2025's Final Jobs Report Shows Little Change

No Change Means No Jobs, And America Needs Jobs.

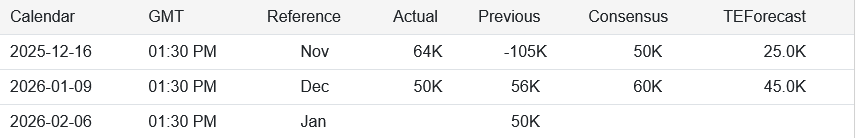

The good news in the December Employment Situation Summary from the Bureau of Labor Statistics is that it reports 50,000 jobs created during the month.

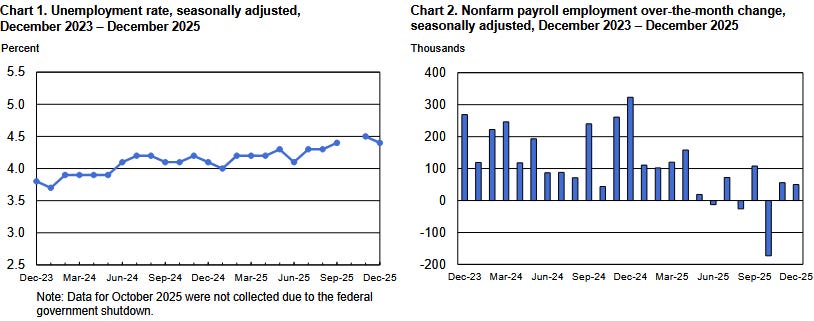

Both total nonfarm payroll employment (+50,000) and the unemployment rate (4.4 percent) changed little in December, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in food services and drinking places, health care, and social assistance. Retail trade lost jobs.

Official unemployment also dropped on the month.

Somewhat good headline numbers—and that’s where the good news ends.

Most economic sectors lost jobs on the month. The numbers of those not in the labor force rose—meaning overall joblessness rose.

At a time when the economy needs joblessness to be declining, this report does not deliver the news we need. The economy is certainly not delivering the jobs we need.

Another Wall Street Miss

The 50,000 headline jobs figure was 10,000 shy of Wall Street’s consensus estimate, although it was 5,000 jobs above the Trading Economics forecast.

Unsurprisingly, corporate media lost no time in using that shortcoming to bash President Trump.

Longtime readers of All Facts Matter will understand when I snicker at corporate media’s economic virtue signalling. I have been discussing how the US economy is mired in a jobs recession for over a year. Labor markets have not “turned” sluggish. Labor markets have been sluggish for quite some time—they have in fact been toxic for quite some time.

President Trump’s economic policies have not yet reversed the recessionary trends we have been seeing in US labor markets, but it is fatuous and false to infer that those economic policies are what produced those recessionary trends. They did not, and any “economist” who argues otherwise is either ignorant, illiterate, or simply too lazy to look at the actual data.

Still, that neither President Trump nor White House Press Secretary Karoline Leavitt saw fit to take a social media victory lap over the jobs numbers is a clear indication of how weak a jobs report it really is. If the eternal pitchman Donald Trump can’t spin the numbers into something good, the obvious inference is that there is nothing good on which anyone can spin.

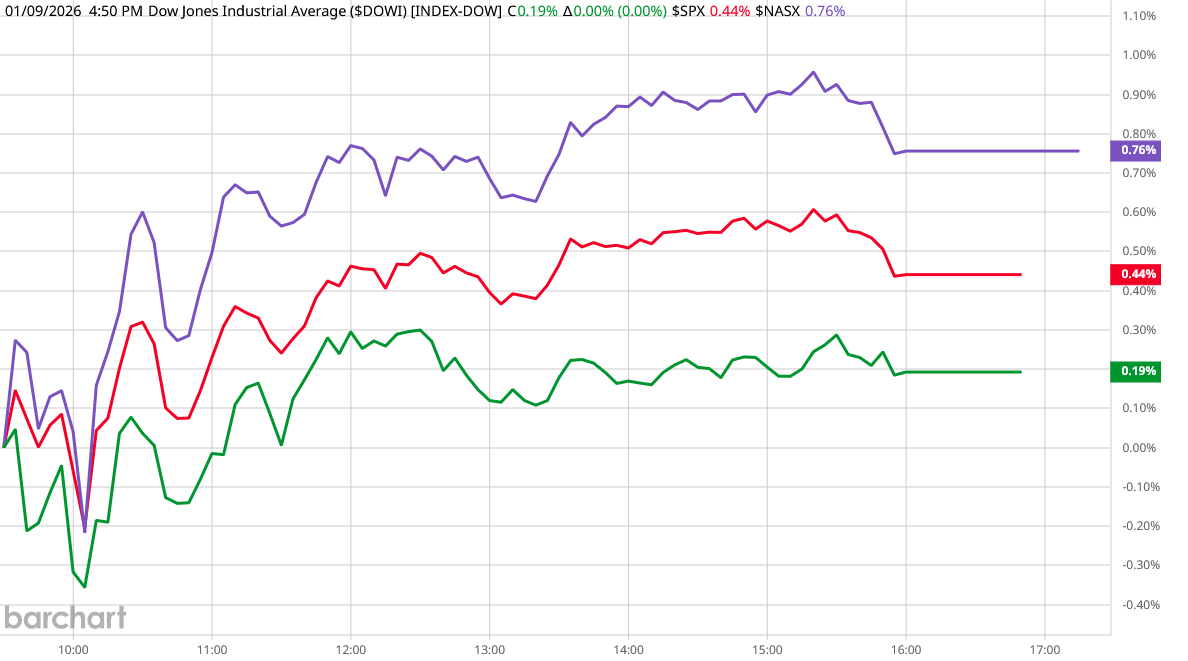

Even Wall Street had an initially negative reaction to Friday’s BLS jobs report.

