Powell Ignores Jobs Recession, Bows To Wall Street

Powell Is Clueless About What The Data Actually Says

There was no surprise yesterday when the Federal Open Market Committee opted to leave the federal funds rate unchanged. Wall Street had long ago priced in just that outcome, and Jay “Too Late” Powell hates to disappoint Wall Street.

Nor was it terribly surprising that the FOMC once again ignored crucial data, choosing instead to hyperfocus on its arbitrary two percent “holy grail” on inflation.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 3‑1/2 to 3‑3/4 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

Of course, what the FOMC neglects to mention is that the Federal Reserve’s actual price objective is stable prices, not 2% inflation.

The FOMC also neglects to mention that inflation has largely stabilized on a global basis in the range between 2.5% and 3%.

The FOMC also once again fails to recognize the jobs recession in this country, even as it admits labor markets are “softening”.

There was also no real surprise in Jay Powell’s comments during his monthly FOMC press briefing. Powell was his usual befuddled and clueless self, and either does not know how to read the economic data or simply does wish to be bothered by the laborious act of studying the data.

Powell and the FOMC gave Wall Street the federal funds rate it wants, while ignoring Main Street yet again, and then once again managed to avoid stepping on any landmines during the press briefing. On the whole, Wall Street was satisfied. On the whole, Main Street was screwed…again.

Two Percent Inflation Is Just A Number

Nothing puts Powell’s sheer mindlessness on full display more than his rote invocation of “two percent inflation”. Given his constant reverent references to the number, people might be forgiven for thinking there was some extraordinary significance attached to that particular inflation rate.

However, people would be wrong for thinking that. The 2% inflation figure is an arbitrary inflation level the FOMC pulled out of some orifice at its July, 1996, meeting.

The debate leading up to the selection of that number as an inflation target was about whether the Fed should have an inflation target at all. The ultimate consensus that emerged was that the Fed could boost its credibility by having an explicit inflation target, and after much back and forth, the FOMC settled on the target being 2%.

The Federal Reserve, in other words, chose to set a target inflation rate of 2% because it believed that would make it sound more credible.

Perversely, the Fed Chair at the time, Alan Greenspan, did not want the inflation target to become public. Greenspan strongly believed in keeping FOMC deliberations secret, and the inflation target was no different.

Because he believed in keeping the committee’s monetary policy decisions confidential, market watchers over the course of Greenspan’s nearly two decades as chair went so far as to analyze the size of his briefcase on FOMC meeting days for some sort of signal as to whether he would push for an interest rate cut. In keeping with that predisposition toward secrecy, at one point in the July 1996 discussion, after the committee seemed to settle on 2 percent, Greenspan reminded members of their obligation not to disclose any decisions it might reach regarding the inflation target. With an eye on potential political and market blowback, he warned, “I will tell you that if the 2 percent inflation figure gets out of this room, it is going to create more problems for us than I think any of you might anticipate.”

Given Powell’s rigid adherence to the two percent orthodoxy, Greenspan had good reason to be concerned.

Why is the two percent figure a bad idea?

One reason is that two percent is not zero percent. Consumers invariably view inflation as a negative—we do not want prices rising, and if at all possible we prefer them to be falling. From the consumer perspective, monetary policy should seek to eliminate inflation entirely.

While zero percent inflation is the consumer ideal, however, the reality is that zero percent inflation on a constant basis is not simply not achievable. Markets are never that frictionless or that efficient. As a goal for monetary policy, it is far more practical and achievable to focus on keeping inflation “low” and also fairly steady. A low inflation rate which does not fluctuate too much is the next best thing to zero percent, and it is a goal that is actually achievable in a real world economy.

The Federal Reserve’s mandate of “stable prices” is best apprehended as when consumer price inflation is low and which does not fluctuate much. When the inflation rate is itself stable, inflation becomes predictable, and consumer behavior can adapt in consistent and rational ways.

