Lather. Rinse. Repeat.

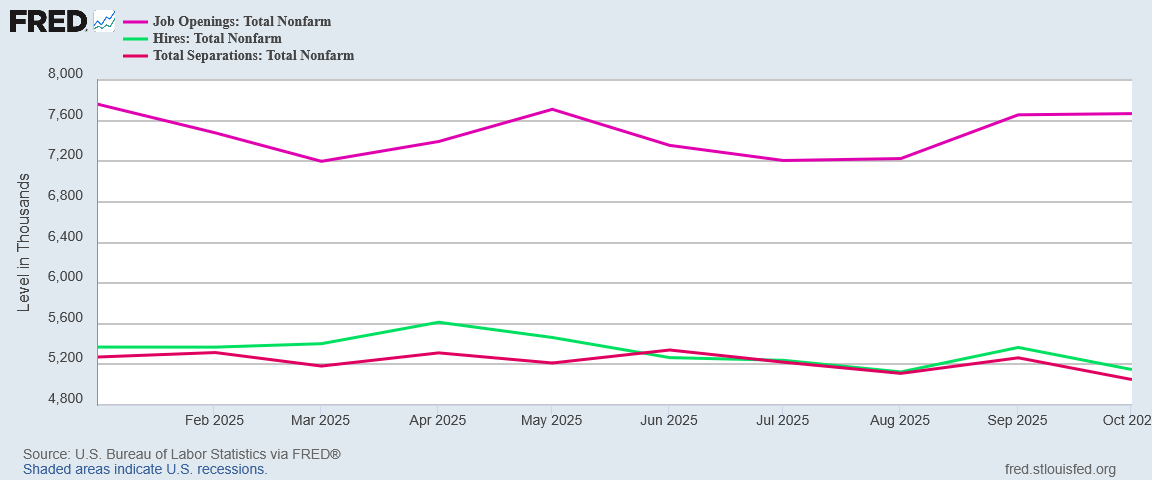

While the numbers have shifted somewhat, the trends within the October Job Openings and Labor Turnover Summary report still have not changed. Fake job openings rose slightly, actual hiring and separations plunged, net hiring dropped slightly.

The number of job openings was unchanged at 7.7 million in October, the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.1 million.

Within separations, both quits (2.9 million) and layoffs and discharges (1.9 million) were little changed.

Once again, the JOLTS report presents a US labor market that’s short on actual jobs even as it remains long on the “promise” of job openings that never seem to get filled.

Once again, corporate media sees the job openings number and forgets the rest.

Once again, the rest of the data makes the JOLTS report clearly negative.

The jobs recession is continuing, and in several sectors is getting worse. Labor markets are not doing at all well, and certainly are not showing any real signs of resilience. There still is no “Golden Age” for the American worker.

The “Good” Headline: More Job Openings

In the corporate media narrative, rising job openings is a sign of a robust economy. In reality, rising job openings when hiring is dropping is a sign of an ailing economy.

More job openings should indicate businesses are more interested in hiring people and expanding their workforce. Yet when hiring is falling at the same time, whatever businesses are interested in doing, expanding their workforce is clearly not it.

Lack of employer interest in hiring is exactly what we see in the headline JOLTS data, with job openings ticking up slightly while hiring and separations moved down significantly in October. The job openings data once again has to be dismissed as essentially fake.

