Powell Proves (Again) That He Ignores The Data

The Same Deteriorating Jobs Trends We've Seen For Months Now Are Worthy Of A Rate Cut

Jay Powell, in his Tuesday address to the 67th Annual Meeting of the National Association for Business Economics, was his usual befuddled and factually off base self.

With his take on US labor markets being the usual mix of fiction and fantasy, Powell proved once again that the Federal Reserve is nowhere near as data dependent or data driven as they would like people to think. Deprived of his usual data crutches by the government shutdown, Powell has chosen to muddle ahead and pick a policy position based on “a wide variety of public- and private-sector data that have remained available” (i.e., throw policy darts at a target and see where they land).

Amazingly, his amorphous amalgam of “public- and private-sector data” managed to persuade Jay Powell of something his usual data crutches historically could not: labor markets are decidedly unhealthy, the economy is decidedly unhealthy, and last month’s 25bps reduction to the federal funds rate was not nearly enough.

Based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago. Data available prior to the shutdown, however, show that growth in economic activity may be on a somewhat firmer trajectory than expected.

While the unemployment rate remained low through August, payroll gains have slowed sharply, likely in part due to a decline in labor force growth due to lower immigration and labor force participation. In this less dynamic and somewhat softer labor market, the downside risks to employment appear to have risen. While official employment data for September are delayed, available evidence suggests that both layoffs and hiring remain low, and that both households’ perceptions of job availability and firms’ perceptions of hiring difficulty continue their downward trajectories.

Of course, whatever alternative data Powell is using, he’s still getting his basic facts wrong. Unemployment might be nominally “low”, but it has been rising steadily since the spring of 2023.

Additionally, if people not in the labor force but who want a job now are included in the unemployment calculations, the unemployment rate jumps to over 8%—and is climbing faster than the “official” unemployment rate.

