The Fed Cut The Federal Funds Rate, Then Jay Powell Gave A Press Conference

Powell's Blissful Ignorance Gives Everyone Else Permanent Heartburn

Wall Street had been fully prepared for the Federal Reserve to trim the federal funds rate yesterday.

Wall Street had fully priced in a 25bps rate cut.

The Federal Reserve delivered a 25bps cut to the federal funds rate.

So why did Wall Street have a down day yesterday?

The short answer: “Jerome Powell held a press conference.”

Powell proved yet again that he is truly gifted. With a few ill-chosen and artless words, he can scare the bejesus out of the most thick-skinned of Wall Street speculators.

In a press conference that was supposed to be all about good news, Powell managed to inject bad news at all the wrong places.

Yesterday began in a seemingly positive fashion.

Wall Street had, after all, fully anticipated the Federal Reserve’s Federal Open Market Committee would conclude its meeting yesterday by trimming the federal funds rate another 25bps to a target range of 4.25%-4.50%.

Ironically, Wall Street has been pricing this rate cut by bidding up treasury yields, extending the upward trend in yields that has held since the jumbo rate cut earlier in the fall.

While the expectation may have been that the Fed would trim the federal funds rate, the rest of the economic outlook is apparently less than rosy in Wall Street’s estimation. When the Street bids yields up, that generally does not mean they expect happy days to be right around the corner.

Still, the rational person would think that Wall Street would be thrilled that the Fed did what was expected of them and trim the federal funds rate by the anticipated 25bps. The rational person would, of course, be wrong.

The Federal Reserve did do what was expected. They did trim the federal funds rate by the anticipated 25bps. After which Wall Street went into a mini-meltdown, tanking stocks and spiking Treasuries.

Treasury yields surged, with the 10 Year Treasury taking back nearly all of the 25bps rate cut the Fed announced for the federal funds rate. The jump was across the board, with the 30 Year, 2 Year, and 1 Year all jumping up by similar amounts.

Keep in mind that yields are the inverse of price. When Treasury Yields spike, their price is plunging, which is what they did in response to Powell talking.

The Dow, which had been holding steady, plunged to close down 1100 points on the day, with the S&P 500 and the NASDAQ following along for the ride.

