Producer Prices Say Don't Panic

Producer Prices Hold Steady in June, Easing Inflation Fears

The June Consumer Price Index Summary was bad news, so there is a certain symmetry in the June Producer Price Index release being good news.

Nor should there be any doubt that the PPI report is definitively good news.

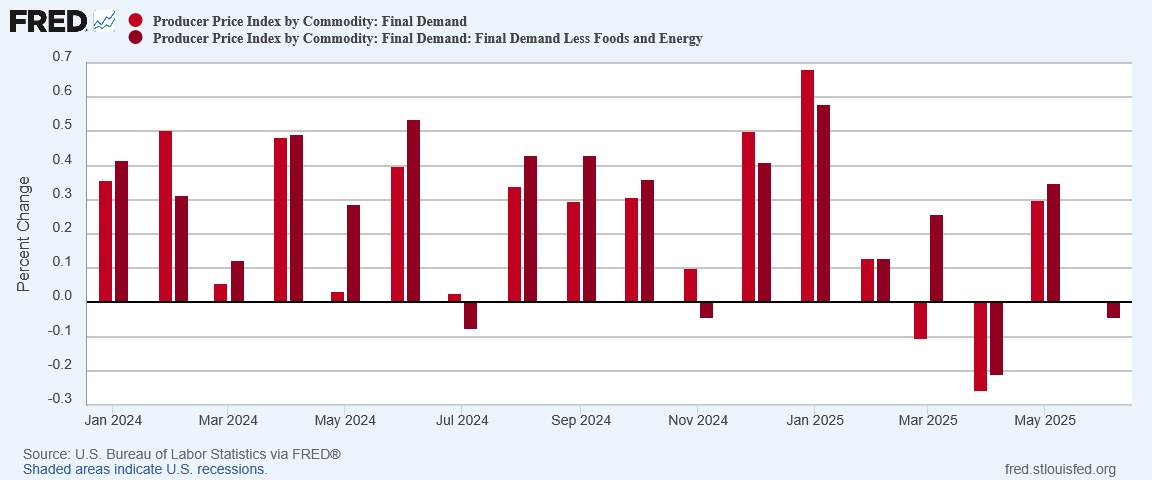

The Producer Price Index for final demand was unchanged in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.3 percent in May and declined 0.3 percent in April. (See table A.) On an unadjusted basis, the index for final demand rose 2.3 percent for the 12 months ended in June.

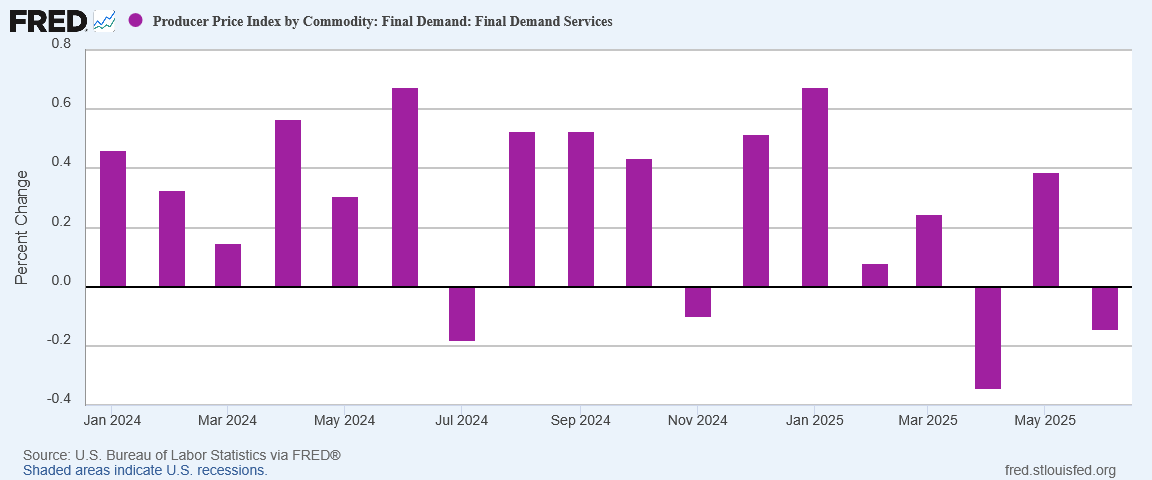

In June, a 0.3-percent advance in prices for final demand goods offset a 0.1-percent decrease in the index for final demand services.

Prices for final demand less foods, energy, and trade services were unchanged in June after inching up 0.1 percent in May. For the 12 months ended in June, the index for final demand less foods, energy, and trade services advanced 2.5 percent.

