The ADP Jobs Alarm: US Jobs Are Disappearing

Is Washington Or Wall Street Paying Attention?

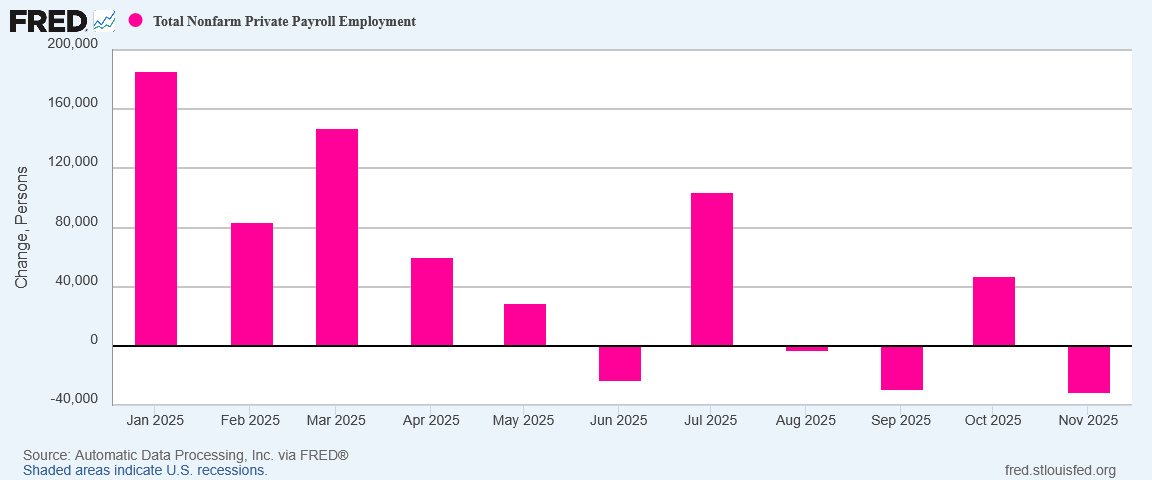

ADP’s November National Employment Report makes one thing absolutely clear: the jobs recession in this country is getting worse.

For the third time in four months, the US economy shed jobs in November.

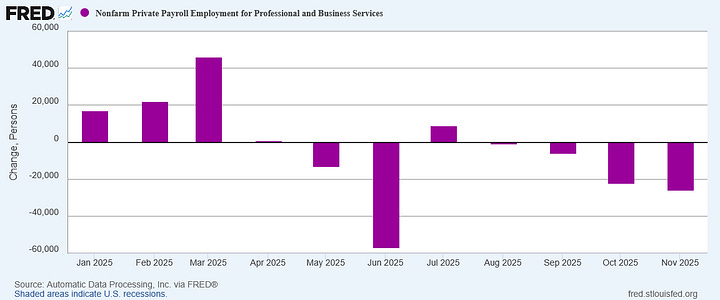

Job creation has been flat during the second half of 2025 and pay growth has been on a downward trend. November hiring was particularly weak in manufacturing, professional and business services, information, and construction.

Dr. Nela Richardson, ADP’s Chief Economist, understated the employment situation with the anodyne disconnected descriptors common among the “expert” class.

Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment. And while November’s slowdown was broad-based, it was led by a pullback among small businesses.

A day of digesting the data has not altered my assessment from yesterday morning both of Dr. Richardson’s remarks and the jobs report overall.

“Cautious consumers” and “uncertain macroeconomic environment” are not anodyne euphemisms for a Golden Age.

They are anodyne euphemisms for a jobs recession that has taken a noticeable turn for the worst .

The jobs recession is getting worse.

The ADP jobs report sucks.

Not only is this not the employment situation of a “Golden Age”, it’s an employment situation that is moving farther away from a “Golden Age.” If this trend continues the US economy as a whole is in very serious trouble.

That’s why consumers are “cautious”. There’s no uncertainty here: they are quite certain that if there is not a change in circumstances soon they won’t have much with which to consume.

The National Employment Report is not just a warning. It’s not just a “red flag”. It’s an alarm klaxon going off at full volume.

Is anyone paying attention? Probably not in Washington.

Not The Report ADP Was Supposed To Give

Most of Wall Street’s “experts” were caught off guard by ADP’s reported job loss.