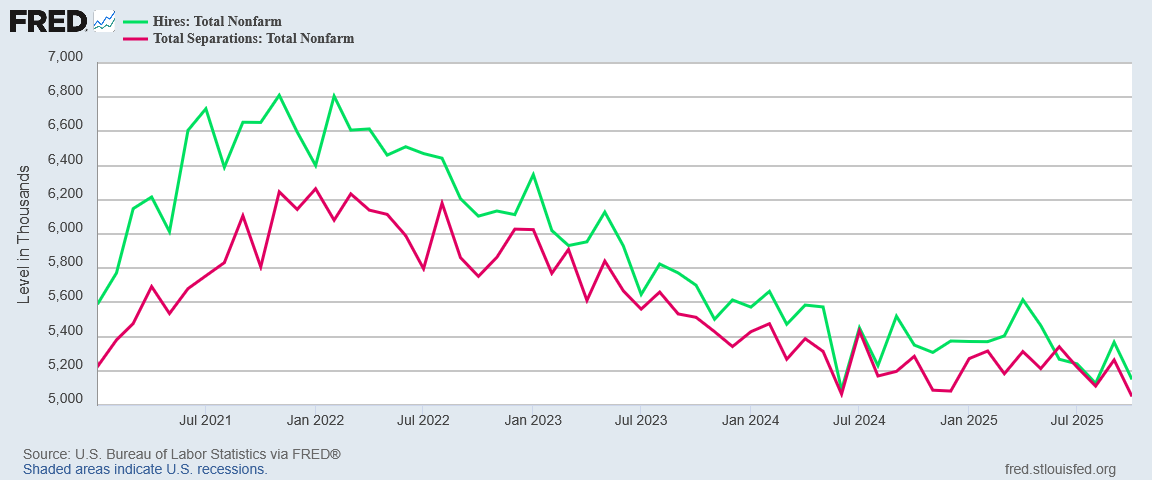

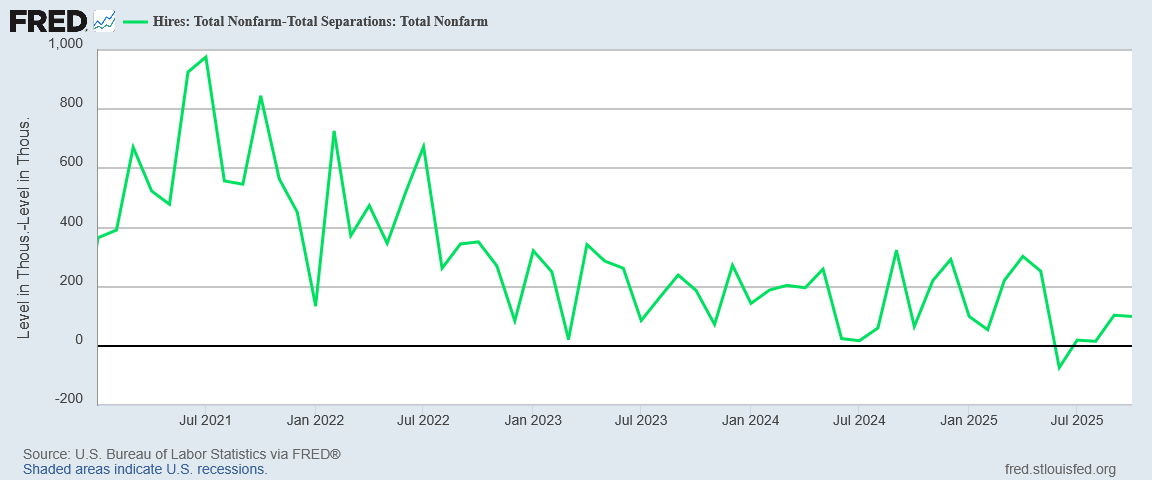

Hiring in October continued on the same downward trend that it has held since early 2022.