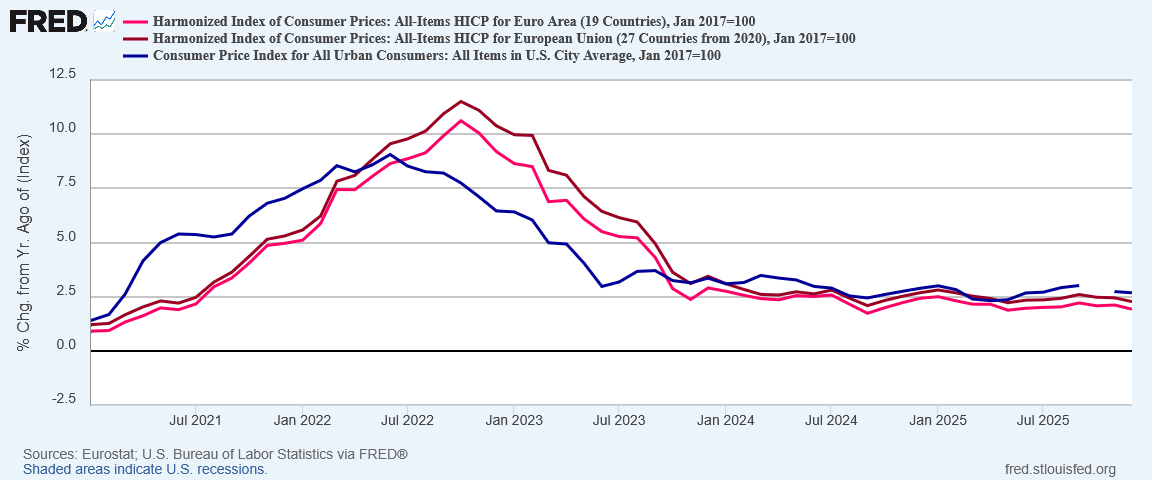

This brings us to the second reason the two percent figure is the wrong objective for the present time: inflation has become stable over the past two years—just not at 2%.

When we look at inflation rates both here in the US and in Europe, we see that, after the 2022 hyperinflation cycle ended, consumer price inflation stabilized in around 2.5%-3%.

The Fed largely achieved its goal of stable prices by approximately January, 2024. Europe had also achieved stable prices by then.

That Europe and the US have been experiencing stable inflation rates around 2.5% suggests that rate of inflation is primarily structural. European nations do not have the same monetary policies as the US, and if monetary policy were the driving factor we would expect to see significantly different inflation rates for Europe and the US. Clearly, monetary policy is not the dispositive factor for why inflation rates are stable, even if they are stable at a percentage point higher than the two percent holy grail.

If price stability has been achieved, Powell and the Federal Reserve should be focusing far more on maximum employment—which we clearly do not have.

Powell Says He Looks At The Jobs Data. Does He?

Listening to his opening comments at his post-FOMC press briefings, he certainly tries to sound as if he is paying attention to the jobs data.

In the labor market, indicators suggest that conditions may be stabilizing after a period of gradual softening. The unemployment rate was 4.4 percent in December and has changed little in recent months. Job gains have remained low. Total nonfarm payrolls declined at an average pace of 22,000 per month over the last three months; excluding government employment, private payrolls rose at an average pace of 29,000 per month. A good part of the slowing in the pace of job growth over the past year reflects a decline in the growth of the labor force, due to lower immigration and labor force participation, though labor demand has clearly softened as well.

However, if we look at the data, it is clear that Powell either is not looking at the jobs data or he does not understand the jobs data.

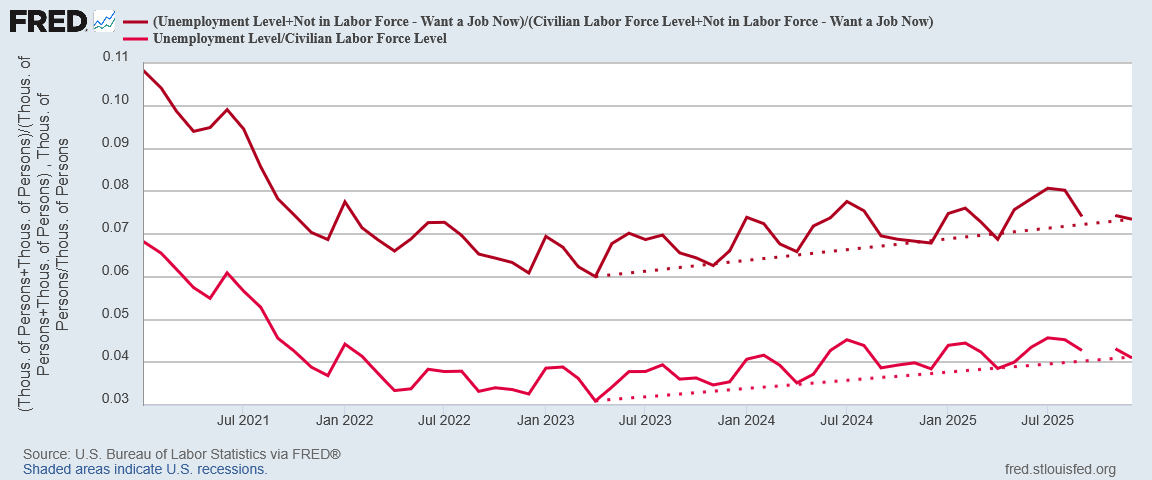

While the “official” unemployment rate did print at 4.4% for December, that figure systematically undercounts the actual number of people who are unemployed. As I have written many times, if we simply incorporate those persons not in the labor force but who want a job now into the unemployment rate, the percentage quickly jumps to 7.3%.