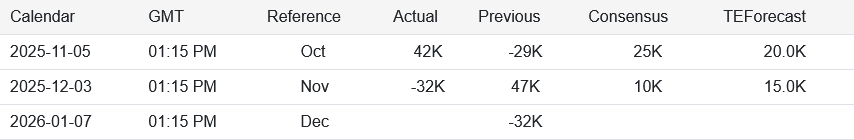

At Trading Economics, the consensus forecast for the November report was job growth of 10,000 jobs, and the financial site’s own internal forecast was a bit more optimistic at 15,000 jobs.

Dow Jones’ roster of “experts” were more optimistic still, hoping for 40,000 jobs to be created in November.

To say the “experts” were slightly off in their estimates would be a mastery of understatement. They missed the forecast completely.

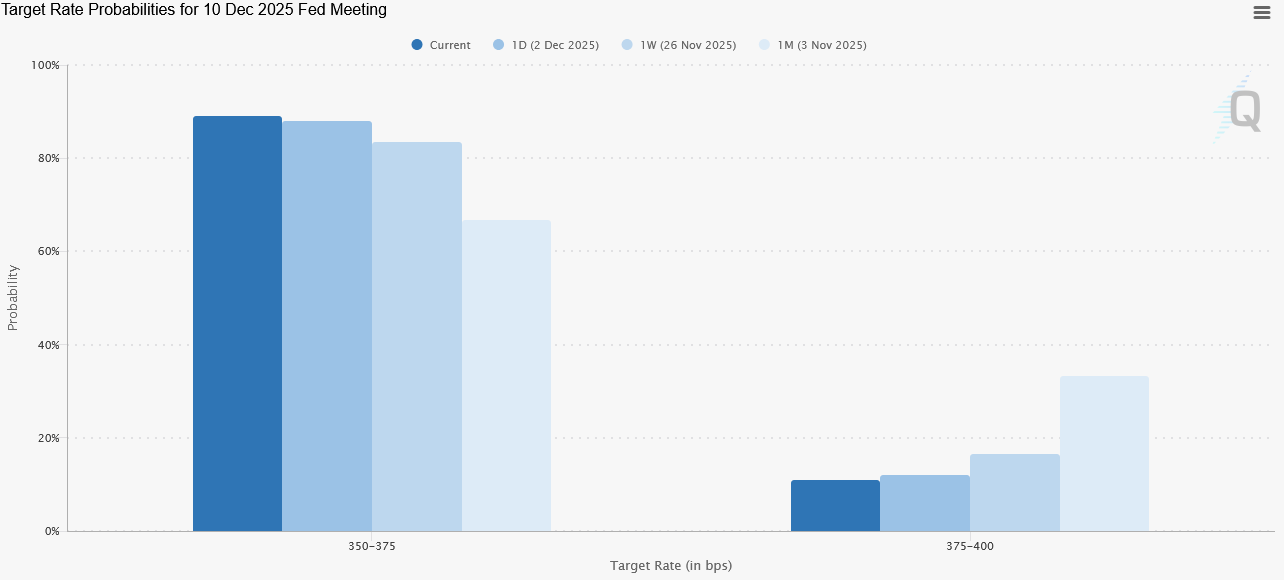

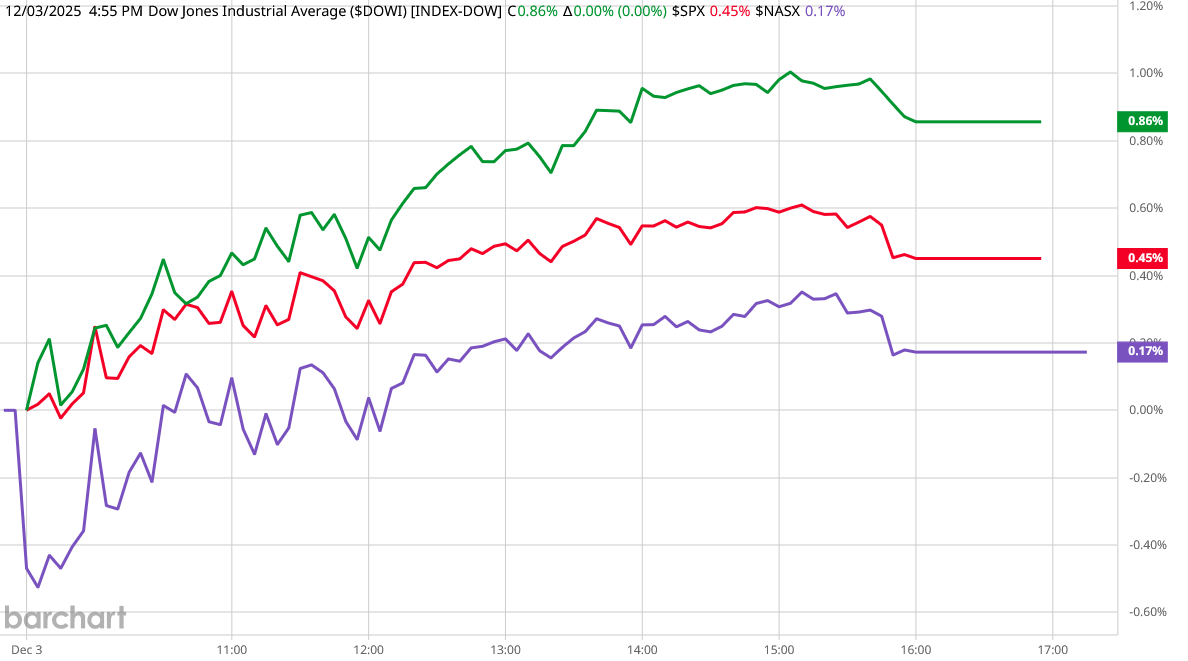

Yet Wall Street managed to take the miss in stride. In its inimitable fashion, it assessed the negative jobs report as “good bad” news: the negative jobs figures only adds pressure for Jay “Too Late” Powell to cut the federal funds rate. While just a few weeks ago Wall Street was uncertain if the Fed would make another 25bps rate reduction when the Federal Open Market Committee meets next week, as of yesterday Wall Street had priced in an 89% probability of a rate cut.

Although the NASDAQ dipped briefly at the opening bell, throughout the day all the major indices trended up, deciding that shedding jobs wasn’t necessarily a bad thing.

That Wall Street cares about the state of employment in this country only as a potential pressure point on the Federal Reserve says much about Wall Street’s view of the economy, and Main Street’s place in it. None of what that says is very complimentary of Wall Street.

