OPEC is desperate to stop the decline in oil prices, so Saudi Arabia cutting oil production even further. Why not, since the last production cuts worked so very well?

On Sunday, after a meeting of OPEC ministers, Saudi Arabia affirmed its commitment to "do whatever it takes” to support oil prices.

Speaking after an OPEC+ meeting in which other producers offered no additional action to buttress current oil prices, but did extend their existing cuts into 2024, Saudi Energy Minister Prince Abdulaziz bin Salman said the kingdom “will do whatever is necessary to bring stability to this market.”

The kingdom is doubling down on production cuts after the previous round of curbs — agreed just two months ago — failed to deliver a sustained price rally. The Organization of Petroleum Exporting Countries and its allies announced a surprise supply reduction of about 1.6 million barrels a day in early April, but since then weak economic data from China and recession fears have weighed on oil futures, which fell 11% in New York in May.

Saudi Arabia is hoping that oil prices will begin moving upwards again after these latest production cuts, arresting the long term decline in the price for the OPEC Basket crude blend.

How well that will work remains to be seen. If it fails, OPEC’s ultimate impotency in setting global oil prices will be confirmed.

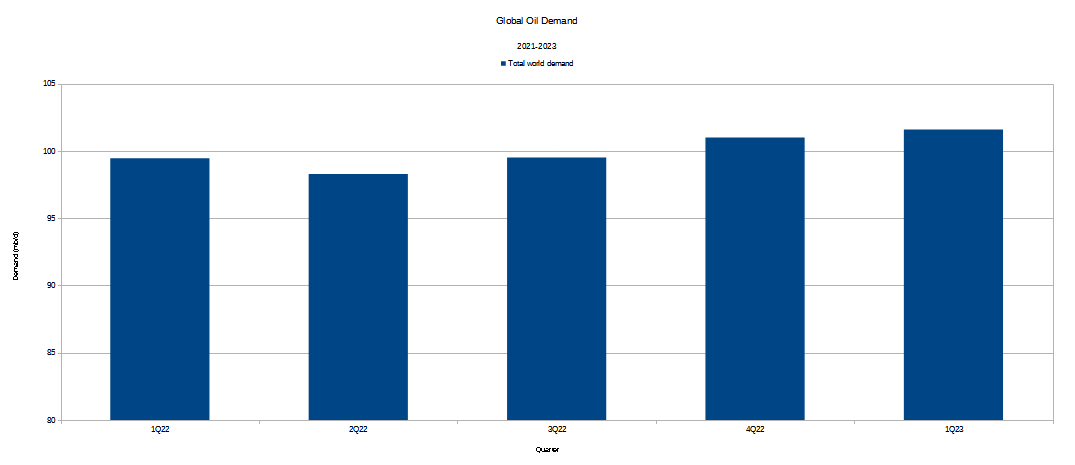

It is remarkable that OPEC should find itself in this situation, with the price of oil steady falling lower and lower. After all, a quick look at OPEC’s global forecast data shows aggregate oil demand rising.

However, rising oil demand does little good for the price of oil when oil production persistently surpasses oil demand.

So long as oil production exceeds oil demand, oil prices are going to fall. Basic economics as well as the history of global oil prices throughout 2022 prove that in abundance.

Despite world events which arguably should have provided more than a little price support for oil, the market has shrugged off all of them.

Part of OPEC’s dilemma is that it is not the only producer of oil. The US remains the world’s number one oil producer—and the US is not trimming output in an effort to support oil prices.

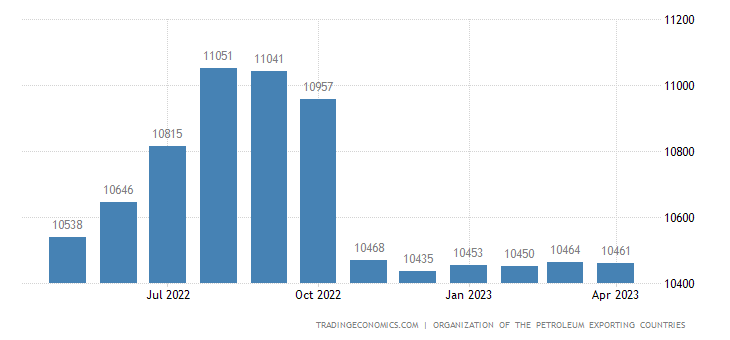

Saudi Arabia, on the other hand, made a significant production cut last October, and announced it wold do so again in April, neither of which had success halting the downward trend in oil prices.

The October cut was the production cut that appears to have been carried out by most OPEC members, as we see in Kuwait’s output.

