On the same day the Bureau of Labor Statistics released its December Employment Situation Summary, the Institute for Supply Management released its December Services PMI Report, which contradicted the BLS employment statistics directly.

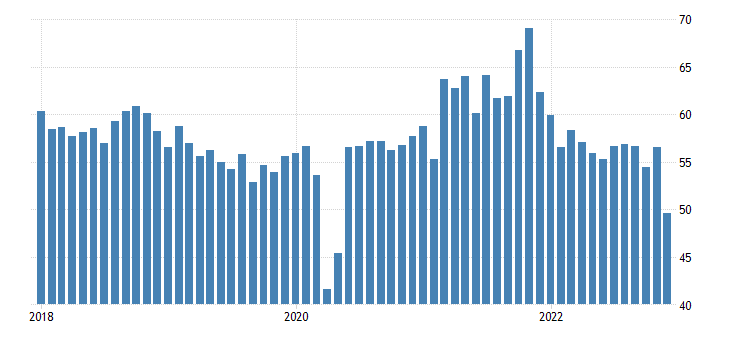

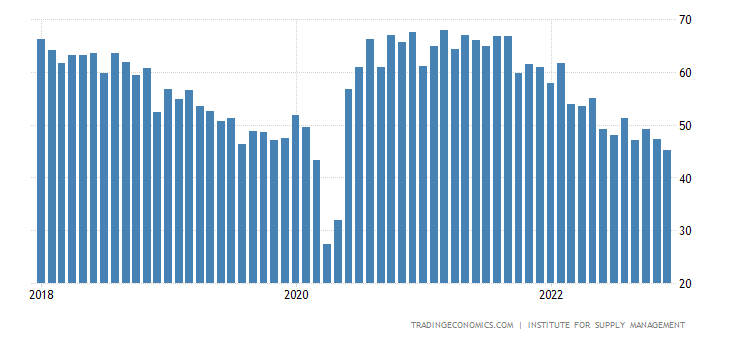

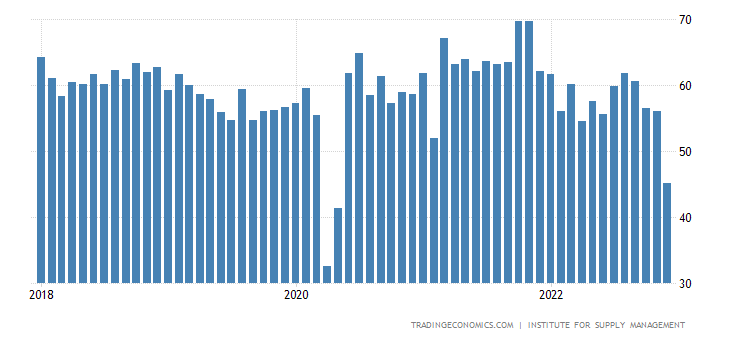

Economic activity in the services sector contracted in December after 30 consecutive months of growth — with the Services PMI® registering 49.6 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®

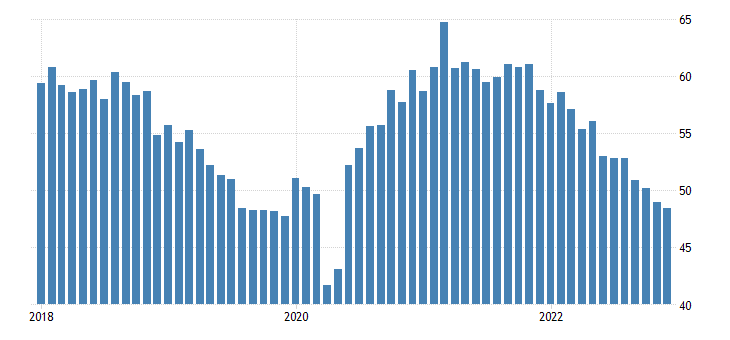

With a 6.9 percentage point drop, the Services PMI® joins the Manufacturing PMI® in reporting yet more economic contraction for the United States.

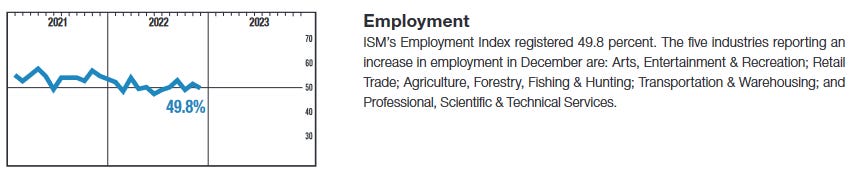

Most significant is what the ISM reports had to say about employment in the country’s service sectors: The ISM Employment index for the service sector contracted to 49.8.

