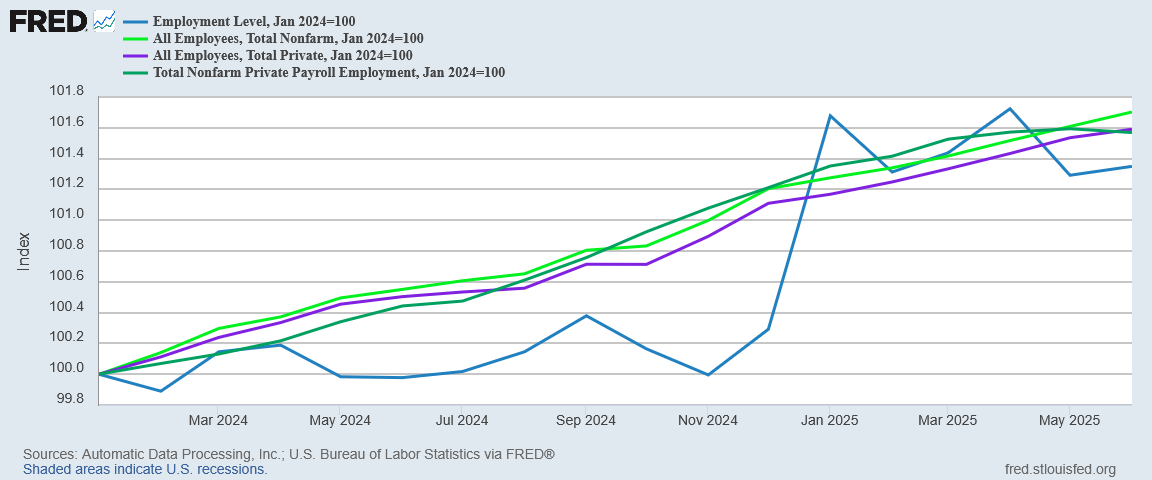

Against the private-sector numbers, the ADP numbers no longer appear that far out of bounds, and when we index the various BLS metrics as well as the ADP numbers to January of 2021, we see a continuation of the divergences from May—a strong indicator the BLS data is tainted with the statistical garbage of Lou Costello Labor Math.

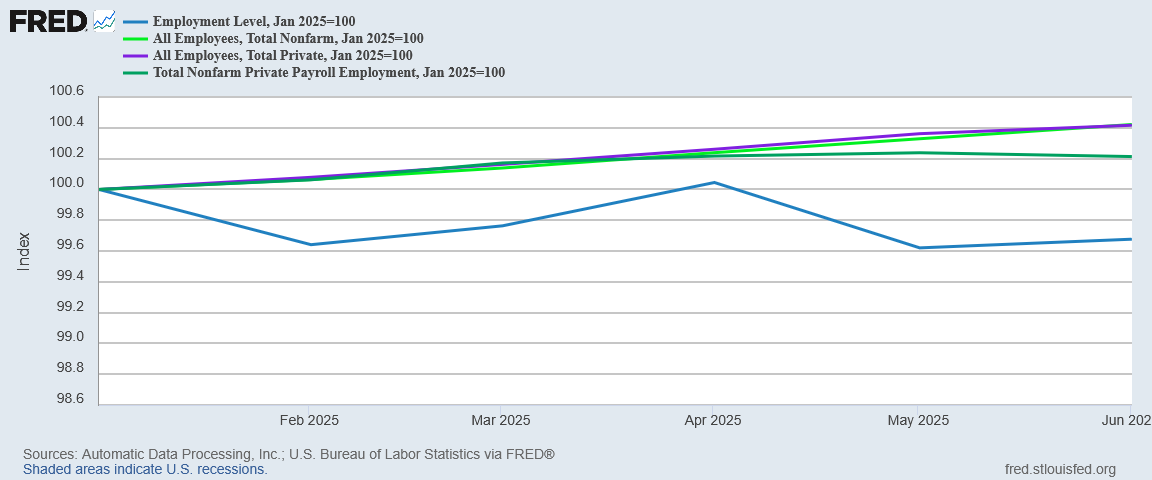

With six months of data for 2025, we begin to have enough post-Biden data to focus on the BLS results strictly for the Trump era—and that does not add any confidence to the BLS data. Redoing the index to January of 2025 confirms Lou Costello Labor math, highlighting the divergence between the Employment Level metric from the BLS Household Survey and the metrics of the BLS Establishment Survey.

