NOW The Russia Sanctions Are Starting To Work?

That's The Narrative. Is It The Reality?

The official corporate media narrative on Russia is that the oil sanctions are finally starting to gum up Russia’s energy-driven economy.

The Russian oil-export machine funding the Kremlin’s war in Ukraine is finally getting some grit in its gears.

Indian oil refiners — Moscow’s second-biggest customers after China since the 2022 invasion — will no longer accept tankers owned by state-run Sovcomflot PJSC because of the risk posed by sanctions.

It only took more than two years to work, but, so the narrative goes, the sanctions are actually now starting to make a difference.

Or are they?

Does the data really bear that out?

Readers will recall that, this time last year, I was not at all optimistic about the state of the Russian economy.

Russia is already paying a heavy economic price for a year of war, and will continue to pay a heavy price. Yet Russia’s contracting economy—and corresponding declines in hydrocarbon production—means that, long term, at least a portion of that price will be paid by the larger global economy.

There was reason to be pessimistic at the time, even though the oil price cap regime implemented by the EU and G7 countries fell apart in March of last year.

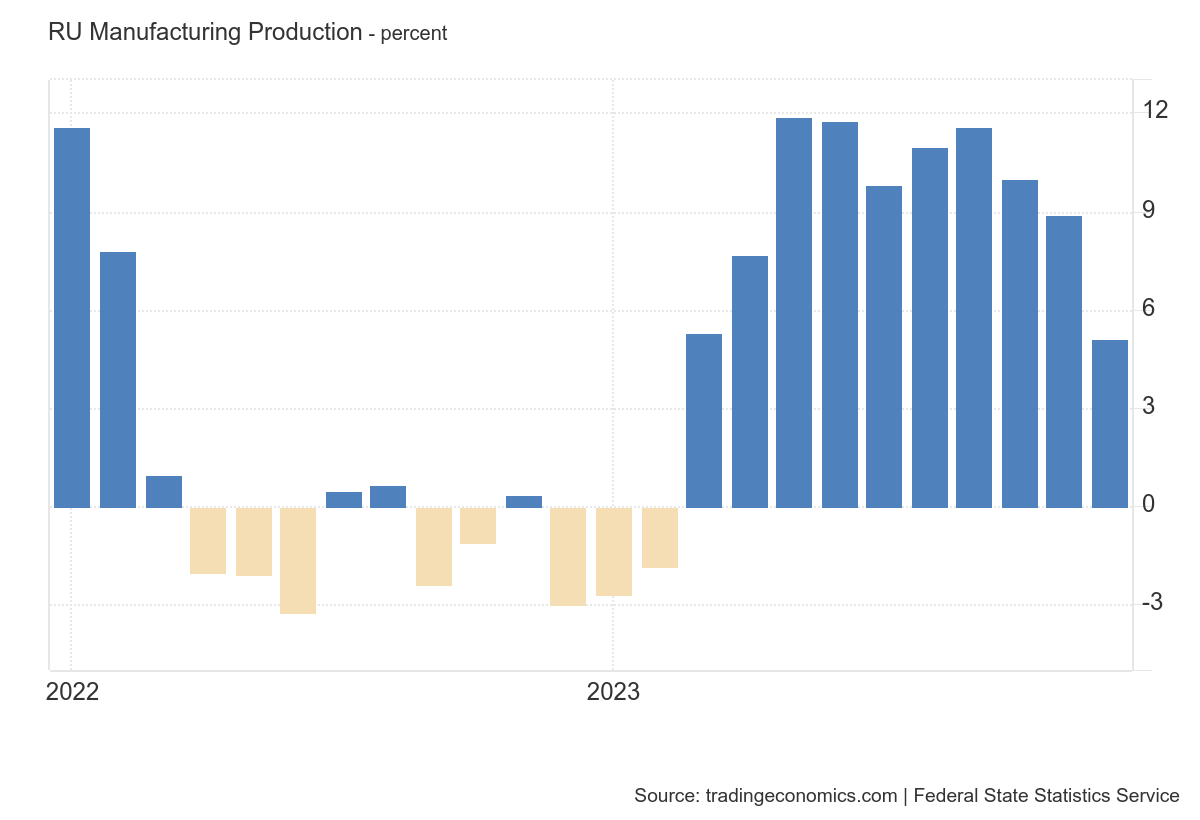

While the price cap did eventually fail, its initial impact was significant on the Russian economy. Certainly Russian industrial output and manufacturing struggled to adjust to a Russian wartime economy for most of 2022, as illustrated by Russia’s industrial production and PMI data.

