Putin's Costly War

Recession, Economic Contraction, And Inflation Are The Price Tag For Invading Ukraine

Back in January, while Putin and Biden were merely haranguing each other over whether would be an actual war in Ukraine, I contemplated the likely global costs of such a war.

The short answer to the question of “who will pay” for Putin’s war is always the same: “the people”, both here in the US and around the world.

Last month, I observed that Russia was already paying a steep price for the war.

With Putin’s “partial” mobilization of Russian reservists and conscripts, we see now that Putin’s strategy of escalation is adding significantly to the price tag Russia will have to pay for the invasion of Ukraine—win, lose, or draw.

If ever there was a time that raw facts and data argue for peace, this is that time.

The Fighting Drags On…And On….

As the latest Russian news updates on events in Ukraine demonstrate, the grinding war of attrition in Ukraine is continuing. Ukrainian forces are still pressing the Kherson front, and so far the Russian forces are managing to hold them off.

This morning Russian news agency TASS highlighted eight Russian counterattacks along the entirety of the front line, from Kherson in the south towards the Kharkiv front in the north.

During a special military operation, the Armed Forces (AF) of the Russian Federation hit units of the Armed Forces of Ukraine and foreign mercenaries at eight points of temporary deployment in the DPR, Zaporozhye and Kherson regions. This was stated on Friday by the official representative of the Russian Defense Ministry, Lieutenant-General Igor Konashenkov.

"Units of the Armed Forces of Ukraine and foreign mercenaries were hit in eight points of temporary deployment in the areas of the settlements of Kamyshevakh in the Zaporozhye region, Sadok, Bezymennoe, Pyatikhatki in the Kherson region, Kramatorsk, Artemovsk of the Donetsk People's Republic, the cities of Nikolaev and Zaporozhye," he said.

According to Konashenkov, strikes by operational-tactical and army aviation, missile forces and artillery hit three command posts in the areas of the settlements of Drobyshevo in the Donetsk People's Republic and Novovoznesenskoye in the Kherson region, as well as 69 artillery units in firing positions, manpower and military equipment in 167 districts.

However, these counterattacks are not stopping Ukrainian offensive operations, as TASS also noted that Ukrainian forces mounted two separate attacks on objectives near Kherson, which the Russians were able to repel.

This was stated on Friday by the official representative of the Russian Defense Ministry, Lieutenant-General Igor Konashenkov.

"On the Nikolaev-Kryvyi Rih direction during the day, Russian troops thwarted two attempts to attack units of the Armed Forces of Ukraine by the forces of company tactical groups in the areas of the settlements of Davydov Brod and Sukhoi Stavok in the Kherson region," he said.

Seperately, Russian news media outlet Kommersant reported Ukrainian forces shelling the Antonovsky bridge across the Dnipro River in Kherson.

Already at 8:17 Moscow time, Kirill Stremousov, deputy head of the administration of the Kherson region, announced the shelling this morning. He said that during the strike in the area of the Antonovsky bridge, 4 residents of Kherson were killed, 13 people were injured.

The Antonovsky Bridge is the southernmost of two main bridges across the Dnipro, with the northern span located at the Nova Kakhovka dam.

That the southern bridge is under Ukrainian artillery attack is testament to the success Ukraine has had thus far in pushing forward towards Kherson itself. Antonovsky and Nova Kakhovka are the only two bridges near Kherson, and if those are destroyed or lost to Ukrainian forces, all Russian troops on the west bank of the Dnipro River are effectively cut off and isolated.

While this has not happened yet, there is a rising probability of just that sort of setback for Russia along the Kherson front. The battlefield stakes for both sides are high and getting higher.

Mobilization Is Impacting Russian Labor Markets

While Russian forces are still grinding it out on the front lines in Ukraine, Putin’s mobilization call is already inflicting a labor supply shock of as-yet undetermined magnitude and duration within Russia proper, according to Kommersant, citing Central Bank of Russia (CBR) statistics.

“By the end of the month, economic dynamics began to deteriorate somewhat. The economy is faced with new shocks of supply and demand, to which it will additionally have to adapt,” this is how analysts from the DIP Central Bank describe the events that took place in the Russian Federation on the eve of and after the announcement of partial mobilization, which caused a contraction in the labor market and the entry of companies into a period of instability.

Moreover, as Kommersant has reported, the impact to employers is likely to get worse before it gets better.

Russian enterprises do not yet complain about the shortage of personnel, although, according to their own estimates, now the share of mobilized among their employees sometimes reaches 10%. However, in the future, the discrepancy between demand and supply of labor may increase: the Ministry of Defense sees the "ceiling" of the share of the called up 30% of the workforce. It is possible that the authorities of the regions, who received new powers, could take the side of employers, but so far, according to Kommersant, they are not doing this.

This labor shock comes on top of a fading almost-recovery, as inflationary forces returned to the fore again in September, based on CBR data:

In the future, as part of the forecast of the Bank of Russia, some increase in inflationary pressure is expected. This conclusion is also supported by the dynamics of lending and the money supply, as well as updated budget projections for 2022-2023 . In 2024, inflation will return to 4%, taking into account the ongoing monetary policy.