Moreover, the trend in unemployment is clearly rising. We are seeing, over the longer term especially, more joblessness rather than less. That “real” unemployment rate which includes those not in the labor force but who want a job now has been trending up slightly faster than the official unemployment rate.

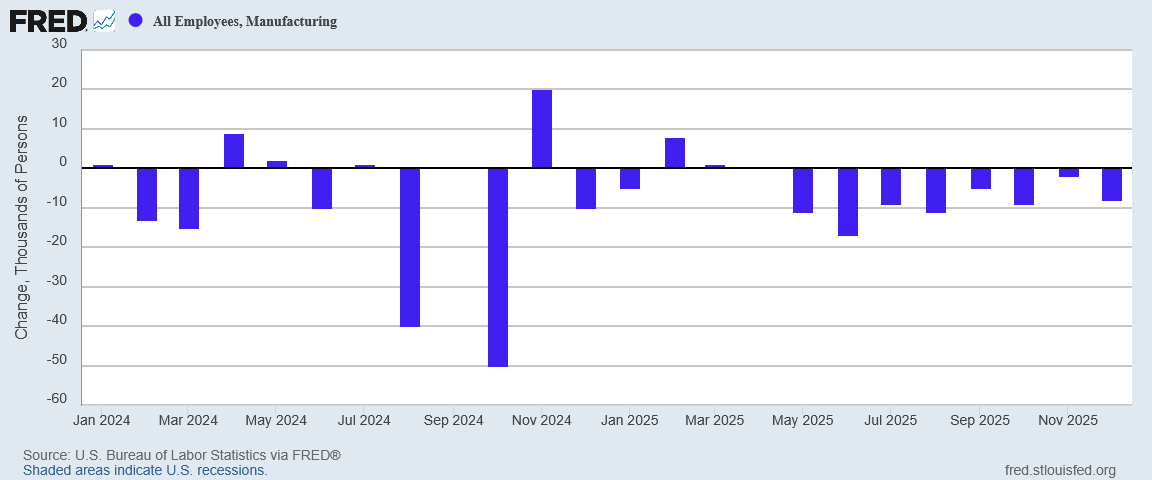

As for jobs markets stabilizing, does it sound as if manufacturing employment is stabilizing when the sector continues to hemorrhage jobs?

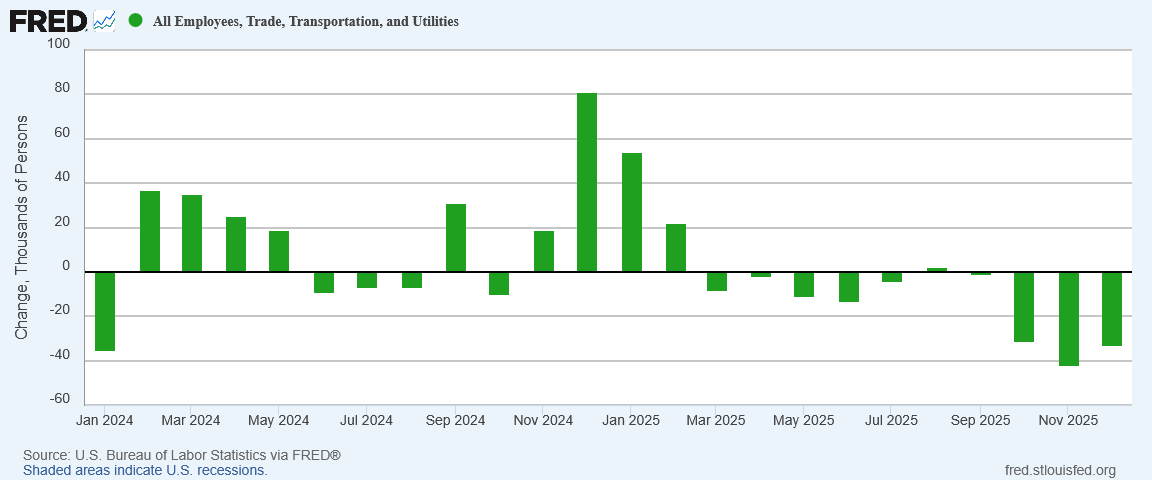

Does it sound as if employment within the Trade, Transportation, and Utilities sector has stabilized when it also has been hemorrhaging jobs?