Stocks dropped on the day before staging a recovery later on in Friday’s trading session. Whatever pieces of good news Wall Street saw on Friday, the jobs report was not numbered among them.

The Sector Bloodbaths Continue

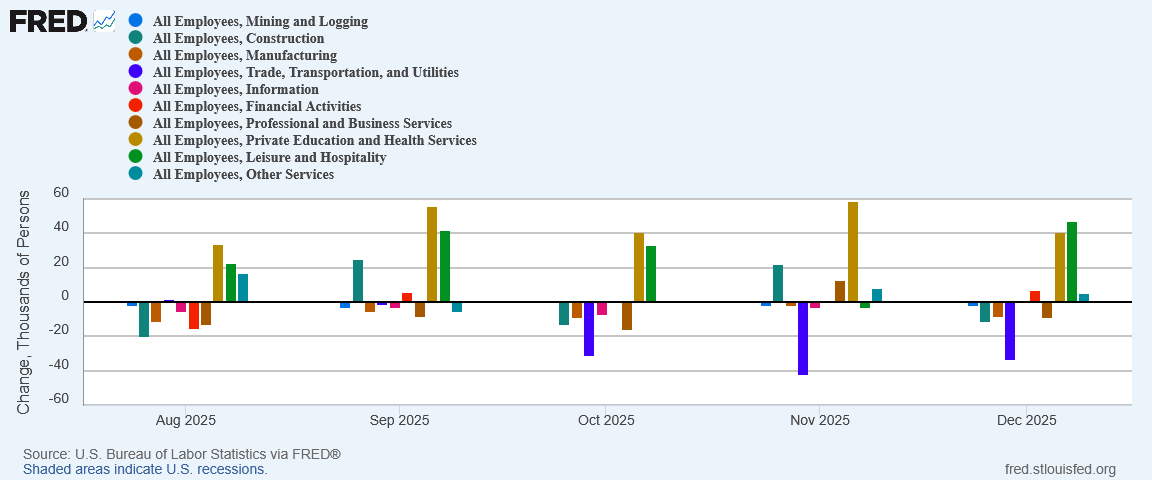

While the headline number was positive, for most economic sectors, the data was not.

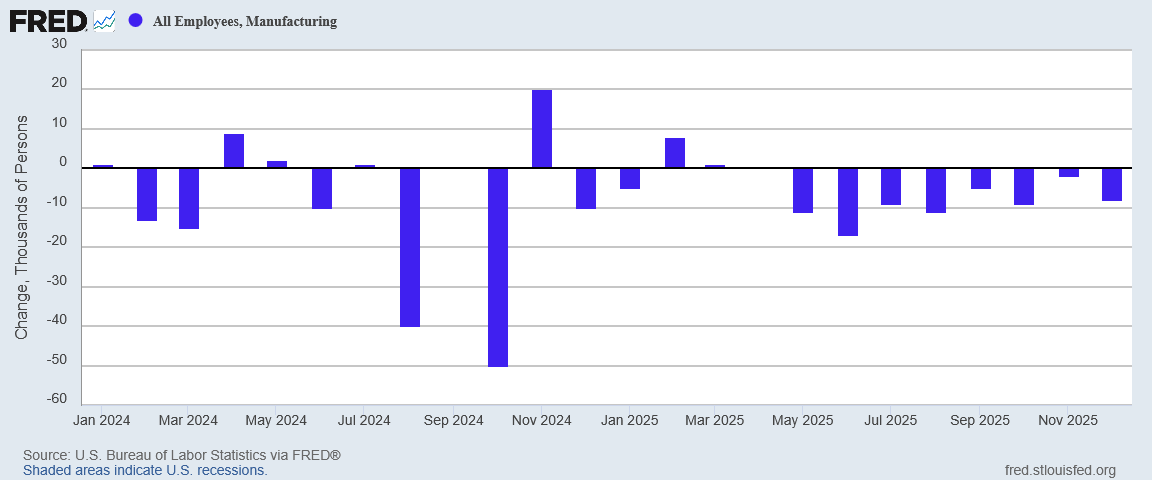

Manufacturing once again shed jobs, continuing a trend that has gone on for far too long.