ISM Employment index for the manufacturing sector showed growth—from 48.4 to 51.4.

The problem this poses for the BLS jobs report is that both indices directly contradict what the Employment Situation Summary reported:

In December, employment in leisure and hospitality rose by 67,000. Employment continued to trend up in food services and drinking places (+26,000); amusements, gambling, and recreation (+25,000); and accommodation (+10,000). Leisure and hospitality added an average of 79,000 jobs per month in 2022, substantially less than the average gain of 196,000 jobs per month in 2021. Employment in the industry remains below its pre-pandemic February 2020 level by 932,000, or 5.5 percent.

Over the month, employment in manufacturing changed little (+8,000), as job gains in durable goods (+24,000) were partially offset by losses in nondurable goods (-16,000). In 2022, manufacturing added an average of 32,000 jobs per month, little different than the average of 30,000 jobs per month in 2021.

According to the BLS, the service sector of the economy showed significant job growth, while the manufacturing sector was largely stagnant.

According to the ISM, the service sector of the economy had significant job loss, while the manufacturing sector show significant job growth.

These two assessments cannot occupy the same logical space. Given the internal inconsistencies within the Employment Situation Summary itself, it is no great leap of either faith or logic to give greater credence to the ISM metrics rather than the BLS’ Lou Costello Labor Math.

Nor is the Bureau of Labor Statistics the only Federal entity the ISM reports call into question.

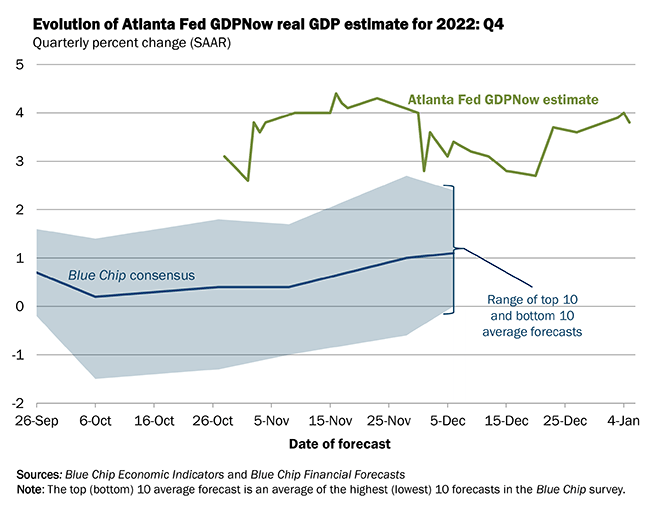

According to the Atlanta Federal Reserve’s GDPNow nowcast of economic growth, the US economy presumably grew 3.8% during the fourth quarter of 2022.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.8 percent on January 5, down from 3.9 percent on January 3. After recent releases from the Institute for Supply Management, the US Bureau of Economic Analysis, and the US Census Bureau, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth decreased from 3.6 percent and 6.1 percent, respectively, to 3.2 percent and 5.8 percent, respectively, while the nowcast of the contribution of the change in real net exports to fourth-quarter real GDP growth increased from 0.17 percentage points to 0.35 percentage points.

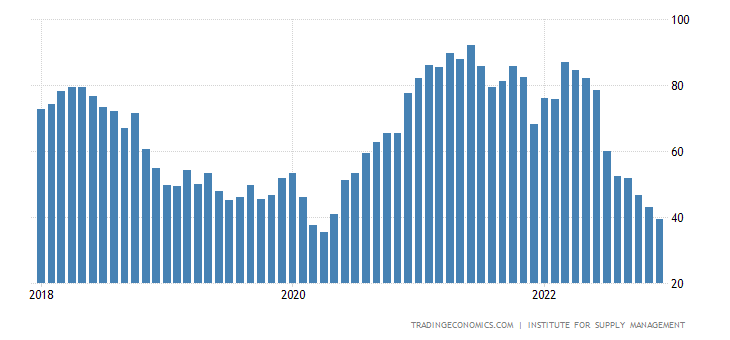

Yet according to the ISM, manufacturing in the United States has been slowing and then contracting throughout the year.

For its part, the service sector plunged to its lowest level since the 2020 pandemic-induced recession in December.

With manufacturing and services in contraction, where is there room left for 3.8% GDP growth?

