OPEC+ Cuts Production, Confirms Global Recession Is In Full Swing

There Is No Escaping Soft Demand

On Sunday Saudi Arabia announced a surprise production cut of 500,000bpd, beginning in May and lasting at least through the end of the year.

Saudi Arabia said Sunday it will cut oil production by 500,000 barrels per day from May until the end of 2023, a move that could raise prices worldwide.

Higher oil prices would help fill Russian President Vladimir Putin's coffers as his country wages war on Ukraine and force Americans and others to pay even higher prices at the pump amid inflation fueled in part by that conflict.

While the corporate media hyperfocused on the narrative that the Saudi decision was a plus for Putin and Russia while being a negative everywhere else, and that this must be due to waning US influence in the Middle East, the reality is likely far more mundane: the OPEC+ nations need to produce less oil if they want to see higher prices per barrel. The production cut is more about a growing glut in oil than it is any geopolitical power game between Saudi Arabia, Russia, and the United States.

A moment’s review of the data shows why this production cut is more likely a recession response than a solid for Russia.

First, we must note that the Saudi production cut was coordinated with an extension of Russia’s earlier 500,000bpd production cut beginning in March.

Russia has decided to keep its oil production at a reduced level through 2023 amid high volatility in the global market, said Deputy Prime Minister Alexander Novak.

Russia had previously pledged to cut its crude-only output by 500,000 barrels per day in March in response to Western sanctions, including price caps on its oil and petroleum production, and to keep those curbs in place through June.

“Today the global oil market is going through a period of high volatility and unpredictability due to the ongoing banking crisis in the US and Europe, global economic uncertainty, and unpredictable and short-sighted energy policy decisions,” Novak said in a statement released on Sunday. “At the same time, stability and transparency in global oil market are key in ensuring energy security in the long run.”

It is also important to note that a Russian production cut of 500,0000bpd in March never actually showed up in the export volumes.

Shipping data for March indicate that exports are steady despite Moscow’s stated intention of reducing them by 500,000 b/d.

While Russia may be extending the policy, it remains to be seen how much that will translate into actual production cuts. Similarly, other OPEC+nations have been seen exceeding their agreed-upon production quotas, making the Saudi 500,000bpd cut as well as the cuts announced by other OPEC+ nations somewhat problematic.

Elsewhere, Kuwait’s oil ministry said the country will cut 128, 000 barrels a day, while the United Arab Emirates said it would cut its production by 144,000 barrels a day, according to a statement by Energy Minister Suhail Al Mazrouei, reported by Attaqa Breaking News. Oman said it would implement a voluntary cut of 40,000 barrels a day. Kazakhstan said it would cut by 78,000 barrels a day and Algeria said it would cut by 48,000 barrels a day.

The U.A.E., for example, was seen producing around 200,000 barrels a day above its target for a few months, while Russian output in March didn’t see the full 500,000 barrel-a-day reduction announced in February, [Giacomo] Romeo noted.

Thus, while on paper the OPEC+ cartel is announcing production cuts amounting to more than 1,000,000bpd, in reality the actual reduction in production could very well be much less.

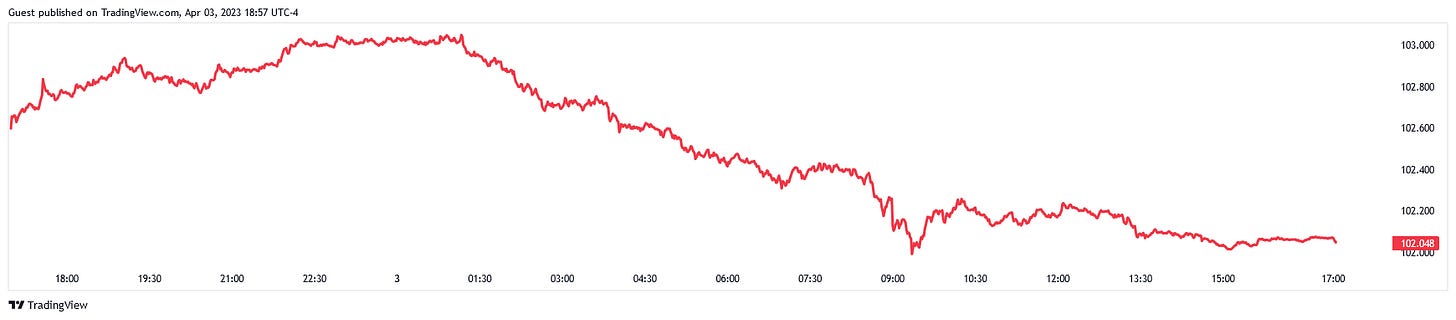

After digesting the initial shock of the surprise announcement—which Wall Street was not expecting—the follow-on reactions in oil markets were mostly mixed.