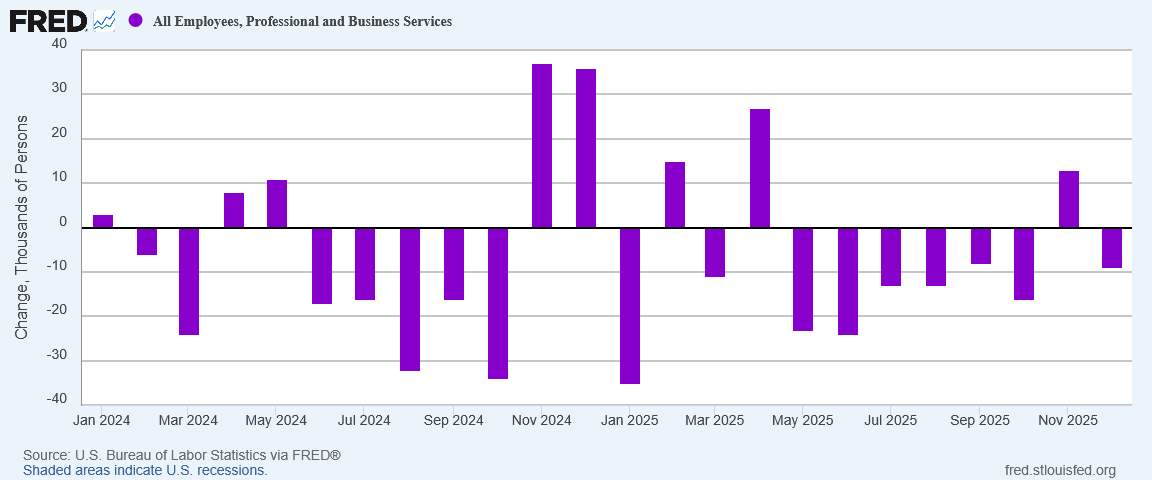

Do the jobs in the Professional and Business Services sector appear “stable”?

Within entire swaths of the US economy, employment is demonstrably not stable.

Is Powell aware of this? He is if he’s actually looking at the data—but if he’s actually looking at the data, why is he making such self-congratulatory comments about jobs markets being stable?

Job markets are clearly not stable, which means Powell is either being deceitful, deceived, or both.

Corporate Media Is Also Not Looking At The Data

We do not have to speculate on why Powell is able to get away with his serial confabulations about jobs markets: corporate media is also not looking at (or not understanding) the data. Consequently, they never challenge him on the data.

We can see that plainly in this little exchange between Neil Irwin of Axios and Powell from yesterday’s press briefing.

Neil Irwin (Axios): Obviously no SEP in this meeting, but in light of the slight firming up of the language around growth in the labor market and the statement, should we assume that the timeline for any further rate cuts is pushed back compared to what people might have thought in December?

Powell: Well, first of all, if you look at the incoming data since the last meeting, clear improvement in the outlook for growth. The data have come in and sentiment, the Beige Book, everything comes in suggesting that this year starts off on a solid footing for growth. Inflation performed about as expected, and as I mentioned, some of the labor market data came in suggesting evidence of stabilization. So it’s overall a stronger forecast, really, if that’s your question. I’m not sure I answered your question.

Neil Irwin (Axios): But in terms of timing or pacing of any additional easing?

Powell: So we haven’t made, you know, what we’d say about this was that after this meeting, after the three recent rate cuts, we’re well positioned to address the risks that we face on both sides of our dual mandate and we’ll continue to make our decisions meeting by meeting based on the incoming data implications for any implications for the outlook and the balance of risks. Haven’t made any decisions about future meetings, but, you know, the economy is growing at a solid pace. The unemployment rate has been broadly stable, and inflation remains somewhat elevated. So we’ll be looking to our goal variables and letting the data light the way for us.

Instead of Neil Irwin asking Powell how he reconciled claims that jobs markets were stabilizing against the evidences just from the BLS of jobs market instability, he simply took Powell at his word.

As with Powell, we are forced to conclude that Neil Irwin is also unfamiliar with the data, or is being deceptive about the data.

What is clear is that corporate media does not give one tinker’s damn about what the data is actually showing.

Whither The Economy?

As Powell made clear even in his answer to Neil Irwin, the official Fed narrative is that the economy is growing, and doing so at a good pace overall. Powell emphasized that point even in his opening remarks.

Available indicators suggest that economic activity has been expanding at a solid pace. Consumer spending has been resilient, and business fixed investment has continued to expand.

