Jobs Report Once Again Has Positive Headline, Negative Details

The Jobs Recession Is Still Getting Worse. Is Anyone Paying Attention?

When analyzing data sets, one of the key considerations is confirmation. Do similar data sets present similar conclusions and express similar trends? Do independent data sets present data which reinforces each others conclusions?

This right away gives us a major reason to be skeptical about the November Employment Situation Summary released yesterday by the Bureau of Labor Statistics.

Total nonfarm payroll employment changed little in November (+64,000) and has shown little net change since April, the U.S. Bureau of Labor Statistics reported today. In November, the unemployment rate, at 4.6 percent, was little changed from September. Employment rose in health care and construction in November, while federal government continued to lose jobs.

64,000 is not a great number, and its a far cry from the 108,000 reported for September (after round one of the monthly revisions), but it does have the saving grace of being positive.

64,000 jobs added in November is a positive headline number. It is not positive enough to signal an end to America’s jobs recession. It is not positive enough to reverse the trend of rising joblessness we have seen in this country for over two years. It is only positive so long as we do not look closely at the rest of the data—which means we absolutely should look closely at the rest of the data!

When we do look closely at the rest of the data, we quickly see that, Trumpian cheerleading notwithstanding, the Employment Situation Summary is yet another jobs report that shows a deepening jobs recession.

Because of the Administration’s Trumpian cheerleading, one question of concern: is anyone paying attention?

More Lou Costello Labor Math

We do well to note that the BLS is once again deviating from the headline jobs figure reported by ADP. For November ADP measured 32,000 jobs lost. The BLS is nearly 100,000 jobs higher than the ADP report.

This massive variance between the two reports immediately tells us that Lou Costello Labor Math is still the favored reporting modality of the BLS.

This conclusion is confirmed when we look at the very last bit of data in the jobs report, the monthly revisions.

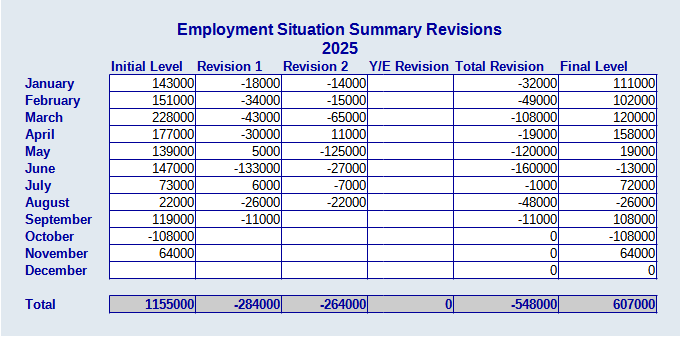

The change in total nonfarm payroll employment for August was revised down by 22,000, from -4,000 to -26,000, and the change for September was revised down by 11,000, from +119,000 to +108,000. With these revisions, employment in August and September combined is 33,000 lower than previously reported. Due to the recent federal government shutdown, this is the first publication of October data and thus there are no revisions for October this month.

Once again, the BLS is displaying a bias towards reporting optimism, resulting in statistical corrections being made in subsequent months.

Moreover, as I have noted many times before, the corrections are not exactly small.

Note that October is something of an “artificial” month because the usual data collection methodologies were off line due to the Silly Schumer Shutdown. Because of the shutdown, we are compelled to take the October number with an even larger grain of salt than usual. I include it in the revisions figures merely for completeness.

Year to date, the total number of jobs the BLS has had to admit were never really there is 548,000.

That number is not an overstatement, either, but an understatement. Because the BLS has not reported job numbers for October due to the Silly Schumer Shutdown, we do not have any corrections or revisions for October. However, given the reporting patterns we have seen in most months this year, it is not unreasonable to interpolate that October would have resulted in even more downward job revisions if that data were available. Given that October already has a negative jobs number, further downward revisions could give October a perversely appropriate ghoulish cast with respect to jobs.

Before we even get to the sector data, we already know we are looking at yet another month of tainted data.

