OPEC Finds Oil Price Floor...And Ceiling?

Production Cuts Have Finally Pushed Oil Prices Up. But Is It Enough?

July was the month the OPEC+ production cuts finally started…and finally started working. Since June 27, the spot price for benchmark Brent Crude has risen 17.5%, and the spot price for West Texas Intermediate has risen 19.9%. July was also the month their latest production cut hit the world market.

Contrary to my earlier expectations, it would appear that the production cuts have in fact put a floor under oil prices.

Saudi Arabia is feeling powerful as a result. Last week, the OPEC leader hinted at even more production cuts while also indicating the current production cuts would be extended.

Saudi Arabia has warned it could deepen cuts to oil production as it extended its voluntary supply curbs with Russia for another month, despite a recent rally in crude prices threatening to revive tensions between Riyadh and Washington.

The Opec+ leaders have sought to prop up oil prices with a series of production cuts over the past year, frequently placing Riyadh at odds with the White House, which wants lower prices to support the economy ahead of next year’s election, while limiting revenues flowing to the Kremlin.

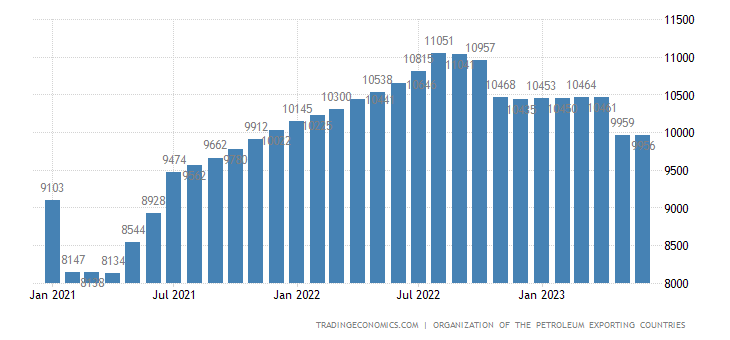

OPEC’s production cuts of 1 million barrels per day are aligned with Russia’s production cuts, which is set to decrease oil exports by a further 300,000 barrels per day.

Saudi Arabia will prolong its 1mn-barrels-a-day production cut — first implemented in July and dubbed the “Saudi lollipop” or sweetener for the oil market by energy minister Prince Abdulaziz bin Salman — until the end of September, while Russia will cut oil exports next month by 300,000 b/d.

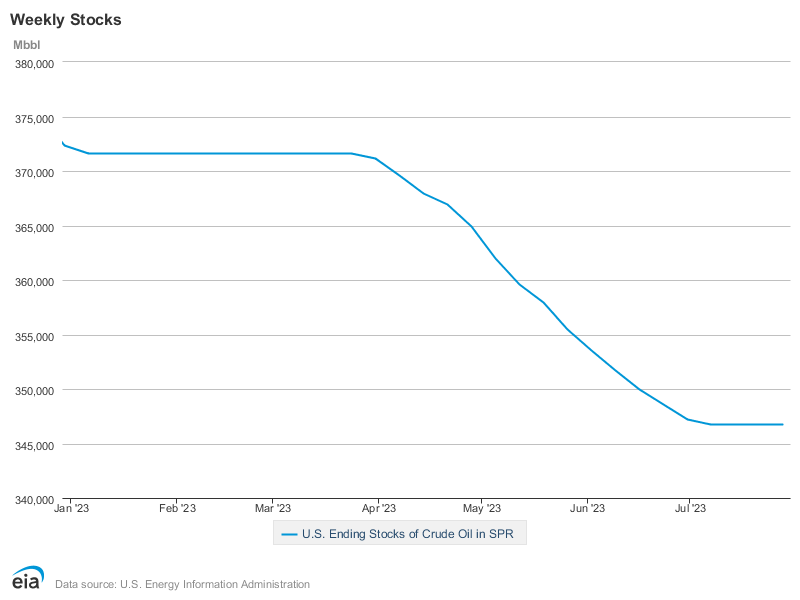

July also saw the US turn the supply spigot off on the Strategic Petroleum Reserve, ceasing any further drawdowns (for now).

As this combination of supply restrictions impacted the market, the price of oil began to rise, suggesting that the global glut of oil has ceased for the time being. However, there are also signs that the price rise may be at or near its peak, meaning the Saudis have gathered all the price support they are likely to get from the production cuts. Having found the price floor, OPEC may also have found the price ceiling.

While oil prices have been trending up over the past month, it behooves us to retain a certain perspective and remember that the recent peak price for Brent Crude of $86.24/bbl is only just above the previous year-to-date maximum price ($85.60/bbl for Brent Crude on January 23)., and as of Monday’s close had retreated to $85.34/bbl for Brent Crude.