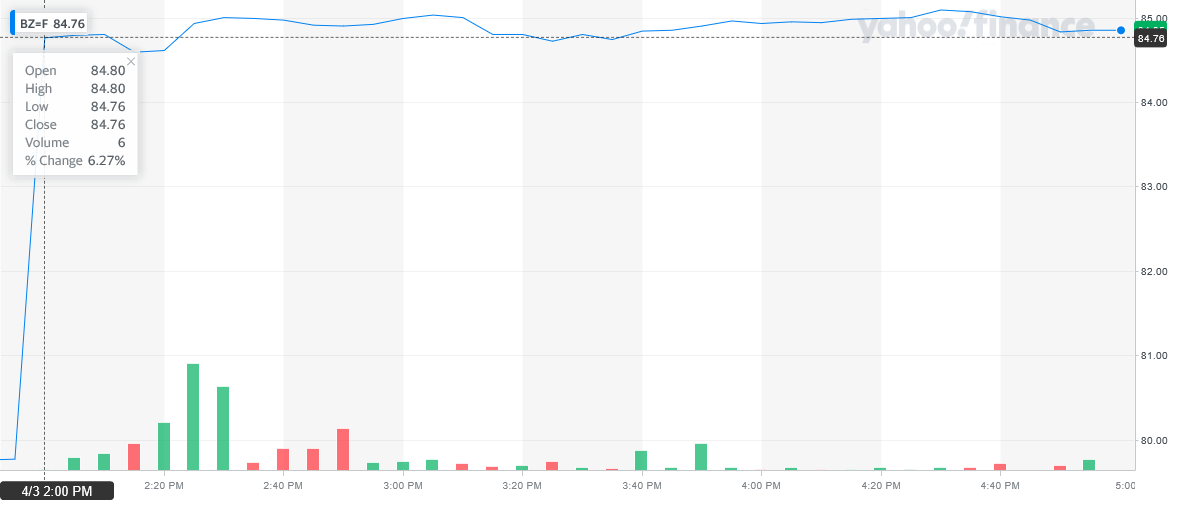

After jumping more than 6% at the opening bell, the price of Brent crude spent most of the day yesterday. moving sideways.

West Texas Intermediate followed a similar pattern

While there will likely be more price shifts in the days to come, the immediate pricing in of the production cuts took very little time at all. This is the first indication that this was mostly a defensive manuever against declining oil prices.

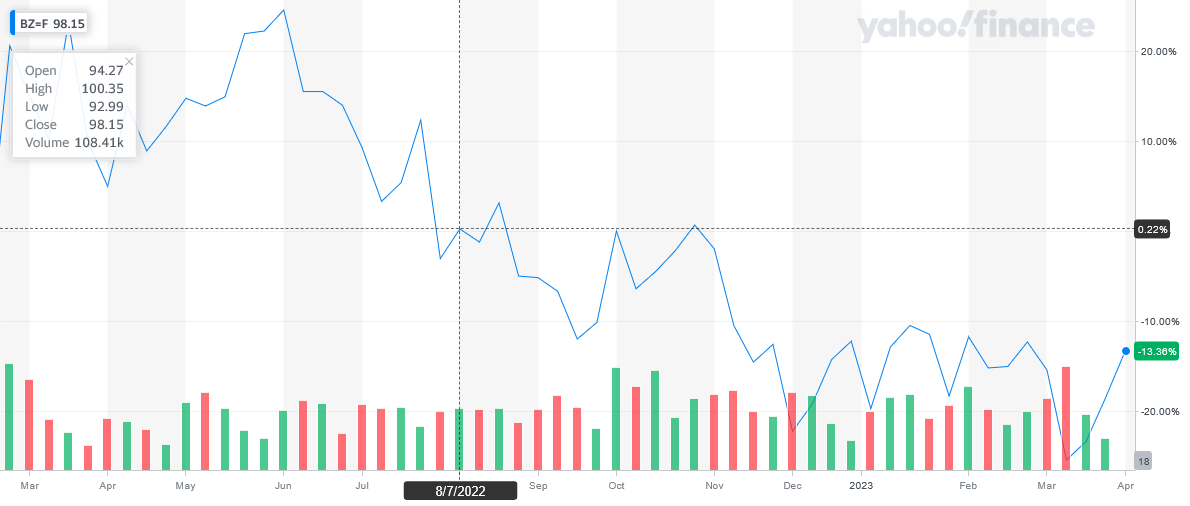

Bear in mind just how much the price of oil has fallen from last year. Even if we discount last year’s price rises after Russia invaded Ukraine as a reaction to the start of that war, the price of Brent crude has still fallen more than 13% since its price on February 23, 2022—the day before Russia invaded Ukraine.