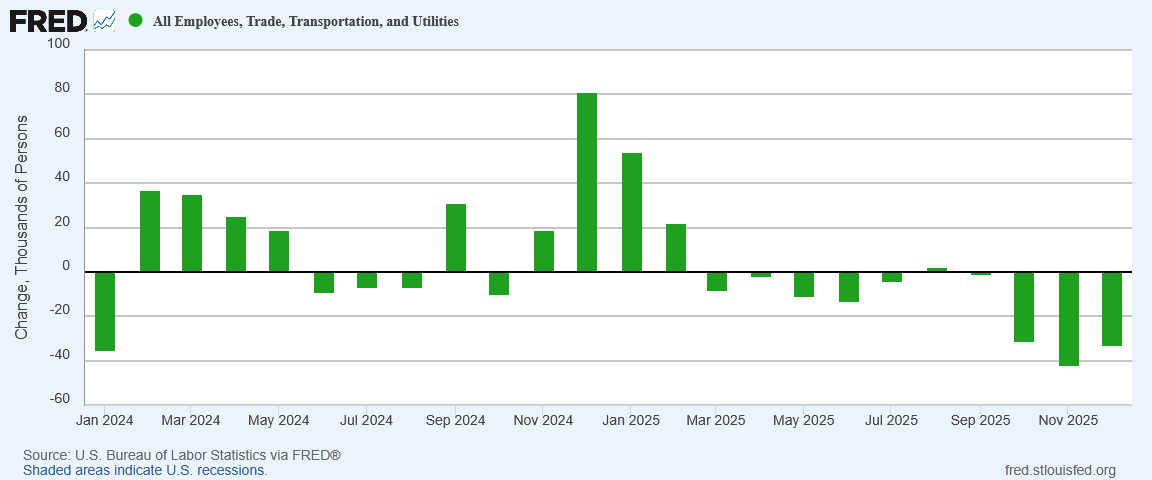

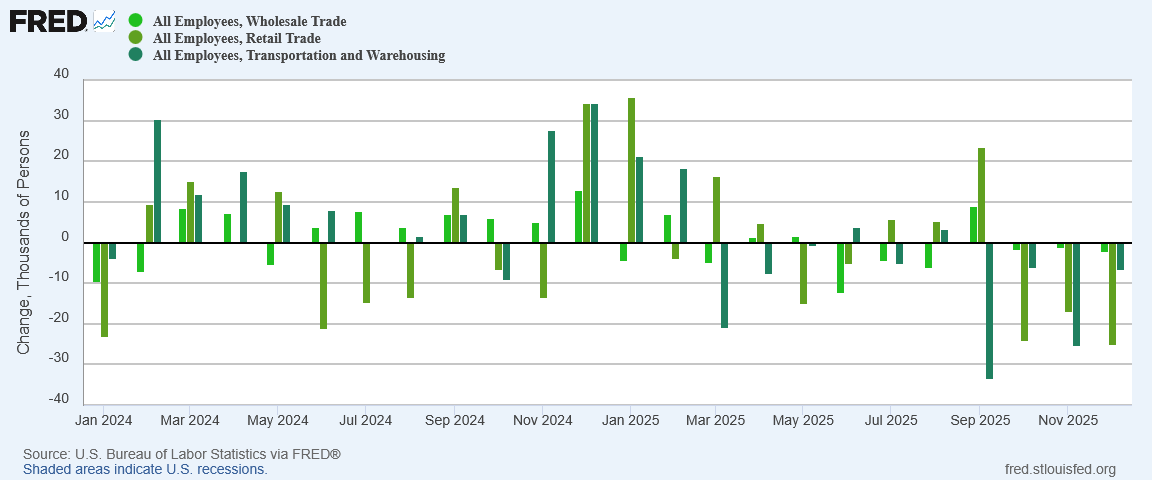

Trade, Transportation, and Utilities also hemorrhaged jobs last month.

Drilling into the sectors within Trade and Transportation, the jobs carnage was across the board.

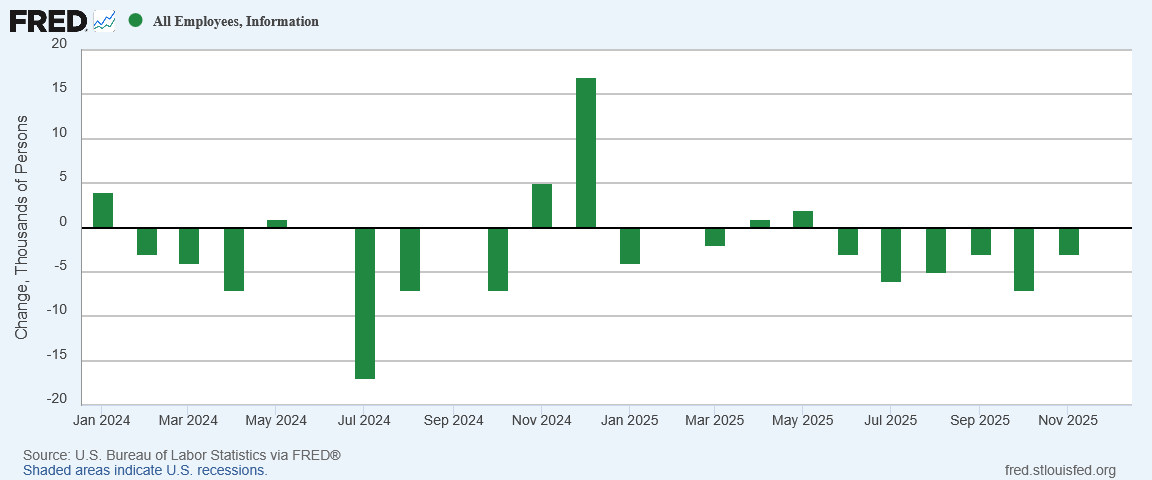

Information also continued to shed jobs (which makes one wonder where the payoffs from Artificial Intelligence will come if the tech sector is laying everybody off).

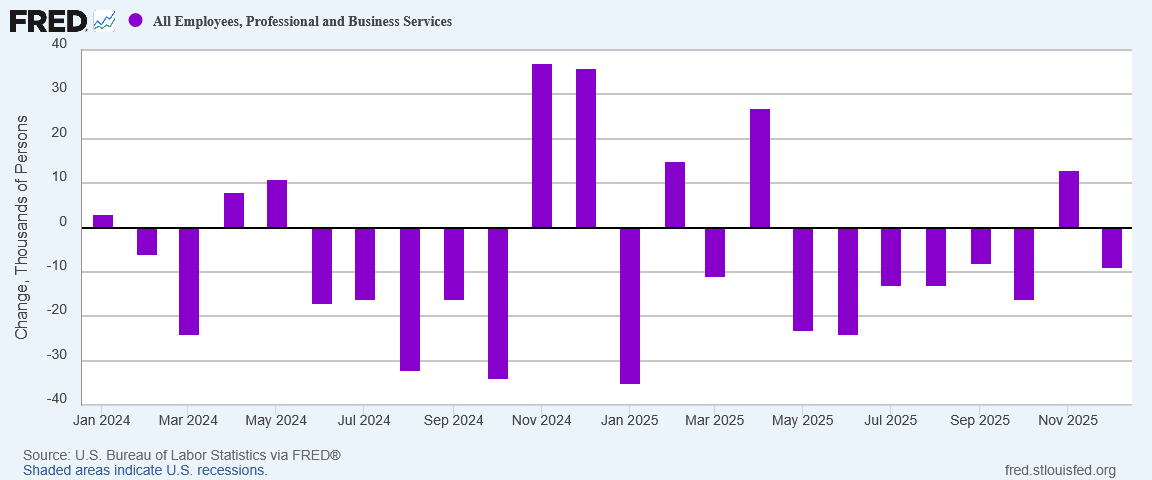

Even Professional and Business Services, which had staged a recovery in November, shed jobs again in December.

