On What Planet Is Corporate Media Spending Most Of Its Time?

How Is This A Healthy Economy?

The level of economic illiteracy within corporate media is truly astounding.

How else to explain why outlets like Reuters continue to put out faux journalism propaganda nonsense (and I am being polite here) bemoaning the ungrateful voter who doesn’t realize just how wonderful the American economy has been doing?

As good as the economy might seem across most major indicators, inflation that peaked at 9% more than two years ago has been hard for Vice President and Democratic nominee Kamala Harris to outrun, and given former President and Republican candidate Donald Trump a cudgel that remains effective on the eve of the election even as inflation has dwindled to 2.4%.

Most major indicators are showing a good economy?

Only if you accept the corporate media horse hockey and don’t look at the actual data.

The actual data shows what every American knows every time they look in their wallet: this economy sucks.

The question must be seriously asked of corporate media: “On what planet do you spend most of your time?

Perversely, corporate media acknowledges what people are saying they percieve about the economy. This gets reflected time and again in corporate media’s polling regarding the nearly completed Presidential Election.

In a recent Reuters/Ipsos poll, 68% of respondents in seven swing states said the cost of living was "on the wrong track," and 61% said the same about the economy.

Corporate media even provides the explanation for why voters feel this way:

Surveys about inflation have been consistent in finding that price shocks register deeply and are not quickly forgotten.

"Inflation significantly complicates household decision-making, which is seen as its most critical consequence," researchers Alberto Binetti of Bocconi University and Francesco Nuzzi and Stefanie Stantcheva of Harvard University concluded from the results of an online survey of 2,264 people conducted between March and May. "This complexity affects daily economic choices" and adds to economic uncertainty.

Nor do people seem to care much if, as has happened recently and Democrats have tried to emphasize, wages rise faster than prices.

"Inflation is perceived as an unambiguously negative phenomenon without any potential positive economic correlates," they found, with people expecting it to be fixed "without significant trade-offs."

When prices rise relative to incomes, people tend to notice, and they tend to not like it very much.

When the labor cost of food surges by a third over four years, people tend to notice and they tend to not like it very much. And the labor cost of food has surged, with the government’s own “official” data showing that the amount of labor necessary for the average worker to buy a cheeseburger and fries has in fact gone up by over 36% since the start of the (Biden-)Harris Administration.

When people have to work a third again as much just to have the same as what they had, how is that a healthy economy? It isn’t. There’s no economic perspective where this is a healthy economic phenomenon.

How does corporate media not understand this?

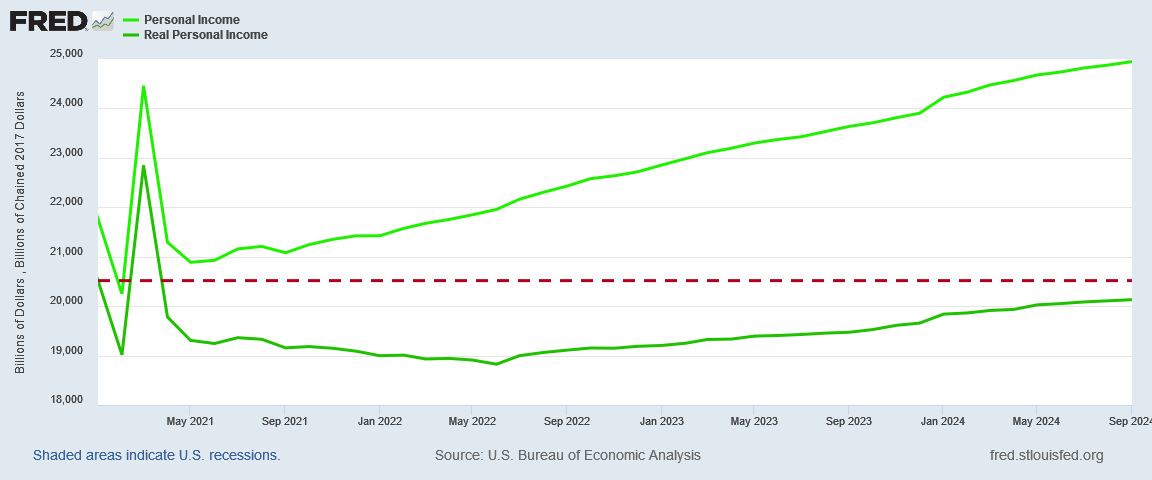

When Real Personal Income for the US stood at an aggregate $20,516.5 Billion in January 2021, but has since declined to $20,130.6 Billion as of September 2024, how is that a healthy economy?

It isn’t. There’s no economic perspective where this is a healthy economic phenomenon.

How does corporate media not understand this?

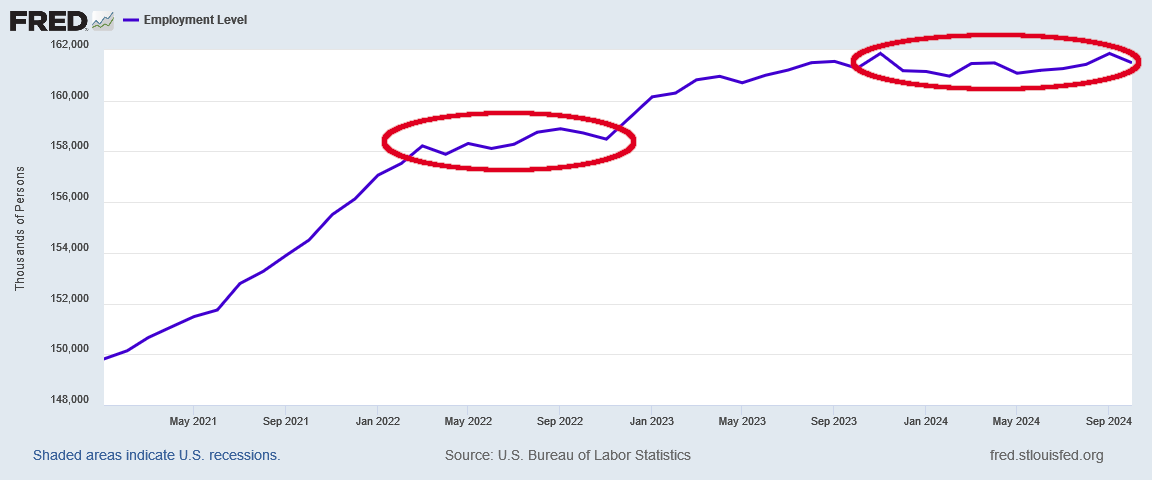

When employment in this country stops rising and actually starts falling, how is that a healthy economy?

