The Return Of Energy Price Inflation

Energy Prices Are Rising Again As Winter Approaches

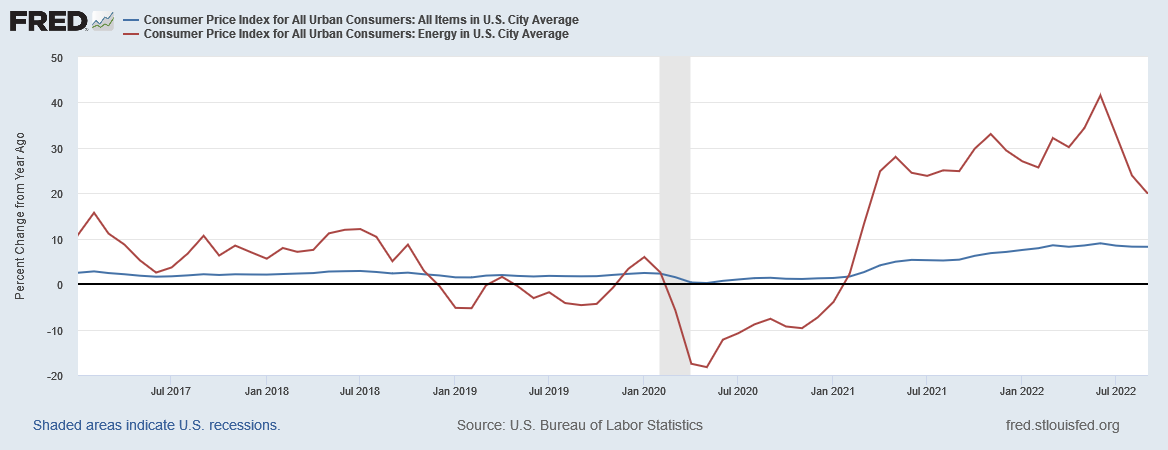

In spite of many economic prognosticators’ predictions of accelerating energy price inflation, this past summer has seen inflation largely easing in the energy sector (although it is still disproportionately high relative to overall consumer price inflation).

Oil prices will rise again to $100 per barrel faster than previously estimated, Morgan Stanley said on Thursday, lifting its price forecast for the first quarter of 2023 to $100 from $95 per barrel.

“Brent will find its way to $100 per barrel quicker than we estimated before,” the investment bank said in a note carried by Reuters after OPEC+ decided on Wednesday to make the largest nominal cut to its oil production quota since 2020.

While such predictions have so far not matched the reality of energy commodity prices, recent price shifts in key energy products—in particular diesel fuel, home heating oil, and gasoline—indicate that energy price inflation is poised to accelerate yet again as winter approaches.

Energy Price Inflation Peaked In June

After nearly a year and a half during which energy price inflation steadily rose higher, a peak was reached in June of this year, when energy price inflation reached 41%.

From June onward, energy price inflation has steadily decreased, dropping to 19.8% at the end of September—a level which is still more than double top-level consumer price inflation rates of 8.2% year-on-year.

The peak coincides with the last time crude oil topped $100 per barrel before staging a significant retreat on world commodity markets.

The decline in crude oil prices ended at the end of September and in early October, when prices briefly surged above $90 per barrel before retreating once again into the mid-80s.

While direct correlation between crude oil prices and overall energy price inflation would be an unsupportable extrapolation of the price data, it is reasonable to anticipate that October’s rise in crude oil prices will be reflected in an uptick in energy price inflation during the month of October.

The likelihood of continued rises in energy price inflation stems from the reality of tightening crude oil supply worldwide, a condition greatly exacerbated by the Russo-Ukrainian War and resulting economic sanctions against Russia, one of the more impactful is likely to be Europe’s formal termination of waterborne oil imports from Russia.

Supply-side pressures are indeed mounting. Inventories in the United States, the world’s leading economy, are okay, but there’s a drastic shortage of diesel that could become a problem during the upcoming holiday shopping/shipping season. By December, global supplies of crude will become an even a bigger concern because Europe by then will have formally ended imports of waterborne crude oil from Russia.

