The Federal Reserve’s Price Pressures Measure is a probability metric that seeks to gauge how likely inflation will be above 2.5% over the coming 12 month period.

Unsurprisingly, the PPM has been near 1 (perfect probability, or certainty) for most of this year. However, while still near the upper bound, the PPM has been trending slightly down in recent months, which would seem to indicate a moderation of current inflationary trends. Certainly, this is borne out by overlaying the PPM metric with the headline consumer price inflation metric as well as the principal sub-indices (food, energy, and overall inflation less food and energy).

While headline consumer price inflation remains elevated, even food price inflation moderated slightly in September, which tracks with the slight moderation of the PPM.

This moderating signal is reinforced by trends in the Producer Price Index, which are showing moderating producer price inflation for the headline metric as well as the final demand food and energy sub-indices.

Keep in mind that the PPI is widely understood to be a leading indicator and predictor of trends in the CPI—producer price inflation generally precedes consumer price inflation.

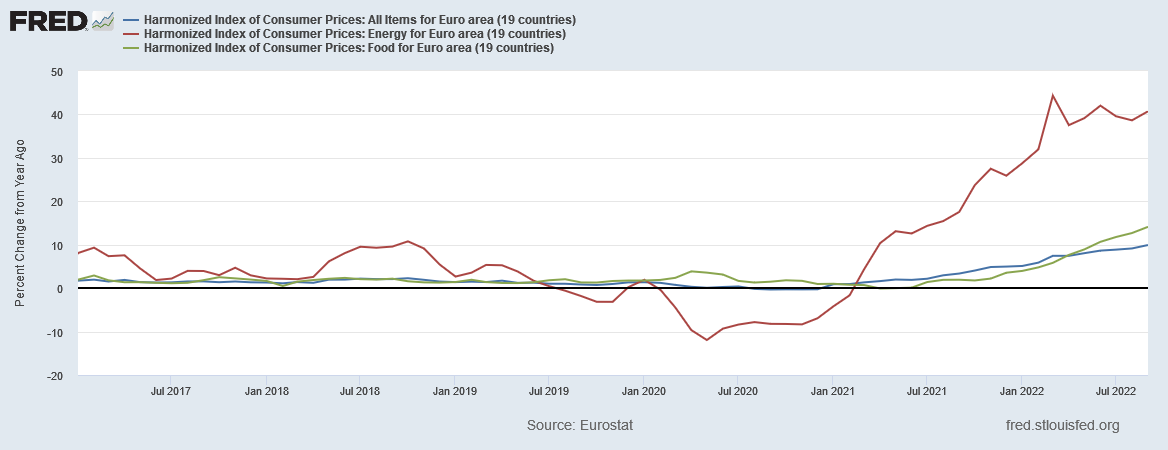

If this trend bears out, the United States will be faring better than Europe, which is seeing accelerating price inflation not just at the headline level, but within food and energy as well.

However, the PPM remains close to 1, which means inflation is anticipated to remain elevated for quite some time. Consumer price inflation may be easing somewhat in recent months, but the likelihood that this is merely a pause in a longer acceleration trend and not a peak and the start of a deceleration trend should not be dismissed.