It isn’t. There’s no economic perspective where this is a healthy economic phenomenon.

How does corporate media not understand this?

Keep in mind, all of the data I use comes from either the Bureau of Labor Statistics or the Bureau of Economic Analysis. Most of my charts are generated using the Federal Reserve Economic Data (FRED) system maintained by the Federal Reserve.

This is not “obscure” data. This is not “proprietary” data. My calculations are accessible to everyone, to replicate, interrogate, and criticize.

Corporate media has access to this same data. They have the wherewithal to perform the same analyses. They are at liberty to reach the same or different conclusions by so doing.

Yet they won’t. They would rather propagandize and shill for the politicians who have help created this mess. They would rather lie to the public—and then marvel that the public sees through their lies.

Seriously, on what planet does corporate media spend most of its time?

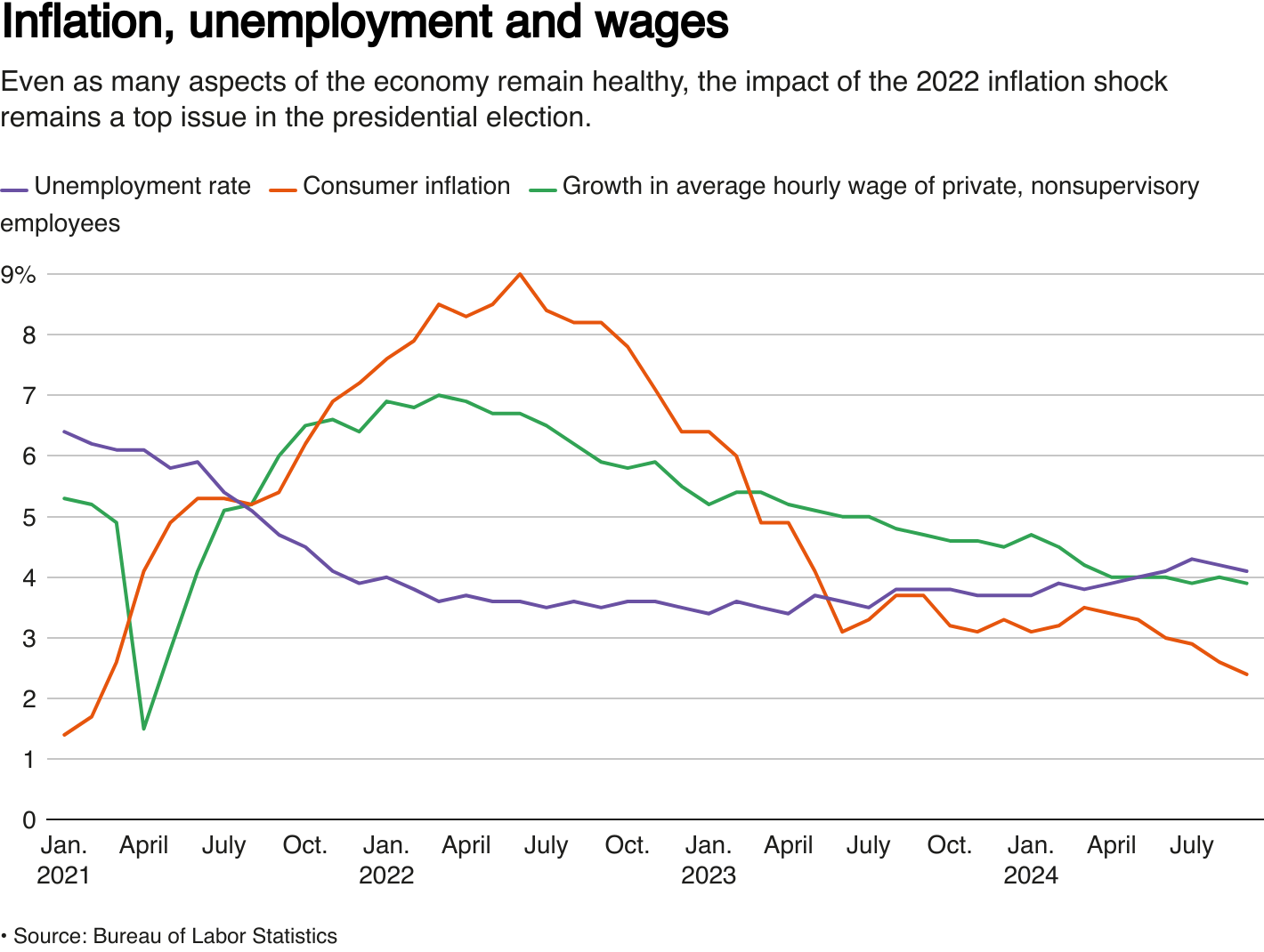

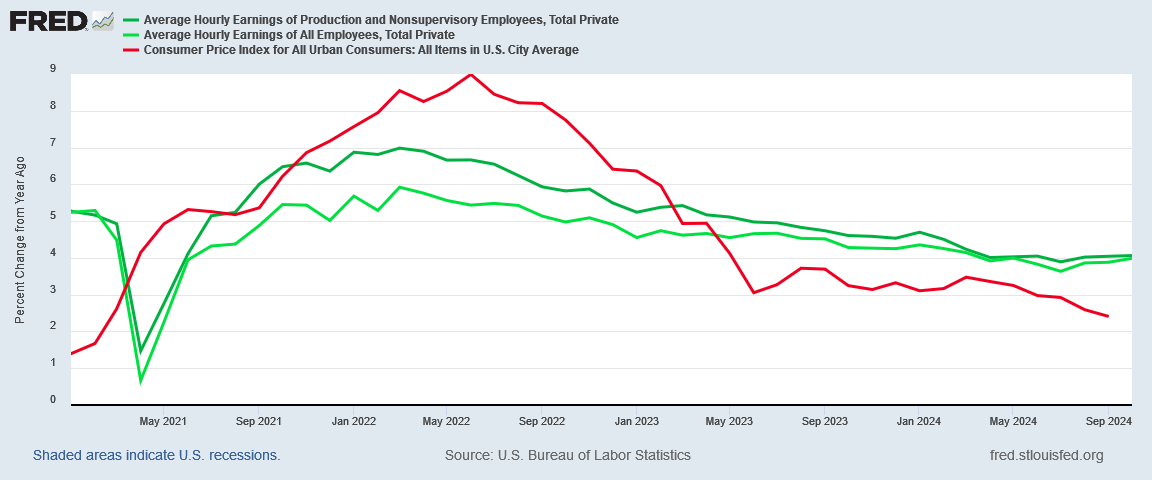

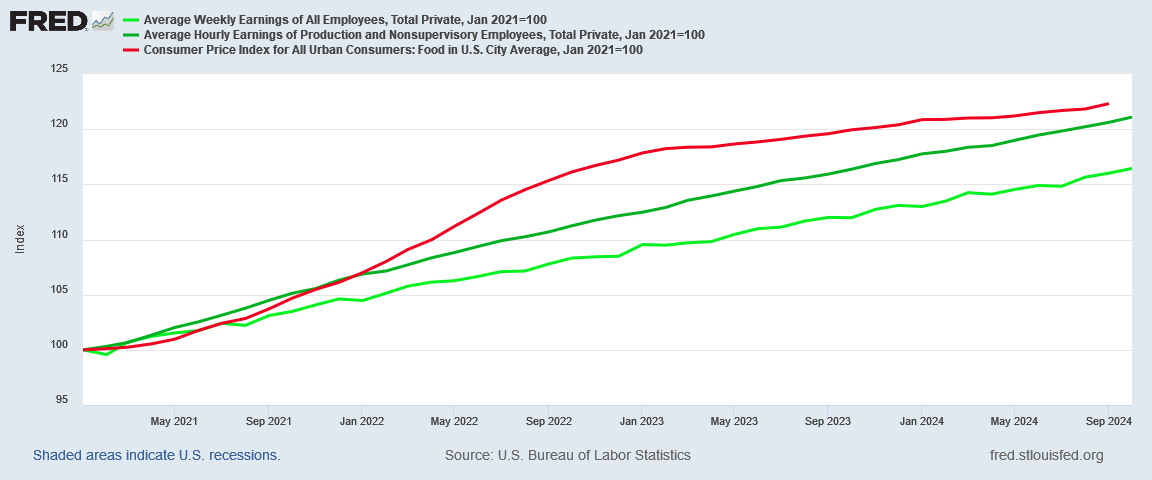

The crux of the Reuter’s article which roused my ire was that, as inflation is down and wages are up, people should be happy. They even put a nice little chart to show everyone how wonderful things really were.