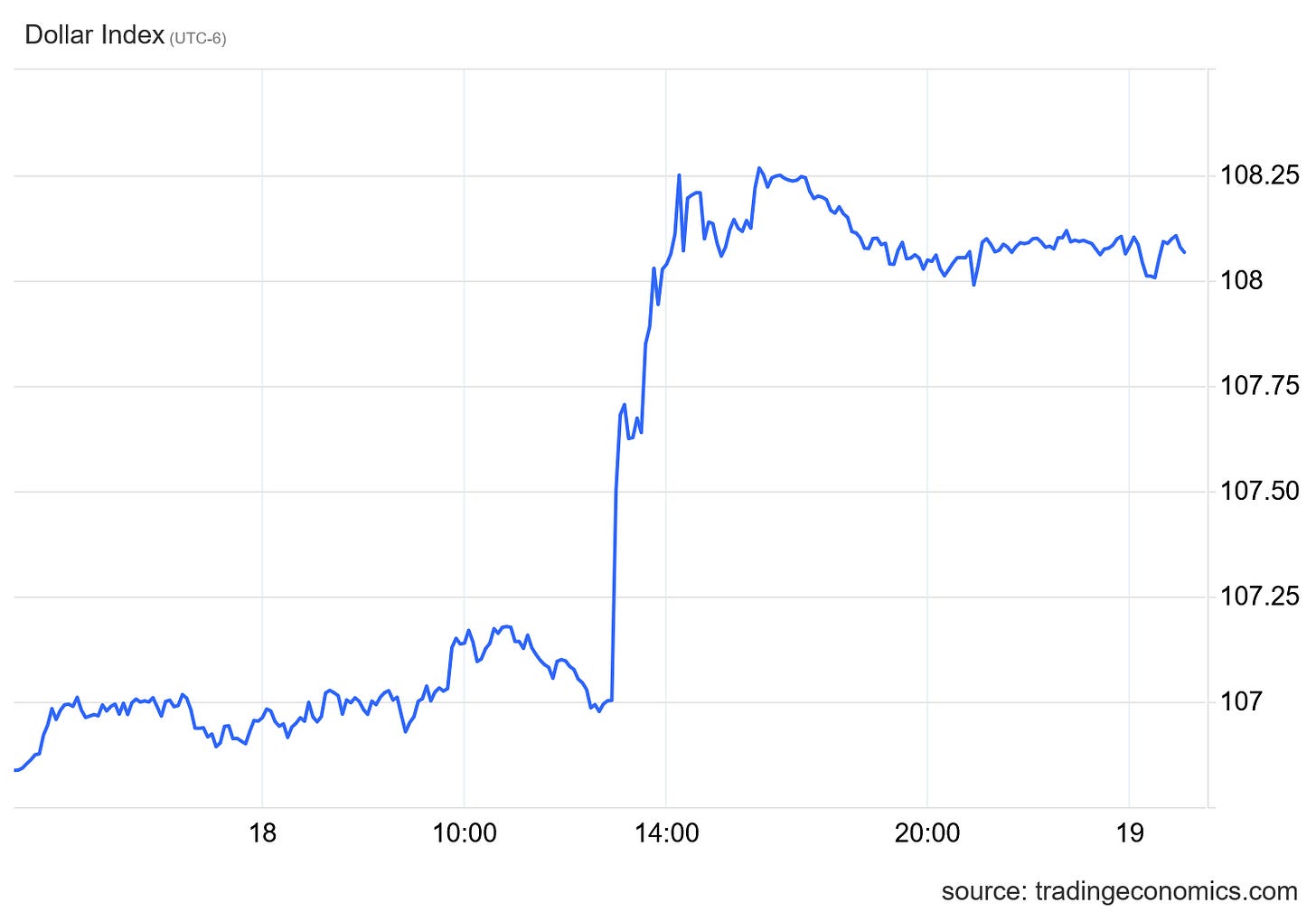

About the only people on Wall Street who were happy with Powell were forex traders betting on the dollar. They like hearing Powell tell the rest of Wall Street that inflation was going to be higher for longer, and the rate cuts were therefore going to be slower for longer.

This is hardly the rational response to the Fed doing what Wall Street wanted and expected. Of course, no one ever said Wall Street was rational. Certainly I never said Wall Street was rational!

So how did Powell spook the market?

For starters, he didn’t know when to stop talking.

Powell started doing damage very early in the presser, when Howard Schneider asked about the Fed’s take on the incoming Trump Administration’s likely fiscal policies:

So this does seem similar to the dynamic in 2016 during the last transition to a Trump administration where the committee saw slightly tighter policy in part in expected anticipation of the fiscal policy stance that was seen evolving over the year. Some of it was a data mark to market exercise and some of it was anticipation of fiscal. What's the split on this one? How much of this was accounting for inflation data that was coming in and how much of it is expecting that there will be inflationary fiscal policy next year?

To his credit, Powell did start out with an optimistic tone:

I'd start, let me start by saying that we think the economy is in a really good place and we think policy is in a really good place. Let's remember that the economy is growing two and a half percent this year, that inflation has come down by 50 percent to two, from 5.6 percent to 2.6 percent. Headline inflation is 2.5 percent on a 12 month basis. We're actually in a really good starting place here.

He went on to say the usual boilerplate about the economy being stronger (it isn’t, but remember, he’s talking to Wall Street).