The headline report deserves repeating: “The Producer Price Index for final demand was unchanged in June.”

On a seasonally adjusted basis, there was no producer price inflation, broadly speaking, for the month of June. Core producer prices actually fell on a seasonally adjusted basis.

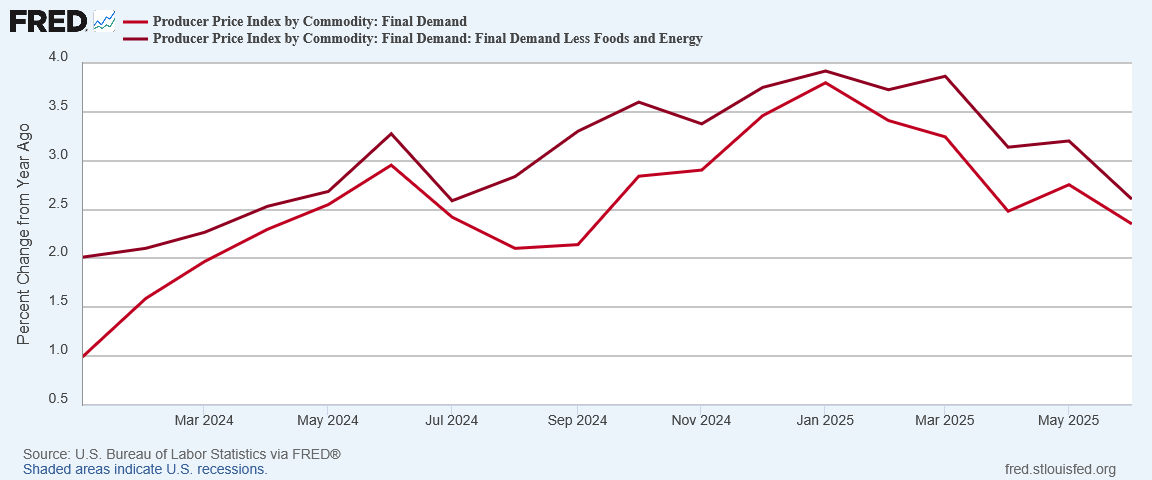

Year on year, producer price inflation continued the disinflationary started at the new year.

Readers will note that this runs directly counter to the consumer price inflation reports unveiled on Tuesday.

This is encouraging news. Producer prices are widely seen as a precursor and predictor of coming consumer price inflation. An inflationary pulse in the PPI broadly transmits into an inflationary pulse in the CPI a few months further on.

Lack of inflation today in the Producer Price Index means a lack of inflation (or reduced inflation) in the CPI tomorrow.

Moreover, just as the June CPI print showed inflation across the board, the JUne PPI print is showing a distinct lack of inflation across the board.

Energy price inflation returned, but in the smallest increase since last fall.

Food price inflation, while up, was similarly muted.

Goods prices overall rose month on month, but not enough to reverse the disinflationary trend started at the beginning of the year.

Service prices printed deflation month on month.

Even Intermediate Demand continued to print mainly deflation.

As a predictor of future consumer price inflation, the June Producer Price Index report is not predicting much consumer price inflation for the remainder of the summer. June producer prices give some reason to hope that inflation will not be the coming trend in consumer prices.

Nor are producer prices the only reason for thinking that inflation might not turn out to be the coming thing.

Oil prices, while up for the month, have been largely stable following the Twelve Day War.

Commodity prices have followed a similar pattern.

Inflation may not drop much below the June levels over the next few months, but the lack of inflation at the producer price level argues against consumer price inflation rising much higher than the June levels.