Note that they are using the same BLS data that I use.

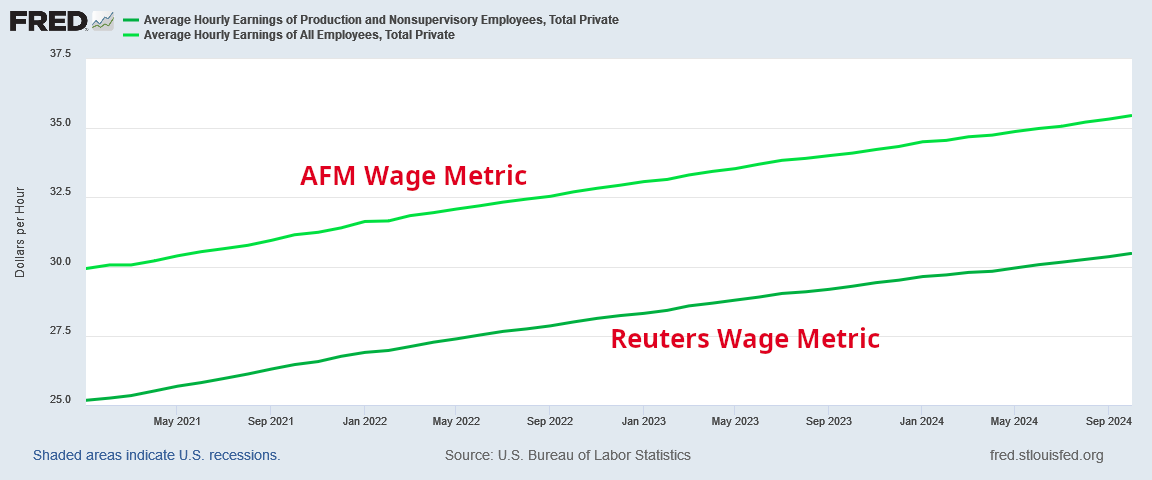

However, there is a sublime bit of subterfuge at work here. To chart wage growth they are using the “Average Hourly Wage of Private Nonsupervisory Employees.”

They are using one of the many wage metrics published by the BLS, and on the surface they’re even being conservative because they are using a wage metric that is lower than the broader average hourly earnings metric, which is the one I use typically when doing economic analyses. Generally the difference between the “Average Hourly Earnings of All Employees, Total Private” and “Average Hourly Earnings of Production and Nonsupervisory Employees, Total Private” is approximately $5/hour.

Yet while nonsupervisory wages are lower, they have also been more responsive to inflationary pressures.

While consumer price inflation year on year outpace them both, nonsupervisory wages rose by approximately a percentage more as inflation was heating up, and maintained a higher rate of increase longer than the broader average hourly earnings metric.

In other words, Reuters chose the most “inflation friendly” wage metric.

However, that wage metric does not say what they think it says, and labor costing shows why.