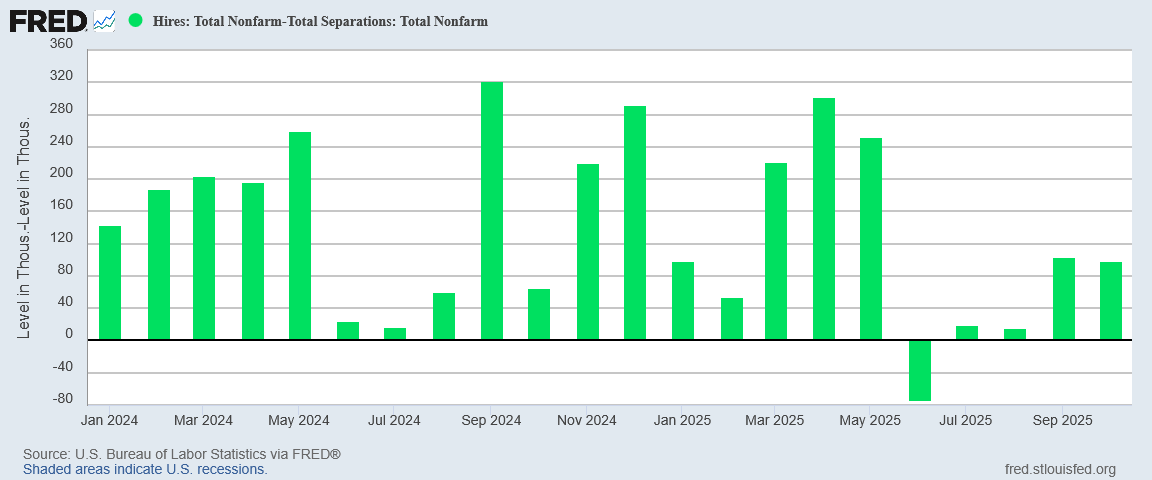

While separations has also trended down over that same time period, it has not moved as significantly to the downside as hiring, with the result that net hiring (hiring less separations) has also been trending down over that same time frame.

While net hiring did improve somewhat late last year, since May of this year it has deteriorated significantly.

Job openings simply do not make a difference if workers are not being hired, and workers are not being hired at the moment.

More Than Manufacturing Taking A Beating

When we drill down to the individual sector data, net hiring gets worse—much worse.

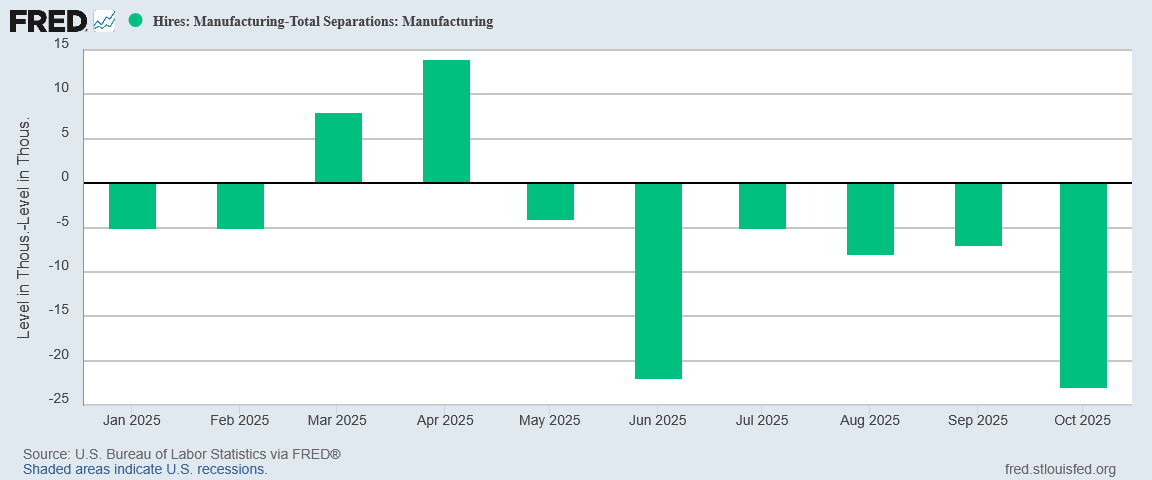

Manufacturing of course continued to shed jobs, but the drop accelerated in October.