The job loss on the ADP report is itself indicative of a growing divergence between the BLS and ADP results—something we should not see happen, since all of these metrics are presumed to sample the same large data set.

The marginal increase in the employment level from the Household Survey lends far more credibility to the ADP results than to the Establishment Survey results.

Before we even delve deeply into the numbers, we already can dispense with any celebratory nonsense for the June jobs report. Thanks to Lou Costello Labor Math the best we can say of it is that the data is garbage.

Sector Level Data Is Weak

When we do delve into the numbers, the report only gets worse.

Manufacturing lost jobs for the second month in a row.

Even Private Education and Health Services, which has carried the BLS report for the past few reporting cycles, showed significantly weaker growth.

At the same time, Trade, Transportation, and Utilities—a mainstay of service-sector employment, continues to show anemic, almost non-existent job growth.

Such are the private-sector results when fully half of the jobs created in June were state and local government jobs.

The Trump Administration is continuing to trim the payroll for the federal government, but states and municipalities more than countered those efforts in June.

Not only did the US economy lose jobs in the most desirable sector, its best job growth for June came in the least desirable sector. While this makes the headline numbers look good, swelling government payrolls does not translate into productive economic growth overall.

A healthy economy needs more workers who actually make “things”, and the BLS is reporting that we have fewer such workers.

A sick economy adds government workers rather than productive private-sector workes, and the BLS is reporting that is exactly what happened in June.

Neither of these realities is good news. The BLS gave us both realities for June.

Backsliding On Wages

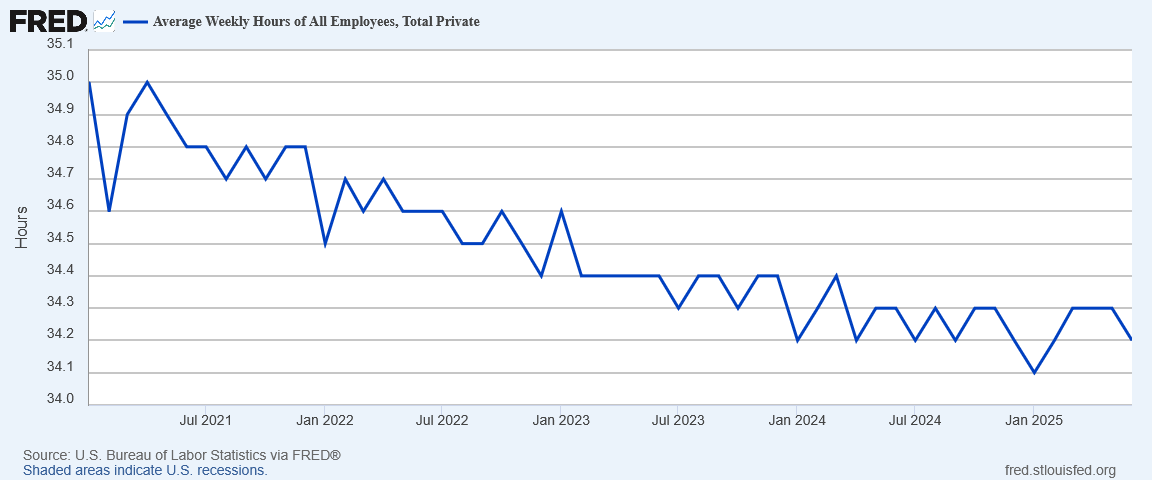

Adding to the poor job growth data is a decline in average hours worked.

When people work fewer hours, hourly wage growth is undermined, and that is exactly what we see happening when we scrutinize the wage data.