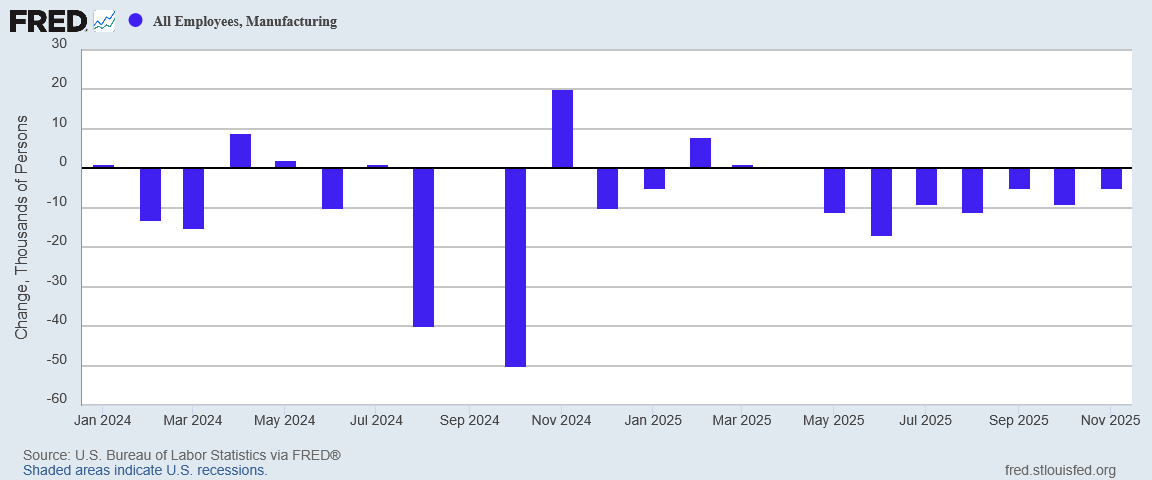

More Manufacturing Jobs Lost

Much as with the ADP report, important economic sectors such as manufacturing are presenting us with a “lather, rinse, repeat” scenario.

Manufacturing continues to bleed jobs, with no obvious end in sight to the job loss.