No Good News Anywhere

The typical deconstruction I apply to jobs reports involves debunking a seemingly good headline number by pointing out the negative numbers lurking underneath.

With the November ADP report, there are literally nothing but negative numbers.

As mentioned at the top, the headline number was a negative 32,000 jobs.

November was the third time since August and the fourth time since June that the National Employment Report showed overall job loss in the US. Even without the negative months, however, the overall trend in job growth for the ADP report has been on the decline all year, with even the positive months adding fewer and fewer jobs as the year progressed.

This is what a jobs recession looks like.

Even more worrisome is that the job loss was concentrated in small businesses (1-49 employees).

In years past, small businesses have been the primary engines of job growth in the US economy. During an expansion smaller businesses have historically been far more willing to add jobs than larger businesses.

While the ideal is for businesses of all sizes to be adding jobs, if there must be segment that loses jobs, it is better for the economy overall if that segment is among the larger-sized businesses. Instead, the National Employment Report gives us the exact opposite scenario.

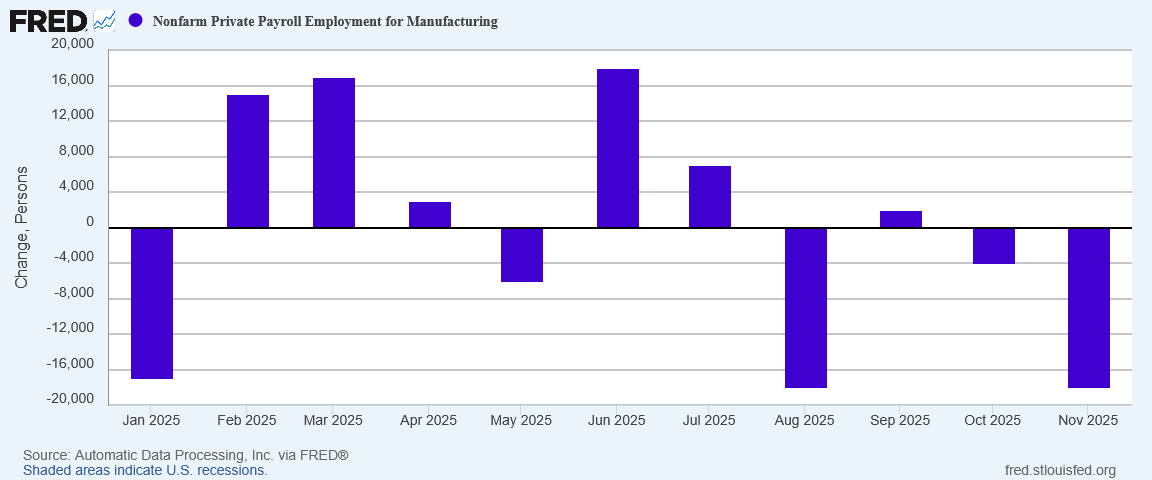

More than half of the total job loss came in manufacturing, which shed 18,000 jobs for the second time this year.

