Vladimir Putin must think (or hope) that most Russian’s can’t do basic math. Why else would he claim that Russia is not losing money over the EU/G7 oil price cap on Russian oil?

"Yes, of course, the goal of our geopolitical opponents, opponents, is clear - to limit the revenues of the Russian budget. But we do not lose anything from this ceiling, there are no losses for the Russian fuel and energy complex and the economy, the budget. There are no losses, because we sell at these prices" Putin added.

Simply put, this is nonsense. When oil prices go down oil companies make less money. The price of Russian oil has gone down since the price cap was imposed. These indisputable facts mean Russian oil companies are making less money than they would otherwis. That is a loss by definition.

As of this writing, the spot price for Urals crude, Russia’s flagship blend delivered from its European ports, is $55.78 per barrel.

The decline below the price cap of $60 per barrel happened almost immediately after the cap came into effect on December 5, and Urals crude has remained below the cap ever since.

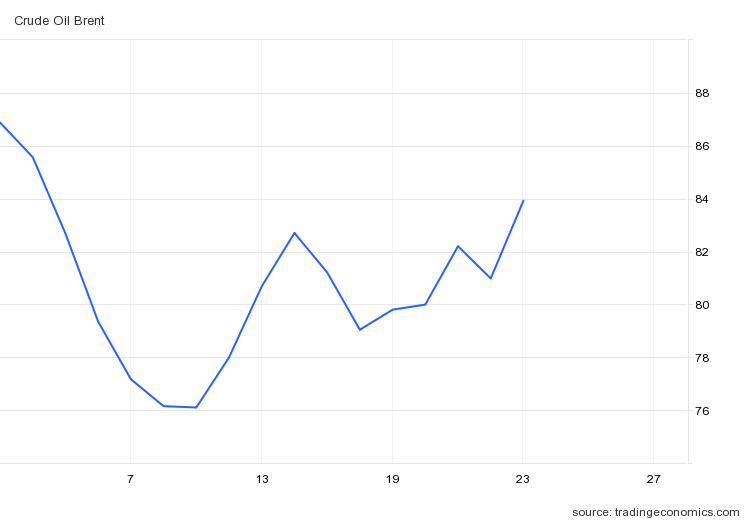

Urals crude has long been trading at a discount to Europe’s benchmark Brent crude, which also declined at the time the price cap came into effect. Yet while Brent crude has risen since that initial decline, the price for Urals crude has been far more uncertain.

While Brent crude’s price has recovered by around $8 per barrel since the cap was put into effect, Urals crude has recovered only about $3 per barrel, meaning the discount for Urals crude relative to Brent has increased.

It is mathematically impossible, therefore, for Putin’s statement to be even somewhat accurate. The price cap might not be bankrupting Russian oil firms, but to the extent the price cap has driven down prices, Russian oil firms have undeniably lost money. That much is simple mathematics.

The unavoidable reality of oil prices might explain why, a few days after Putin made this nonsensical statement, Russia’s Finance Minister Anton Siluanov hinted that Russia might curtail production and refuse to sell oil at prices below the price cap.

"What does the Russian Federation say? We will not supply oil under contracts that will indicate price limits offered by Western countries. This is out of the question," he said in an interview with Asharq News, answering a question about the details of the Russian response to the introduction of a price ceiling for Russian oil.

On the surface, this would suggest that Russia is contemplating halting production of Urals crude, or at least reducing it. Curtailing supply would, of course, create an upward pressure on prices, possibly even pushing the price for Urals crude above the level of the cap. Indeed, Siluanov suggests Russia is counting on such market forces.

"But the principled position that we will not supply our main energy resource at some prices that Western countries will set, we will not allow this. Here is the dictate of the consumer, but by market methods, because today this price restriction is applied to Russian manufacturers. Tomorrow, Western countries will introduce prices for other manufacturers. We cannot agree with this," Siluanov added.

As a basic policy, this stance makes perfect sense. Of course Russia should want to receive market price for its oil.