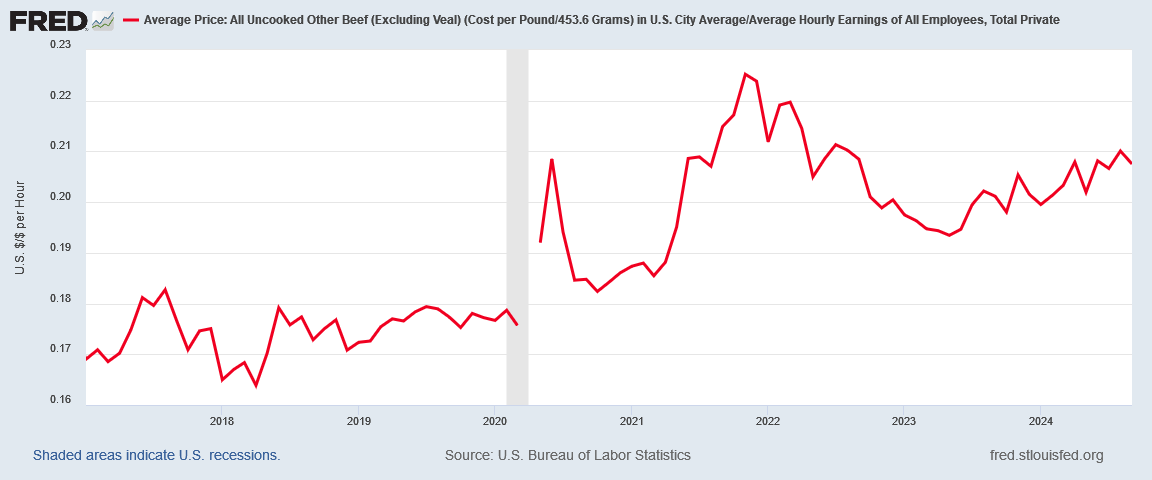

Referring back my earlier article on the topic, consider the labor cost for beef using the average hourly earnings wage metric.

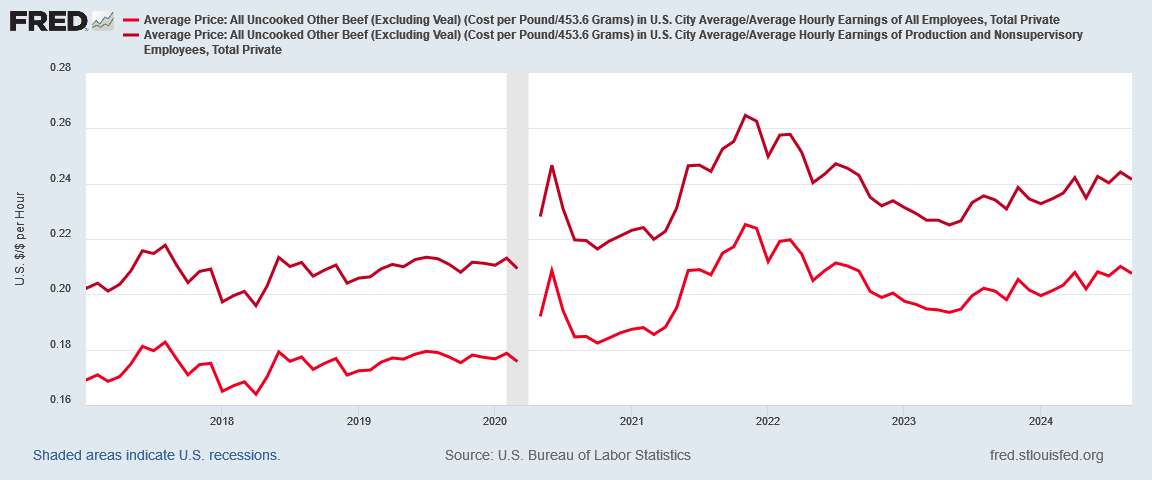

We can do the same calculation using nonsupervisory wages and get a similar labor cost curve.

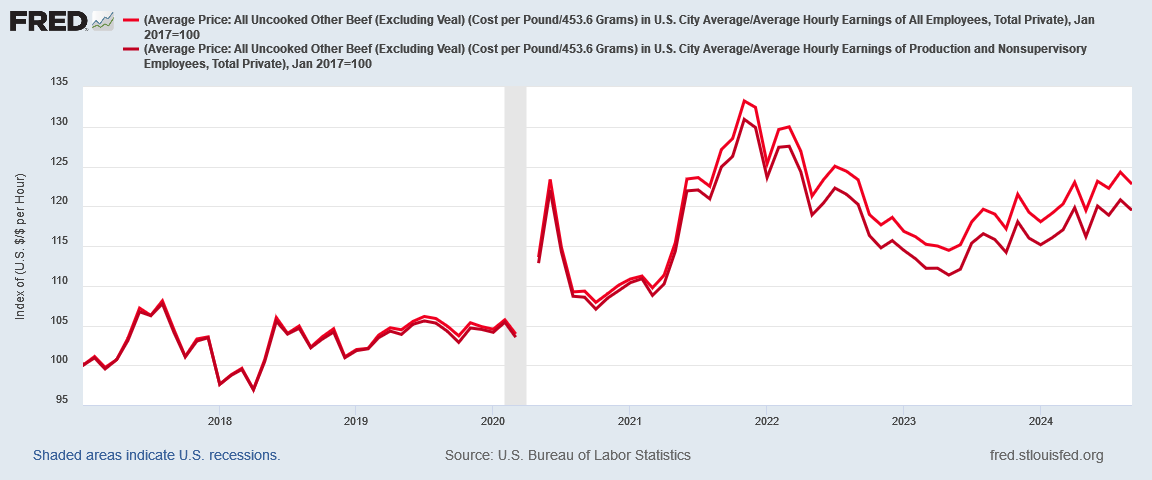

The offset is to be expected from the $5/hour wage differential, which is more or less constant over time. However, that wage differential largely disappears when we index the two.

Using nonsupervisory wages, the labor cost for beef since 2017 increased by “only” 19% instead of 22%—not even an additional burger bite at current prices.

We need to remember that, by definition, all market prices are relative to each other. Because of this, inflation always has to be understood as a relative rather than an absolute phenomenon. If wages rose at the same pace as consumer prices, and by the same degree, inflation would not ever be an economic phenomenon worthy of discussion.