So bad are the per-sector jobs numbers that, if not for the only two sectors which gained jobs (Private Education and Leisure), the jobs report would have been sharply negative for the month.

When sector after sector is losing jobs, the jobs report is by definition weak and worrisome. In December, sector after sector once again lost jobs.

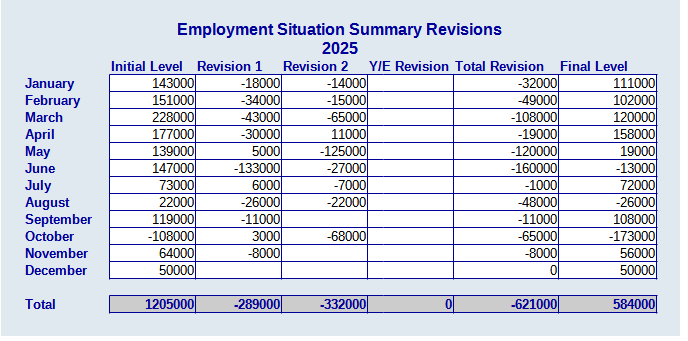

Corrections Continue

On its own, 50,000 jobs is, for the US economy, a weak jobs number even in the best case scenario.

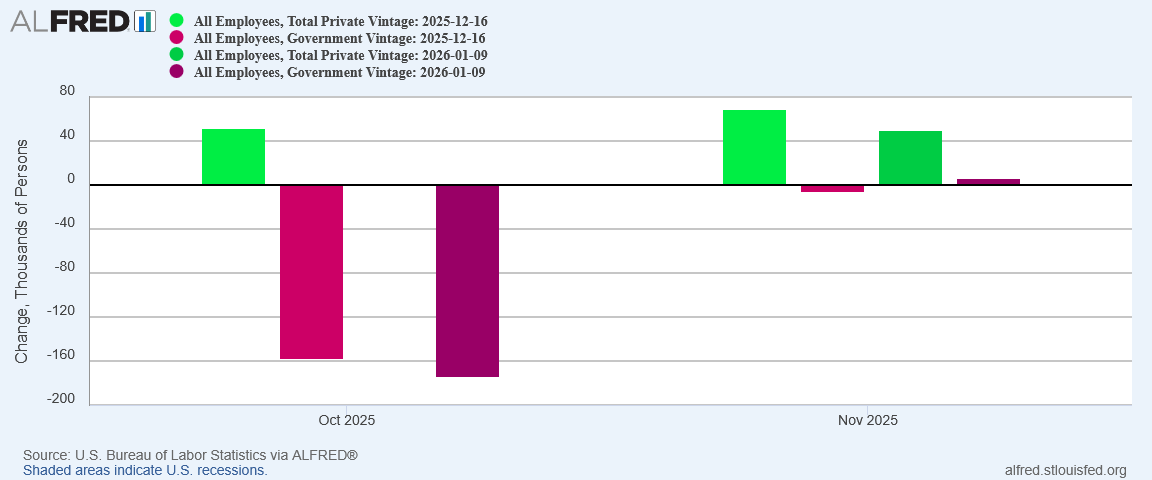

However, that 50,000 jobs was then blasted out of the water by the BLS’ infamous prior months “corrections”, which overmatched the December jobs numbers and then sum.

While the October downward revision of government sector jobs might not be seen as a complete negative, the elimination of nearly all private sector job growth in October is absolutely a complete negative. So is a similar correction for November.

The net effect of the revisions was to take 76,000 previously declared jobs off the table.

The change in total nonfarm payroll employment for October was revised down by 68,000, from -105,000 to -173,000, and the change for November was revised down by 8,000, from +64,000 to +56,000. With these revisions, employment in October and November combined is 76,000 lower than previously reported.

For the year, some 621,000 initially reported jobs have been removed from the BLS jobs data in subsequent months.

Most damning of all is that the subsequent revisions have been negative in every month for 2025. The Bureau of Labor Statistics has overshot the mark in its initial job estimates every single time.

For those wondering if there is still a problem with the BLS’ data collection and analysis methodologies, the answer is an unequivocal yes. When the initial results are uniformly either too high or too low a bias factor is creeping into the data from somewhere. However the Bureau is building its projections from the data received is demonstrably too generous and optimistic.

Even if December is revised by the average correction for 2025, the net result would be 6,000 jobs lost. That is how uncertain the December jobs number is at the moment.

