ADP Jobs Report Looks Good, But Just Does Not Satisfy

Once Again, America's Economic Outlook Is Neither Boom Nor Bust, Just "Stuck"

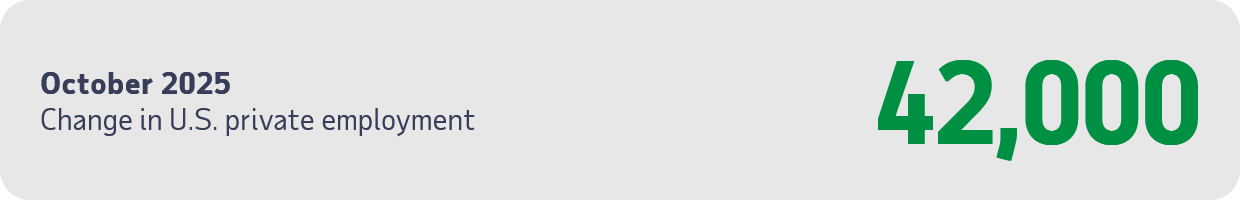

Despite a huge surge in layoff announcements, according to global outplacement firm Challenger, Gray, and Christmas, the October ADP National Employment Report still managed to show a rebound in job growth after a dismal August and September.

According to ADP Chief Economist Nela Richardson:

“Private employers added jobs in October for the first time since July, but hiring was modest relative to what we reported earlier this year. Meanwhile, pay growth has been largely flat for more than a year, indicating that shifts in supply and demand are balanced.”

Once again, we are forced to consider the ADP employment data largely in isolation, as we once again do not have the luxury of the “official” employment data from the Bureau of Labor Statistics, courtesy of the government shutdown.

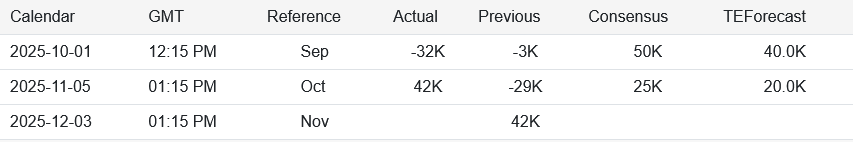

What the ADP employment data shows is that job growth had been slowing all year before turning into outright job loss in August. It is ironic but telling that the addition of 42,000 jobs in October—what would normally be a weak jobs report number—was well above what was forecast.

When the good news is that the bad news is less bad than you thought, there is no real good news to be had.

The ADP National Employment Report once again shows the American economy to be in neither boom nor bust, but merely “stuck”.

While the addition of 42,000 jobs is definitely a welcome change after two months of job loss, that level of job growth does little to alter the trajectory of slowing employment growth that ADP has charted since the beginning of the year.

Although the jobs number was weak, it still came in well ahead of expectations, according to Trading Economics.

How weak an employment figure is 42,000 jobs? Weak enough that job growth at very large companies literally accounted for all of the jobs growth, while being dragged down by the rest of the country’s employers.

That weakness is certainly confirmed by the Institute for Supply Management, which found that employment for manufacturing firms in this country continued contracting during the month of October.

According to the ISM’s data, even services employment has been largely contracting during 2025.

