Oil Prices Are Rising...And Falling...Again

OPEC's Production Cuts Anticipate Declining Global Oil Demand

This past Wednesday (April 12), Wall Street was in full pearl-clutching mode over recent rises in oil prices, in particular those coming on the heels of the US latest consumer price inflation report.

Heightened expectations for a pause in U.S. rate hikes led to a 2% rally in crude futures for a second day in a row on Wednesday.

Oil bulls were also hyped up by speculation that the Biden administration will refill the nation’s heavily drawn down reserve — despite Energy Secretary Jennifer Granholm saying the action will only come at prices per barrel that work for American consumers

Certainly oil prices have climbed dramatically in recent days, as the spot prices for West Texas Intermediate crude illustrate.

Are the OPEC+ production cuts having a delayed bite? Perhaps…or perhaps not.

One thing we need to remember is that oil prices started rising in the middle of March, well before OPEC+ announced their production cuts right at the end of March.

As I noted in that earlier article, even with the immediate jump in oil prices following the OPEC+ announcement, the overall trend for both Brent and West Texas Intermediate crude ultimately was not that much changed.

Revisiting that same chart, we see that, as of Thursday’s close, the upward trend still has not changed all that much.

While Wall Street digested Wednesday’s inflation report to produce the latest surge in oil prices, the reality of America’s deepening recession (or, as the corporate media facetiously hopes, the “looming” recession) managed to push prices back down again.

Oil prices edged lower on Thursday, after scaling multi-month high levels in the previous session, weighed by fears of a looming recession in the United States and warnings from the OPEC group about hits to summer oil demand.

In particular, OPEC sees global oil demand softening through the summer.

Since the beginning of the year, economic growth appears to have been well supported in several key economies, yet uncertainties have risen recently. Although general global inflation has fallen in recent months, core inflation has remained persistently high, leading key central banks to continue their monetary tightening

efforts. The consequences of this inflation-interest rate cycle were mirrored in the latest turbulences of small and medium-sized US banks. The near-term global growth pattern will depend to a large extent on inflation, the consequent monetary policies in key economies – particularly the US – and the consequences that rapid monetary tightening may have on highly indebted areas of the global economy.

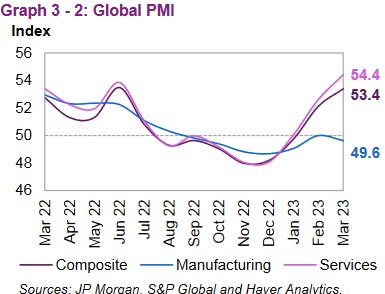

OPEC is especially concerned about declines in global manufacturing, which tipped into contraction during the month of March.

The global manufacturing PMI retraced very slightly to stand at 49.6 in March, compared with 50 in February and 49.1 in January.

Arguably, Thursday’s oil price fluctuations merely prove that oil prices which go up eventually must come down again.

Certainly oil demand from China is on the upswing, although it is unclear how much of this is organic demand increase and how much is either exploiting export opportunities created by sanctions on Russia as well as hopium for a broader recovery in China’s economy.

China's crude oil imports in March surged 22.5% from a year earlier to the highest since June 2020, data showed on Thursday, as refiners stepped up runs to capture fuel export demand and in anticipation of a domestic economic recovery.

As China is a major oil importer, a significant increase in Chinese oil purchases is bound to exert upward pressure on global oil prices.

Yet OPEC has been experiencing something of a supply glut recently, and their recent statements have expressed concerns about overall global demand being softer than previously anticipated.

But in a discussion on the summer market outlook in its monthly oil report on Thursday, the Organization of the Petroleum Exporting Countries (OPEC) said oil inventories looked more ample and global growth faced a number of challenges.

"OECD commercial inventories have been building in recent months, and product balances are less tight than seen at the same time a year ago," OPEC said, referring to the Organisation for Economic Co-operation and Development.

The IMF cutting their global economic growth forecast certainly does not make the oil demand picture any better for OPEC.

The International Monetary Fund chief said Thursday the world economy is expected to grow less than 3% in 2023, down from 3.4% last year, increasing the risk of hunger and poverty globally.

Reduced global growth includes whatever growth comes in the form of a recovery to China’s economy. At a minimum that tends to suggest that China’s recovery may prove to be somewhat weaker than previously anticipated.

What makes the oil price and oil demand outlook picture particularly complex is the reality that, as I had discussed previously, the price cap on Russian oil has completely broken down.

As of April 11, the spot price for Russia’s benchmark Urals crude was over $65/bbl.

As Brent crude has risen, both the Urals blend and Russia’s other benchmark, the ESPO blend, have followed suit.

While countries such as China and India do not officially endorse the price cap, or most of the other sanctions placed on Russia, there are reports that India’s banks are leery of processing payments for shipments of Russian oil where the price exceeds the $60/bbl price cap.

The drive by OPEC and its allies to boost oil prices is lifting Russian crude along with it, prompting concerns from India’s banks that cargoes could breach the $60-a-barrel cap.

State Bank of India and Bank of Baroda informed refiners they will not handle payments for oil bought above the limit, said a refinery executive involved in seeking financing for the company’s Russian oil purchases, who asked not to be identified as he isn’t authorized to speak publicly. Banks in the South Asian nation are keeping a closer watch on prices at loading ports, before shipping and logistics costs are added, executives said.

While the upward pressure on oil prices has doomed the Russian price cap, the potential for geopolitical fallout for buyers blatantly breaching the cap adds several new wrinkles to the global market for oil, making the future trend for the Russian benchmark blends difficult to anticipate.

Although a recurring narrative has been that OPEC’s production cuts were a strategic move to recapture pricing power in oil markets, the erratic behavior of oil prices since gives the production cuts a far more defensive aspect.

Far from flexing their market muscles, OPEC+ is most likely attempting to maintain a solid floor price for oil by reducing output to compensate for a global demand outlook that is quite likely to trend down. While their production cuts may have exerted just enough pressure on global oil prices to break through the Russian price caps—making Russia a clear beneficiary of OPEC’s decision, perhaps moreso than even the Persian Gulf OPEC members—the overall positioning by OPEC of the production cuts is more in line with a defensive effort to prop oil prices up.

Such a move may backfire on OPEC, however, if the US Energy Information Administration’s projections for global oil production to increase among non-OPEC member countries are at all accurate.

“The OPEC+ production cut is certainly significant, but we expect growing global production — especially in North and South America — to offset those cuts,” said EIA Administrator Joe DeCarolis, in a press release on Tuesday.

If non-OPEC+ nations step up to fill any production void left behind by the OPEC+ production cuts, OPEC’s global share of the oil market—and its pricing power by definition—will diminish.

Where all the market perspectives ultimately converge, however, is that OPEC’s production cuts are in anticpation of weakening global oil demand. Their stated projection is for less oil demand, not more.

If global oil demand surges, either from China or India or elsewhere, and OPEC tries to hold the line on production cuts, they risk ceding market share (and market power) to other producers. If global oil demand does not surge, or if it only ticks upward marginally, OPEC’s production cuts will not leave much in the way of a void for non-member states to fill.

OPEC’s gamble is that global oil demand will not surge.

As the IMF’s own economic projections suggest, they might be making the right bet. If the global recession deepens, global oil demand is sure to trend down and not up.

OPEC+ may not succeed in pushing the price of crude much higher than it has already reached, but it appears to have already succeeded in postponing the eventual oil price decline.