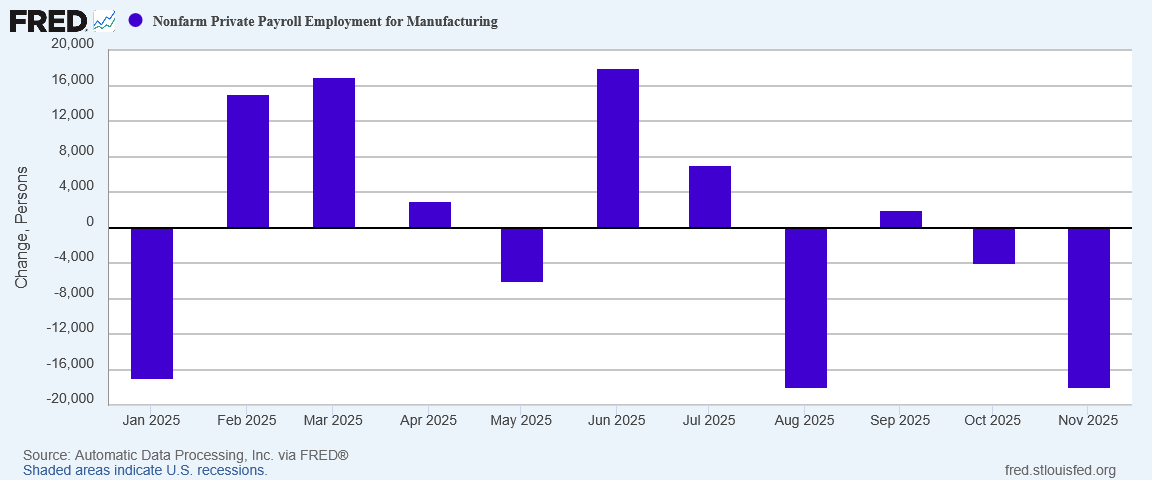

The JOLTS data shows manufacturing losing jobs for the past six months straight. That is a significantly worse result than has been reported by the ADP National Employment Report, which itself shows Manufacturing shedding jobs.

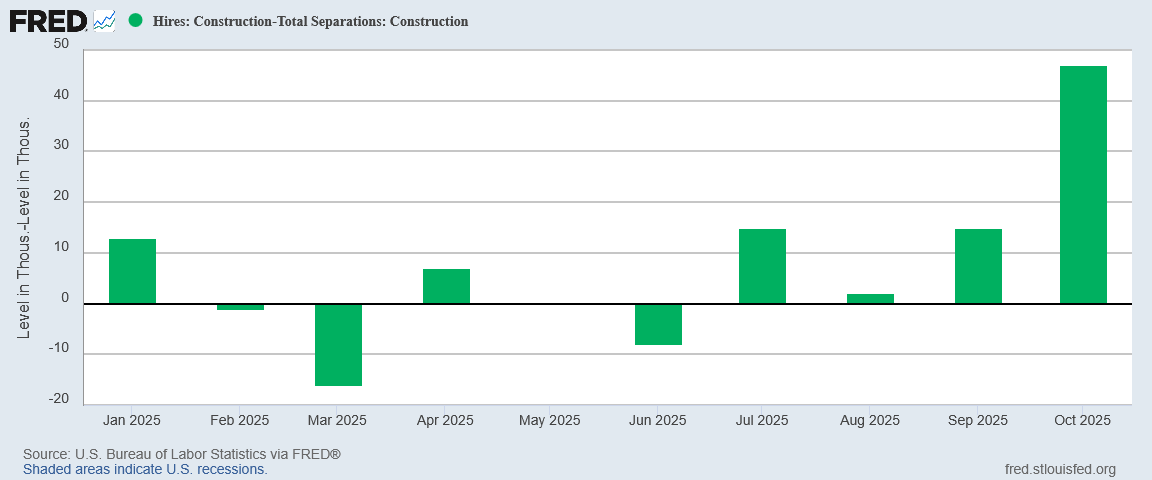

To be sure, it’s not all bad news. Construction net hiring rose significantly in October.