Throughout 2025, America has had fewer people employed in the business of making things. That is not a good sign for the economy overall, and it is definitely not a sign the economy is on track to make the US a manufacturing superpower.

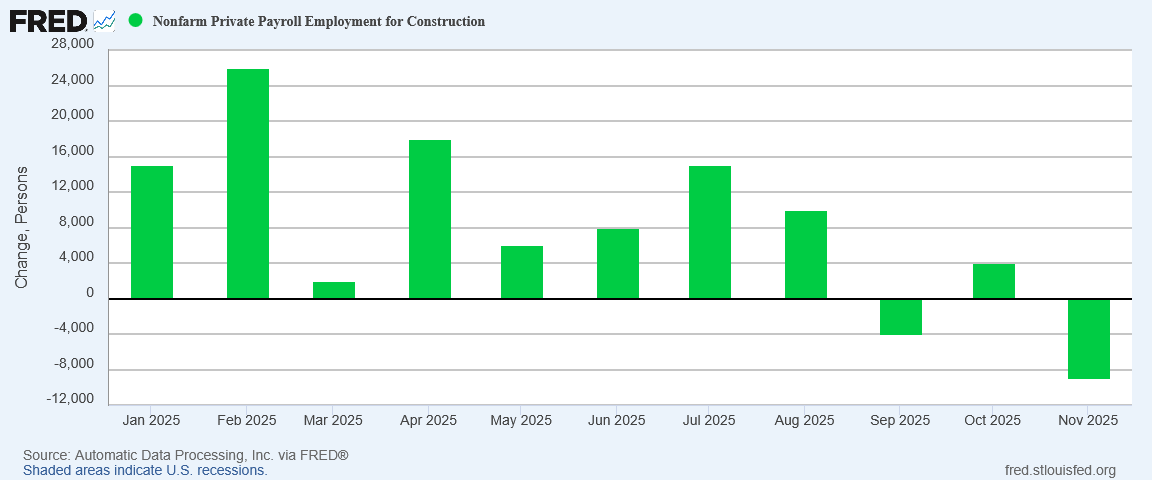

Construction, which has charted mostly job growth in 2025, also shed a significant number of jobs.

Of all the sectors broken out by ADP, the only ones with positive job growth were Trade, Transportation, and Utilities—which barely notched any job growth (1,000 jobs)—and Leisure and Hospitality, which added 13,000 jobs.

Information as well as Professional and Business Services both continued to shed jobs, as they have largely done all year.

There no actual good news in this jobs report. It shows the economy shedding jobs, and doing so across nearly all economic sectors. Wall Street assessments aside, that is very bad news. It is not “good bad” news.