Manufacturing Decline Is More Than Jobs

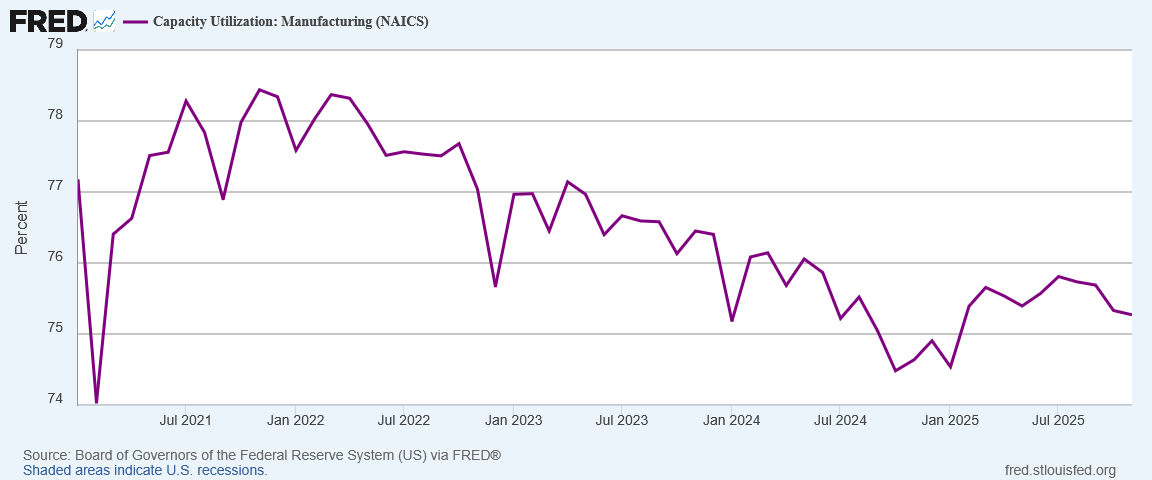

The primary reason to be concerned about the continuing decline in manufacturing employment especially is that it highlights an ongoing decline in manufacturing generally.

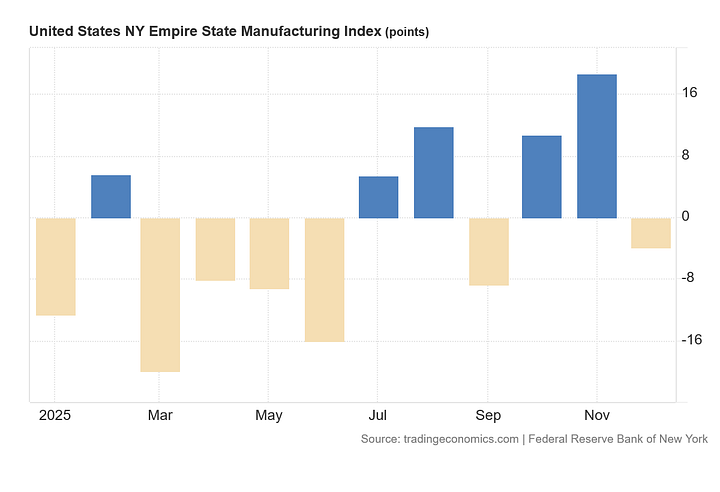

While manufacturing capacity utilization staged a recovery during the first half of 2025, since July the sector has been retreating once again.

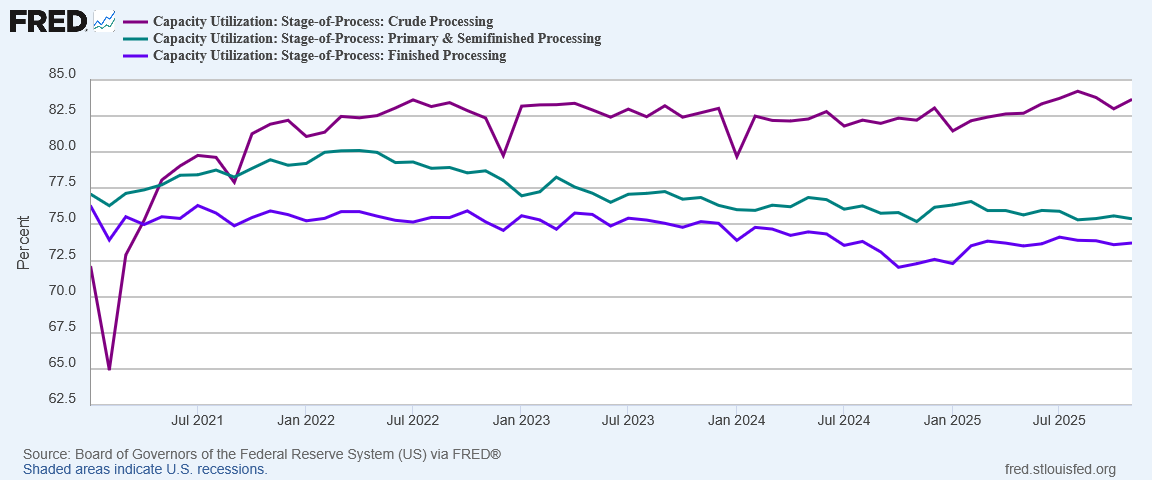

The decline has been across all stages of production, with only crude processing showing any growth.

These are signs of a manufacturing sector in decline. These are not signs of a manufacturing sector on a trajectory to become the “superpower” Donald Trump envisioned for Agenda 47.