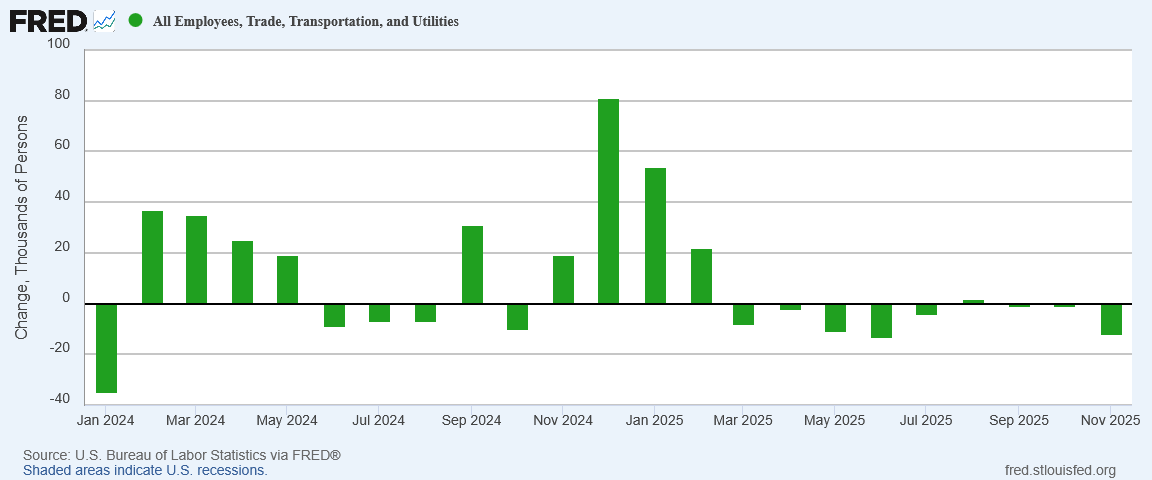

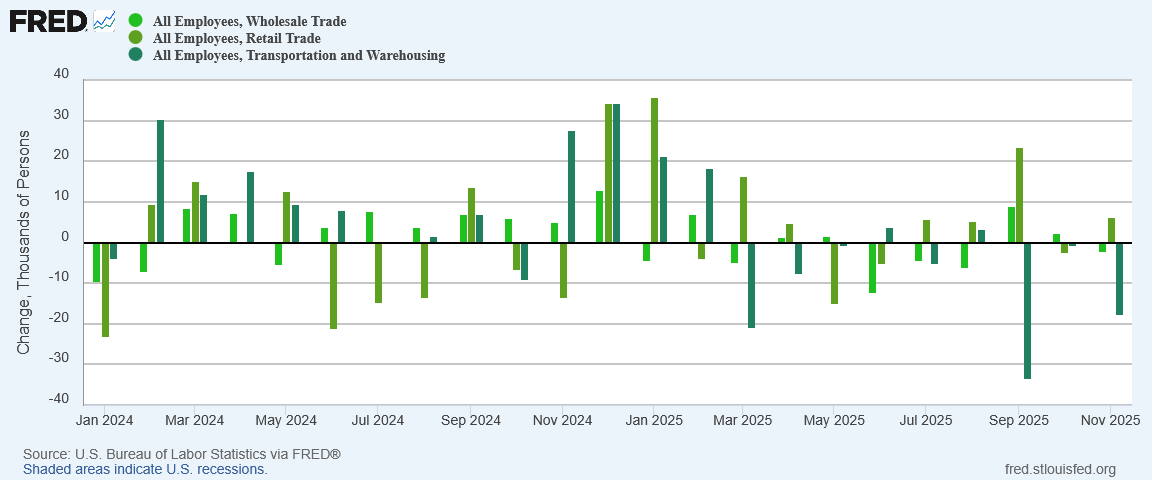

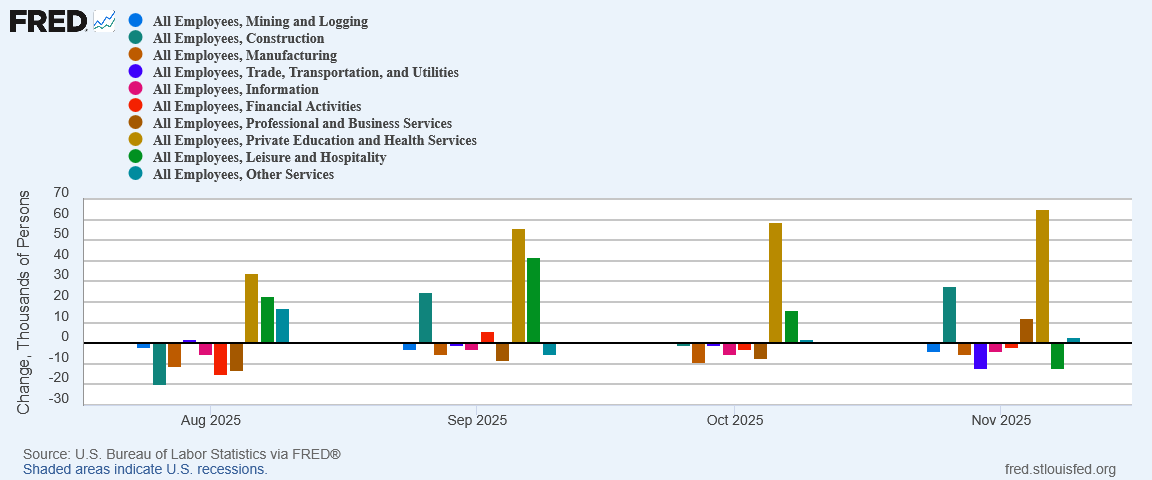

Among service sectors, Trade, Transportation, and Utilities also continued to shed jobs in November.