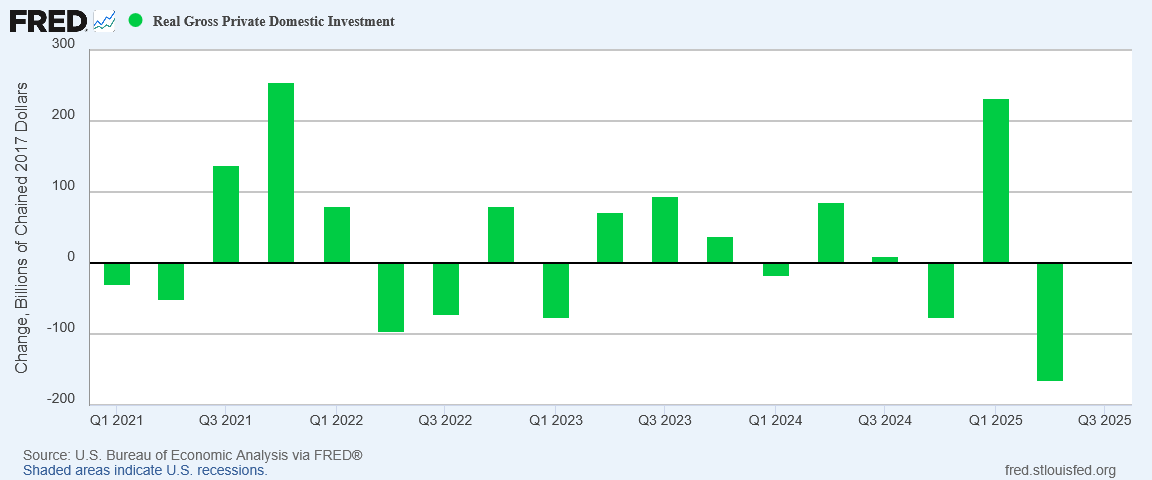

Is investment expanding? Not according to the Bureau of Economic Analysis, which has printed negative Real Gross Private Domestic Investment in three of the past four quarters.

When investment growth is not only nonexistent but is actually negative, it is more than a little absurd to speak of expanding investment.

The “expansion” narrative on investment rests entirely on a surge in investment spending in Q1 of 2025. Outside of that one quarter, investment in the US has contracted.