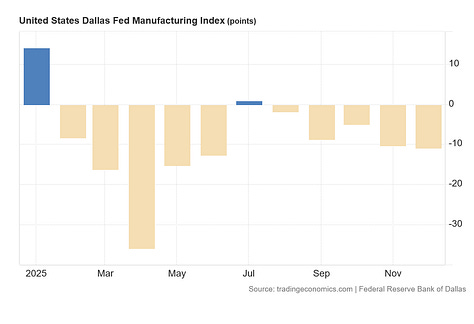

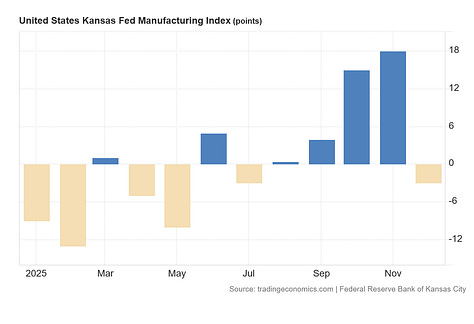

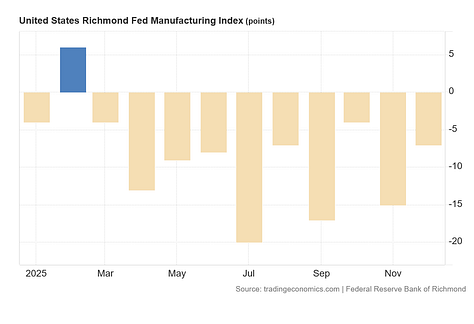

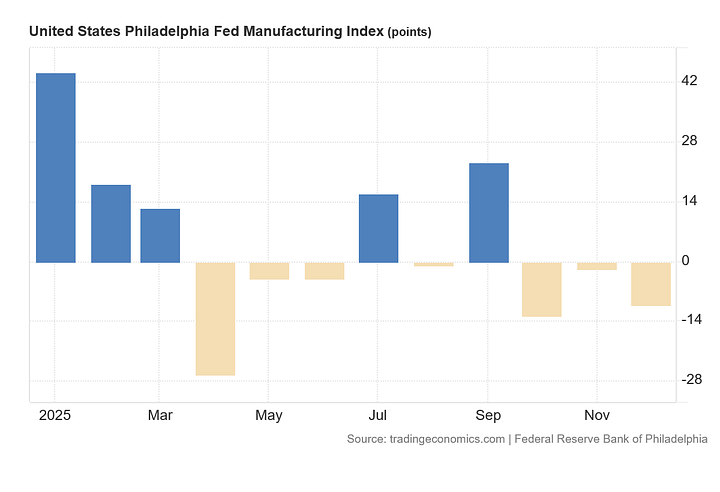

As I discussed when reviewing the November JOLTS data, even the Federal Reserve’s regional manufacturing indices do not show US manufacturing on the upswing.

Manufacturing job loss is symptomatic of far deeper issues within the US manufacturing sector. Thus far, President Trump’s economic policies have not resolved any of these issues, and manufacturing remains mired not just in a jobs recession but in overall stagnation and decline.

Unemployment Falling? Maybe, Maybe Not

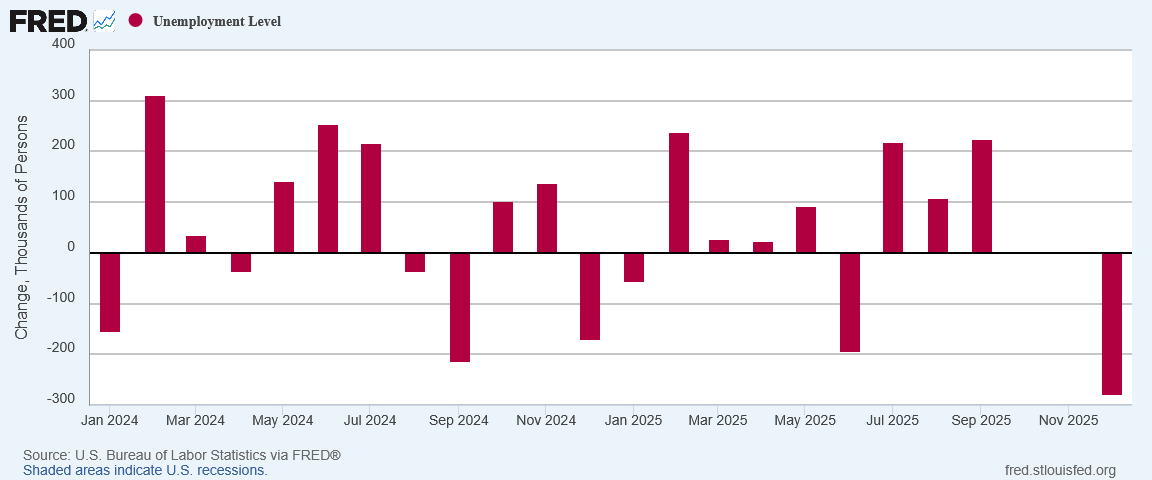

The other seemingly bright spot in the Employment Situation Summary is that unemployment presumably fell by 278,000 for the month.

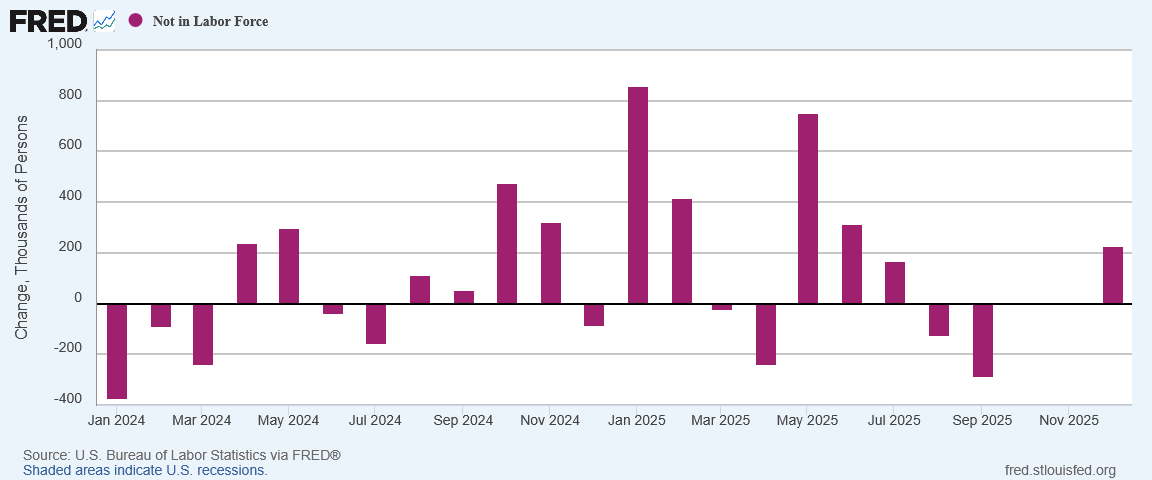

However, we must temper that bit of good news with the realization that the number of workers not in the labor force rose by 229,000.