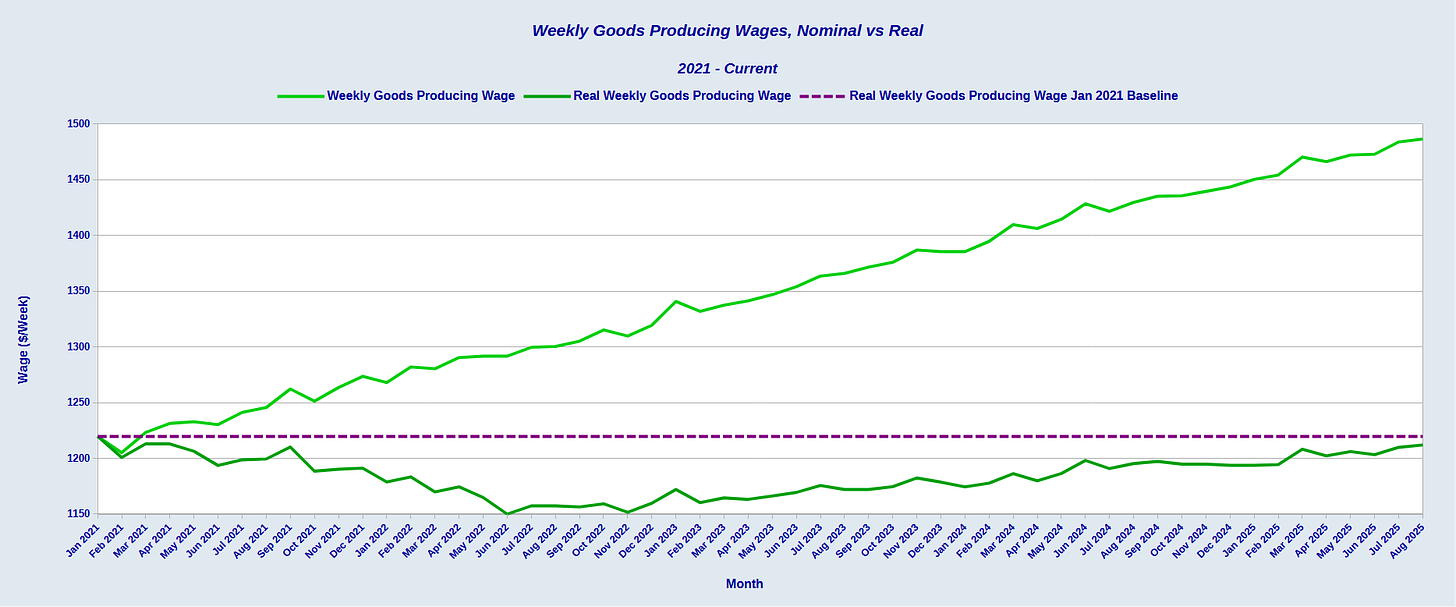

As for supposed payroll “gains”, let us remember that real wages for both goods-producing jobs and service jobs still have not recovered from the 2022 hyperinflation cycle, and both lag behind where they stood in January of 2021.

Regarding Powell’s claim of “slowing labor force growth”, over the summer the civilian labor force in the United States shrank.

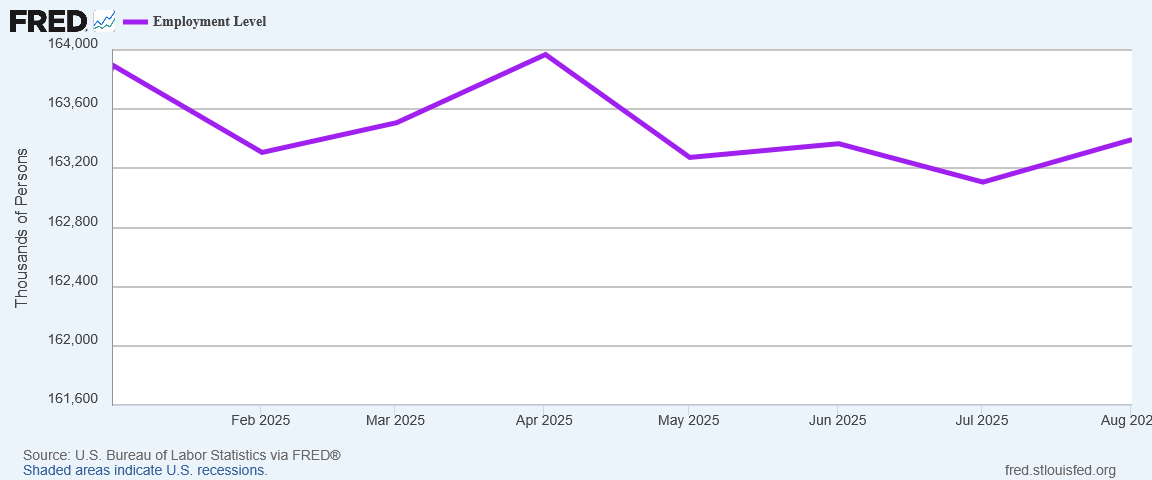

As one would expect from the labor force chart, the employment level in the United States also declined over the summer.