Wall Street’s problem was that he kept talking, and by continuing to talk he admitted that the Fed really doesn’t know what it’s doing:

...but then getting to your point, there's also, there's uncertainty. Uncertainty around inflation, I pointed out, is actually higher. It's also, in the case of some people, some people, the way I would say it is this. Some people did take a very preliminary step and start to incorporate, you know, highly conditional estimates of economic effects of policies into their forecast at this meeting and said so in the meeting. Some people said they didn't do so, and some people didn't say whether they did or not. So we have people making a bunch of different approaches to that. But some did identify policy uncertainty as one of the reasons for their they're writing down more uncertainty around inflation. And, you know, the point about uncertainty is it's kind of common sense thinking that when the path is uncertain, you go a little bit slower. It's not unlike driving on a foggy night or walking into a dark room full of furniture. You just slow down.

Of course there’s uncertainty. How can there not be uncertainty when Powell has no idea what he’s doing on interest rates or inflation?

There is, of course, no doubt that Powell doesn’t know what he’s doing on inflation. Both he and the Federal Reserve have proven that time and time again.

Wall Street, however, doesn’t want to hear “uncertainty”. That’s not the narrative they want. They want a narrative of “yes, we know what we’re doing and yes we’ve got this under control.” It does not matter if the narrative is true, that’s just what they want to hear. Powell did not give them the narrative they wanted.

Of course, it’s hard to avoid upsetting your audience when the facts are themselves upsetting. The fact is that the Fed really hasn’t been making any real progress on inflation—which Powell openly admitted.

I can tell you that might be the single biggest factor is inflation has once again underperformed relative to expectations. It's still, you know, going to be between two and a half and three. It's way below where it was. But, you know, we really want to see progress on inflation to, you know, as I mentioned, as we think about further cuts, we're going to be looking for progress on inflation.

We have been moving sideways on 12-month inflation as the 12-month window moves. That's in part because inflation was very, very low measured in the fourth quarter of 2023. Nonetheless, as we go forward, we're going to want to be seeing further progress on bringing inflation down and keeping a solid labor market.