Gasoline And Diesel Prices Also Reversed In October

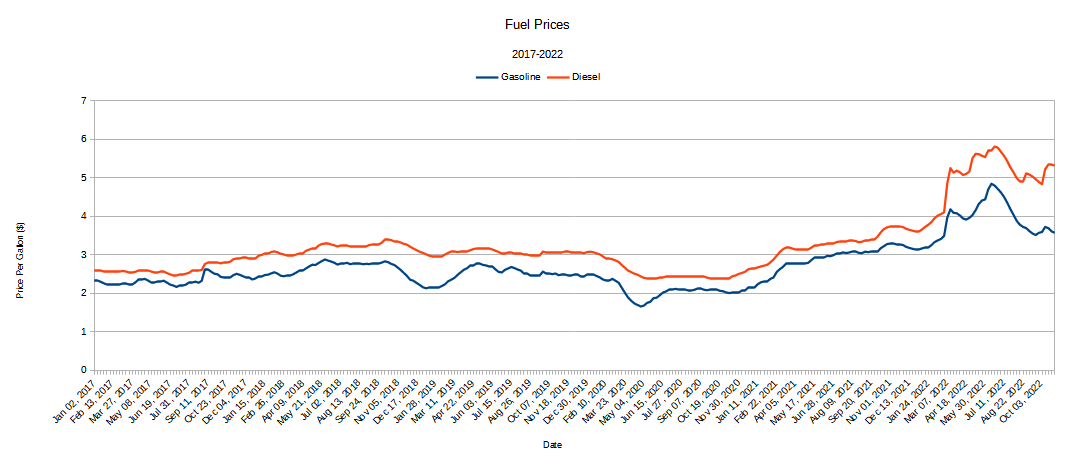

For most of the summer, gasoline and diesel prices trended down, after having surged dramatically in late February and early March.

As was the case with crude oil prices, however, price inflation for both gasoline and diesel returned in October, with average nationwide gasoline prices briefly climbing above $4 per gallon and diesel rising to just under $5.34 per gallon.

Gas prices went consistently down over the summer after reaching a record high of $5.041 on June 14 in New York state, but costs went back up when OPEC+ cut crude oil production by 2 million barrels per day earlier this month. AAA says demand is now lower than the same time last year, contributing to prices starting to go back down again. Oil prices have also gone down.

These increases in production costs have been at least partially offset by reduced demand for fuel, yet the supply constraints which have catalyzed the production cost rises are systemic factors, rather than variables more amenable to market forces.

Of even greater concern is that the cost increases asserted as explanation for October fuel price rises are largely the result of anticipated supply constraints, as the OPEC+ production cuts are not due to take effect until this month.

Energy ministers cut production by a larger-than-expected 2 million barrels per day starting in November after gathering for their first face-to-face meeting at the Vienna headquarters of the OPEC oil cartel since the start of the COVID-19 pandemic.

The reality of constrained oil supply is particularly illuminated by the fact that, even before the OPEC+ quota cuts, some OPEC+ member states were failing to meet production quotas.

Oil is trading well below its summer peaks because of fears that major global economies such as the U.S. or Europe will sink into recession due to high inflation, rising interest rates and energy uncertainty over Russia’s war in Ukraine. The OPEC+ decision could help member Russia weather a looming European ban on most of Moscow’s oil, but its impact will have some limitations because countries in the alliance already can’t meet their quotas.

Diesel supply is additionally constrained due to losses (both temporary and permanent) of refinery capacity post-pandemic.

A confluence of factors has also strained diesel markets.

These factors include reduced refining capacity due to the pandemic, increased demand amid COVID-19 recovery and Chinese export quotas, Chowdhury said.

“Diesel demand came back a lot faster than other products. There are refineries that shut down across the globe so the ability to supply was hindered,” he said. “And then finally, China, which is a larger diesel exporter … wasn’t able to export.”

The prognosis is that gasoline and diesel prices will continue to increase, driven not by demand but by limitations in supply. With crude oil prices rising, rising gasoline and diesel prices raise the likelihood that overall energy price inflation will trend upward starting in October.