This was made even more apparent in the fall of 2022, when Russia’s budget deficits came to the fore during legislative debates over the governments budget.

However, as the saying goes, “that was then, this is now.”

As was plain even last year, while the Russian economy was bowed by the sanctions regime imposed since Putin opted to invade Ukraine, it did not break and it did not collapse.

Indeed, when we look at the IEA data, we see that Russia’s oil production largely stabilized in 2023.

The reduced production levels were as much an effort alongside Saudi Arabia to boost the price of oil as they were a response to the sanctions regime.

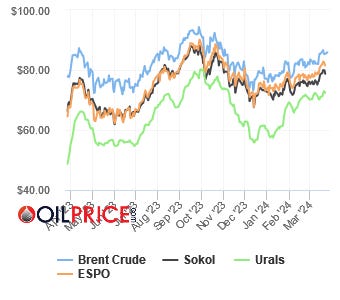

In short, 2023 was the year Russia began adapting to the sanctions regime, which it seems to have largely done. The widening and than narrowing of the discount on Urals crude shows that the winter of 2022-2023 was a low point for Russian oil prices—and thus Russian oil revenues—and since then there has been a considerable narrowing of that discount.

Indeed, when we look at all the Russian oil blends, their prices have been coming back into alignment with the global benchmark Brent crude prices.

These are not price movements indicative of Russia having difficulty selling its oil abroad.

How, then, does the corporate media narrative on Russia conclude that the oil sanctions are finally starting to bite?

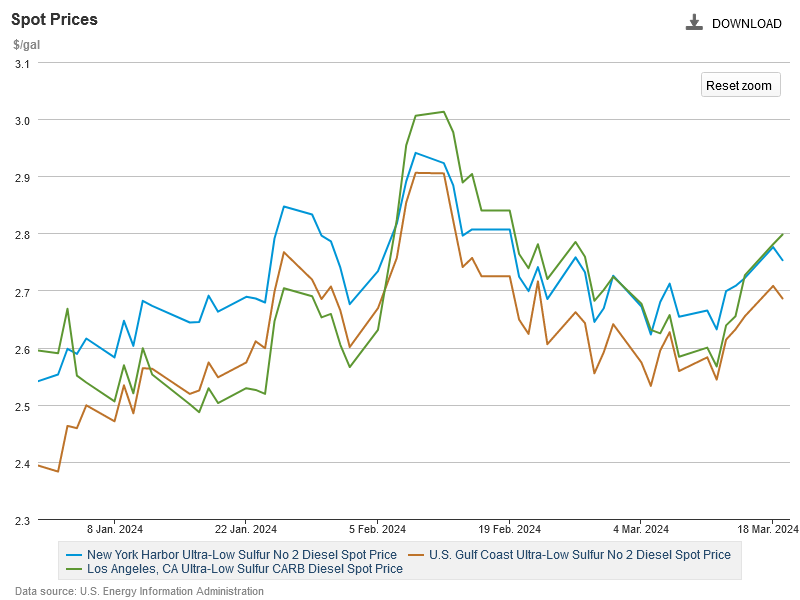

One report driving this narrative is that Russia is having to store its refined diesel fuel increasingly offshore, indicating that Russia lacks customers for its diesel and refined products.

An average of 6.2 million barrels of diesel had been floating in the 10 days to March 17, according to data from Kpler, an analytics firm. That’s the highest the measure’s been since at least 2017.

The recent buildup easily surpasses what was seen in the pandemic and even beats levels seen in 2023, when sanctions banning shipments into the European Union came into force.

We must note that US spot prices for diesel have been trending up since last fall, and especially since the first of the year.

