Wrecking Crew: The Fed Cut Rates, Then Jay Powell Uncut Them

Snatching Defeat From The Jaws Of Victory?

You have to hand it to Jay “Wrecking Crew” Powell. He is one of the few public servants who can implement a policy change in one minute and then seemingly reverse it the next just by talking about it.

The policy change, of course, was the Federal Reserve’s Federal Open Market Committee’s decision to trim the federal funds rate yesterday by 1/2 a percentage point.

In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

Regular readers will recall from the other day that the broad cross-section of Fed watchers on Wall Street were expecting a 1/4 percentage point reduction in the federal funds rate.

Yet despite having announced an aggressive rate cut, when Jay Powell stepped up to the podium to take questions from the media just half an hour later, he almost immediately succeeded in jawboning market interest rates up.

Give “Wrecking Crew” credit—he is talented!

We should note that while the broad cross-section of Fed watchers were expecting the 25 basis point cut, a large segment of the market had priced in the 50 basis point reduction the Fed handed out, as illustrated by the CME Group’s "FedWatch” tool.

While the cut was more aggressive than many had expected, it was not entirely outside the realm of what the markets had considered.

The stock market’s initial reaction reflected this. After largely indifferent trading during the morning, the initial reaction to the FOMC announcement was quite positive, with the Dow jumping some 280 points on the news, and it sustained that enthusiasm until just after Jay Powell’s press conference began.

Within minutes the Dow shed 250 of those 280 points, and by the end of the trading day was in negative territory.

Treasury yields were not much better. After drifting up during early morning trading (remember, treasury yields move in the opposite of prices, so when yields are rising the price of treasuries is falling), at 2PM the market responded with the same burst of enthusiasm as stocks.

As soon as Powell opened up his mouth, however, treasury yields headed south—which is to say they shot up again, and the 10 Year Treasury Yield actually rose on the day.

How did Powell manage to turn what should have been a well-received and much anticipated policy change into a market reversal?

It mainly stems from his talent for blurting out awkward and inconvenient truths.

Powell started doing damage right off the bat with the first question1:

Steve Leisman, CNBC. Thank you, Mr. Chairman, for taking our questions. In July, you said you weren't necessarily thinking about a 50. You didn't want to be specific, but you said you weren't thinking about a 50. The inflation data last week came out a little firmer than expected. Retail was strong, third quarter GDP running 3%. So what change had made the committee go 50, and how do you respond to the concerns that perhaps it shows the Fed is more concerned about the labor market? And I guess, should we expect more 50s in the months ahead? And based on what, should we make that call?

[Powell] So since the last meeting, okay, the last meeting, we have had a lot of data come in. We've had the two employment reports, July and August. We've also had two inflation reports, including one that came in during blackout. We had the QCEW report, which suggests that maybe, not maybe, but suggests that the payroll report numbers that we're getting may be artificially high and will be revised down. You know that. We've also seen anecdotal data like the Beige Book. So we took all of those and we went into blackout and we thought about what to do, and we concluded that this was the right thing for the economy, for the people that we serve, and that's how we made our decision.

Let’s chew on this answer a bit. Powell mentioned the QCEW report “suggesting” the jobs numbers were overstated.

Actually, that report revealed that 818,000 jobs claimed to have been created in fact never existed.

That was hit number one.

Then there was the “Beige Book”, which had absolutely nothing good to say about the economy.

When the Beige Book was published in August, Bloomberg reported it showed a stagnating economy.

The number of districts reporting flat or declining activity rose to nine in recent weeks, up from five in the prior period. Economic activity grew in three districts. Contacts, however, generally expected economic activity to remain stable or improve somewhat in coming months.

At best the economy was revealed to be “slowing”.

These are not the sort of reminders that are ever likely to jawbone a stock index to rise higher.

Right about the time Powell finished answering this question, yields began to rise and the Dow Jones began to fall. Both outcomes were the polar opposite of what the Fed presumably wanted to see happen.

Next came questions about jobs and overall employment, where Powell repeatedly stuck his foot in his mouth.

Hi, Chris Rugaber, Associated Press. Thank you. The projections show that the Fed officials expect the Fed funds rate to still be above their estimate of long-run neutral by the end of next year. So does that suggest you see rates as restrictive for that entire period? Does that threaten the weakening of the job market that you said you'd like to avoid? Or does it suggest that maybe people see the short-run neutral as a little bit higher?