West Texas Intermediate fell just under 13% over the same time period.

These price declines come despite having excluded Russian oil from much of the European market. The demand for oil simply has not been that intense even with the dislocations and disruptions from the Russo-Ukrainian War.

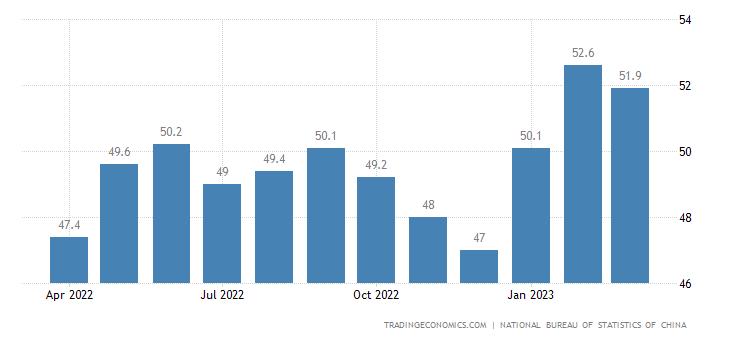

While many analysts had projected higher oil prices on the basis of rising China demand due to its “reopening” after emerging from its Zero COVID policies, the recent PMI data indicates that reopening is proving far more frail than analysts have been wont to believe.

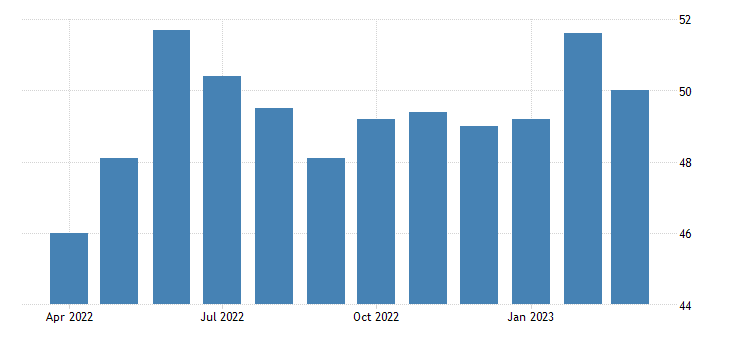

After posting the first Caixin Manufacturing PMI north of 50 (50 is the threshold between expansion and contraction) in six months, the PMI for March printed at a neutral 50, suggesting that China’s reopening is already weakening and losing momentum.

This comes on the heels of the PMI published by China’s National Bureau of Statistics showing the manufacturing sector declining to 51.9—still technically expansive but showing significant weakness from the previous month.

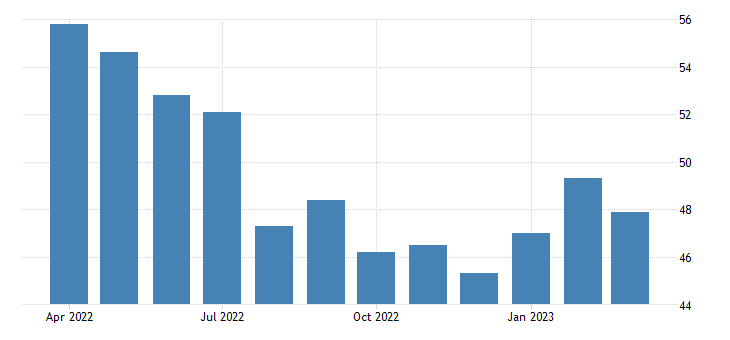

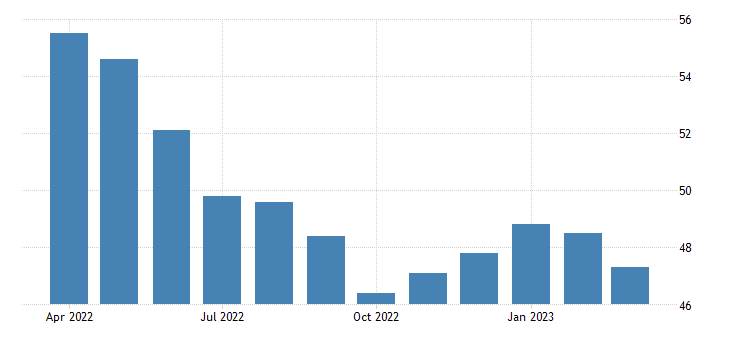

Nor is the weakness in manufacturing confined to China. Great Britain also just released its S&P/Markit PMI data, which at 47.9 put Britain’s manufacturing sector in contraction for the eighth straight month.