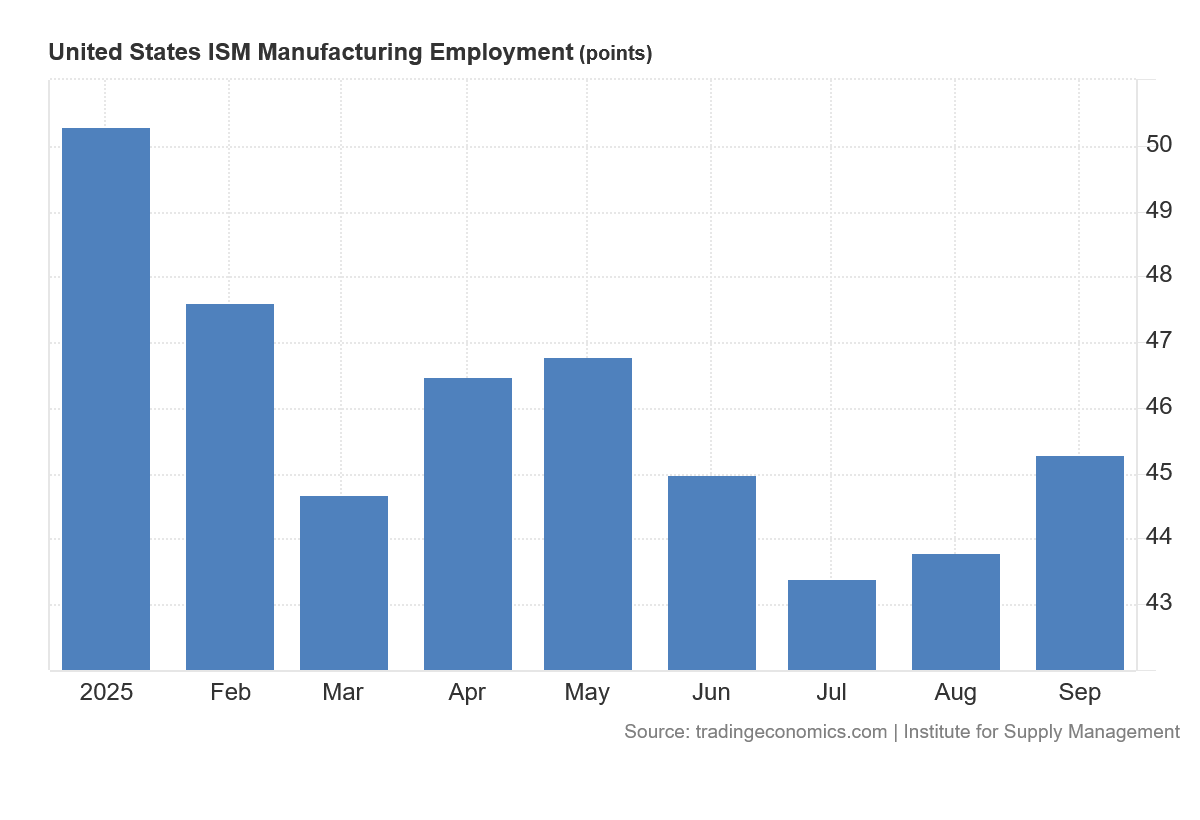

This trend is confirmed by the Institute for Supply Management’s manufacturing service employment PMI data. The Manufacturing Employment PMI has been printing contraction (shrinking employment) all year.

The Services Employment PMI has been in contraction since June.

As a further confirmation of the toxic labor trends, it is worth noting that the PMI data reflects the collapse in net hiring per the JOLTS report over the summer.

