October Brings Cooler Inflation, But Hot Spots Remain

Headline Consumer Price Inflation Shows Progress. Underneath, Not So Much.

October’s Consumer Price Index Summary was an unexpected bit of good news regarding inflation: Despite a consensus expectation among economists of inflation printing around 8% year on year—a consensus reiterated by the Cleveland Fed’s inflation nowcast—consumer price inflation for October printed at 7.7% year on year.

On an unadjusted basis, headline consumer price inflation has now declined nearly 1.3% from a June peak of ~9%. By any metric imaginable, this is undeniably good news.

Naturally, Wall Street received it as good news, and reacted accordingly, with the major stock indices all making strong gains on the day.

Has the Federal Reserve’s campaign of interest rate hikes finally started to bear fruit? Is the Fed finally on a path to slay the inflation beast once again?

Not exactly. As always, one has to peel back the headline figures and look at the data underneath.

Monthly Inflation Rate Actually Rose

While headline inflation cooled significantly year on year, on a monthly basis inflation is still scorching, actually rising in October to 0.4%. Significantly, the monthly rise in consumer price inflation is observed in both the seasonally adjusted data and the non-adjusted data.

It is difficult to declare a victory over inflation when the headline inflation rate rises from one month to the next.

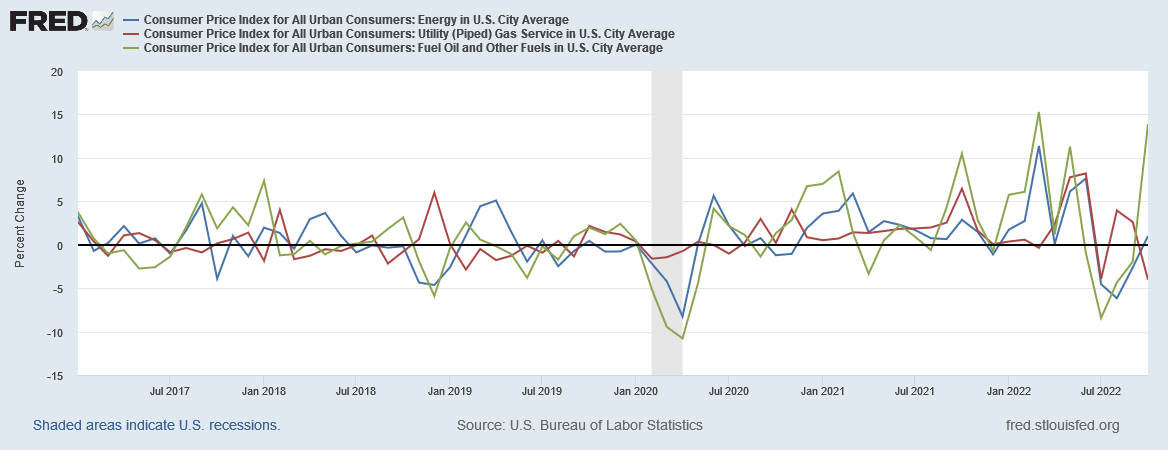

Energy Price Inflation Returns

A principal reason for this increase is resurgent energy price inflation, which flipped from outright deflation in September to just over a 1% month-on-month increase in October.

Readers will recall I discussed the factors driving resurgent energy price inflation last week.

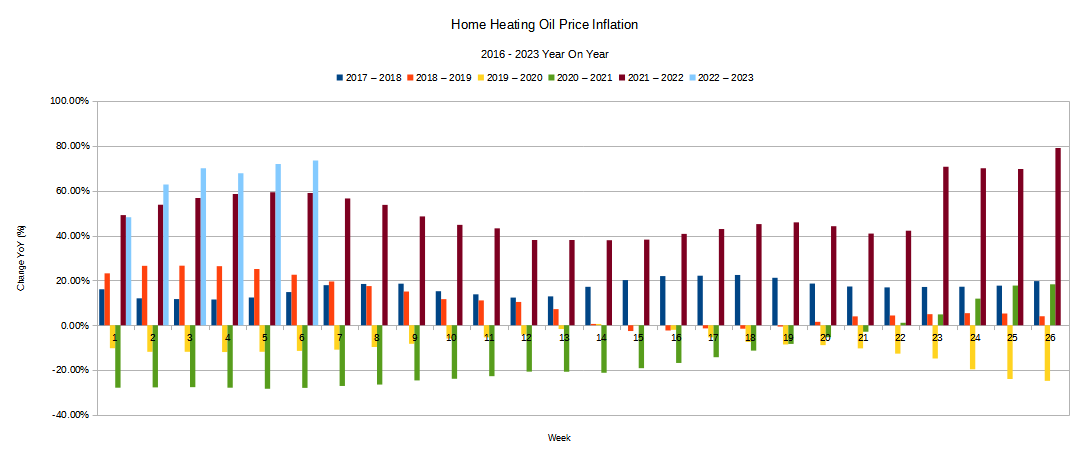

Home heating oil continues to be a driver of energy price inflation. After a few months of showing decline, monthly inflation for fuel oil and other fuels surged to 13.9%.

After displaying significant inflation during the 2021-2022 season, home heating oil is starting the 2022-2023 season with even greater inflation rates compared to prior seasons.

Also contributing to energy price inflation have been recent rises in gasoline and diesel fuel.

Diesel prices in particular have seen extraordinary price rises in 2022, creating an unusual spread between diesel prices and gasoline prices, with diesel currently 36% more costly than gasoline.

Food Price Inflation Is Cooling But Still Hot

One encouraging trend in the CPI detail is that unadjusted food price inflation year-on-year declined for the second month in row, dropping to 10.9% year-on-year.

However, even this encouraging trend comes with a few important caveats: food price inflation is still running well above headline consumer price inflation, and food price inflation for at-home dining is still running well above food price inflation for eating out.

Food price inflation may be cooling off at the moment, but it is still running hot enough to make eating something of a luxury in the lower income brackets.

Shelter Price Inflation: Still Hot And Getting Hotter

The one contributor to headline inflation that tends to significantly lag behind is shelter price inflation. The costs for putting a roof over one’s head have been rising steadily since January of 2021.

Most notably, the inflation rate for the rent of a primary residence is, if current trends continue, about to exceed the headline inflation rate for the first time since consumer price inflation began heating up in January of 2021.

Headline consumer price inflation might be cooling off, but shelter price inflation has not yet gotten the memo.

The Headline Inflation Number Is, As Always, A Distraction

As I have noted previously, beneath the headline number in every inflation report is data which details not just inflation, but imbalances within the US economy.

The reality of consumer price inflation is that not all prices rise equally, nor do they rise simultaneously. Various elements of the CPI rise and fall largely independently of each other. Inflation damages an economy by distorting relative prices within that economy.

Consumer price inflation in the US is (finally) heading in the right direction—downward. Yet that good news at the top should not be allowed to obscure the bad, the ugly, and the downright disturbing news of rising inflation underneath.

Inflation is still a problem, and, in many respects, it is still a growing problem. Improvements in the headline rate do not change that.