The Eurozone’s manufacturing PMI also printed below 50 for March, which was the 9th consecutive month of contraction for manufacturing in the eurozone.

It’s hard to have anything other than a recession when manufacturing around the world is in a state of contraction.

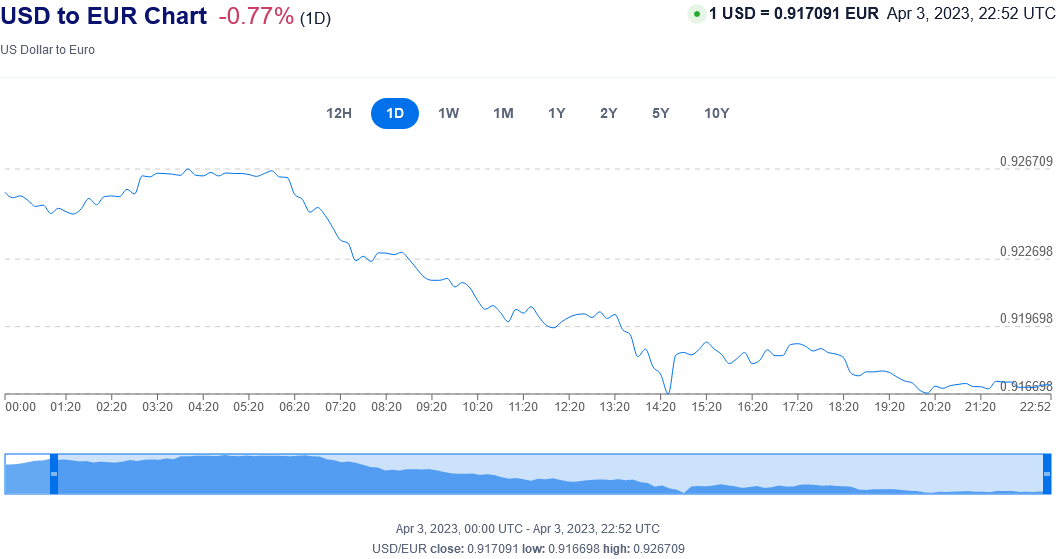

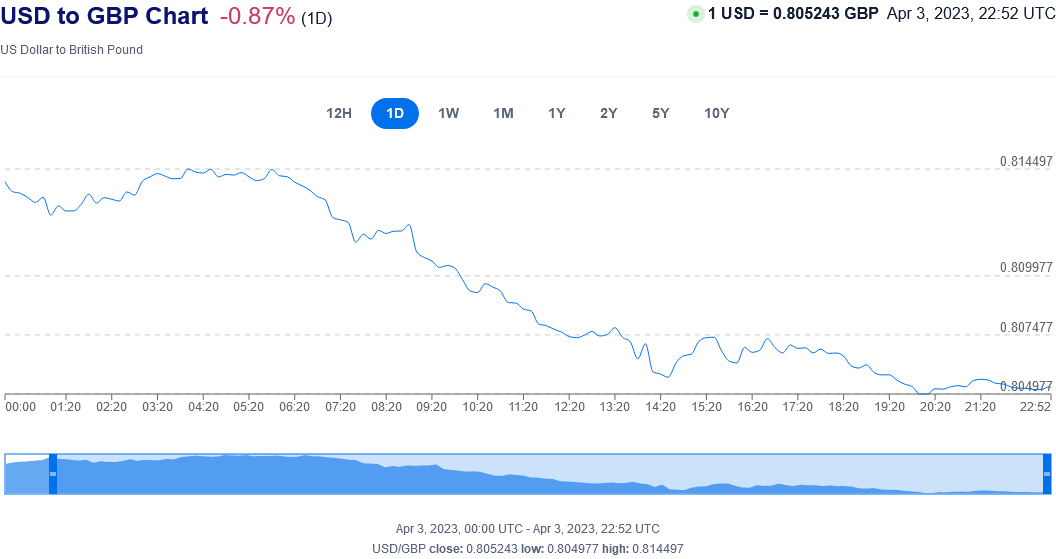

The dollar also telegraphed a fresh recessionary signal. Monday’s trading day began with the dollar moving higher against most major foriegn currencies.