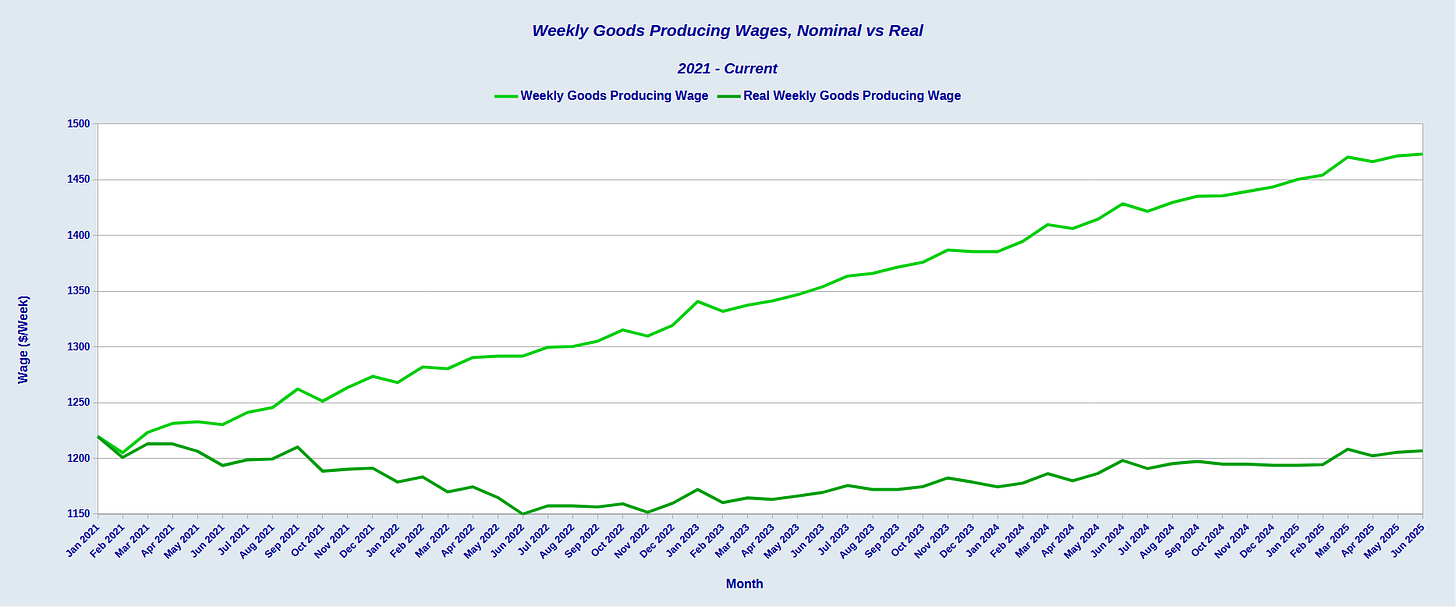

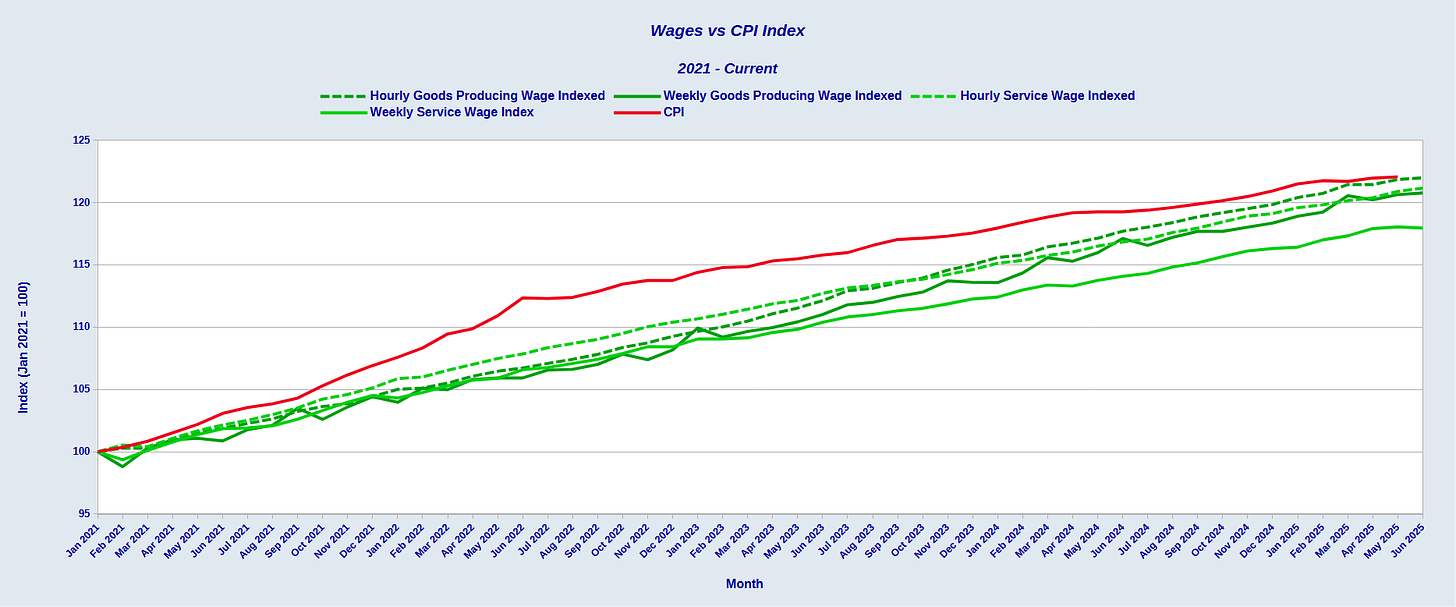

While real hourly goods producing wages continue to tick upwards, they are only now just matching the real hourly goods producing wages from January of 2021, before the 2022 hyperinflation cycle.