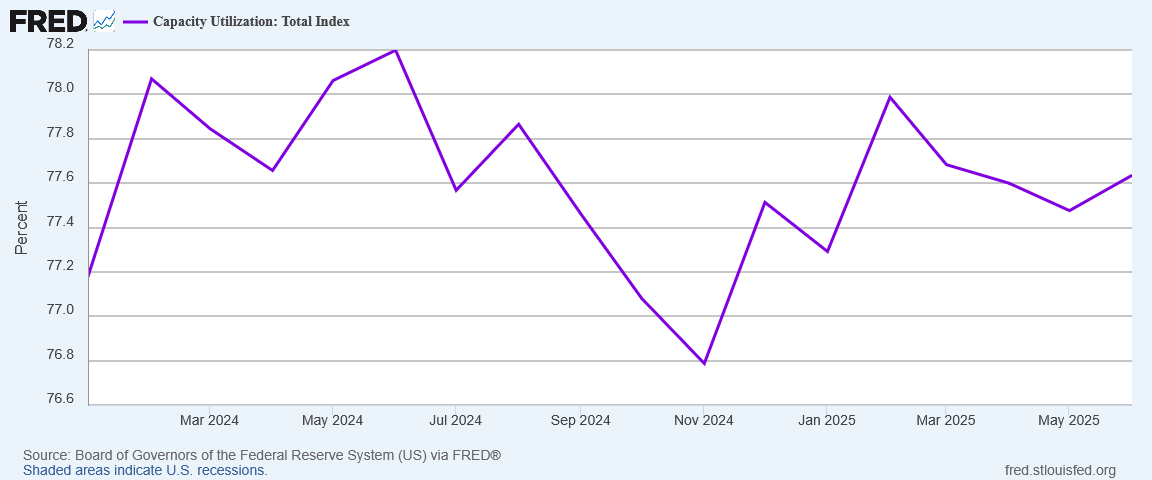

A further optimistic note comes from the Federal Reserve’s Index of industrial production, which has been printing a steady rise since last fall.

Capacity utilization within the US economy has likewise been on the rise since last fall.

We should note that rising domestic production and increased capacity utilization directly rebut the corporate media’s favorite apocalyptic narratives surrounding the Liberation Day tariffs. Within the corporate media’s view of the economy, President Trump’s tariffs should not result in increased domestic production, as that would imply President Trump actually had a good idea regarding economic policy.

A positive PPI report does not alter the negative CPI report, and we should not presume that it does. Consumer price inflation rose significantly in June, and rose across the board. In any month that is not a good thing.

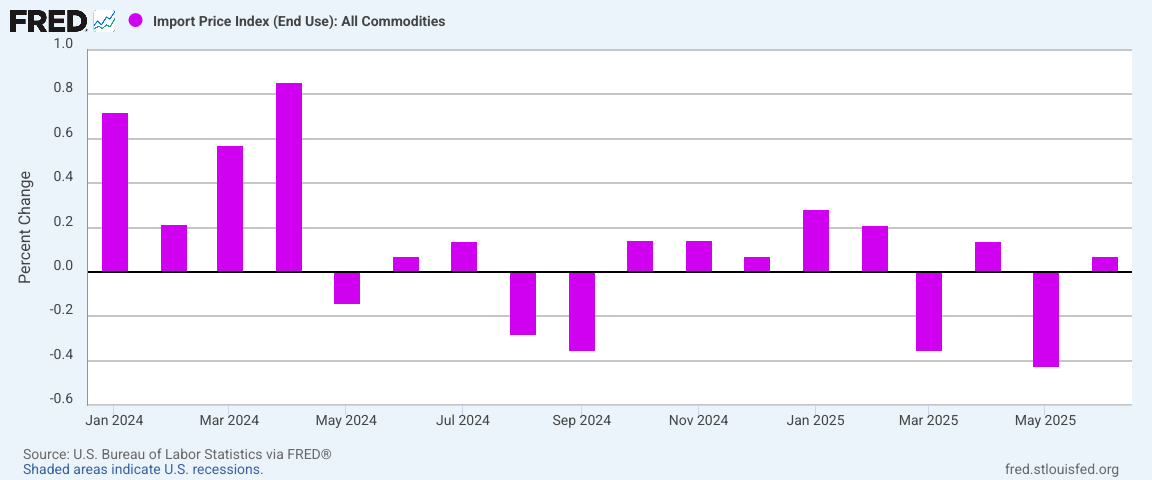

However, the positive PPI report does suggest that June will not be the start of a rising inflation trend in consumer prices. The positive PPI report also significantly undercuts the narrative that President Trump’s tariffs are driving higher prices; the longer-term inflation trends are simply not present at the producer price level. If import prices (which will be coming out right as this article publishes) fail to show significant price appreciation, the “tariffs cause inflation” narrative will have been roundly rebuked for yet another month.

Update

The import price index is out. Import prices barely rose in June--0.07% month on month.

We can safely dispense with blaming June's inflation on the Liberation Day tariffs.

June was a setback where inflation is concerned. Consumer prices did rise, while wages did not. Yet if producer prices are any sort of leading indicator, June is likely to be just a setback on inflation, and not the start of a new inflation cycle.

After the CPI report, such news is surely a relief for everyone.

Peter, one valuable lesson economics lessons I learned from my grandfather was “Always look at how much it’s costing to produce something, eventually someone will have to pay for it.”