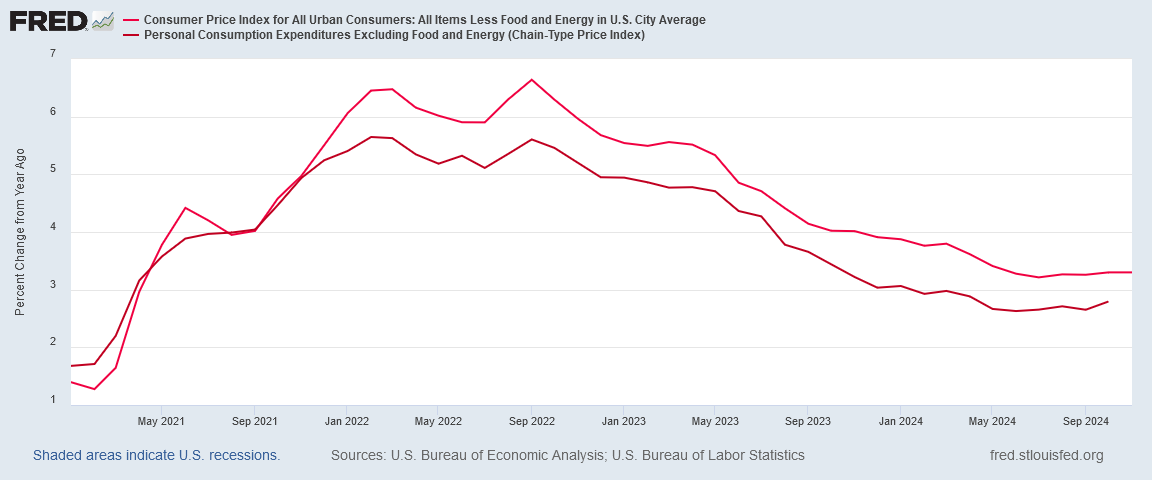

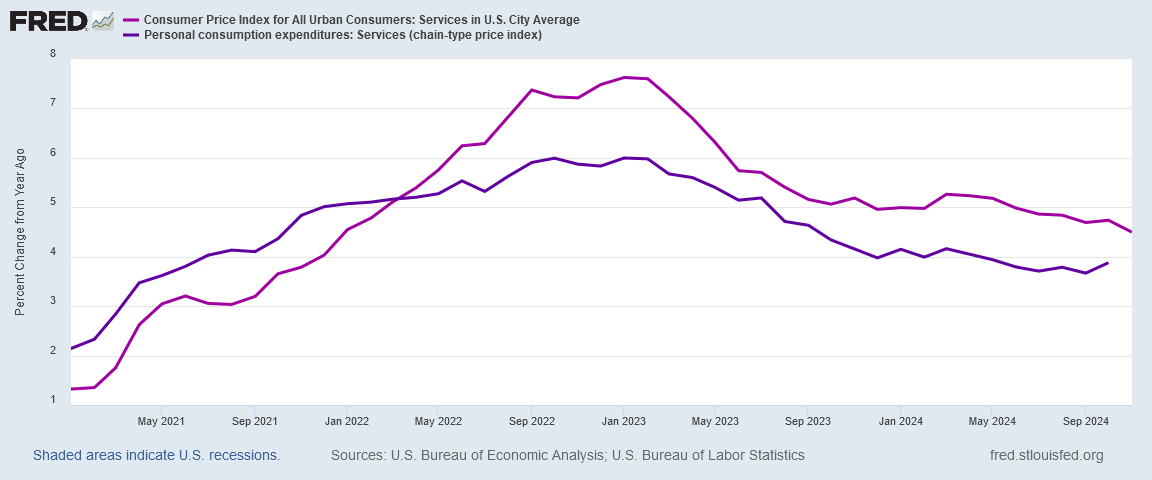

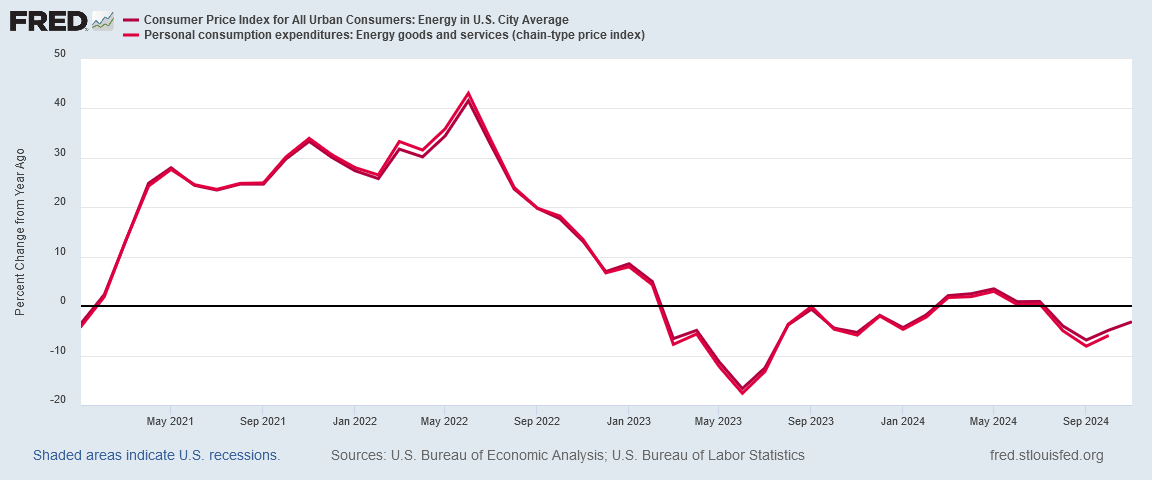

Just looking at the charts tells the tale:

Progress has slowed on headline inflation.

Progress has completely stopped on core inflation.

Progress has slowed on services.

Even energy deflation is not as pronounced as it was.

It is very hard to be completely optimistic when the data says you are losing the battle you are supposed to be winning.