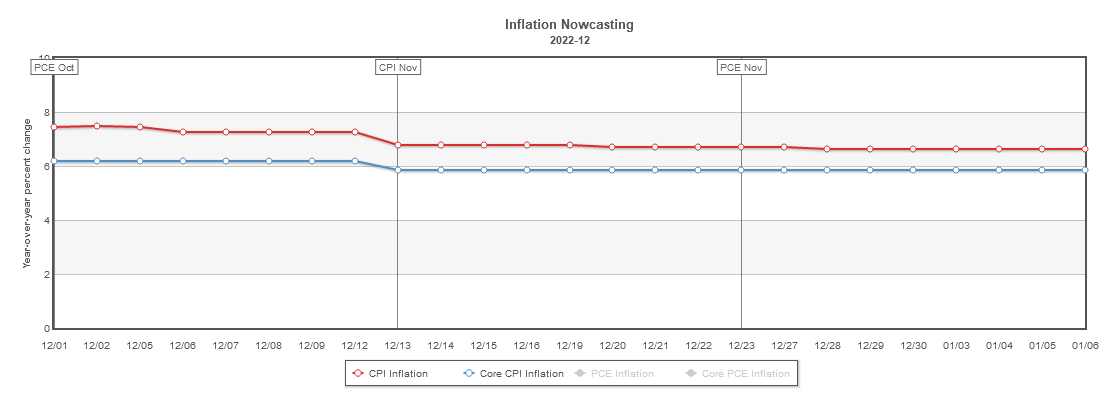

Additionally, the ISM is giving reason to question the Cleveland Federal Reserve’s inflation nowcast which projects only marginal declines in both headline and “core” consumer price inflation.

It is difficult to square minimal declines in consumer price inflation with the steep drops in prices paid by manufacturers for their inputs.

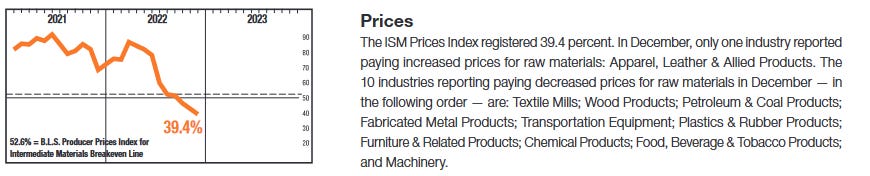

However, according to the ISM, not only are the prices paid by manufacturers dropping, they are nearing levels last seen during the 2020 recession.

This is a depiction of deflation, not inflation—which suggests that consumer price inflation may be about to get “fixed” by the economy slipping into a far more destructive deflationary cycle.

Moreover, new orders for both manufacturing and service businesses are on the decline.

Manufacturing new orders, already in contraction, declined another 2 points in December.

Service-sector new orders plunged by nearly 11 points in December.

When businesses aren’t taking new orders, they aren’t doing new business. When businesses aren’t doing new business, the economy is not growing, but contracting. When the economy is contracting and business activity is less, prices should at least be steady if not declining.

The ISM reports are flatly incompatible either with the Atlanta Fed’s GDPNow nowcast or the Cleveland Fed’s inflation nowcast. Either the nowcasts are woefully inaccurate or the ISM reports are woefully inaccurate.

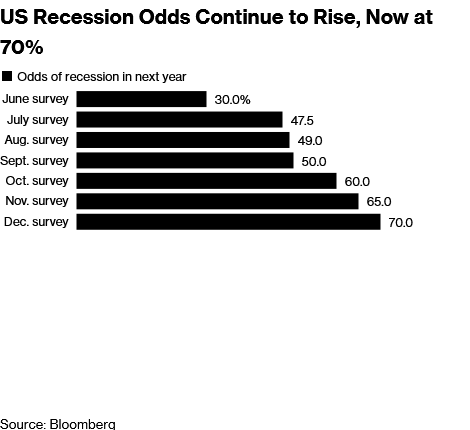

Ironically, a growing chorus of “the experts” acknowledge that a recession is at least coming (it’s actually already here), while (unintentionally?) throwing shade on the very things the BLS and other government entities would point to as signs of economic strength.

“The US economy is facing big headwinds from surging interest rates, high inflation, the end of fiscal stimulus, and weak export markets abroad,” said Bill Adams, chief economist at Comerica Bank. “Businesses have turned cautious about adding to inventories and hiring, and will likely delay construction and other capex plans with credit more expensive and order books shrinking.”

If businesses are “cautious” about hiring, how do 223,000 jobs get created in December? The answer, of course, is painfully simple: 223,000 jobs were not created in December, and the BLS jobs report is little more than fertilizer.

The “experts” get one thing right: we are all advised to be extremely cautious, because the contradictions and outright fictions coming from the “official” government sources are proof positive that the government has no clue what it is doing to the economy, nor what the consequences of its persistent meddling will be.

Oh, they know what they’re doing all right. And succeeding at their goal.

No sane person can come to any other conclusion. Never attribute to innocent ineptitude that which is attributable to malice.