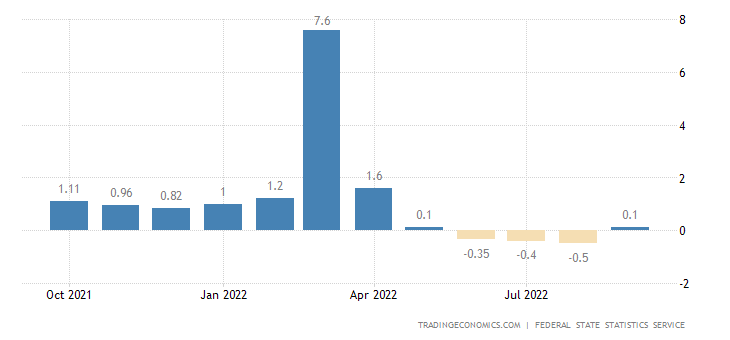

As reported by finance site Trading Economics, inflation month-on-month in Russia rose in September to 0.1%.

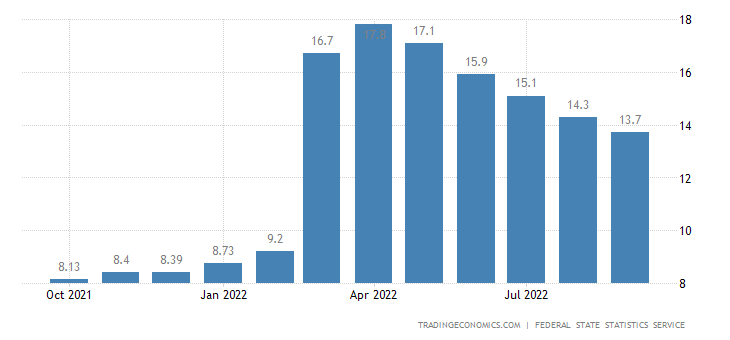

This uptick in monthly inflation still allowed the year-on-year inflation rate to inch down to 13.7%, although the CBR forecast is that inflation will begin rising again into 2023.

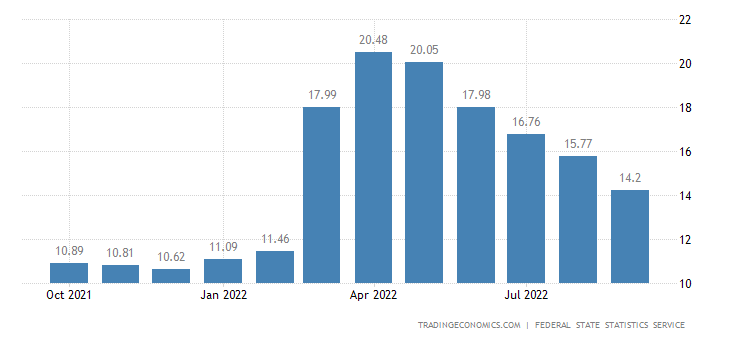

Food price inflation is still running above the headline consumer price inflation rate in Russia, even though it, too, declined year on year, from 15.77% to 14.2%.

Note that while consumer price inflation has for some time been running higher in Russia than elsewhere in the world, it greatly increased after the start of the war.

These are prices the Russian people are paying for the war today.

Russia’s Economy Is Continuing To Contract

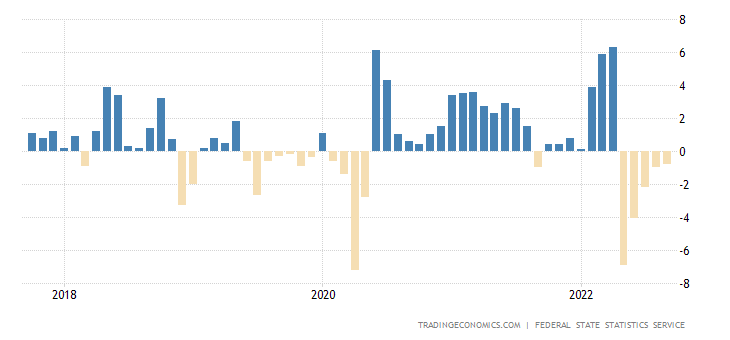

As Russia’s producer price growth—or lack thereof—illustrates, the Russian economy has been contracting since shortly after the war began. After largely rising during 2021 (during which period producer price inflation was largely not transmitted into consumer price inflation), beginning in April producer prices collapsed, and while producer price inflation technically “rose” to -0.8% month on month, which is another way of saying producer prices continued to decline, just at a slower pace.

