The data is crystal clear on this one point: inflation is receding. Yesterday’s Personal Income And Outlays Report for June leave very little room for any other conclusion.

From the same month one year ago, the PCE price index for June increased 3.0 percent (table 11). Prices for goods decreased 0.6 percent and prices for services increased 4.9 percent. Food prices increased 4.6 percent and energy prices decreased 18.9 percent. Excluding food and energy, the PCE price index increased 4.1 percent from one year ago.

That’s the good news.

The bad news is that prices are still high and wages are still not keeping up.

The current regime touts this toxic economic mess of imbalances as “Bidenomics”—it has not done the US any favors.

The most glaring weakness in the report comes straight off the top: Personal income and Disposable income rose less than personal expenditures.

Personal income increased $69.5 billion (0.3 percent at a monthly rate) in June, according to estimates released today by the Bureau of Economic Analysis (table 3 and table 5). Disposable personal income (DPI), personal income less personal current taxes, increased $67.5 billion (0.3 percent) and personal consumption expenditures (PCE) increased $100.4 billion (0.5 percent).

When incomes rise less than expenditures, one is out money. That’s not a good thing.

Corporate media, of course, failed to do the basic math.

An inflation measure tracked closely by the Federal Reserve eased sharply in June, a development that could help convince the Fed to hold interest rates steady after a spate of aggressive hikes.

An underlying gauge of price gains that has stayed stubbornly high also slowed substantially.

At the same time, household income and spending both rose smartly, portraying a consumer who still has the wherewithal to splurge and could continue to put upward pressure on prices.

Instead, corporate media chose to accentuate the positive, and focus on the low consumer price inflation percentages, which printed below expectations.

The Personal Consumption Expenditures (PCE) Index grew 3.0% year over year in June, down from 3.8% the month prior and in line with expectations. "Core" PCE, which excludes the volatile food and energy categories, grew 4.1%, down from 4.6% from the month prior and below the 4.2% economists surveyed by Bloomberg had expected.

Core PCE is the inflation measurement most often mentioned by Federal Reserve Chair Jerome Powell, who noted on Wednesday that inflation remains "well above our longer-run goal of 2%." The comments came after the Fed raised interest rates to a new range of 5.25%-5.50%, the highest level since March 2001, in an effort to tame inflation.

Amazingly, Dementia Joe’s handlers opted to not tweet out one of his many undeserved victory laps.

The data is pretty clear about the state of consumer price inflation, however, the corporate media narrative notwithstanding: Inflation is still high and prices are still rising.