[Powell] I think the way I would really characterize it is this. I think people write down their estimate. Individuals do. I think every single person on the committee, if you ask them what's your level of certainty around that, they would say there's a wide range where that could fall. So I think we don't know. There are model-based approaches and empirically-based approaches that estimate what the neutral rate will be at any given time. But realistically, we know it by its works. So that leaves us in a place where we expect, in the base case, to be continuing to remove restriction, and we'll be looking at the way the economy reacts to that, and that will be guiding us in our thinking about the question that we're asking at every meeting, which is, is our policy stance the appropriate one? We know, if you go back, we know that the policy stance we adopted in July of 2023 came at a time when unemployment was 3.5% and inflation was 4.2%. Today, unemployment is up to 4.2%. Inflation is down to a few tenths above 2%. So we know that it is time to recalibrate our policy and to something that is more appropriate given the progress on inflation and on employment, moving to a more sustainable level. So the balance of risks are now even. And this is the beginning of that process. I mentioned the direction of which is toward a sense of neutral. And we'll move as fast or as slow as we think is appropriate in real time. What you have is our individual accumulation of individual estimates of what that will be in the base case.

The short version of this bit of economic word salad is “we’re making it up as we go along”.

Powell essentially admits that neither he nor the rest of the FOMC knows whether the rates they set are going to restrain or reward employment growth. Their solution? Trim a little, and if jobs numbers or inflation numbers move in the wrong direction, they’ll trim a little more or they’ll hike a little back.

Each rate cut (or hike) at that point becomes its own little experiment in financial economics, with the American worker as the lab rat and his or her job the economic slice of cheese.

Don’t you feel just all sorts of reassured knowing your friendly neighborhood central banker gauleiter knows how to make stuff up as he goes along?

Ah, but the self-inflicted wounds on jobs were not quite done.

Gina Smiley with the New York Times. Thanks for taking our questions. You and your colleagues in your economic projections today see the unemployment rate climbing to 4.4% and staying there. Obviously, historically, when the unemployment rate climbs that much over a relatively short period of time, it doesn't typically just stop. It continues increasing. And so I wonder if you can walk us through why you see the labor market stabilizing, sort of what's the mechanism there, and what do you see as the risks?

[Powell] So again, the labor market is actually in solid condition, and our intention with our policy move today is to keep it there. You can say that about the whole economy. The U.S. economy is in good shape. It's growing at a solid pace. Inflation is coming down. The labor market is in a strong pace. We want to keep it there. That's what we're doing.

Yes, Jay Powell actually stood there and said with a straight face that labor markets are in solid condition. That really happened.

Readers of this Substack already know, however, that nothing could be farther from the truth. This country has been in a jobs recession since at least late last year.

Contrary to what corporate media has to say, labor markets are in the process of contracting.

Yet even if we go along with the “softening” labor thesis promoted by corporate media, that is still the antithesis of “the labor market is in solid condition.” That which is solid by definition is not getting “softer”.

Gina Smiley with the New York Times was not done with Powell however:

Does today's action constitute a catch up in action given recent substantial revisions to the employment data? Or is this larger than typical rate cut a function of the elevated nominal level of the policy rate such that an accelerated cadence could be expected to continue?

[Powell] So I would say we don't think we're behind. We do not think we're behind. We think this is timely. But I think you can take this as a sign of our commitment not to get behind. So it's a strong move.

In other words, even though Powell just got through admitting that he and the FOMC were surprised by the most recent data, Powell was still in control. That he was having to react to data he did not see coming and having to overcompensate for not having sussed out what the data would say back in July is no indication that he was behind the times. After all, what indication did anyone have that there was anything untoward in the US econom back in July?

And Gina was still not done with Powell:

Well, is this about what happened in the employment data between this meeting and the last meeting? Or is this about the level of the funds rate, the high nominal level of the funds rate relative to what might be expected if you're trying to maintain equilibrium?

[Powell] I think it's about, we come into this. with a policy position that was put in place, as you know, I mentioned, in July of 2023, which was a time of high inflation and very low unemployment. We've been very patient about reducing the policy rate. We've waited. Other central banks around the world have cut many of them several times. We've waited, and I think that patience has really paid dividends in the form of our confidence that inflation is moving sustainably down to 2%. So I think that is what enables us to take this strong move today. I do not think that anyone should look at this and say, oh, this is the new pace. You have to think about it in terms of the base case. Of course, what happens will happen. So in the base case, what you see is look at the SEP. You see cuts moving along. The sense of this is we're recalibrating policy down over time to a more neutral level. And we're moving at the pace that we think is appropriate given developments in the economy in the base case. The economy can develop in a way that would cause us to go faster or slower, but that's what the base case says.

In other words, when other central banks around the world started cutting their bank rates, the Fed went and did its own thing. Now the Fed is taking a large step in the direction other central banks have been moving for months.

Why on earth would anyone think the FOMC was indulging in a bit of CYA with the large rate cut? Just because they’re doing exactly what they would need to do if they suddenly realized they were behind the curve is no reason to assume the Federal Reserve suddenly realized they were behind the curve.

Ah, but Powell’s most delusional answer was still to come.