As of this writing, plunged briefly during Tuesday’s trading, then managed to finish the day slightly higher.

However, as of Tuesday evening, Brent crude did not reach the $86.24 peak reached previously.

It should be noted that the potential for disruptions to Russian oil exports are a significant albeit transitory price pressure resulting from the war in Ukraine.

Crude prices rebounded from early losses after Ukraine President Zelenskiy warned his country would retaliate if Russia continues to block Ukrainian ports, triggering buying in the futures market as traders weighed the possibility of supply disruptions.

Such pressures can and will continue to inject volatility into oil markets, but in all instances they are pressures on the supply side only. They do not reflect increased demand for oil.

That oil prices may be peaking also suggests that the longer term price pressures are almost entirely the result of the production cuts to push up oil prices. The price increases are happening because of decreased supply, not because of increased demand.

This appears to be confirmed by US oil production flows year to date (excluding the SPR).

Note that the earlier peak 2023 oil price was set in January, a time when US oil stocks were increasing. Additionally, while oil stocks peaked during the week ending March 17, for the most part the draw down has been more gradual than the the earlier increase, excepting the drawdown during the last week in July, which was a steeper drawdown than had taken place previously.

The increase and then decrease of oil stocks suggests that oil demand particularly in the United States has not picked up much if at all over the course of the year thus far. If demand is soft, then the recent price increases are being driven almost exclusively by reductions in available supply, which we now know were significant.

We can also rule out the releases from the SPR having dramatic effect. The price increases and decreases earlier this year occurred during an interval when there were no releases from the SPR.

Before drawdowns resumed at the end of March, oil prices had already peaked, declined and bottomed out. Oil has not traded much below the trough set March 17—while the SPR drawdowns undoubtedly placed downward price pressures on oil, that effect would appear to have been muted, else the drawdowns would have had pushed oil prices farther down than where they were. That they didn’t suggests the current market floor is around $71-$72/bbl for Brent Crude.

Curiously, the major drop in US oil stocks at the end of July also, somewhat counterintuitively, suggests that domestic demand for oil here in the US at least is not as strong has was forecast earlier in the year.

Much of that forecast was based on expectations of increasing economic activity and increasing oil demand—demand that simply has never fully materialized.

Consequently, oil analysts looked at the major drawdown at the end of July as strictly a one-off, one not likely to repeat itself.

“Oil prices are falling as the macro backdrop is killing sentiment,” said Edward Moya, senior analyst for the Americas at Oanda.

A downgrade of the U.S. credit rating to AA+ from AAA by Fitch Ratings was seen as a negative for overall market sentiment. Treasury yields were on the rise as the Treasury Department detailed plans to increase supply. Rising debt yields lifted the greenback, with the ICE U.S. Dollar Index DXY up 0.3%.

China in particular has underperformed expectations literally all year long.

That US oil stocks dropped by 17 million barrels that last week of July is largely seen as a confluence of factors, all of which have more impact in the short and near term than over the longer period.

It was the combination of robust crude exports and strong refinery runs that yielded the largest draw to weekly U.S. crude inventories on record, said Matt Smith, lead oil analyst for the Americas at Kpler.

“This is very much a timing issue: peak summer refining activity has coincided with very strong end-of-month exports, and draws of such magnitude should not be expected going forward,” he said.

The drawdown was driven largely by a transitory surge in export volumes which is not expected to be sustained, and is certainly not something which indicates strong demand for oil at least within the United States.

As it turns out, the bump in exports appears to be largely a shifting of oil inventories rather than an increase in global consumption (i.e., demand).

Although global oil inventories increased in May to their highest since September 2021, according to the IEA, driven by a substantial rise in non-OECD countries, analysts say signs of tightness are appearing, in the United States in particular.

Stock declines have been geographically uneven so far, with inventory falls in the United States and Europe offset by increases in China and Japan.

Global oil inventories at the end of July were the highest they have been in two years, according to analytics firm Kayrros.

Big crude builds in China and Japan have so far offset a drop in the Mideast Gulf, meaning there is no sign yet of an overall global onshore crude inventory drawdown, according to satellite analytics firm Kayrros.

In fact, data from the firm shows that crude inventories in the week to July 20 reached a two-year high, with the world adding 200 million barrels into storage since Russia's invasion of Ukraine in February 2022.

If inventories are building, demand is not (yet) increasing—although there is still the expectation of future demand.

With inventory builds pointing to continued softness in oil demand, understanding the July rises in oil prices requires us to look at the supply side of the equation—and the most notable aspect of the supply side is that there has been steadily less of it.

Russia, for example, has been seeing its oil production trend down for several months, and has not reached even close to the peak levels of production it enjoyed before its war with Ukraine.

Russia’s production volume cut is seen as confirmed by declining seaborne exports of crude.