ISM PMI Data Concurs

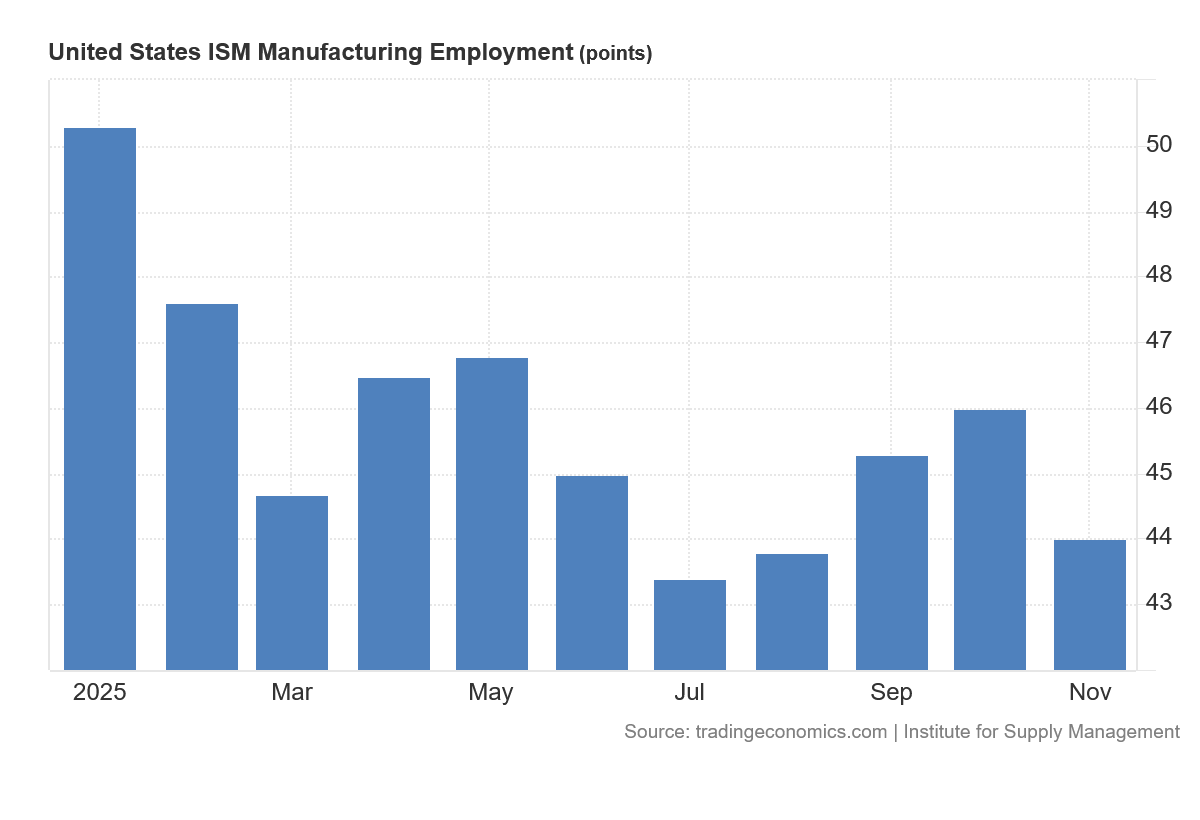

The ADP jobs report is bad enough on its own. What makes it even worse—and even more relevant—is that the Purchasing Managers’ Index data from the Institute for Supply Management offers up a similarly negative assessment of US jobs markets.

The ISM Manufacturing Employment Index charted at 44 for November, marking the tenth straight month of contraction in manufacturing employment.

If manufacturing concerns in the United States are experiencing a contraction in employment, by definition they are shedding jobs, which is the same overall trend being reported by ADP.

The ISM Services Employment Index also was in contraction for November, although the index “rose” to 48.9 (which is to say, the contraction slowed down).

November was the sixth straight month of job loss among service businesses, according to the index—slightly better than Manufacturing but not by much.