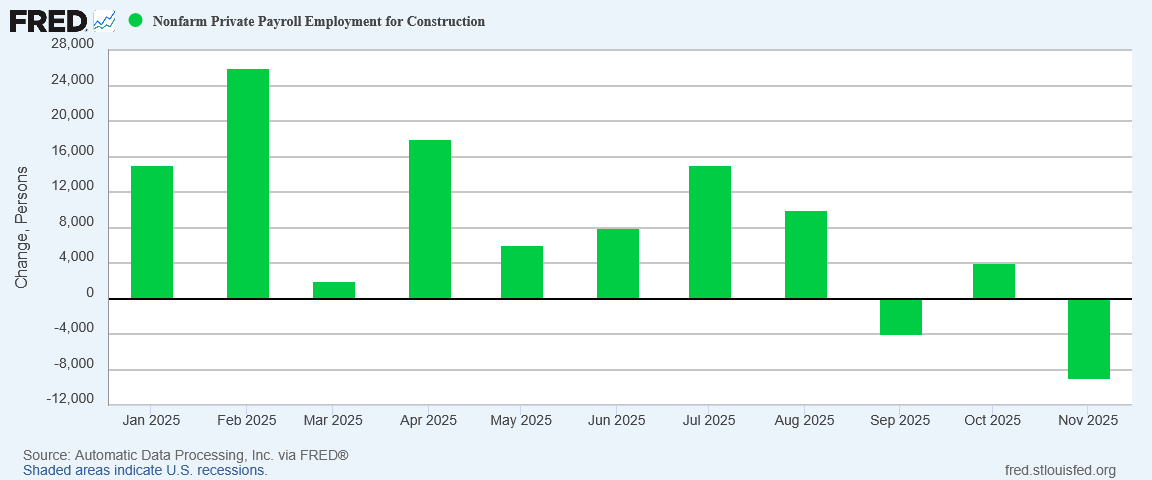

This is something of a positive deviation from ADP, which has been printing weakening employment for construction.

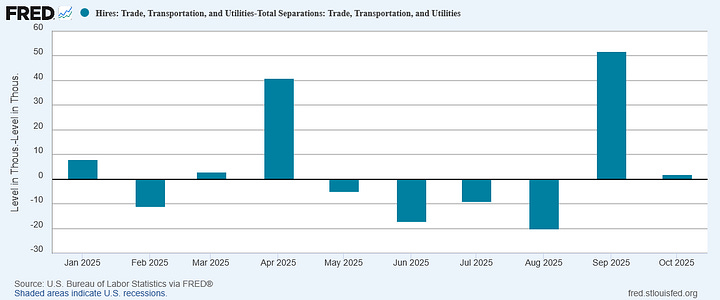

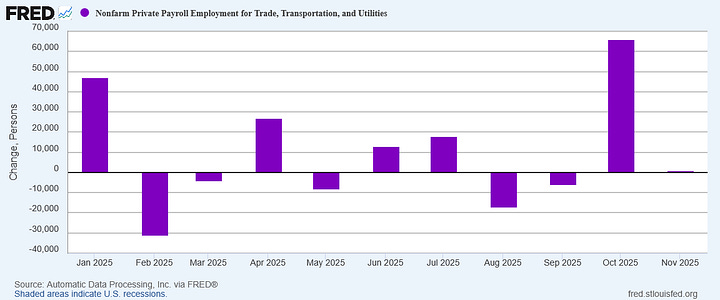

Trade, Transportation, and Utilities, however, has printed very similar trends over the past two years for both the JOLTS report and ADP.