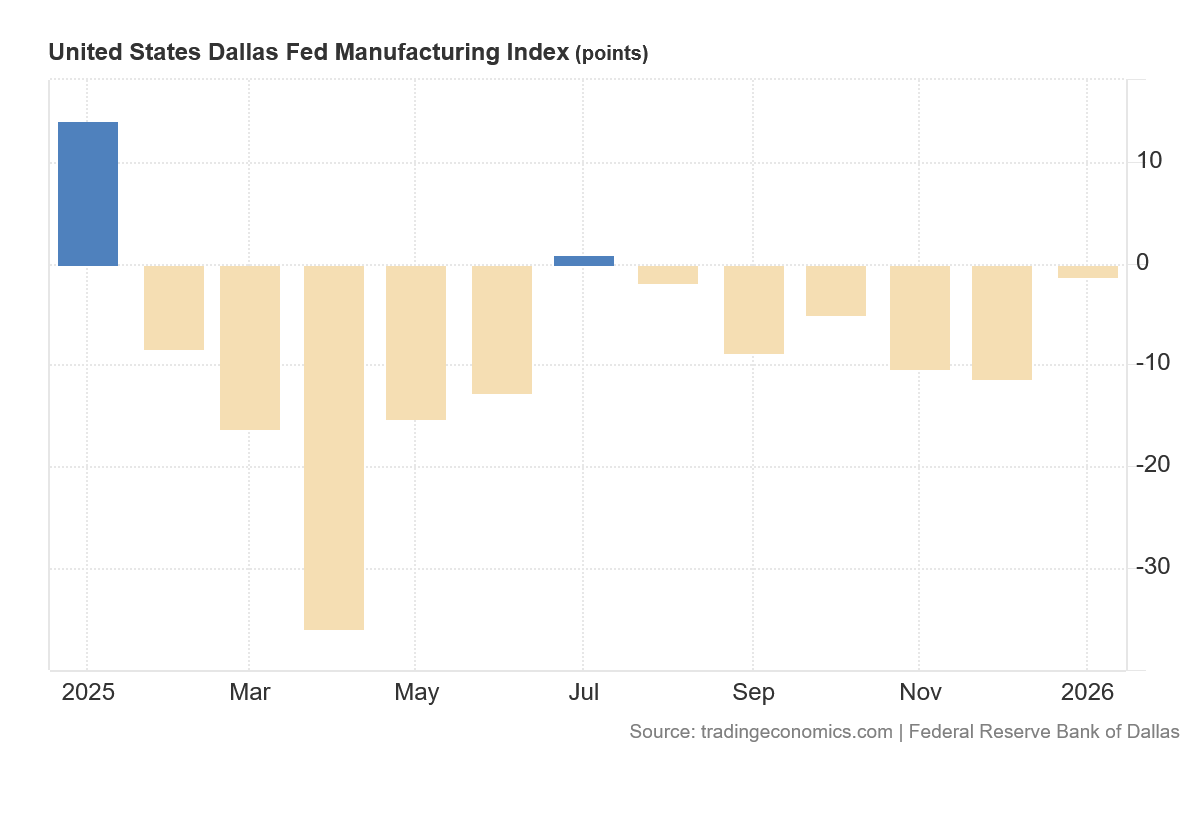

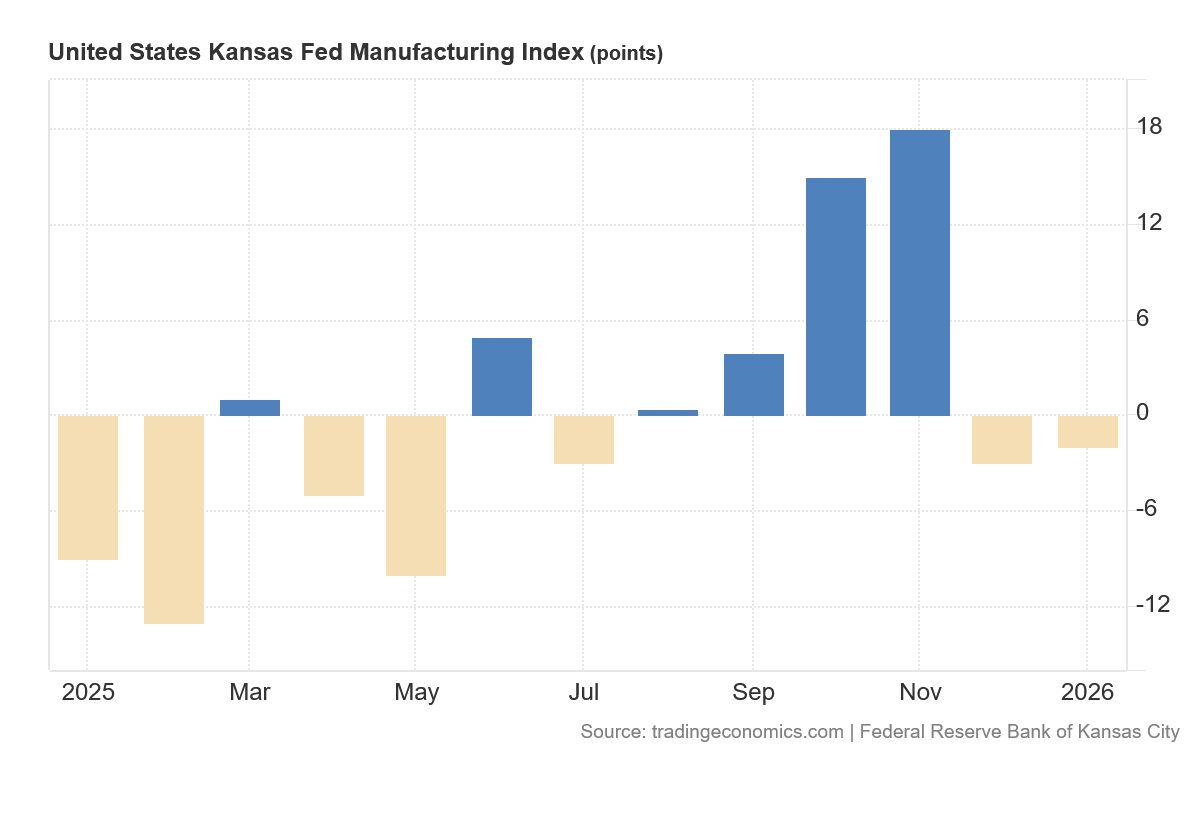

Yet, as I have documented previously, even the Federal Reserve’s own regional data shows the economy not doing at all well. In at least five Federal Reserve districts, manufacturing especially is languishing.

That is certainly the case in Dallas.

That is also the case in Kansas City.

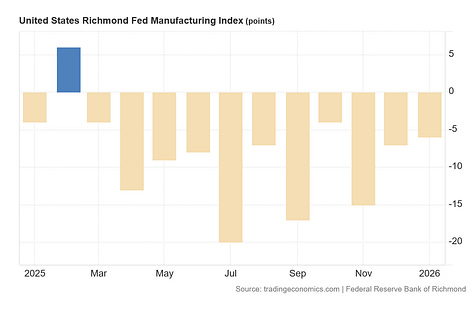

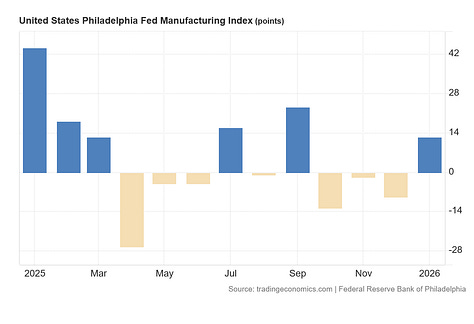

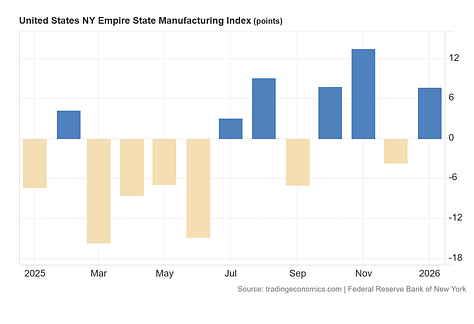

Ditto for the Richmond, Philadelphia, and New York Reserve Districts.