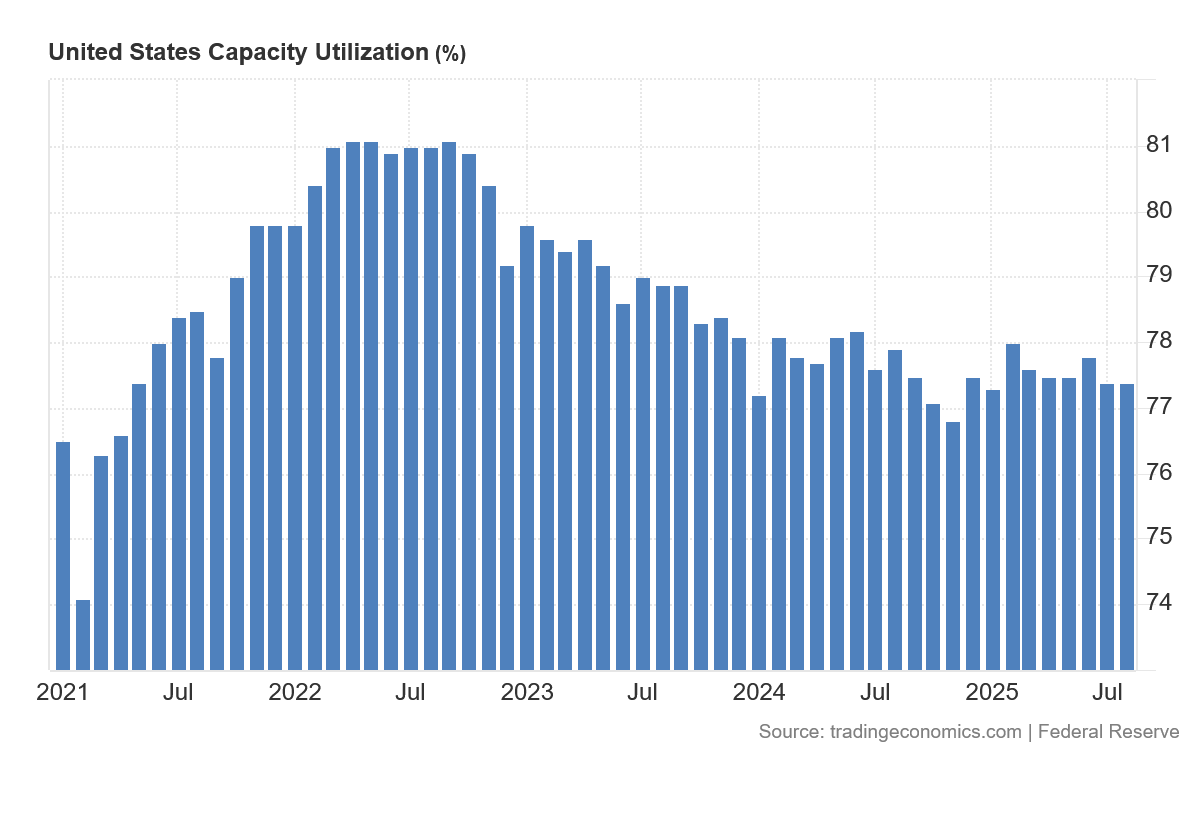

Nor do we need to confine ourselves to just job-related data. The Federal Reserve’s own gauge of capacity utilization in this country shows a steady decline since the peak of the 2022 hyperinflation cycle.