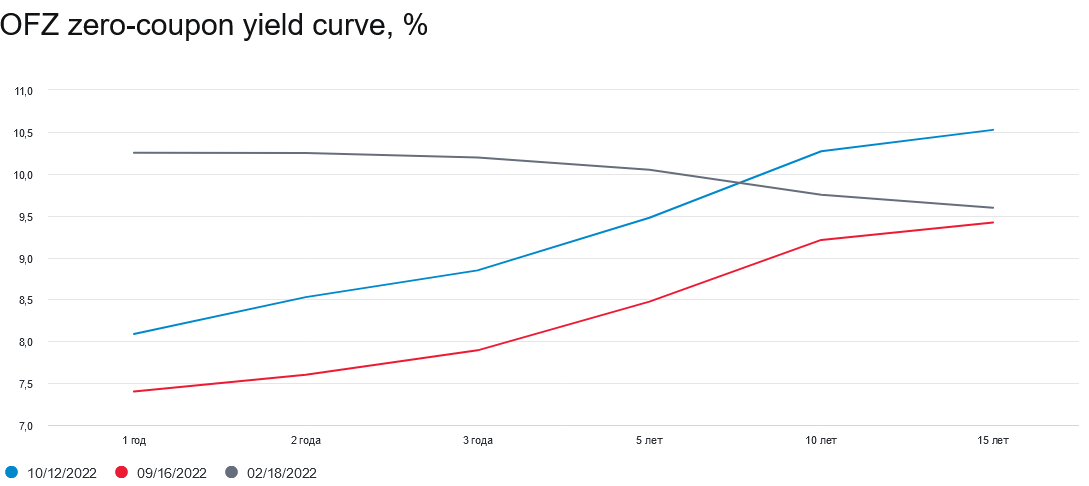

Yet while producer prices are declining, the cost of producer debt is increasing, with debt yields as measured by the CBR rising just within the past month by approximately a percentage point across the entire yield curve.

With yields on Russian debt running more than double US treasury yields, one can only begin to imagine the impact such a credit crunch is having on the overall Russian economy. Certainly, as reported by Kommersant, mobilization has made debt and debt service more costly for firms with already weak credit ratings.

The announcement of a partial mobilization at the end of September caused a sharp increase in yields on bonds of Russian issuers: the values of the indices of high-yield bonds and the broad bond market returned to the levels of April, more than doubling, according to a study by the ACRA rating agency, although in mid-September these indicators fell from March peaks of 2500 and 1300 basis points (25 and 13 percentage points, respectively) - up to 700 and 460 basis points (bp). The maximum values of risk premiums for bonds occurred at the end of March and the beginning of April 2022, when the key rate was at historical highs.

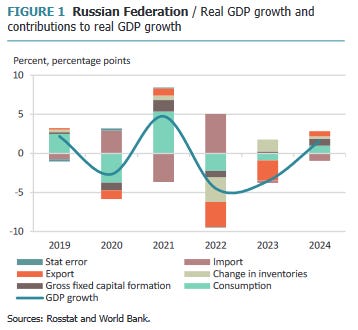

What we do not have to imagine is what the Russian media is reporting to the Russian people, which has for some time been conveying a narrative of economic contraction for Russia for the near term. As Kommersant reported earlier this month, the World Bank forecast for Russia is a 4.5% contraction in 2022, continuing recession in 2023, with recovery not beginning in earnest until sometime in 2024.

Russia’s economy will contract by 4.5 percent in 2022, less than initially expected thanks to the strong fiscal response and the surge in energy prices which helped increase fiscal revenues. The economy has experienced a sharp drop in imports, and a fall in real incomes. The recession will continue in 2023 due to the sanctions and reduced fiscal expansion. Thereafter the economy is expected to stabilize. However, medium to long-term growth is expected to

be very low as Russia has lost access to key sources of productivity.

Based on the World Bank forecast, exports and domestic consumption are both forecast to fall, while imports are slated to rise.

Lack of exports and export revenue is having a knock-on effect with Russia’s international reserves. Russian media is reporting that the state government’s international reserves as well as reserves of gold have been declining steadily, particularly in August and September.

From August to September, Russia's reserves were constantly declining. On August 12, they amounted to $580.6 billion, on September 30 - $540.7 billion. On October 1, the volume of reserves amounted to $540.688 billion, down 4.41% compared to early September.

The drop in reserves is almost certainly also contributing to the recent decline in the ruble against the Chinese yuan, which dropped in the weeks following the mobilization order and only began a diffident climb around the middle of October.

None of which bodes well for Russia’s economic future.

Even In The Best Case Scenario, Russians Are Paying Dearly For Invading Ukraine

By any metric, and for at least the next several months if not years, the Russian people are paying dearly for Putin’s war in Ukraine.

Rising inflation means they are paying dearly every time they shop.

Tighter labor markets are inhibiting productivity.

Collapsing producer prices means manufacturing output is continuing to decline.

Russia’s gold and international reserves are declining.

No matter what the ultimate military outcome is in Ukraine, these are the costs the Russian people have paid for Putin’s war, are paying even now for Putin’s war, and will be paying for Putin’s war into the near future at the very least.

At some point the Russian people will pause and ask themselves: is Putin’s war worth the price the Russian people are paying?

Of course the Russian citizens are paying. But if it's really a "war of attrition", Russia seems likely to win in the end. 150 million people vs. 40 million people, and a GDP almost an order of magnitude larger.

Will enough Russian citizens tire of it first to change that? Good question. Historically, Russians have a a great deal of resolve when it comes to wars -- just ask Napoleon or Hitler.