Russia’s two most-watched oil indicators — seaborne exports and domestic crude processing — are finally signaling that the nation may be in full compliance with its OPEC+ pledge to cut output.

Last month, a greater amount of crude was delivered to Russia’s refineries, but exports by sea fell even more. The net result was a combined daily volume for those two crucial flows of just under 8.6 million barrels.

For its part, Saudi Arabia has also been cutting production for the past several months.

However, both Russia and Saudi Arabia have also experienced significant revenue shortfalls. The price rises have not yet reached the point where they offset the production declines to neutralize the revenue impact.

Saudi Arabia’s budget deficit has been climbing and getting worse as the production cuts have taken hold.

Saudi Arabia’s budget deficit widened in the second quarter as the government raised spending on social benefits and projects meant to diversify the economy from oil.

Government income rose, driven mainly by higher non-oil revenue, which Crown Prince Mohammed bin Salman is trying to grow as he looks to end boom-bust oil cycles of the past. Still, the government’s deficit came in at 5.3 billion riyals ($1.4 billion), around 80% higher than that for the first quarter.

Saudi Arabia might be receiving more per barrel because of the production cuts, but it needs to sell more barrels of oil to balance its budget.

Russia for its part is being reported as having experienced a 47% drop in oil revenues through the first half of the year.

According to a report by the Finance Ministry, the fall is linked to lower oil and gas prices and a reduction in natural gas exports.

"The monthly dynamics of oil and gas revenues are gradually moving towards a trajectory corresponding to their base level (8 trillion rubles per year)," the ministry said.

In December, the US, EU, UK, Canada, Japan, and Australia imposed a price cap of $60 per barrel on seaborne supplies of Russian oil, and in February, the cap was expanded to petroleum products.

This may reverse in July, as Russian oil has finally pushed through the G7 price cap on Russian crude in a major way.

Some oil analysts are calculating that Russia could see a July boost in oil revenue of $9.3 billion as a result of rising oil prices and the shattering of the G7/EU price cap.

Russia's revenue from oil and gas sales may increase by around 60% in July from May receipts to 844 billion roubles ($9.3 billion), Reuters has reported. The rise in income from oil and gas will, however, be merely a reflection of cyclical patterns. The increase will also help alleviate Moscow’s budget deficit, which stood at 2.6 trillion roubles ($28.7B) in the first half of the year.

Much of this is from a narrowing of the discount Russian benchmark Urals Crude has commanded relative to Brent: On June 27, Urals traded at a discount of $17.5/bbl, and by August 4 that discount had shrunk to $14.18/bbl. Still, this means that Urals Crude has seen a greater relative price increase than Brent or West Texas Intermediate, driven mainly by the combined Saudi and Russian oil production cuts. The shattering of the price cap may also make buyers less reluctant to take Russian crude, but even this is still less of an overall increase in global demand than a shifting in buying patterns among crude blends.

With the price rises being driven chiefly by production cuts rather than demand increases, the question looking forward has to be to what extent will the higher oil prices choke off any anticipated future demand?

With Brent crude having risen some $13/bbl in July, the higher oil price will almost certainly constrain future demand. Already there is some indication that oil prices may have already reached their ceiling and are drifting down again—which would indicate that oil demand is decreasing rather than increasing. At the very least it would indicate that the desire to build inventories against anticipated future demand has peaked. Global inventories may need to come down before oil prices can rise much farther than last Friday’s peak.

If that proves to be the case then oil prices could be headed for a dynamic equilibrium round an overall average price close to where it was earlier in the year. If that is the case, the OPEC+ production cuts will have yielded all the upward price pressure they are going to yield. Saudi Arabia may have to make good on its threats of yet more production cuts if they want to push the price of oil even further.

This would pose a problem, particularly for Russia: if the current prices can only be sustained with arbitrary production cuts, then how does Russia restore its idled wells? How does Saudi Arabia bring its production back up to summer 2022 levels? As matters stand, neither Russia nor Saudi Arabia can restore their idled production without pushing oil prices lower again. If oil prices have peaked, then so have oil revenues at any given level of production, and any increase in production will simply push oil prices back down again. Without increased oil demand, Russia and Saudi Arabia are both effectively constrained from increasing production to increase their revenues, locking their production at the current constrained levels.

The production cuts are pushing up oil prices. That much is fairly certain. Everything else remains uncertain. Whether oil demand in the second half of the year will rise as forecast even with significantly higher prices remains very much to be seen. With China slipping into deflation and the US not far behind, forecasting increased oil demand going forward could prove to be mostly wishful thinking.

Saudi Arabia and Russia have gotten their wish: they have successfully pushed up oil prices. However, the price of being able to do so is restraint on how much oil they can sell. That may end up making the production cuts more expensive to Russia and Saudi Arabia than they are worth.