Home Heating Oil Prices Are Just Starting To Heat Up

While crude oil as well as gasoline and diesel prices have more or less stablized for the time being, one energy commodity that has not achieved such stability is home heating oil.

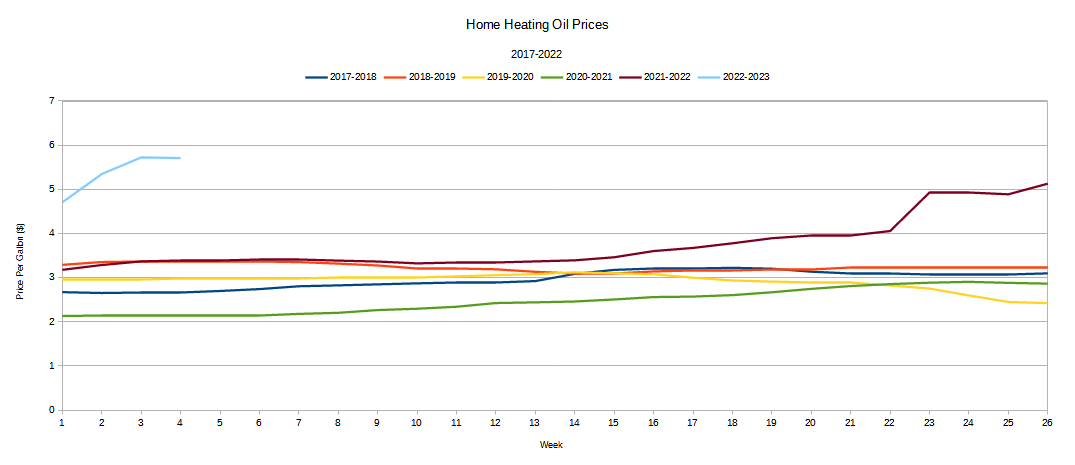

The “market” for home heating oil generally is tracked for only the winter half of the year (October through March), yet during those half-year markets home heating oil has shown dramatic and sustained price inflation.

With the 2022-2023 half-year market for home heating oil just starting, and starting with a dramatic rise, home heating oil becomes the third energy commodity to show rising prices in October. More importantly, the upward trend in prices for heating oil did not truly abate during the summer months, as summer weather merely reduced demand in a normal seasonal fluctuation. The price pressures did not change during the summer, but were merely put on hiatus. Winter is returning, and with it comes more inflation for home heating oil.

It is also worth noting that the price for home heating oil in the 2021-2022 half-year market began increasing dramatically relative to historical norms in January, about the same time that the price of diesel increased dramatically relative to gasoline. The particulars of why the two divergences occurred more or less simultaneously is a greater depth of analysis than space allows me to explore here, but it is sufficient for now to observe that these two divergences illustrate that the supply side of energy markets has had more than a few external forces acting upon it this year—far more than the jingoistic rhetoric of “blame Putin” would imply.

Increasing Prices For Energy Commodities Is Energy Price Inflation

The convergence of rising prices among so many different energy commodities all but guarantees that energy price inflation is set to accelerate once again in October, and very likely for some months beyond. That prices rise at all is the definition of inflation, and for prices to rise across any breadth of goods in any market sector makes it likely that market sector will experience a rise in average prices—which shows up in the Consumer Price Index and the Personal Consumption Expenditures Index as energy price inflation.

Last week I posed the question of whether consumer price inflation had peaked or merely paused.

Energy commodity data for October is sending a strong signal that consumer price inflation has indeed merely paused, and will soon if not sooner trend upwards again—despite what the official narratives have to say.

Diesel fuel and home heating oil are darn close to the same thing. They come from the same fraction of a barrel of crude, so it's no surprise that the price of home heating oil is up there with diesel.

What's interesting is the very high price spread between "distillate fuels" (diesel & heating oil) and gasoline. I can't recall another time when distillate fuels were ~50% more expensive than gasoline, do you?