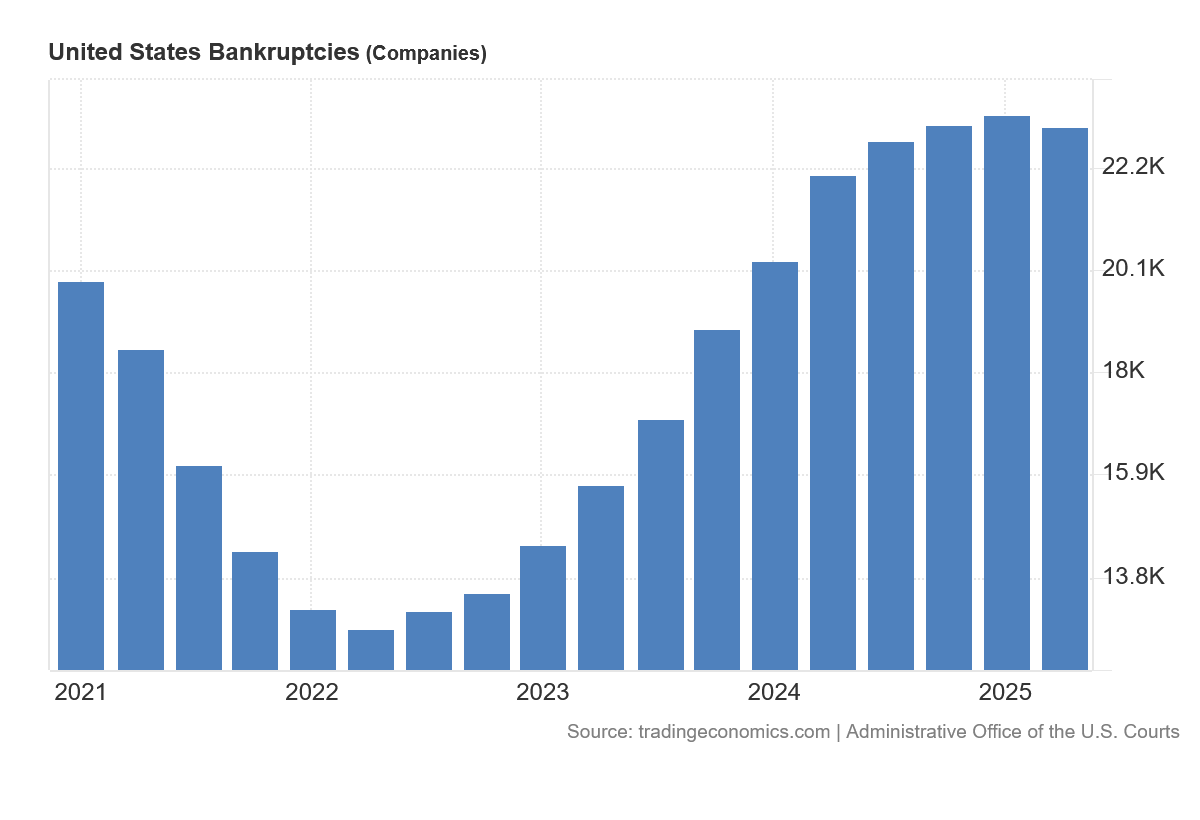

As for overall business health, what conclusion should we draw from the steady rise in business bankruptcies over that same time frame?

This is the data that Powell claims shows the economy is on a “firmer trajectory.”

This is the same data that Powell looked at during the spring and summer and steadfastly refused to trim the federal funds rate.

To hear Powell tell it on Tuesday, however, his minions on the Federal Open Market Committee looked at these same data points in September and concluded that a 25bps rate cut was in order.

Rising downside risks to employment have shifted our assessment of the balance of risks. As a result, we judged it appropriate to take another step toward a more neutral policy stance at our September meeting. There is no risk-free path for policy as we navigate the tension between our employment and inflation goals. This challenge was evident in the dispersion of Committee participants’ projections at the September meeting. I will stress again that these projections should be understood as representing a range of potential outcomes whose probabilities evolve as new information informs our meeting-by-meeting approach to policymaking. We will set policy based on the evolution of the economic outlook and the balance of risks, rather than following a predetermined path.

Judging by the dovishness of his rhetoric, Powell seems likely to steer the FOMC towards another 25bps rate cut at the end of the month. Certainly that is what Wall Street has priced in at the moment.

Because of the shutdown, Powell cannot reference the latest jobs data from the Bureau of Labor Statistics, nor can he reference the latest inflation data. All he can reference are un-named alternative metrics such as the ISM PMI data or the capacity utilization data, or he can look to the historical data from the BLS.

Yet the historical data has not changed, and the historical data is not at odds with other data sources. Multiple data sources, and not just the BLS historical data, show the US economy in a parlous condition and in declining, not increasing, health.

Even without the latest jobs report from the BLS, there is no reason to assess any improvement in the jobs market in the US. The overall state of the jobs market in the US is still following the same deteriorating trend it has been all summer and even all year. Joblessness is continuing to rise in this country, and wage growth has yet to get real wages back to where they were before the 2022 hyperinflation cycle. The jobs recession continues, and it continues to get deeper.

Somehow Powell is looking at these same data points he has looked at all summer long, only now he is deciding the federal funds rate needs to come down. For reasons about which we can only speculate (*cough* “politics” *cough*), Powell is seeing the data differently than he has been.

If one is looking at the same data points as before and reaching a different conclusion from before, the one certainty is that those data points are not what is driving the conclusion.

Powell is changing his tune on interest rates, but it is not because of the data. It can’t be—the data literally has not changed, except to get worse. Jay Powell is just catching up to everyone else on what the data has actually been saying all along.

He’s not asleep at the wheel, he’s a political hack who is purposely holding back the economy to damage Trump.

Still don’t understand if he is not doing his job, how he can keep it. Ughhh