Drilling into the trade numbers, the retail and wholesale sectors remained grim all the way down.

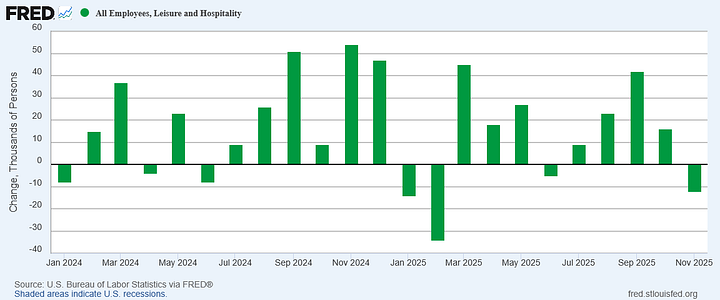

The Information and Leisure sectors also had another bad month.

There is perverse irony in that, at a time when artificial intelligence is a constant presence in news headlines, the information sector jobs which presumably support AI and other technology platforms continue to decline.

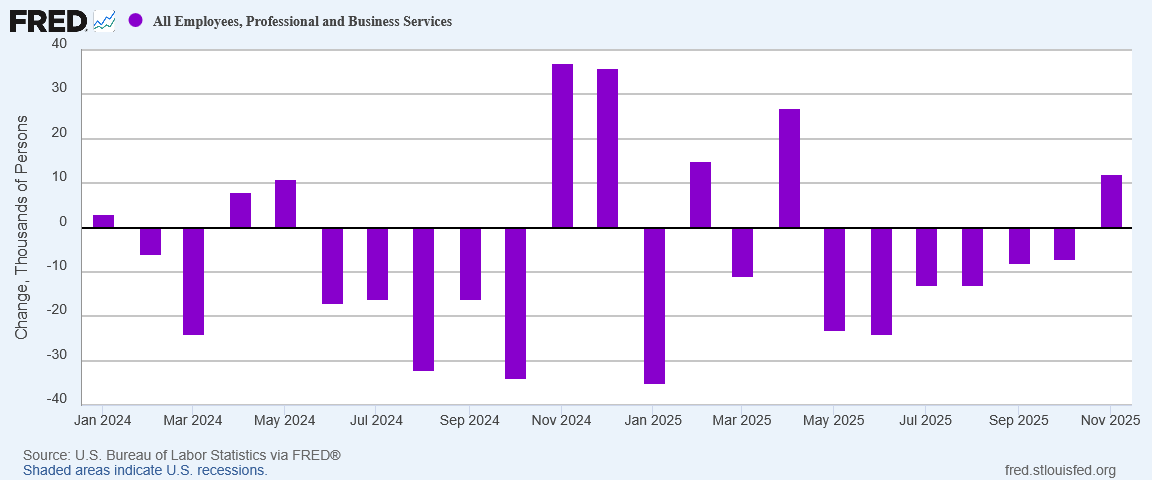

One notable turnaround in November was Professional Services, which notched the first month of job growth since April.