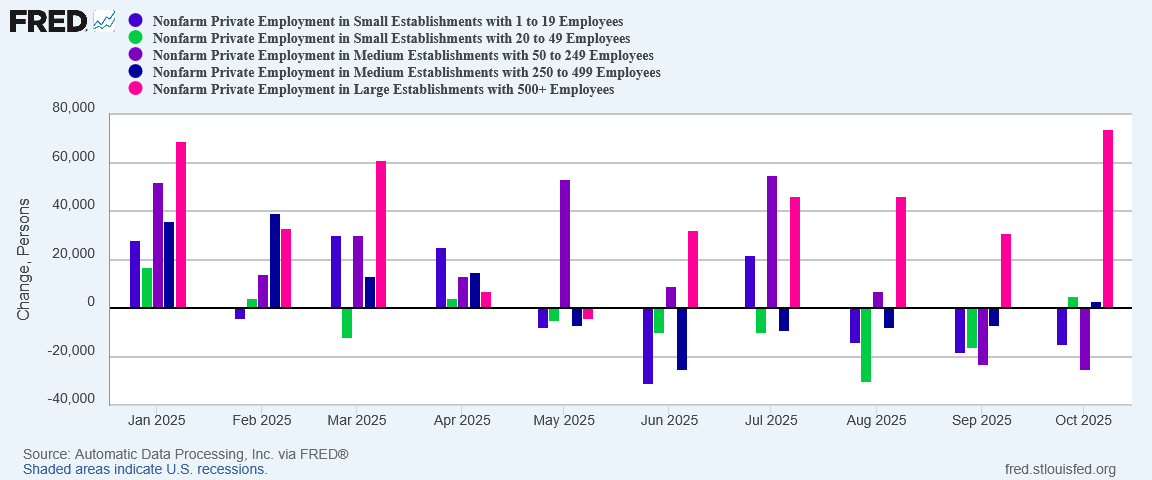

The ADP data certainly confirms the trend of the Bureau of Labor Statistics Employment Level from the currently suspended Current Population Survey.

Underscoring the weakness in US labor markets is the reality of layoffs for some 153,074 individuals during October.

“October’s pace of job cutting was much higher than average for the month. Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes. Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market,” said Andy Challenger, workplace expert and chief revenue officer for Challenger, Gray & Christmas.

Despite the reported growth in jobs during October, the Challenger, Gray, & Christmas layoffs report shows that rising joblessness is still very much a trend for the economy.

42,000 jobs is better than no jobs, but 42,000 jobs does not come close to offsetting 153,000 layoffs for the month. 42,000 jobs is nowhere near the amount jobs the US economy needs to be producing each month if the jobs recession that has bedeviled the economy since 2023 is to finally come to an end.

Reported job growth is on its own merits good economic news. However, that there was any job growth in the ADP report is where the good news ends.

While large companies fared well with job creation in October, that good fortune did not extend across most economic sectors, as several continue to shed jobs.

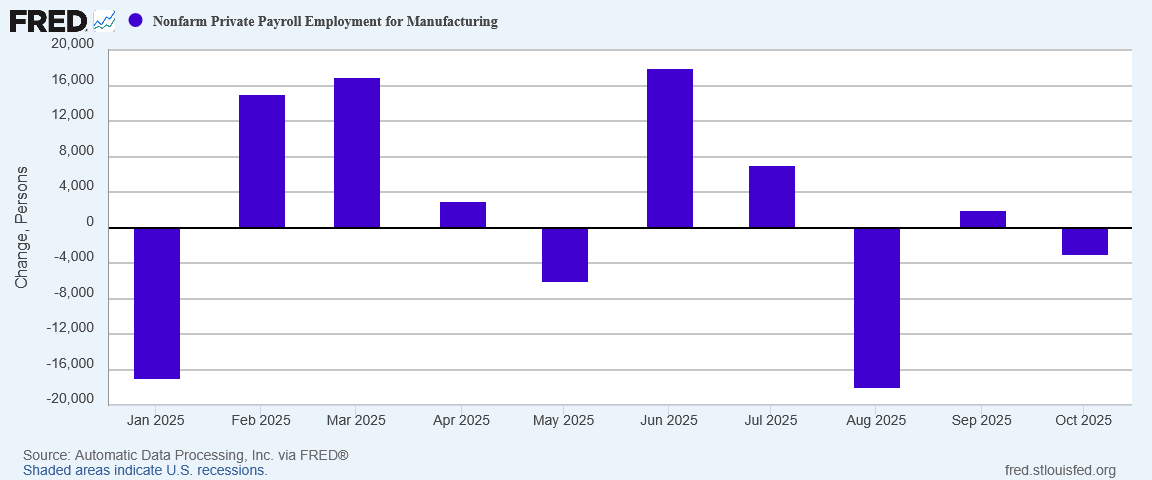

Manufacturing continues to shed workers, with ADP reiterating the gloomy sentiment ISM reports on manufacturing employment.