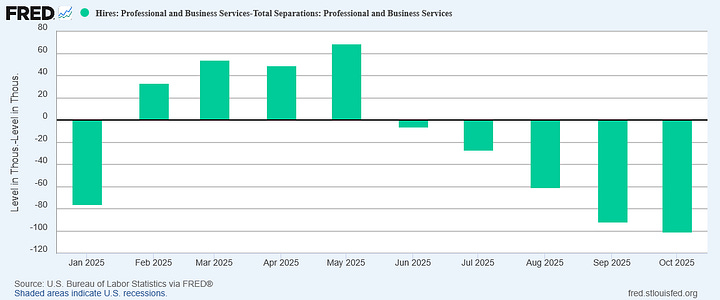

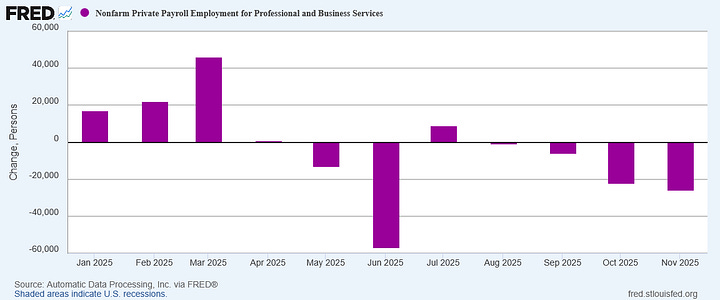

Professional services was another sector where the JOLTS data largely aligns with ADP.

Both reports agree that professional services—which includes Information Technology—has been almost as toxic as Manufacturing. What neither report shows is any semblance of employment health in that sector.

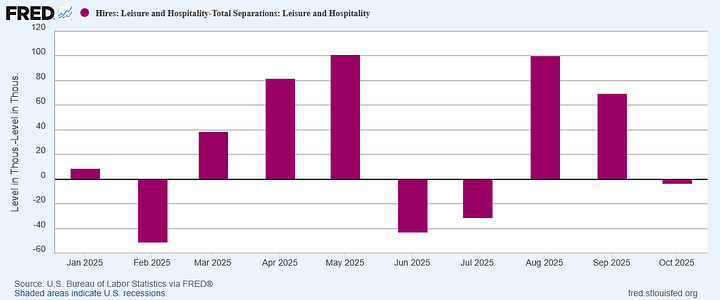

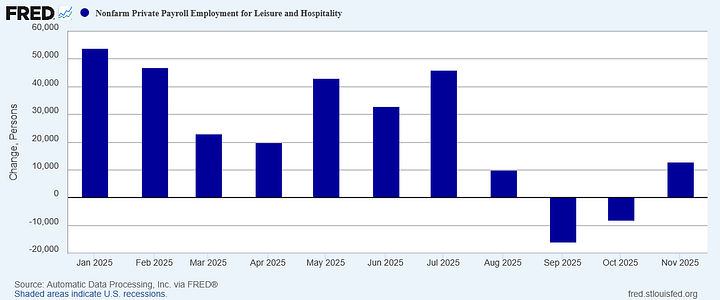

Leisure and hospitality saw a little more divergence between the JOLTS report and ADP, but even at that neither report shows robust job growth in the sector.

The JOLTS report does not show any real job growth in any sector, and a number of sectors with job losses.

There is no way this data can be indicative of a robust and healthy labor market in the US. In sector after sector, we see clear and unmistakable signs that the labor market in the US got significantly worse in October.

Washington And Wall Street Ignoring The Obvious

The data is there. The trends are there. The conclusions follow from the data and the trends, and the conclusions which follow are not good at all.

Corporate media seems not to want to acknowledge that. CNN, ever The Most Busted Name in Fake News, chose to focus their lede paragraph entirely on the non-existent job openings number.

Job opportunities didn’t shrink as expected in October, but hiring continued to stall and layoffs increased in a month when the US government was shut down and hundreds of thousands of federal workers were furloughed, according to new data released Tuesday by the Bureau of Labor Statistics.