However, prices and wages do not rise in unison, and they do not rise by the same amount at the same time. During the 2022 hyperinflation cycle, prices rose significantly more than wages, whether one looks at the average hourly wage of all employees or just the nonsupervisory wages. A quick indexing of both wages and consumer prices to January 2021 establishes this conclusively.

The gap between the wage indices and the consumer price index is the effective reduction in real wages experienced by the consumer as a result of inflation.

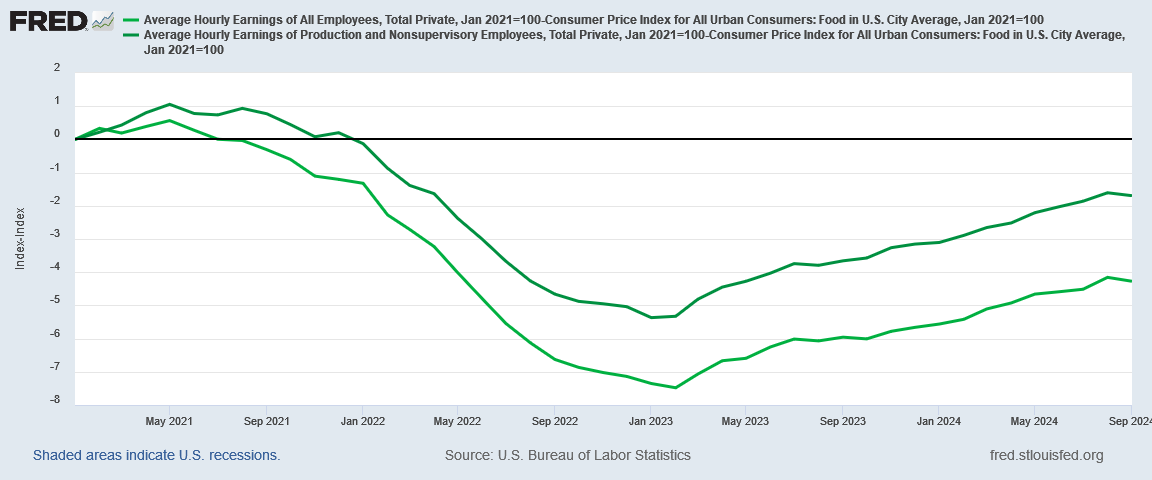

To illustrate the impact of this, if we chart that differential between consumer prices and wages, using the Consumer Price Food subindex for the inflation metric, we can directly measure how much the rising cost of the prototypical food budget has impact the average paycheck.

Even using the higher nonsupervisory wage metric, the average household still has not recovered from 2022’s hyperinflation, and are still having to spend more to buy the same groceries.

Inflation has pushed the labor cost for most items significantly higher, and regardless of wage metric used for comparison we are a long way from even recovery.

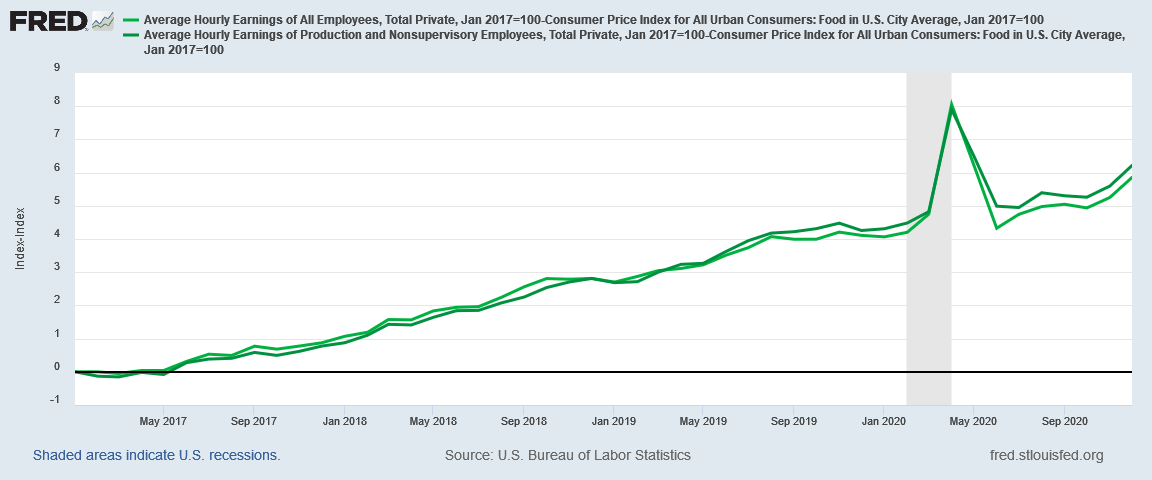

During the Trump Administration, we did not see this problem. If we extend this same curve back to January 2017, and re-index on to January 2017, we can see the extent to which wages improved on Trump’s watch.

This is why people perceive the economy as bad. This is why people recall the economy as being better under Donald Trump.

In the ways that resonate most directly with the average consumer—in grocery budgets and gas bills and monthly rent and mortgage payments, the average consumer got to keep a rising portion of his or her paycheck.

People recall the Trump-era economy fondly because, in their direct experience of the economy, it was.

Contrary to Reuter’s clueless misapprehension, people are not soured on the economy because the consumer price index rose by 2.5% rather than 2% last month, or because average wages only rose 1% instead 3%. Rather, people are not soured on the economy because they are having to work significantly more just for the price of a cheeseburger and fries.

In every scenario, that’s not a healthy economy.

In every scenario, that’s the economy we have, using the government’s “official” data.

Yet people are not merely distressed by prices and incomes, and the imbalances which have arisen between the two.