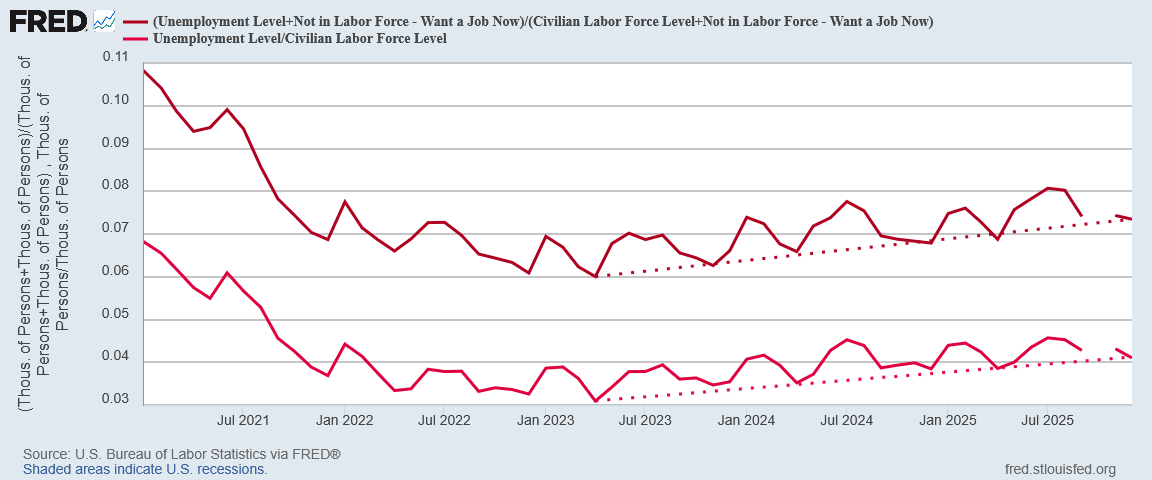

The net effect of the divergent jobless numbers is that real unemployment in this country is still far higher than the “official” unemployment figure of 4.4%. When we incorporate the number of workers not in the labor force but who want a job now, the unemployment rate rises to 7.3%.

More importantly, the long-term trend for both the official unemployment rate and the real unemployment rate is still upward, and has been so since April of 2023.

The drop in official unemployment would be a nice improvement—if it were not largely wiped out by the rise in those exiting the labor force completely.

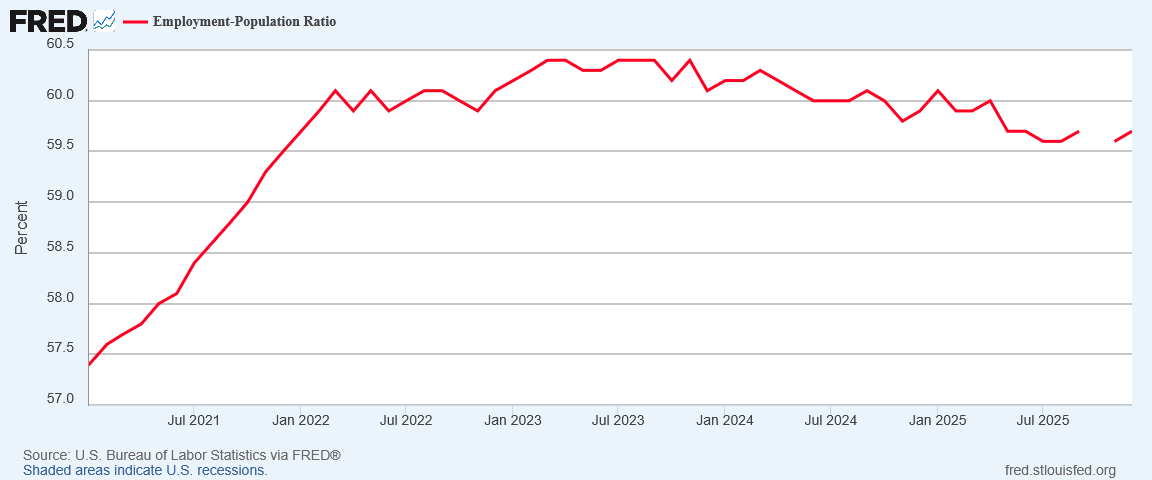

When we step back and look at employment more broadly, we see a clear negative trend in the Employment-Population Ratio going back to approximately late 2023.