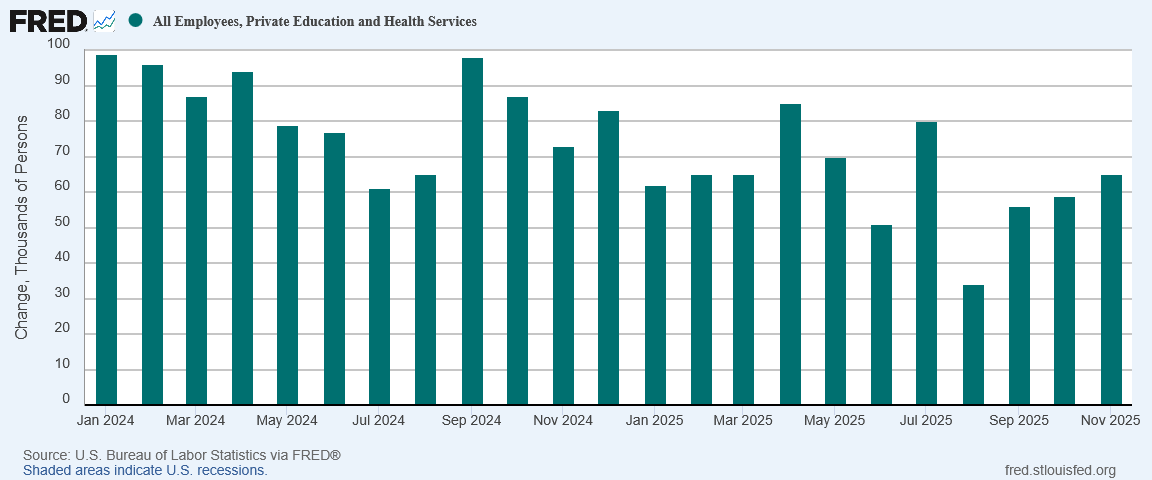

Once again, Healthcare provided nearly all job gains on the month.

But for healthcare, the headline jobs number itself would be negative—that is how dominant the sector is compared to the others.

I will pause to make one note about October’s data. Although in the aggregate the BLS is reporting a net loss of nonfarm jobs in October of 108,000, that is entirely due to an extremely large reduction of 157,000 government jobs, coupled with modest private job growth of 52,000 jobs.

October being the month of government shutdown, however, it is unwise to place much significance in the October numbers. BLS operations were disrupted during October. It will be some time before they can provide a reliable presentation of the October data, if they ever do.

We are not seeing sustainable job growth across all economic sectors. Outside of healthcare, all private economic sectors are at best sporadic and uneven in producing job growth. Quite a few, particularly important ones such as Manufacturing and Trade, Transportation, and Utilities, have been steadily shedding jobs, not creating them.

Such imbalanced job growth is not at all a sign of economic health. Any system which shows a lack of balance will eventually undergo a reversion to mean and a restoration of balance—meaning the distortion presented by the growth of healthcare jobs will result in a labor market correction at some point.

Market corrections are rarely pleasant experiences. Get ready for one coming to a job market near you in the not too distant future.

ADP, ISM, And Fed Data Confirm Job Recession

As I noted when reviewing the ADP jobs report, the economic weaknesses on display in that jobs report are confirmed by the grim PMI data from the Institute for Supply Management as well as the Federal Reserve’s own manufacturing surveys.

As that data has not changed in the past week, I will not repeat that analysis here, but we do well to note that the sector weaknesses on display in the BLS jobs report track with the economic weaknesses charted by the ISM data as well as the Fed manufacturing survey data.

That is in addition to the ADP report itself, which is itself a dire warning of a worsening jobs recession in this country.

The taint of Lou Costello Labor Math in the BLS jobs data means that positive headline number of 64,000 jobs does nothing to diminish the alarm raised by the ADP report. That the sector data within the BLS report finds the same confirmations in other data sets as the ADP report bolsters the ADP report, including its negative headline jobs assessment.

Even the October JOLTS data from the BLS cuts against having any real confidence in the headline jobs number in the Employment Situation Summary.

When multiple independent analyses and reports, covering multiple independent data sets, all point in the same general economic direction, we may be fairly certain that the trend indicated for that general economic direction is the economic reality.

The trend for the general economic direction indicated by ADP, October JOLTS, as well as the sector-level data for the November BLS jobs report, is one of continued job loss and a deepening jobs recession.

No Signs Of Trend Reversal Yet

The Trump Administration, quite naturally, is playing up the headline number and ignoring the rest of the data.

“The strong jobs report shows how President Trump is fixing the damage caused by Joe Biden and creating a strong, America First economy in record time. Since President Trump took office, 100% of the job growth has come in the private sector and among native-born Americans — exactly where it should be. Workers’ wages are rising, prices are falling, trillions of dollars in investments are pouring into our country, and the American economy is primed to boom in 2026.”