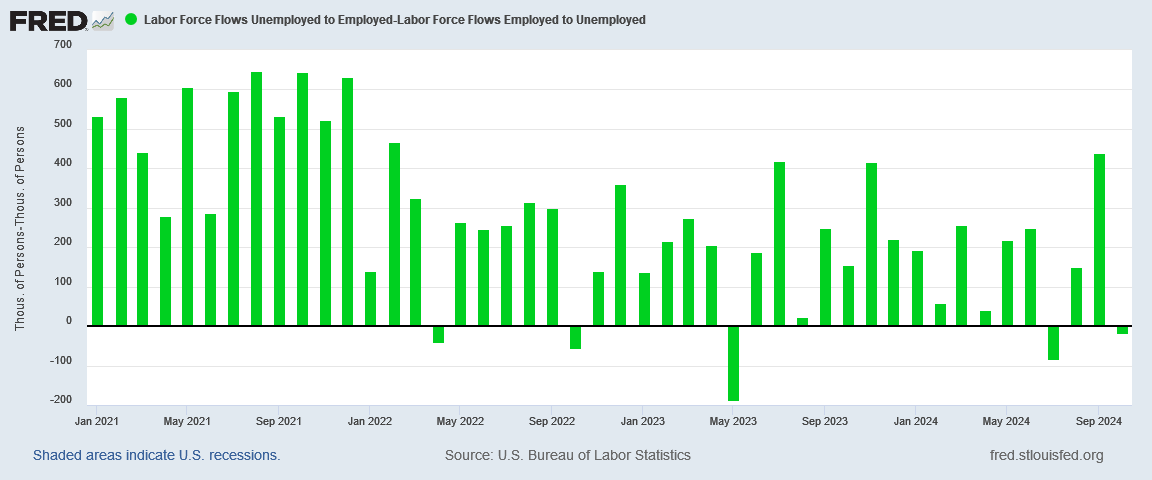

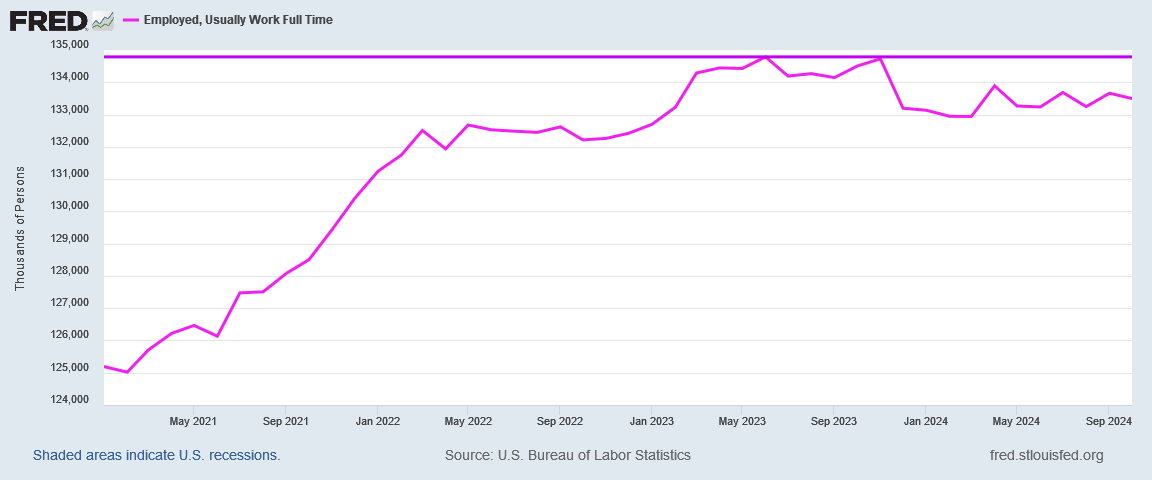

As mentioned above, employment growth per the BLS Employment Situation Summary’s Household Survey (the side of the report which generates the unemployment stats corporate media loves to cite) has stalled out twice in recent years, and over the past year has actually declined.

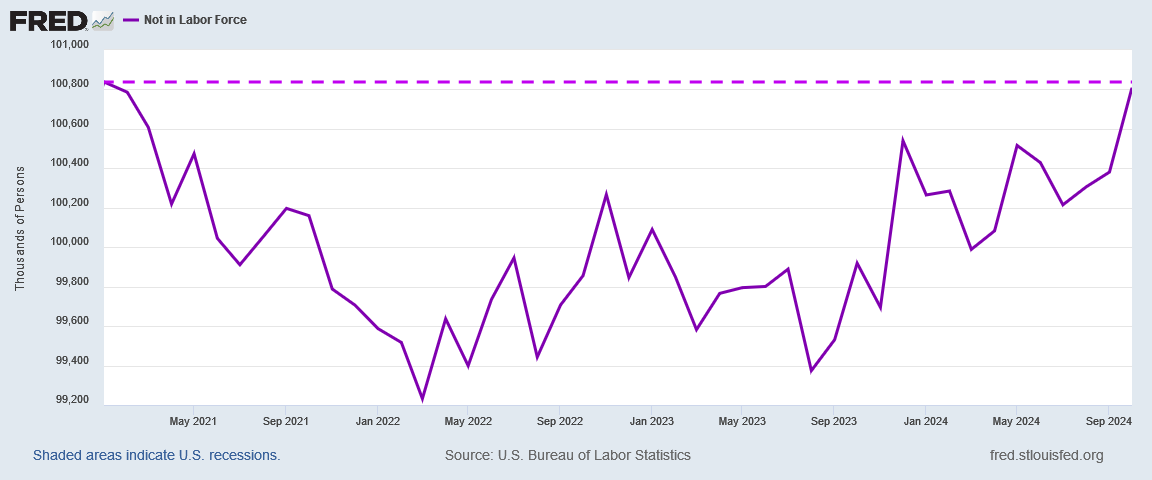

What corporate media routine ignores is that portion of the unemployed that does not get counted as such— those individuals classified as “Not In The Labor Force.”

Since early 2022, the number of individuals in this demographic has been steadily rising, and now is very nearly at the level it was at when the (Biden-)Harris Administration came into office.

An increase in the number of individuals who have exited or refused to join the labor force is not the sign of a healthy economy.

Indeed, one reason why the unemployment rate is so low is that the general outflow of employed workers is to simply exit the labor force altogether.