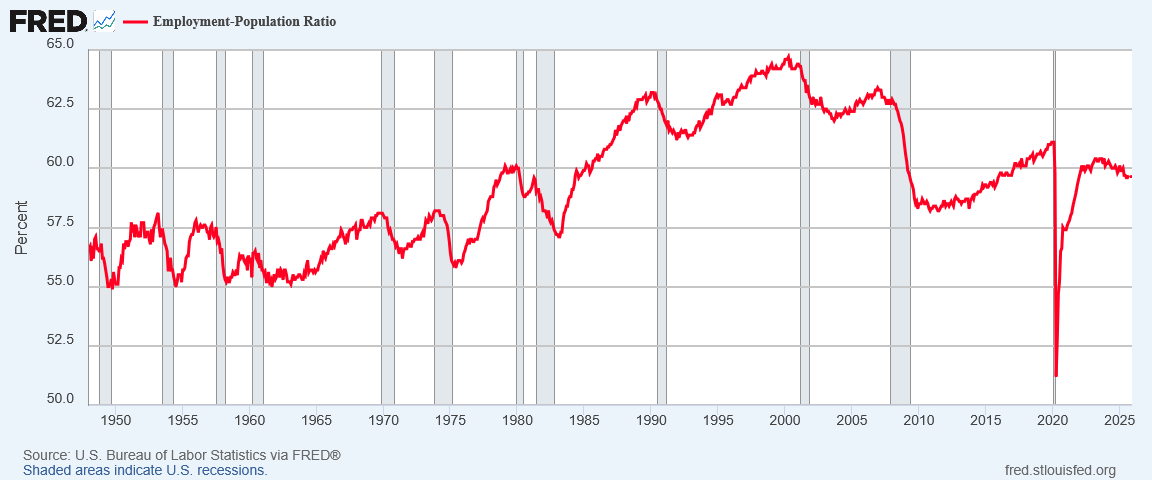

This downward trend is concerning because it is the first time since 1948 that the employment-population ratio has experienced a decline outside of a declared recession.

This period of “non-recession” decline is, not coincidentally, the same period for which I have argued America has been in a jobs recession.

Bear in mind that the employment-population ratio is exactly what it says it is—that percentage of the US population that is actually working and getting a paycheck. When that ratio declines it means fewer Americans are working and fewer Americans are getting a paycheck.

If we defined a recession as a sustained decline in the employment-population ratio, America has been in a recession since some time in 2023. Since late 2023, fewer Americans are working and fewer Americans are getting a paycheck.

For all the hype surrounding the seemingly low unemployment rate in the US, the reality of the US economy is that we have been experiencing rising joblessness for over two years at this point.

There is no economic scenario where that is not a problem.

Same Story, Different Day

The BLS used its favorite stock phrase in the lead paragraph of the news release for the Employment Situation Summary: “changed little.” Sadly, the BLS is right about that. The jobs report has changed little from previous months. It is just as dismal a report as it has been for each of the past several months.

The jobs report was dismal this time last year.

Despite the corporate media bloviations about the state of US labor markets, the reality has been that US labor markets have sucked, and sucked mightily, for years at this point. Even before the onset of a demonstrable jobs recession in 2023, the jobs data during the Biden Reign of Error was far from great.

Keep in mind that, pre-Donald Trump, Fed Chairman Jay “Too Late” Powell viewed a soft labor market as a good thing. We know this because he said so in his December 2024 FOMC presser.

What should really upset Main Street, however, is Powell’s view that a softer labor market is somehow “welcome” when asked by Colby Smith of the Financial Times:

If the idea, though, is that no additional kind of softening in the labor market is welcome here, what’s to prevent that from happening if rates are still restrictive?

To which Powell blurted out:

So what I said is we don’t think we need further softening to get to 2 percent inflation. That’s what I’m saying. Not that it’s not welcome. We don’t need it, we don’t think.

Let that sink in.

Powell is welcoming of fewer jobs. Powell is approving of less employment.

Powell didn’t change his tune until Donald Trump became President. Then the lack of jobs was a bad thing—and was clearly the fault of Trump’s Liberation Day tariffs.

Contrary to what the media now presents, the jobs data has been dismal, soft, and negative for quite some time. Soft jobs markets were seen as an economic good under Joe Biden because reasons, apparently. Those same soft jobs markets are not an economic negative, again because reasons.

No matter which media narrative one uses, the reality of the jobs markets in the US has been the same for some time: no growth or anemic and inadequate growth, with a declining employment-population ratio.

These are problems in any economy. No matter how much GDP growth the statisticians create, without job growth there can be little wage growth, and without wage growth any increase in this country’s overall wealth cannot flow across the broader cross-section of the population. In order to maximize the number of people participating in any increase in this nation’s prosperity, this nation must increase its store of workers.

Period. End of Sentence. End of Discussion.

That has not been happening. It has not been happening since long before Donald Trump returned to the Oval Office. The hope has been that Trump’s economic policies would reverse these negative trends and the country would finally begin to increase its store of workers. So far, that has not happened.

Will it happen in 2026? I certainly hope so. I voted for Donald Trump because I assessed his Agenda 47 was the best bet to make that happen.

In fairness I have no reason to think that Kamala Harris’ proposed policies would have done any better, and I still believe her policies would have created a far worse jobs situation than we have currently. The jobs recession began on her watch.

However, my economic priority remains the same: America needs jobs. America needs more jobs than it is getting. If Donald Trump’s economic policies are not going to facilitate that happening, then we need new economic policies. The politics of it don’t interest me. The jobs numbers are what interest me.

The final jobs report of 2025 said the jobs situation “changed little”. The final jobs report of 2025 was accurate about that.

The challenge for 2026: what will change in the US economy so that it finally generates the jobs America needs?

You’re right, Peter, there are plenty of details in this report that are concerning. For example, retail jobs fell in December - during the Christmas-shopping season, when many stores make 90% of their profits for the year and frequently hire extra labor. That’s a bad sign!

And it’s not Trump’s fault. Here in Minneapolis, the city “leaders” (grrr) have enacted one ordinance after another that are detrimental to retail businesses. They’ve taken away parking spaces; mandated minimum-wages that retail cannot afford; implemented a paid “family leave” that retail truly can’t afford, and so on. The net result has been retail prices that have been required to rise in order to pay for all of these benefits, and then shoppers see that they can buy the same items online for a fraction of the retail price. What a surprise - the stores go out of business! This is the result of Woke, socialist policies spun up during the Biden years, NOT the fault of Trump!

Thank you once again, Peter, for your clear-headed analysis. You are excellent!

Found the problem…

https://x.com/thebabylonbee/status/2010381238998036801?s=46