The apparent diesel glut is, so the reporting goes, even more of a mystery given how Ukraine has been targeting drone strikes on oil refineries of late. With refineries being damaged considerably of late, Russia certainly is not likely to be overproducing diesel fuel and other refined products. The natural conclusion to be drawn, or so it seems, is that Russia is simply not having any luck selling its diesel fuel and refined products.

Russia’s lack of diesel customers comes on top of the news report that India is not buying Russian oil above the price cap any more, for fear of sanctions imposed by Congress.

Since October, the US has designated 40 individual Russian oil tankers. Four of the more recently targeted ones are continuing to make deliveries, but no sanctioned ship has collected a cargo since being named by the US Treasury, tanker tracking data compiled by Bloomberg show.

Now, an increasingly tough trading environment has delivered a powerful symbolic blow to the Kremlin as India — a stalwart commercial ally throughout war — shuns its fleet. At the same time, Ukraine has started blowing up Russian oil refineries, though it’s not clear how much support for the strategy it enjoys in Washington.

“We’re definitely seeing stepped up US sanctions pressure on both Russian crude and on exports,” said Greg Brew, an analyst at Eurasia Group in New York. “It comes at a time when the US is struggling to send more aid to Ukraine, when Ukraine’s fortunes on the battlefield are starting to decline, and when Russia appears to be gaining the upper hand.”

However, closer inspection of the reporting reveals that India is not refusing to buy Russian oil, but is instead refusing shipments of oil delivered by specific tankers and tanker fleets explicitly under US and/or EU sanctions.

All of India’s refiners are now refusing to take Russian crude carried on PJSC Sovcomflot tankers due to US sanctions, further complicating the trade that has flourished since the invasion of Ukraine two years ago.

Private and state-run processors including the biggest — Indian Oil Corp. — have stopped taking cargoes if they’re on Sovcomflot tankers, said people familiar with the matter. Refiners are scrutinizing the ownership of each ship to make sure they’re not affiliated with the company, or other sanctioned groups, they added, asking not to be named because the information is private.

India is still willing to buy Russian oil, it just wants the tankers delivering the oil to have “clean” registration information and documentation showing the diesel oil was purchased under the pricing regime.

However, if Russia is losing oil customers, it certainly is not losing oil price. Indeed, at the end of January Urals crude largely erased the deep discounts from Brent Crude.

Lack of oil sales would drive the price of Urals Blend down, and likely would widen the discount to Brent Crude. That has not happened.

Ultimately, in terms of these news reports representing a serious economic reversal for Russia’s oil-export economy, the data is unclear. An accumulation of diesel fuel stored off shore in tankers is not a positive sign for an economy that thrives on energy exports, but neither is it a sign of imminent economic collapse. That Russia is having to constantly find new tankers and new tanker fleets to ship oil is obviously the mother of all logistics challenges, but even that is not is arguably not having that much of an effect—if that were seriously impacting oil sales the discount to Brent would be increasing, not all but disappearing as it has since late January.

The diesel glut and the difficulties in delivering oil to India are undoubtedly having an effect on Russia’s oil economy, yet at the same time Russia has been having to adapt to the sanctions regime for over two years now. If the sanctions have not brought Russia’s economy to its knees by now it is highly unlikely that they will.

Ultimately, the narrative that sanctions are at last starting to “gum up the works” of Russia’s energy economy is mostly wishful thinking with just a few facts providing the connective tissue for that narrative. Russia’s economy did suffer because of the sanctions, but in 2022 and a little bit in 2023, not so much now in 2024.

Are the sanctions “finally” working against Russia? Looking at the data over the past two years, the conclusion has to be that the sanctions had their greatest effect early on, but that Russia weathered that storm and now the sanctions are little more than an additional expense item.

Sundance (The Last Refuge) says that the Russian sanctions are hurting the West far more than they are hurting Russia.

According to the

https://podcasts.apple.com/us/podcast/the-presidents-daily-brief/id1617887885?i=1000650599829

Russia is ignoring the UN sanctions and shipping directly to North Korea