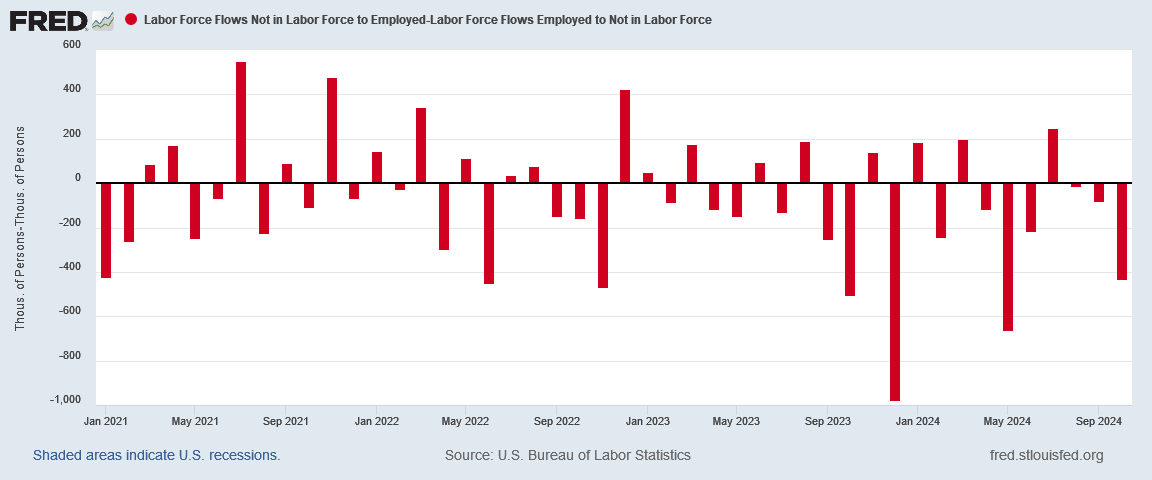

Every month where the difference labor flows to and from employment and not in the labor force is negative is a month where the net flow was of workers out of the workforce.

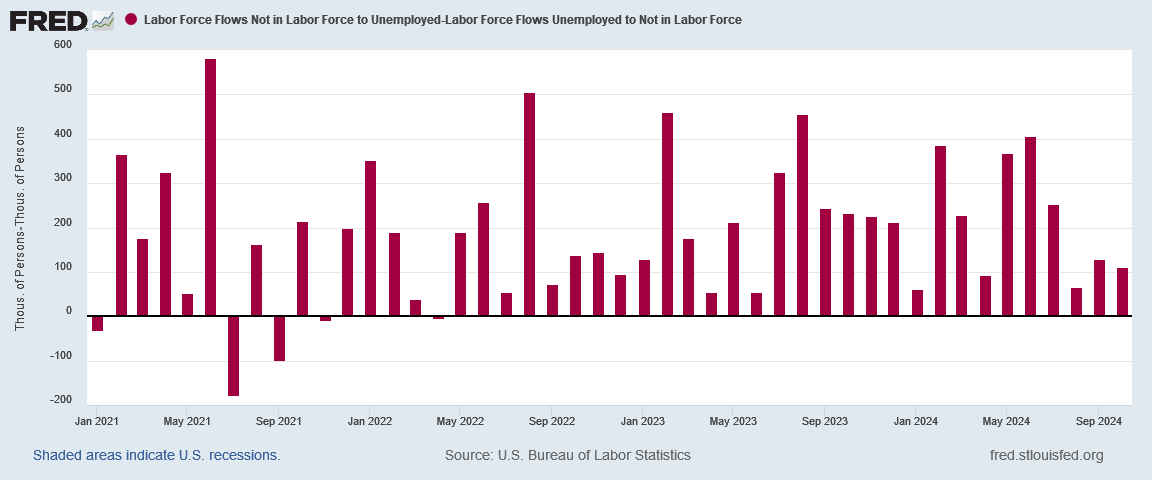

Perversely, later on, some of those workers will then enter the ranks of the unemployed.

Some workers then move from unemployed to employed, and thus the circle is complete.

However, not everyone who falls into the “Not In Labor Force” demographic emerges from it, and thus we see rising numbers in that demographic.

That’s a net outflow of workers from the economy.

Such net outflows are how we get a decline in full-time employment in this country.

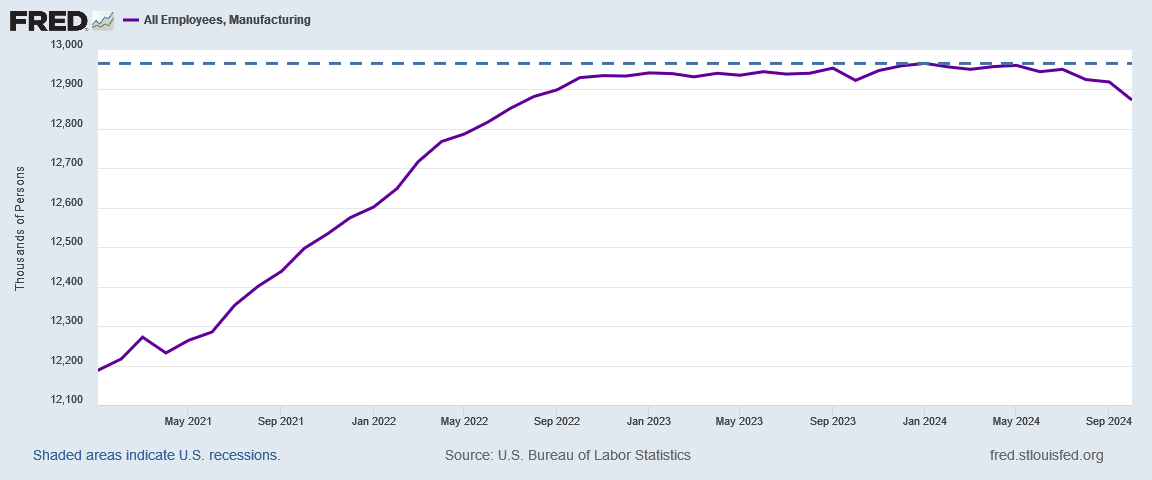

Such net outflows are why manufacturing employment has been declining in this country since January.