However, that recovery falls short when we step back and look at real weekly goods producing wages.

This is what happens when workers work fewer hours.

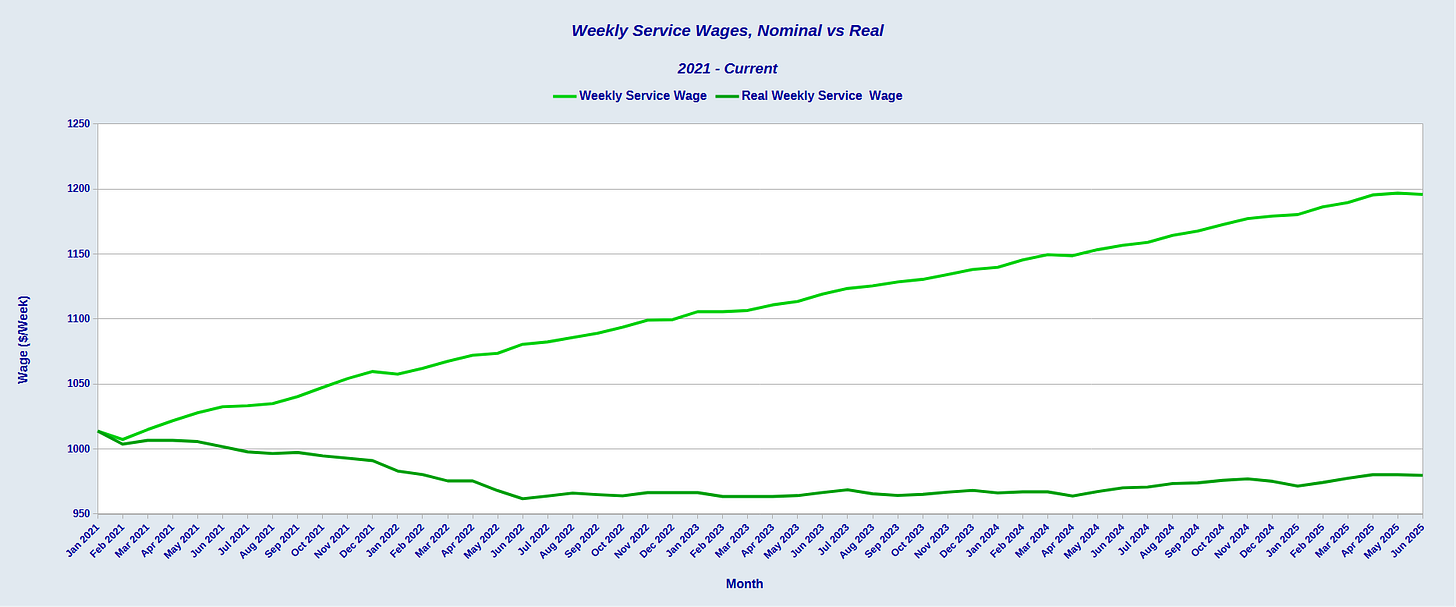

Service wages are in even worse shape, as real hourly service wages still have not recovered to 2021 levels.