What should really upset Main Street, however, is Powell’s view that a softer labor market is somehow “welcome” when asked by Colby Smith of the Financial Times:

If the idea, though, is that no additional kind of softening in the labor market is welcome here, what's to prevent that from happening if rates are still restrictive?

To which Powell blurted out:

So what I said is we don't think we need further softening to get to 2 percent inflation. That's what I'm saying. Not that it's not welcome. We don't need it, we don't think.

Let that sink in.

Powell is welcoming of fewer jobs. Powell is approving of less employment.

No wonder he thinks he’s striking an optimistic tone: the economy is giving him exactly what he wants.

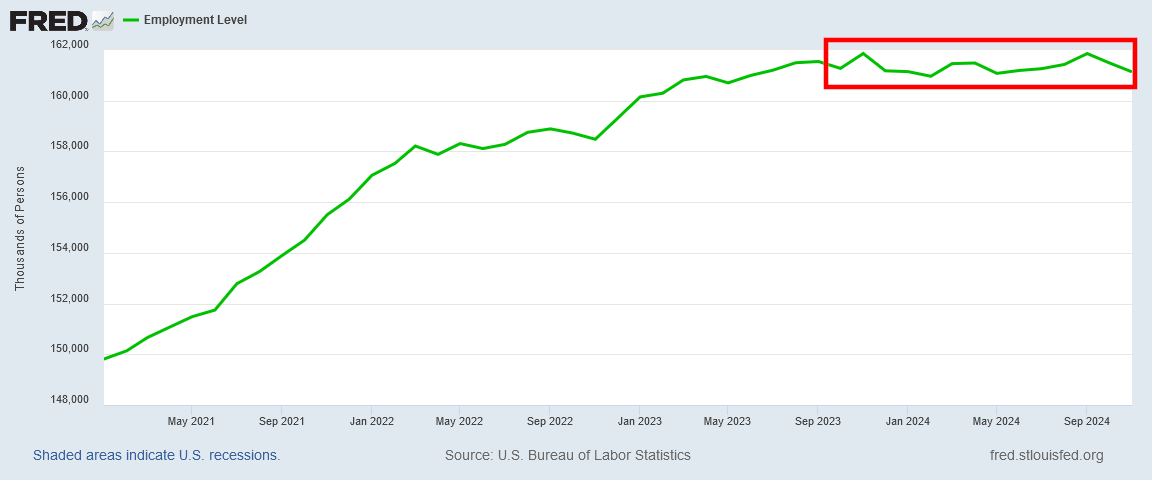

As the Philly Fed confirmed last week, employment is on the decline in this country—and has been for quite some time.

Remember, job growth all but stopped in 2022.

We have been seeing actual job loss since November, 2023—a full year!

Powell must be ecstatic.

Once again, Jerome Powell has proven that ignorance really can be bliss.

He is blissfully unaware of what inflation is doing to the actual economy—to the wallets and bank accounts and paychecks of working men and women.

He is blissfully unaware of how little comfort even Wall Street takes in his artless and bumbling responses.

He is blissfully unaware of the callousness in his logic about the virtues of a “softer” labor market. It just never dawns on him that “softer” labor markets mean more people are out of work, and that there are fewer jobs to go around.

He is blissfully unaware that labor markets have been softening for quite some time, or that even the Philadelphia Federal Reserve—i.e., his people—has established that labor markets are in far worse shape than he wants to believe.

Jerome Powell is blissfully unaware that he really is a “true” expert for this modern era: he really is just a blithering idiot.

Unfortunately, Powell is a blithering idiot in a position where his ignorance can—and has—cost people their jobs and the economic security even a modest paycheck can provide. Judging by his bumbling performance yesterday, he will continue to do damage.

Ignorance may be bliss for him, but his ignorance is permanent heartburn for everyone else.

Yeah, thanks for that Christmas gift, Powell, Jerk!

Y'all know the media cut Powell's closing statement from his presser, right?

Here it is:

https://x.com/alifarhat79/status/1869457880526790970

:)