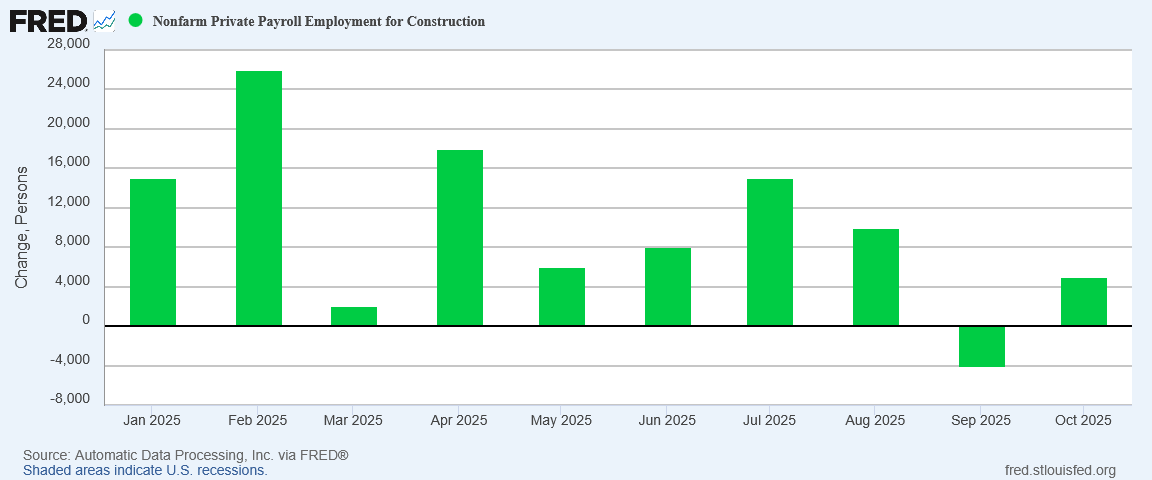

Construction rebounded into positive jobs growth territory for October, but the sector is still showing a downward trend of less job growth month on month.

Within the service sectors, Trade, Transportation, and Utilities staged a welcome recovery, with October job growth surging after two months of declines.

This was one of the few bright spots among the reported economic sectors.

Professional Services and Information reflected the Challenger, Gray, and Christmas report, with both sectors posting significant job losses amid a growing trend of job losses.

Even Leisure and Hospitality struggled, shedding jobs for the second month in a row.

We should note also that the ADP report focuses on private sector employment only. The data presented does not even begin to account for the employment disruptions among the federal workforce arising from the Silly Schumer Shutdown.

The forced idling of much of the federal workforce assures us the October employment situation is not even as good as the ADP jobs report wants to suggest.

Without a robust recovery in employment and job growth, all claims of economic growth and success are primarily wishful thinking. Manufacturing is not going to fully rebound without creating manufacturing jobs. Information technologies and professional services are not going to power the next phase of economic development without creating jobs.

Even sectors with significant job growth in October have, over time, been largely hit and mostly miss on jobs. The jobs recession has very much been a rolling recession, and that recession is definitely continuing to roll.

So long as the jobs recession continues, all Trumpian rhetoric about a new “Golden Age” for America is entirely a product of wishful thinking and Donald Trump’s predictably bombastic “art of the deal” style of leadership.

There is no “Golden Age” yet for the average worker.

This sobering economic truth has come only reluctantly to the “expert” class, who have in recent months belatedly realized that, without employment growth, there is no sustained economic growth. Some have even come to realize the US has been in a jobs recession for over two years.

America is still in a jobs recession. Job growth is either nonexistent or inadequate to the needs of America’s population.

While the ADP National Employment Report shows there are jobs to be had, peeling back the layers and looking at the detail underneath shows that there are simply not enough jobs.

We are left in the same muddled and unsatisfactory position as after the belated release of the September Consumer Price Index Summary data, with an economic outlook that is neither boom nor bust, but is of an economy that is simply stuck.

The jobs report confirms that Fed Chair “Too Late” Powell, with his TDS-inflected obsession over the non-existent inflationary impact of Trump’s tariffs, has ignored toxic state of labor markets in the US, very likely choking off job growth by keeping the federal funds rate higher than needed.

At the same time, the jobs report confirms that those same Liberation Day tariffs might have produced additional government revenues, but they have not thus far translated into domestic investment and employment gains. That prosperity remains very much a promise and a projection rather than a present reality.

Yet the jobs report also confirms that the economic disasters Democrats have fearmongered would follow a Trump Presidency have not materialized. There might not be sufficient employment growth, but employment has also not collapsed.

Once again, all the narratives are proven wrong.

There is no “Golden Age”. There is no apocalyptic inflation. There is no economic collapse.

We are in neither boom nor bust. We are simply…stuck.

There is a huge issue with allowing core manufacturing to degrade or be eliminated. That is; even if reduced Federal funds rates decline and borrowing money is "cheaper" than before, there's little manufacturing infrastructure left to rebuild/revitalize to make products that would otherwise be subject to high tariffs if imported.

It takes time to construct new manufacturing plants or rebuild older ones; not to mention environmental concerns that must be addressed. Assuming no logistics issues; realistically how many plants could be constructed/refurbished by the end of Trump's term of office?

All of the bad economic news will be blamed on Trump, of course, because that’s what corporate media does. However, some of the decline in jobs is due to AI. Peter, is someone keeping track - reliably - on jobs loss due to the implementation of AI?