The decline in hours worked, however, means that both nominal and real weekly service wages fell in June.

This disrupts a trend of steady nominal service wage growth in 2025.

The growth trend had been more significant for real service wages, but that trend also had been broken.

Which means that workers today across the board are earning less in real terms than in January 2021, thanks to inflation. While at the hourly level wages are close to their January 2021 levels, the erosion of hours worked means the weekly wages are still far below where they need to be to compensate for increases in consumer prices.

The June jobs report not only shows no improvement in this, it shows service workers in particular are still losing ground to inflation.

Backsliding on wage growth is another major piece of bad news in the Employment Situation Summary.

Joblessness Rising Or Falling?

Presumably, one bright spot in the overall data is the decline in unemployment. Not only did the unemployment rate presumably fall, but the overall number of unemployed workers dropped dramatically on a seasonally adjusted basis.

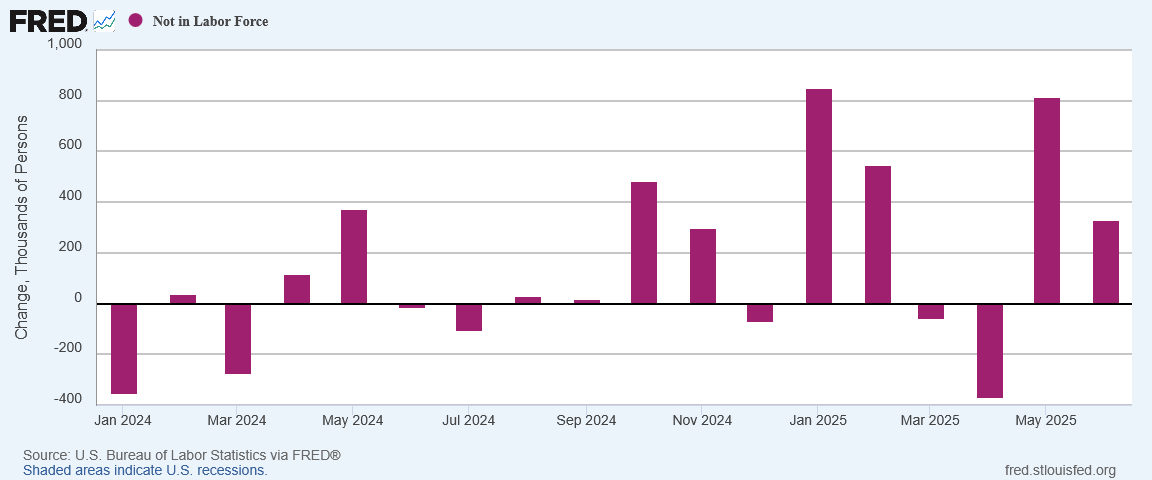

Even the number of workers not in the labor force grew by a much-reduced number—on a seasonally adjusted basis.