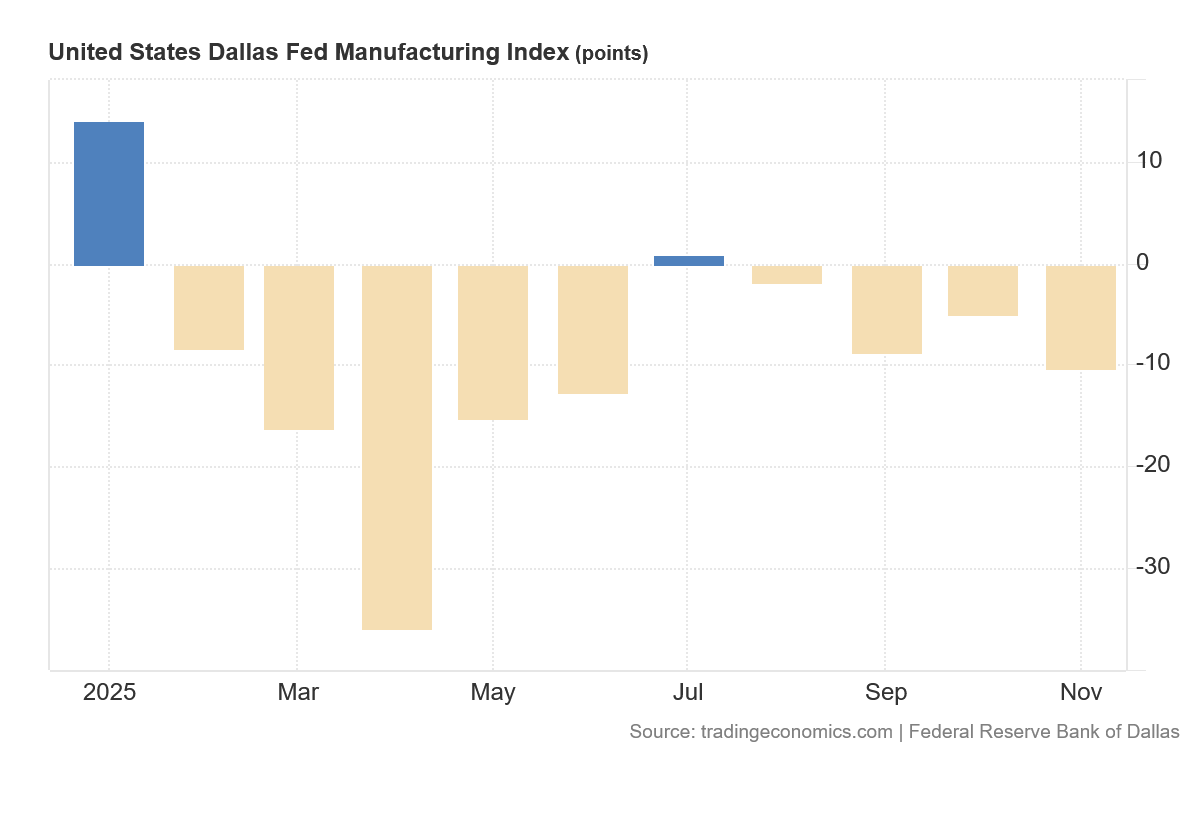

The Manufacturing Employment Index data dovetails uncomfortably well with the Manufacturing Index data published by several of the Federal Reserve Banks.

The Dallas Federal Reserve Manufacturing Index has been charting decline throughout 2025, and November was no exception.

Likewise the Philadelphia Fed as well as the Richmond Fed also have been showing manufacturing on the decline.

Even where there is manufacturing growth recorded for November, such as the New York and Kansas City Federal Reserve districts, that is a change only in the last two months after charting contraction for most of 2025.

When multiple data sources all point to the same phenomenon—in this case, manufacturing decline in the US—that phenomenon has to be considered confirmed. Far from being an economic “Golden Age”, or a trajectory towards making the United States a manufacturing superpower, manufacturing has been declining in 2025.

The Jobs Recession Is Real

The November ADP jobs report, as well as the confirming jobs data from the ISM, leaves no room for any doubt that the jobs recession is real. Manufacturing employment especially, but also employment across the board is just not doing well.

Nor has employment across the board been doing well for quite some time—a point I have made here time and again, as new jobs data gets published.

Given the PMI and Federal Reserve data, and given the negative trends in both as well as in employment, ADP’s jobs report is not all that surprising. It is a disappointment, to be sure, as well as alarming, but the trend was established well before November. One has to wonder how the “experts” could come up with an estimated job growth number for November of even 10,000 jobs, let alone 40,000.

We should note that all of this data is data which has been publicly available even during Silly Schumer Shutdown. Some of the data is even from the Federal Reserve.

Despite the claims by the Trump Administration and even some Democrats that the shutdown left the Federal Reserve “flying blind”, jobs data in particular has been available all along, thanks to numerous private sector sources. While adding the BLS and BEA data to the mix would be a plus, the notion that either the Federal Reserve or Wall Street’s “experts” have been bereft of information because of the shutdown is ridiculous even for politicians and corporate media.

The Fed has had plenty of data on the state of employment in the economy without any disruption due to the shutdown.

Wall Street has had plenty of data on the state of employment in the economy without any disruption due to the shutdown.

Yet neither the Fed nor Wall Street seem able to absorb the private-sector data, much less understand it. By and large Wall Street does not acknowledge the jobs recession which began in 2023, and certainly the Federal Reserve is reluctant to admit that its inflation fighting policies have had a destructive impact on the economy.

Despite such willful blindness, the data remains what it is, and it shows what it shows. What it shows is a continuing jobs recession in the US, a jobs recession that took a significant turn for the worse in November.

America is losing jobs. America has been losing jobs, and has not been producing new jobs at all near the level it must if the US is to be anywhere close to full employment. If these trends continue, the US economy is in very serious trouble.

As I said at the beginning, the National Employment Report is not just a warning. It’s not just a “red flag”. It’s an alarm klaxon going off at full volume.

Is anyone paying attention?

Very gloomy, Peter. The only positive spin I can come up with is what I’ve said before: in the race to the bottom, the U.S. will be last. Bad trends in Europe, China, Russia, Iran, and a dozen other countries will get worse, and we will be able to profit financially. Not a charitable thought, but realistic. I’m counting on Trump to play others’ misfortunes to our benefit.

Question here - how much of this is a result of cutting government jobs which inherently don't produce?