Any time the Federal Reserve district manufacturing indices are negative, that’s not expanding economic activity.

The Federal Reserve’s own data questions the assertion of expanding economic activity.

While some sectors of the US economy are expanding, others are not—and when manufacturing is one of the sectors that is not expanding, surely that warrants even some mention by the head of the Federal Reserve.

Wall Street Went “Meh”

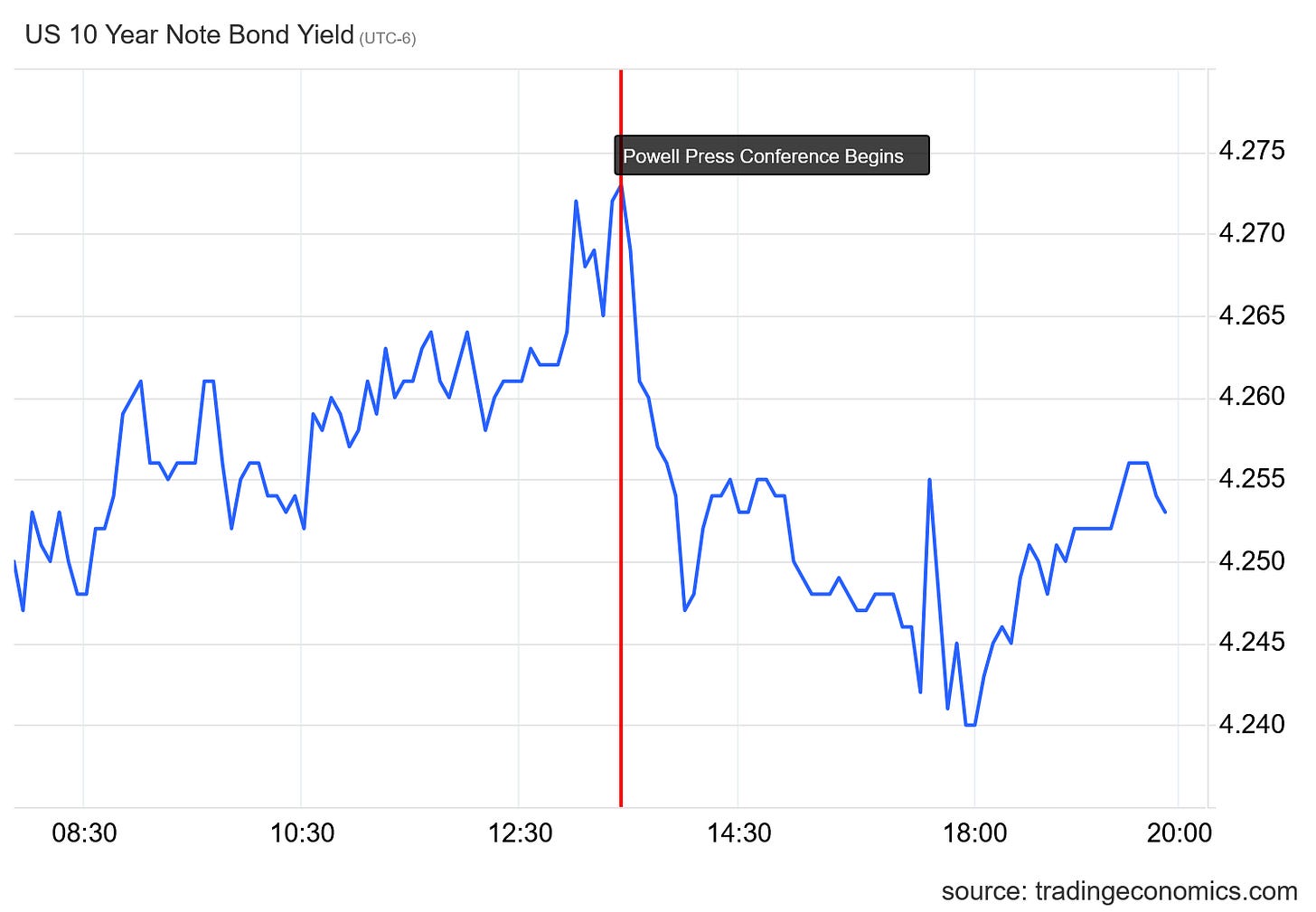

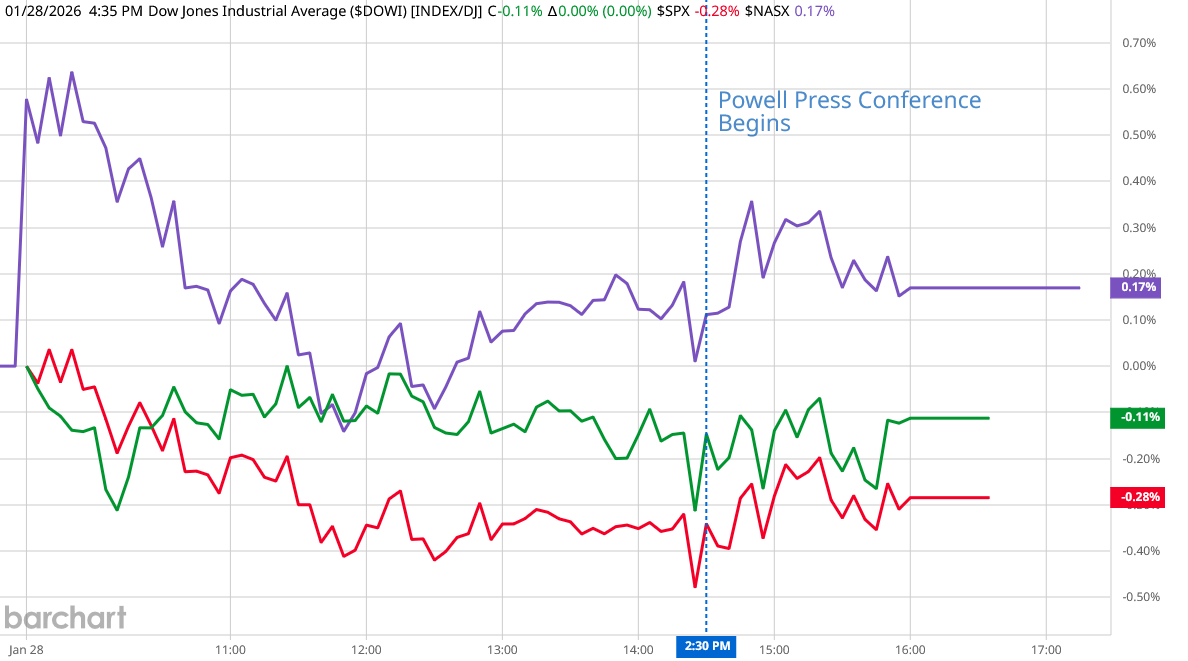

While Powell has achieved a certain infamy for tanking markets just by opening his mouth at the FOMC press briefing, this was one of the times when he managed to avoid stepping on any landmines or gargling his toenails.

Wall Street took his remarks mostly in stride, mulled them over, and wound up after his remarks in largely the same place as at the start of his remarks.

Treasury yields had been rising on the day, reversed when the FOMC press briefing began, and eventually rose again, finishing the day close to the pre-presser peak.

Equities started the day in a similarly pessimistic mood, declining through the morning before rising in the afternoon, reversed that climb briefly just before Powell began his briefing, then resumed their afternoon rise.

By day’s end, Wall Street had shrugged Powell’s remarks off. The markets were not highly enthused by what he had to say nor did they show their usual horror at what he had to say.

What that actually means for the state of the financial markets themselves is a question. Certainly Wall Street shows as little interest in Powell’s inability to speak either honestly or intelligently about the data which he claims drives Fed decision-making as does corporate media.