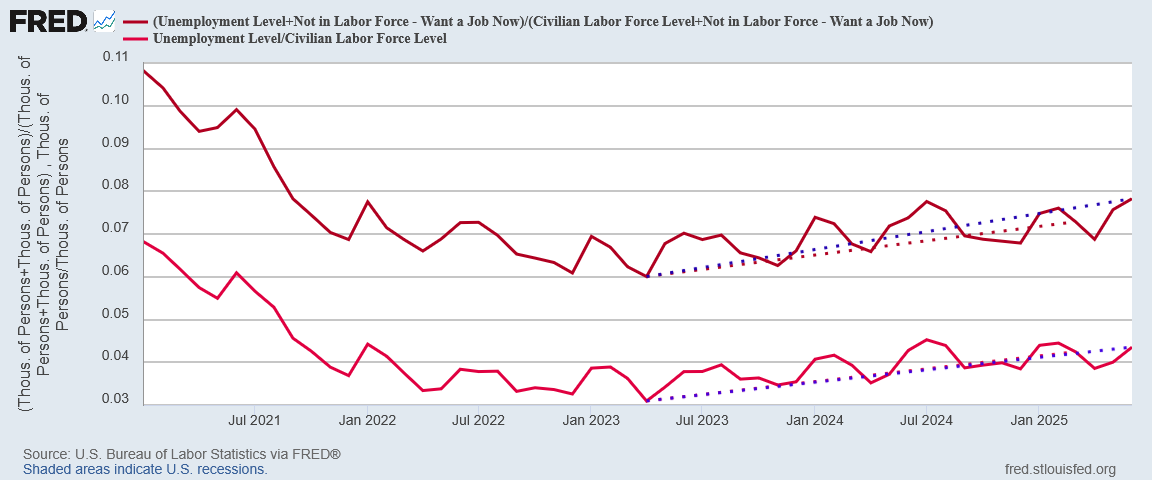

While a seasonally adjusted drop in unemployed is a good thing, the longer term trend in unemployment is still increasing.

The drop in the unemployment level is at most a marginal improvement, and not enough to signal a trend reversal.

Moreover, the raw unadjusted data shows an increase in the unemployment level, as well as a rise in the “real” unemployment rate (where those not in the labor force but who want a job now are included).

Did overall joblessness really decline in June? The data tells us that assessment is far from certain.

The strongest support we have for an assessment of reduced joblessness is that the employment-population ratio did not fall in June, but held steady.

Given the significant drop in the ratio just since the start of 2024, however, merely not falling further is hardly enough to qualify as “good” news. We need to see that ratio rising, and rising sharply.

Victory Lap But No Victory

Surprisingly, corporate media passed on the chance to take jabs at the Trump Administration over the jobs report, preferring instead to focus on the report’s political potential to remove pressure on Jay Powell to trim the federal funds rate.

For its part, Politico decided to focus on the headline numbers beating expectations.

The consensus estimate was that the nonfarm payrolls expansion would slow to 110,000 jobs — well below the 146,000 averaged over the previous year — and that unemployment would tick up by a tenth of a percentage point to 4.3 percent. Instead, the unemployment rate fell to 4.1 percent, and the government’s estimates for April and May were revised up by 16,000 positions. Average hourly earnings climbed at a rate of 3.7 percent.

Even alternative media outlet Breitbart chose to focus on the 147,000 headline jobs number, and only farther down did they give perfunctory notice to the weak sector-level data.

White House Press Secretary Karoline Leavitt naturally took a victory lap over the numbers, crowing about the report on X.

Donald Trump did his own online chest-thumping, reposting on Truth Social the Department of Labor’s celebratory post on X.

The Small Business Administration also joined in the online victory dance.

The only thing missing from the Trump Administration’s victory lap was the actual victory.

The continued erosion of manufacturing jobs cannot be counted as economic good news in any scenario, and it runs directly counter to President Trump’s Agenda 47 goal of making the United States a manufacturing superpower. Being a manufacturing superpower will require more manufacturing jobs, not less.

The June jobs report does not show the President getting closer to meeting that objective.

At the same time, eroding wages might be pleasing to Jay Powell and the anti-labor brain trust at the Federal Reserve, but for workers it means another month of losing ground. Without robust wage recovery workers are going to be in a very bad way should inflation decide to move upward to any significant degree.

Even more insidious than the decline in service wages is the decline in hours worked. The sobering reality of work is that for incomes to grow workers have to in general work more not less. Declining hours do not mean workers are working smarter, only that they are not working harder.

Declining hours means there is less work overall, rather than more, and that is a grim prognosis for any economy. Declining hours and less work raises the possibility of deflation, or perhaps stagflation, where inflationary and deflationary forces collide.

Neither scenario is a good one for the US economy.

President Trump, just like Biden before him, naturally took the headline jobs number and ran with it, building the jobs report up into yet another win for the Trump Administration in a week that had been largely filled with political wins.

Still, the jobs report is not a political report, but an economic report. President Trump may be able to craft a political win out of it, but for the US economy the report is no win at all.

All spin and social media posting aside, the June Employment Situation Summary does not show the US economy doing well.

Lou Costello math:

https://m.youtube.com/watch?v=oN2_NarcM8c&pp=ygUiYWJib3R0IGFuZCBjb3N0ZWxsbyBhZGRpbmcgbnVtYmVycw%3D%3D

It could be that much of the increase in Gov't hiring is seasonal employees hired for recreational locations (park rangers, laborers, aides, lifeguards, etc.). If so, the fall numbers will decline as well.