— White House Press Secretary Karoline Leavitt

If the Employment Situation Summary were in fact a strong jobs report, Karoline Leavitt’s victory lap would be quite appropriate, and would indeed indicate an economy primed for good things in 2026.

Nor has the Trump Administration as a whole been shy about making extravagant predictions for the economy, doubling down on a belief that the economy will “take off like a rocket.”

That was senior Trump Advisor Jason Miller’s confident prediction to Breitbart News late last week.

“As we look at Q1 and Q2 of 2026, our economy is going to take off like a rocket ship. And that’s not me, Jason, just saying that,” he said, explaining that it is coming from Treasury Secretary Scott Bessent as well as numerous economic advisers and those in the private sector.

“Everybody believes that Q1 and Q2 are going to take off, which means there’ll be more jobs. They’ll be hired. That means folks’ salaries are going to go up. They’re going to have much more purchasing powers in their everyday lives,” he said.

However, against Miller’s confidence we must weigh data, such as last weeks unemployment claims data.

To be sure, the drop in continued claims the last week of November does invite consideration that employment is starting to improve in this country.

However, any hope along those lines must also be tempered by the surge in initial claims the first week in December.

We should note also that initial claims underwent a similar plunge during Thanksgiving week as continued claims, only to rebound the very next week. The drop in continued claims may very well be an artifact of the Thanksgiving holiday resulting in an abbreviated reporting period on the week.

If continued claims rebounds in the first week in December just as did initial claims, the plunge from the week before can, in all probability, be dismissed as a holiday-related anomaly.

This is the ongoing problem with the Trump Administration’s over-the-top rhetoric about the economy. The data is simply not as optimistic as Jason Miller, Scott Bessent, Karoline Leavitt, or even President Trump himself.

This does not mean they are wrong in their predictions for next year. We won’t know how solid their predictions are until we get into the second quarter of next year, which is still a few months off. They may be largely correct that 2026 will be a banner economic year for the United States.

However, the broad macro economic data, and certainly the employment data we have from a variety of sources, lends no confidence whatsoever to those predictions. The broad macroeconomic data does not lend any credibility to the Trumpian cheerleading on the economy coming from multiple sources inside the Administration.

President Trump, along with his entire economic team, very much wants us to believe 2026 will be a good year. As I have said before, I would like to believe that 2026 will be a good year. I certainly do not rule out 2026 being a good year.

Yet the data we have at present does not support such a belief. All of Karoline Leavitt’s power and poise at the Press Secretary’s podium cannot turn negative economic data into good, and the November Employment Situation Summary is yet another litany of negative economic data—negative jobs data. The data we have at present shows no sign that these downward employment trends are likely to reverse any time soon.

What I said at the end of my ADP analysis holds equally true for the November Employment Situation Summary: The data remains what it is, and it shows what it shows. What it shows is a continuing jobs recession in the US, a jobs recession that took a significant turn for the worse in November.

America is losing jobs. America has been losing jobs. America has not been producing new jobs at all near the level it must if the US is to be anywhere close to full employment.

If these trends continue, the US economy is in very serious trouble.

My question: is anyone paying attention?

We can rely on you for an accurate summation, Peter. Thank you.

I have been concerned for some time about the increase in jobs in Health Care, which indicates that Americans are becoming less healthy. Vax injury, of course, comes to mind. Peter, have you seen any explanations or elaborations on the causes of increased Health Care employment?

Unfortunately, cycling out the disastrous economic policies of the past few years is going to take longer than a year. Large manufacturers (like Ford) are reorienting their business away from stupid green policies and in the process large numbers of jobs are being eliminated. To make matters worse, the fact that rampant inflation increased prices of manufactured goods from 30% to (in some cases ) several hundred percent has decreased demand for them. The consequence is less demand for manufacturing jobs. IMO the current US government policy of encouraging and attracting capital investment should be an effective way to reverse this trend. Translating that capital investment into jobs is, however, a process that takes some time. I hope US voters understand this in the upcoming midterms. Electing a Congress controlled by democrats would likely mean no recovery, and the US could go the way of UK and Germany.