Is Wall Street simply trading on various narratives? There is nothing in Wall Street’s response to the Powell presser which would definitively rebut such a presumption. That is not the same as having an abundance of data supporting the presumption, but it nevertheless remains a possibility.

At day’s end, what was clear yet again is that neither Wall Street nor the Federal Reserve nor the corporate media who pretends to report on both even acknowledged that there is still a jobs recession in this country. Neither did any of the acknowledge that there are several significant vulnerabilities and weaknesses in the US economy—portions may be growing, but other parts are struggling.

A healthy economy is one that is showing decent growth across all sectors. That is not the US economy at present. With Jay “Too Late” Powell not caring enough to speak honestly about what ails the US economy, the US economy is not likely to become healthy any time soon.

When the US economy does get healthy, it will be in spite of Too Late Powell, not because of him.

Back decades ago when I was studying Economics there was emphasis on the importance of “productivity” - output per man-hour of work. I don’t hear that metric discussed as much anymore, but it still seems to me that it is one of the true measures of improving quality of life and a healthy economy. In Powell’s data on manufacturing, jobs are being lost. Peter, is there anything in his data or comments explaining that it is AI that is taking jobs, but productivity is improving because of AI? I keep waiting for someone in authority to show us if AI is improving productivity, even if it is destroying some livelihoods. Thanks!

Pete, why is Gold so high?

EuroBanks dumping dollars?

Ayatollahs gathering to go?