Colby Smith with the Financial Times peppered Powell with a series of questions about jobs before asking this rather obvious question (emphasis mine):

The point about starting to see rising layoffs, if that were to happen, wouldn't the committee already be too late in terms of avoiding a recession?

[Powell] Our plan, of course, has been to begin to recalibrate. We're not seeing rising claims. We're not seeing rising layoffs. We're not seeing that, and we're not hearing that from companies, that that's something that's getting ready to happen. So we're not waiting for that, because there is thinking that the time to support the labor market is when it's strong and not when you begin to see the layoffs. There's some lore on that. So that's the situation we're in. We have, in fact, begun the cutting cycle now, and we'll be watching, and that will be one of the factors that we consider. Of course, we're going to look at the totality of the data as we make these decisions meeting by meeting.

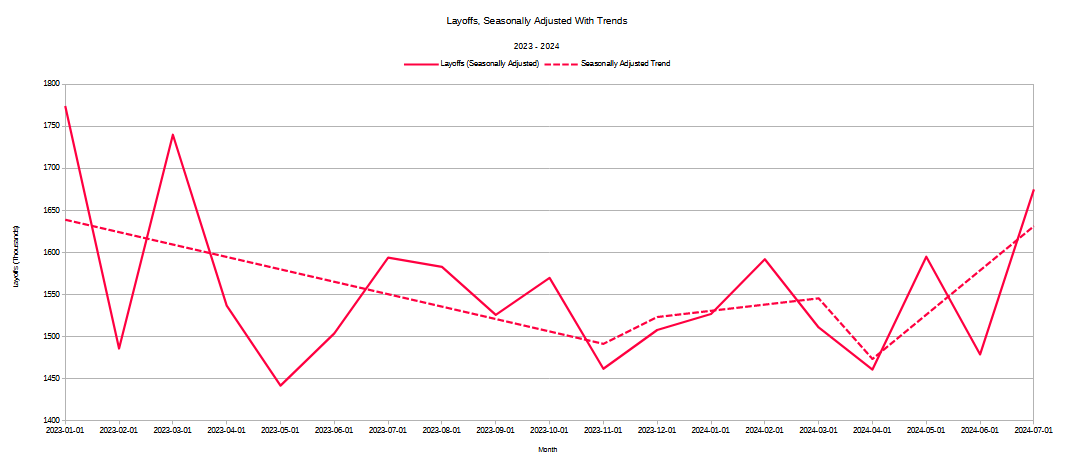

Ahem….not seeing rising layoffs? Gee, the seasonally adjusted layoff data shows a rising trend for the past several months.

The unadjusted layoff data shows the same thing.

What is the FOMC looking at to not see what the data within the Fed’s own databases clearly shows—rising layoffs?

And so it went. With each answer Powell gave, the markets became less and less impressed with him, and with the 50bps rate cut.

The simple reality is that a 50bps rate cut is the sort of action a central bank takes when it sees the need for financial stimulus in a nation’s economy. It is in many respects the flip side of the coin that recommends 50bps rate hikes when goosing rates in the vain hope of containing consumer price inflation.

The brutal reality is that Powell is simply mistaken when he says the economy is in good shape. It isn’t. The economy is not crashing into a major depression (yet), but neither is it thriving. The economy is not firing on all cylinders.

Labor markets are not healthy.

Wages are not where they need to be, not with increases in real expenditures outpacing increases in real disposable personal incomes.

Readers of this this substack in particular are aware of several of the weaknesses in the US economy, as I have discussed them at some length.

Ultimately, Wall Street is at least tangentially aware of these weaknesses as well, and of the impacts these realities are having on consumers.

With employment trending down since last fall, there is no real buffer in the economy against unforeseen event. If there is even a small shock to the economy, a significant recession or even major depression cannot be ruled out.

In that scenario, how bad such a downturn gets depends mightily on how adroitly the government responds—if for no other reason than the government does not fathom that its interventions would be the primary cause of the downturn and that further meddling will only delay ultimate recovery.

Yesterday, Wall Street got a blundering and confused reminder of how Jay Powell will respond in that scenario:

Very badly.

Transcript comes from Substack’s auto-transcription of the uploaded video stream of the press conference, which I published in a video article under the “Fair Use” copyright doctrine.

"Why on earth would anyone think the FOMC was indulging in a bit of CYA with the large rate cut? "

What did communists use before candles?

Electricity.

Powell et.al. are supposed to be data driven not politicians. It’s frustrating how even with all the graphs of data which you faithfully use as concrete objective reality are completely rejected. Warped thinking and feelings are ruling every sphere, gender is a feeling, 2+2=5 or whatever you subjectively wish it was, singing and whistling while the ship is taking on water and sinking. Refusing to see objective reality and taking action is hateful and harmful wickedness