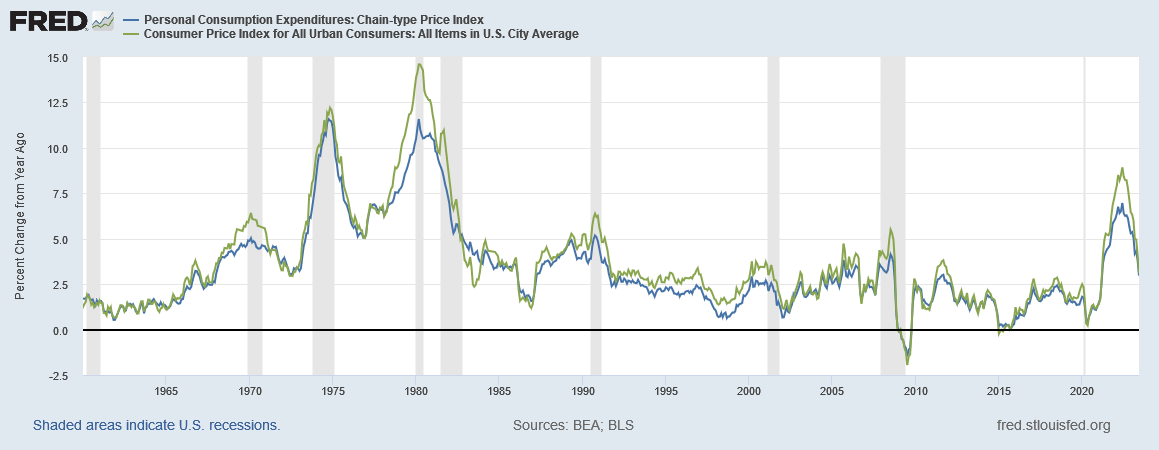

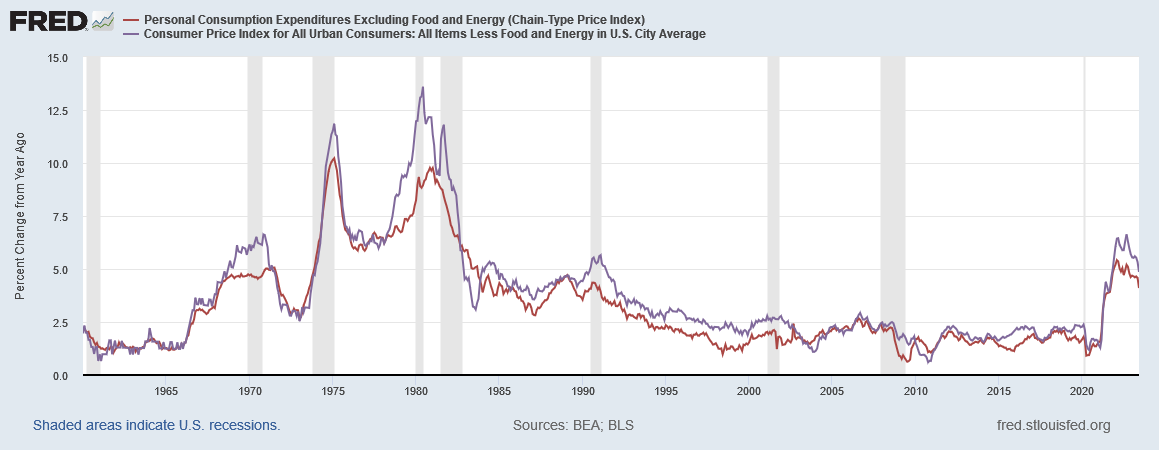

Core inflation remains worse than headline inflation, despite the recent downward trend.

Both of these were true for the CPI, and they are true for the Personal Consumption Expenditures Price Index (PCEPI) as well.

We should pause, however, to acknowledge one important confirmation of receding consumer price inflation—the convergence of the CPI and PCEPI. During periods of significant consumer price inflation, these two indices diverge somewhat, and come together again as inflation eases. That has been the historical pattern and we are seeing that pattern play out in the current data series as well.

We see the trend as well with the core inflation data.

While this is not a sign that inflation is “fixed”, it is a sign that at least this macro trend is moving in the desired direction. If we were not seeing the spread between the two indices converge, we should be properly concerned that inflation was not yet done inflicting economic pain.

At the same time, the PCEPI data gives us good reason for concern about the health of the US economy. While services price inflation has been fairly muted, both in the rising and the falling, manufacturing prices have been significantly more volatile.

In the space of 18 months, the US economy has gone from double digit consumer price inflation for manufactured goods to outright price deflation for those same goods. Additionally, while consumer price inflation is abating for goods, we are seeing no appreciable change in the pace of consumer price inflation for services.

The lack of a noticeable shift in service prices suggests that service price inflation is still very much a concern..

Not only must we be concerend about the specter of consumer price deflation, we also have to worry about the growing imbalance between goods prices and services prices.

Bear in mind that, for quite some time now, I have sought to highlight that one of the problems brought on by consumer price inflation is the distortions and disequilibria it brings.

While inflation has receded in many regards, we still are seeing significant distortions among various prices within the economy.

Perhaps the best example of ongoing price distortion has been the rapid rise and equally rapid fall of energy prices.

Even though energy goods and services are at present exhibiting consumer price deflation, we must remember that the prices for these same energy goods and services are still 48.6% higher than they were at the end of the Pandemic Panic Recession.

While food price inflation has not had quite the dramatic rise and fall that energy price inflation has, relative to the rest of the PCE index, food prices also remain significantly elevated.

Since the Pandemic Panic Recession, food prices have risen roughly 18.7%, while the overall price index has risen 15.4%.

Food price inflation might be falling, but food prices are not falling at all. That’s not a good thing.

Cooling price inflation means that the economic damage is occurring at a slower rate, but the prior damage has yet to properly heal.

The growth of personal incomes (or lack thereof) do much to highlight the distortions and dislocations currently in the US economy. Despite the putative “boon” of cooling consumer price inflation, we still have to face the reality of an 11.4% deficit between “cooling” consumer price levels and real personal incomes. If we want to focus on real disposable incomes, we have to face the reality that a 14.5% deficit between consumer price levels and real disposable incomes since the end of the Pandemic Panic Recession.

This growing disparity is highlighted again when we realize that, since January 2022, personal incomes have risen 7.7%, disposable personal incomes have risen 10.3%, but personal outlays have risen 10.7%.

As a general rule, we want to see personal incomes rising faster than personal outlays. That way we would see more personal savings, which has increased since January 2022 a mere 2%—the consequence of a 40.1% drop in personal savings during the first six months of 2022.

Consumer price inflation is “cooling”. That means prices are rising less slowly than they have been.

However, that leaves us with a number of less than positive realities.

That leaves us with consumer prices that are still rising.

That leaves us with real incomes that are still falling.

That leaves us with erosions of personal savings.

None of these are trends which bode well for folk, either as workers or as consumers.

The headline numbers might make for good sound bites and headlines. That’s about the only good they accomplish.

I just found you today and like your work! I find value in data when trying to make sense of the financial world. I’ll keep reading.