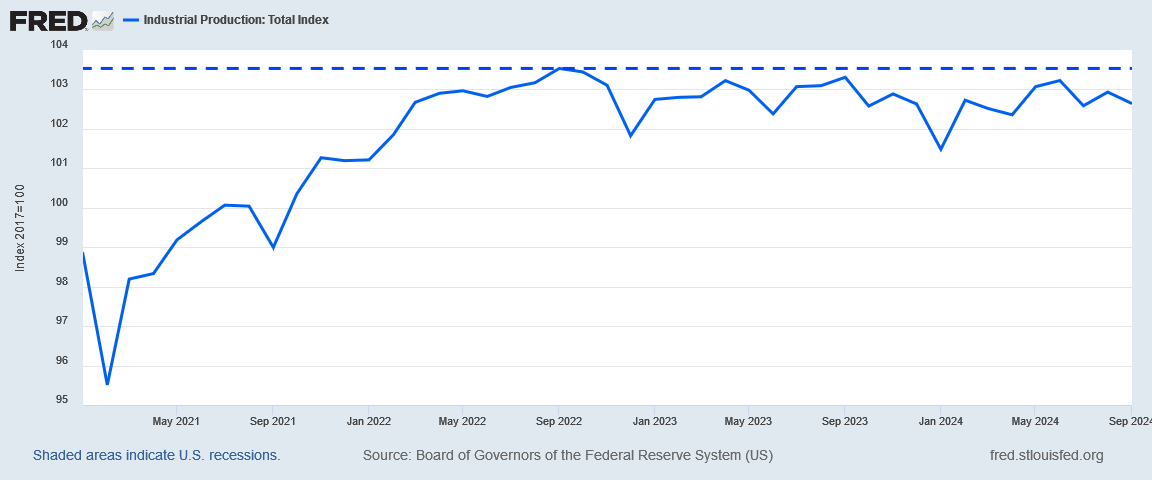

Nor is this the only sign of manufacturing decline. Industrial production in this country peaked in September of 2022 and has trended down ever since.

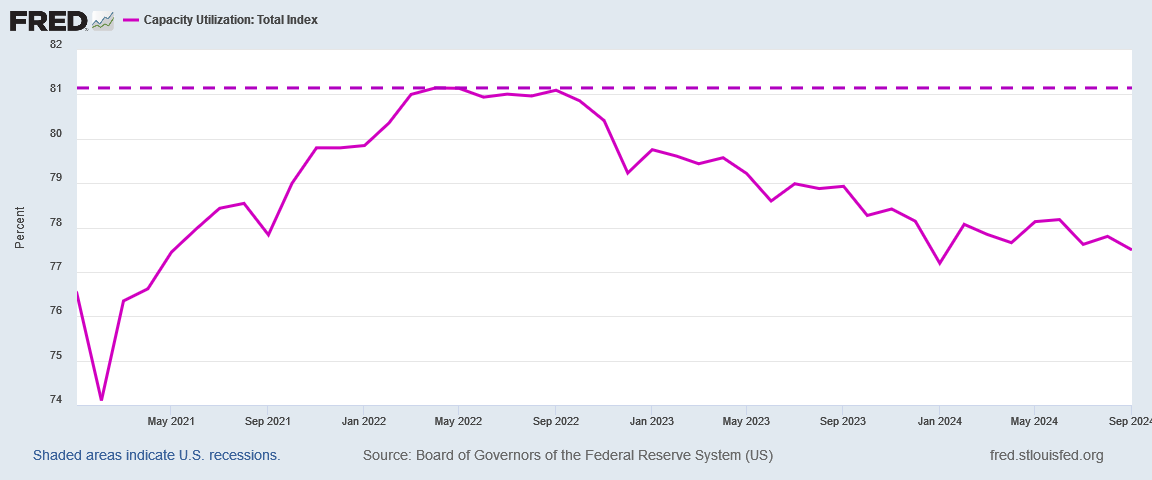

Plant capacity utilization in this country has been in decline for even longer, since April of 2022.

Declining production and declining capacity utilization are every bit the signs of an unhealthy manufacturing economy as declining employment.

Every single one of these economic indicators—and a good many more besides—points to an economy that is not doing well. Every single one of these economic indicators—and a good many more besides—points to an economy that is in bad shape, and is getting worse, not better. Every single one of these economic indicators—and a good many more besides—points to an economy that offers less of everything to the average worker and the average consumer.

Every. Single. One.

Yet corporate media insists on pushing the (Biden-)Harris Administration narrative that the economy is healthy. Corporate media keeps bleating out the Kamala Kackle of “Bidenomics is working”.

Only it is not working. It was not working as Bidenomics. It is not working now as Kamalanomics. It will not be working should she worm her way into office as Kamalanomics 2.0.

Why are people soured on the economy? The answer is embarrasingly simple: the economy sour and has been going sour for far too long.

Corporate media refuses to see this. The (Biden-)Harris Administration refuses to see this. Instead, they gaslight and lie to people, and attempt to persuade people to disbelieve their own experiences. They want people to ignore reality and embrace their narrative.

And so I am left with this singular question of corporate media—and also the (Biden-)Harris Administration:

On what planet do they spend most of their time?

I worked for the government for five years in a different capacity and I can tell you 100% they do not know how to do math. It's ridiculous.

So the people that actually do have stated the inflation rate is around 36 to 38%. I would totally agree with that. Just pull out your bills and look at the difference and you do the math. That's the only way it's gonna be correct.

The other thing as far as food, they've lost their minds. There's a few things that I used to buy that have gone up almost 400%

2% 3% 8% no all those numbers are completely wrong. Let's hope after all the votes are counted tomorrow that there's gonna be a change because if there's not gonna be a change, there's gonna be a war.

And I'll be right there in the front line!

“Gaslight” is indeed the word. Who do they think they’re fooling? Half the country is onto their lies and manipulations. Most people in the grocery store are looking at their shopping lists trying to decide which expensive items they can do without, just like during the Great Depression.

Keep doing the accurate calculations that expose the true picture, Peter. Thank you!