Unfortunately for both Putin and Siluanov, market price for Russian oil—both the Urals blend and the ESPO blend shipped out of the Asiatic port of Kozmino—has declined since Russia invaded Ukraine, and while the price for the ESPO blend is still above the price cap, it is not that much above the cap, and still trades at a significant discount to Brent.

While the price of ESPO has held up better than the price of Urals crude, Russia’s ESPO blend still trades at a significant discount to Brent, a discount which has widened since the cap was imposed.

Neither Urals nor Brent crude traded at much of a discount prior to the invasion.

The threat of curtailed production is not new. As I covered at the time the price cap was imposed, Russia was even then talking about not selling below the cap.

However, with the market price of Urals crude below the price cap, Putin has a dilemma: he can either backtrack and sell at the market price or he can not sell the Urals blend, period. It is highly unlikely Putin can get either India or China—the two recipients of most of Russia’s oil exports at this juncture—to pay more than market price for oil.

Thus, Putin’s choices are less money (sell at the market rates below the cap) or no money (don’t sell at all).

There is not, at the present time, a third option available.

Part of Putin’s problem is that oil prices have been trending down since the summer, with even Brent crude selling for significantly less than it has previously.

Even America’s West Texas Intermediate benchmark has been in decline.

With ESPO trading at roughly a $16 per barrel discount to Brent, and Urals trading at a discount of more than $28 per barrel to Brent, Russia would have to curtail production significantly to push the Urals price back up above the price cap.

That could prove difficult, because oil demand has been softening globally throughout the fall. In its November forecast, OPEC cut its projections by 100,000 barrels of oil per day.

Oil demand in 2022 will increase by 2.55 million barrels per day (bpd), or 2.6%, the Organization of the Petroleum Exporting Countries (OPEC) said in a monthly report, down 100,000 bpd from the previous forecast.

Next year, OPEC expects oil demand to rise by 2.24 million bpd, also 100,000 bpd lower than previously forecast.

OPEC’s forecast for December did not change.

Whether demand strengthens in 2023 remains to be seen. Certainly the International Energy Agency is anticipating global oil demand to pick up significantly.

The Paris-based energy watchdog raised its oil demand growth forecasts for 2022 by 140,000 barrels a day to 2.3 million barrels a day. For 2023, the IEA also lifted its demand growth forecast by 100,000 barrels a day to 1.7 million barrels a day.

However, much of that forecast is based on China’s much ballyhooed “reopening”—which remains mired in chaos and COVID cases.

Should oil prices trend upwards again, the resiliency of the price cap will indeed be put to the test. However, the present reality is that the price cap is having the desired effect on Russian oil revenues.

Arguably the price cap has pushed Urals crude down by some $5 per barrel relative to Brent crude, which is unquestionably money out of Russia’s pocket. Yet even without the price cap Urals crude would still be trading at a deep discount to Brent crude due in no small part to Russia’s invasion of Ukraine. That discount existed before the price cap was even proposed, much less implemented.

Putin may not like that Russian oil is less attractive as a result of his war in Ukraine, but that does not change the reality of the market response to his war in Ukraine. Whether a reflection of a general condemnation of his war or a general reluctance to run afoul of Western sanctions on Russia arising from his war, the prevailing market sentiment is that Russian oil is significantly less valuable then Brent crude, and will command a significantly lower price.

Cutting back on oil production and oil delivery might push Urals crude above the price cap, but only by pushing up the price of Brent as well. Such moves are not likely to endear Putin to the buyers of Russian oil, which throughout 2022 have purchased significant additional volumes above their historical normal purchases in large part because of Urals’ deep discount to Brent. Such moves could very easily result in an even larger discount being imposed on Russian oil—and if the discount on Urals crude increases by $12 from its current $28 spread, Brent could easily reach $100 per barrel and Urals crude would still trade for less than the price cap.

Putin may wish Russian oil is not subject to the idiosyncrasies of the global oil market, but recent prices and recent trends prove Russian oil is very much a child of the global oil market. If he cannot grasp that, he will have flunked much more than basic math.

Neither can Trudeau nor zalinsky. Two craniorectal inversions hellbent on destruction of all that so many died fighting for. 🇨🇦