To their credit, CNN did point out the declining hiring trend just a couple paragraphs further on, although they completely glossed over the real impact declining hiring has on the economy: America is still failing to create enough jobs give the size of the US labor market.

President Trump, meanwhile, continues to talk about the American economy as if it was not shedding jobs. In an interview with Politico’s Dasha Burns, Trump graded the economy’s performance as “A-plus-plus-plus-plus-plus.”

Burns: But ... but I do want to talk about the economy, sir, here at home. And ... and I wonder what grade you would give your economy.

Trump: A-plus.

Burns: A-plus?

Trump: Yeah, A-plus-plus-plus-plus-plus.

Even allowing for Donald Trump’s reflexive habits of hyperbole, such remarks are simply divorced from reality.

While Trump is not completely wrong when it comes to affordability, he also ignores that the best way to resolve concerns about rising prices in this country is to encourage plenty of job growth, enough to bid up wages, so that any rises in consumer prices are at least matched by rises in wages.

That sort of job growth is not happening in the US, and has not been happening for years.

President Trump is not wrong to point to Fed Chairman Jay “Too Late” Powell’s horrendous mismanagement of interest rates and monetary policy as a primary factor behind the lack of real job growth in this country. However, Trump’s rhetoric tries to gloss over the growing chasm that is America’s rising joblessness.

Regardless of the cause, the reality is that there is not robust job growth in this country. Regardless of the role of interest rates, businesses are actually not hiring, no matter what the fake job openings data pretends to show.

Trimming the federal funds rate will help lower the cost of capital particularly for smaller businesses, and that will help encourage business investment. Investment is a necessary precursor to any sort of sustained trend of robust job growth, and while President Trump has had success getting companies to pledge significant amounts of capital investment in the US, pledges are still all that there are. The actual investment and the actual jobs that investment will hopefully produce is not yet here.

Lather. Rinse. Repeat.

Perhaps the most outrageous aspect of the dismal October JOLTS data is that none of this is exactly newsworthy.

We have had months of negative jobs data, months of corporate media ignoring the negative jobs data, months of Jay Powell not understanding the negative jobs data.

We’ve even had months of President Trump being overly optimistic by far, seeking to gloss over the negative jobs data.

Only rarely and with great reluctance has corporate media even considered the possibility of a jobs recession. The data shows America has been grappling with a jobs recession for over two years, yet corporate media (and most alternative media) simply will not acknowledge that data.

It is still quite possible that, as Trump’s investment pledges materialize, we will see a turnaround in job creation. It is still quite possible that 2026 will turn out to be a year of robust job growth and economic expansion. While the data shows that we do not have robust job growth and economic expansion right now, it does not foreclose those possibilities. Certainly President Trump and his economic team believe those possibilities will materialize in 2026.

I hope they are proven right. That would be the best outcome we could have from President Trump’s economic policies. That would be why I and 77 million other Americans voted for Donald Trump last November.

We are not there yet. While we may yet enter into an economic “Golden Age” in this country, we are not there yet.

We are not experiencing robust job growth right now. We are not experiencing significant economic expansion right now. The jobs data is conclusive that neither of those outcomes is being reached at present.

The present is still one of a deepening jobs recession. The present is still one of rising joblessness, of job loss in key sectors such as manufacturing.

The October JOLTS report is not one of economic good news, just as prior JOLTS reports have not been economic good news, not for several months now.

If the economic news does not change, we will never get to Trump’s “Golden Age”. Right now, at least with jobs, the economic news is not changing.

Thank you for confirming, I need to build a cash buffer.

I think I follow your argument that net actual hiring is more or less flat due to employee churn. It seems like a metric worth tracking. Simple and clear.

But I do not understand what you mean by "fake job openings rose." What are "fake job openings?" Who is faking them? Is this like "fake news?"

It seems like you are trying to make a claim but I'm not clear what it it. Help me understand...

With unemployment at 4.4%, what should hiring look like? Should it race towards 3.4%