The dollar rose against other major currencies on Monday as fears over inflation resurfaced after a surprise announcement by major oil producers to cut production targets further, with traders wagering the Federal Reserve may need to increase interest rates again at its next meeting.

However, that turned out to be a head fake, as the dollar ended the trading day on Monday down against the yuan, the euro, and the pound sterling.

The dollar index as a whole also ended the day lower.

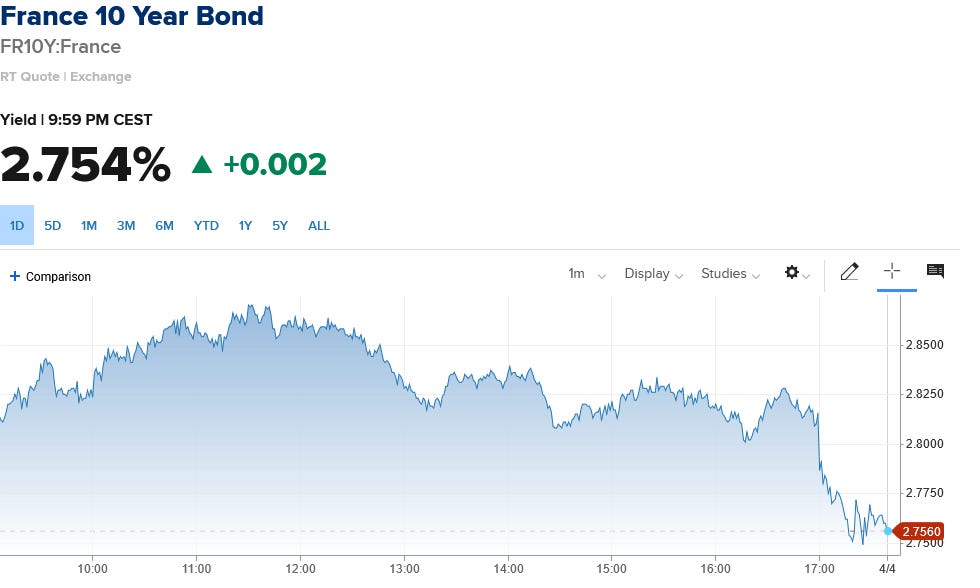

Meanwhile, in another market head fake, the bond markets started the day with treasury yields moving higher.

At around 4 a.m. ET, the yield on the benchmark 10-year Treasury note was up by around 5 basis points to 3.5431%, while the yield on the 30-year Treasury bond added almost 4 basis points to 3.7259%. The yield on the 2-year note rose by more than 5 basis points to 4.1206%. Yields move inversely to prices.

As with currencies, however, the trading day yesterday ended with most common treasury yields lower than where they started.

Even foreign securities saw their yields drop on the day.

In almost every aspect, the global financial response to the increased pricing signal sent by OPEC+ for crude oil translates as economic weakness.

The simple reality of oil markets thus far in 2023 has been that there just is not that much demand for oil. China’s “reopening” has been shaky at best. Europe is still contracting as a result of the sanctions against Russia. The US economy is still very much in recession, as the data has repeatedly shown despite what the government “experts” keep saying.

Cutting global oil production by up to one million barrels per day translates into a roughly 2% decline. In response, oil prices moved up roughly 4-6%—at a time when the immediate trend has been for oil prices to increase. The immediate response of global oil markets to the reduction in future oil production has been quite proportionate to the size of the reduction, which makes the reduction very much in line with current global demand.

Are Saudi Arabia and the other hydrocarbon economies trimming production in order to boost prices? Yes, they are, without a doubt. However, while no one ever wants to pay more for oil, the data clearly shows that this reduction comes to a global market that simply is not that thirsty for oil—and that lack of thirst is the easiest and most straightforward explanation for the reduction.

The problem highlighted by the announced oil production cuts is not that it will tip either the US or the global economy into recession. The problem is that those oil production cuts are being driven by a global economy that already is in recession which is steadily deepening and getting worse.

The times are still getting ever more interesting.

Key Point - "The problem highlighted by the announced oil production cuts is not that it will tip either the US or the global economy into recession. The problem is that those oil production cuts are being driven by a global economy that already is in recession which is steadily deepening and getting worse."

Thank you for this so I can stay in reality and tune out the noise.