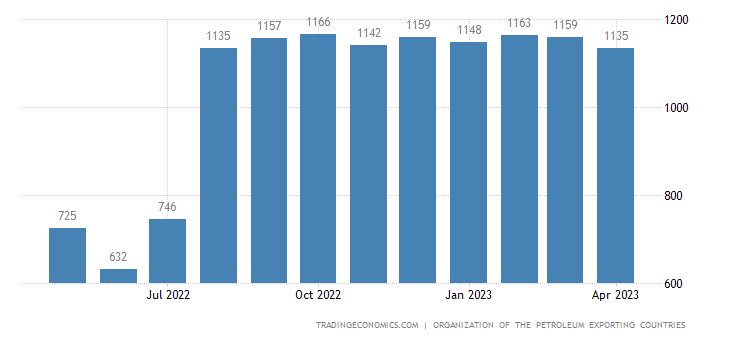

The United Arab Emirates also trimmed significantly in October.

Algeria also cut last October.

Venezuela, however, has been ramping up oil production.

So had Nigeria, up until April, when production dropped dramatically.

Libya has just ignored production cuts and has had fairly consistent production since last fall.

Iran has likewise been increasing production, particularly in April.

Saudi Arabia may be willing to curtail production in an effort to put a floor under global oil prices, but the rest of the OPEC cartel has not shown equal enthusiasm for the concept. A fair number of member countries are producing however much oil they can.

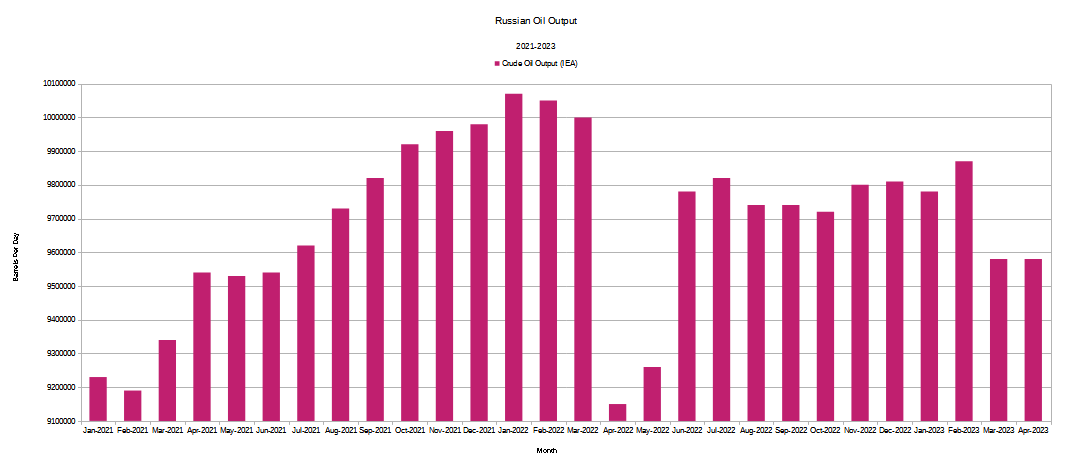

Even Russia has only recently seen production volumes drop, based on IEA data.

Given Russia’s need for oil revenue to sustain a wartime economy, if any country needs a floor underneath oil prices, it is Russia. Yet even their benchmark Urals crude blend has followed the global trend downward.

Russia is especially caught betwixt and between: it needs to sell as much oil as it can, and it needs to push the price of that oil as high as it can. Even a basic grasp of market economics suffices to establish those as irreconcilable needs: one or the other will have to prevail among Russian oil producers.

The inability of OPEC to enforce quota discipline among its members has resulted in a persistent oil glut since early last year. Because only a handful of coutnries have joined Saudi Arabia in curtailing oil production, the production cuts—and even the announcement of production cuts—have had little to no appreciable impact.

That the cartel should be undone in its price control efforts by its own members is a recurring theme in the history of oil prices. Time and again OPEC has sought to manage the price of oil, only to have those efforts upended by the member countries, each of which individually take advantage of announced production quotas by producing and then selling more than their agreed-upon quota.

Nor is there any reason to anticipate a different outcome than before—OPEC indiscipline keeps flooding the market with more oil than is demanded, pushing oil prices lower and lower. Even if Saudi Arabia follows through with its intention to trim oil production, the probability remains that even other OPEC nations will simply replace that production with their own, diluting the impact of the production cut.

Many oil industry observers have concluded that OPEC’s production cuts have been tantamount to the cartel taking back control over oil markets. With this latest production cut—an act that is rational only as an act of desperation—we are seeing that the opposite is the case: the markets are controlling (and will continue to control) OPEC.

If much of the world enters a long deflationary era, how would you expect that to affect OPEC? Do you see the cartel completely falling apart?