Russia Has A Pipeline Problem

Simple Geography Makes Europe Russia's Best Energy Customer--And That Market Is Vanishing

While the world “officially” remains undecided regarding which state actor sabotaged the Nord Stream1 and Nord Stream 2 pipelines (the only serious options are NATO or Russia, take your pick), the loss of those two pipelines for the foreseeable future highlights Russia’s awkward vulnerability regarding its energy exports.

Simple Geography

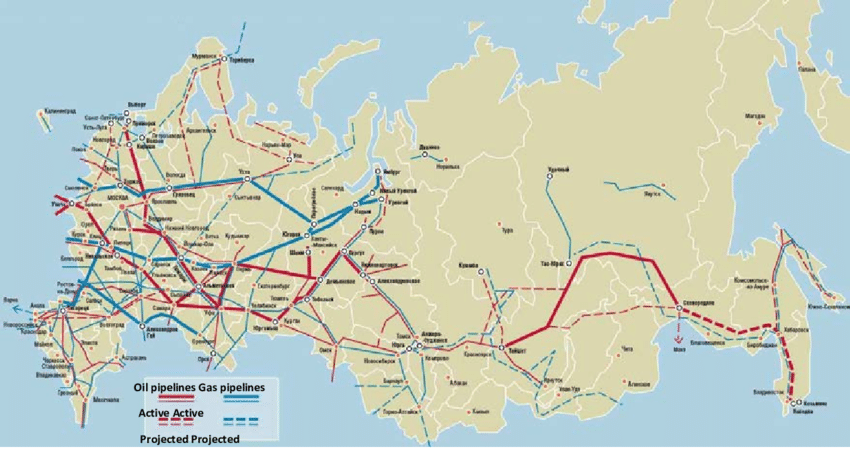

As the map above illustrates, Russia’s pipeline problem is a matter of simple geography: the largest portion of its pipeline network by far leads to Europe, with oil and gas flows heading west rather than east.

The challenge this presents becomes clear if we zoom in on the western part of the above map.

WIth Nord Stream 1 and Nord Stream 2 (export piplines #6 and #11 on the map) out of commission, Russia’s principal gas export pipelines are the Central Corridor pipeline through Ukraine and the Yamal pipline through Poland, with Blue Stream and Turk Stream moving natural gas across the Black Sea to Turkey.

The oil pipeline infrastructure is similarly Euro-centric.

Even before the Nord Stream pipelines were sabotaged, Putin’s war in Ukraine was already alienating Russia from not merely its best energy customer, but its most logical energy customer.

In 2021, Russia sold around 33 billion cubic meters (bcm) of gas to Asia, compared to a European market that typically imports 160 to 200 bcm from Russia.

China is buying more oil and gas from Russia (the Yamal LNG facility delivers mainly to China), and the Sakahlin-2 LNG terminal transships Russian gas to Japan, South Korea, and (of course) China, but the volumes simply do not compare to Europe’s historical demand.

Geography presents another challenge for Russia with the loss of European energy markets: The number of adjacent countries likely to be good customers for Russian energy exports is few. Thanks to the EU organizing much of Europe into a single trading block, the Eurozone is naturally positioned to be Russia’s best customer even if the pipeline network were more balanced between east and west.

With Kazakhstan having itself significant oil and natural gas reserves, there is precious little chance of Russia’s southern neighbor ever becoming a serious customer for Russian oil and natural gas, and they for certain have little economic incentive to allow Russia to build pipelines across their territory.

Similarly, Mongolia is also a small exporter of energy.

That leaves China as the country on Russia’s border most willing to import Russian oil and natural gas.

Pipelines Take Time To Build

While, as the maps show, Russia is expanding its pipeline network to the east, the major pipeline projects such as Power of Siberia 2 are still either “proposed” or “under construction”. Power of Siberia 2 in particular is not scheduled to begin construction until at least 2024. When completed, however, the pipeline will more than double Russia’s pipeline capacity to China for natural gas.

The pipeline, which will deliver Europe-bound gas from western Siberian fields to China for the first time, is expected to go online in 2030, the Moscow Times reported.

The new pipeline will be able to transport 50 billion cubic meters of gas annually from Russia to China, marking a boost from the 38 billion cubic meter capacity of the original Power of Siberia pipeline which commenced operations in December 2019.

While the total capacity of the Power of Siberia pipelines, at 138 billion cubic meters of natural gas, will be comparable to recent export volumes to Europe, that increase does not happen until the end of this decade—meaning Russia is facing multiple years of no gas exports to Europe or greatly reduced gas exports to Europe without the capacity to deliver similar natural gas volumes to China.

Seven years or more is along time to go without energy export revenues, especially for a country such as Russia whose economy is largely driven by those energy export revenues.

Capacity Is One Thing. Delivery Is Another.

It is interesting to note that China, outwardly an eager customer for Russian oil and natural gas, has yet to fully utilize the capacity of the first Power of Siberia pipeline.

Although Russia has reportedly invested $55 billion into its pipeline deal with China, natural gas imports through the pipeline have only totaled $3.81 billion since December 2019, according to China customs data as of June, accessed through Wind Information.

The pace of Chinese purchases picked up in the first half of this year — nearly tripling from a year ago to $1.66 billion, the data showed.

According to industry data, China gets more natural gas from Turkmenistan even after the increased purchases from Russia earlier this year.

This raises the question of whether China will be willing (or even able) to make full advantage of Power of Siberia 2 if and when that pipeline network is completed.

That Russia prioritized the Nord Stream pipelines over the Power of Siberia pipelines indicates which market Russia felt held the most economic promise—and it wasn’t China.

This is not to say that Russia cannot replace Europe as an energy customer with China and other countries in Asia. Given time, Russia can and very well may do just that. However, the time it will take to do that will be measured in years, not months or weeks. Russia is facing greatly reduced energy exports via its pipelines until 2030 at the very earliest.

Putin can try to navigate shifting political tides, but no leader, neither authoritarian, totalitarian, nor democratically elected, can alter the basic realities of geography. Putin certainly cannot call into existence overnight the energy export infrastructure he needs to replace Russia’s westward pipeline systems, all of which are likely to be of diminished utility going forward as a direct result of the war in Ukraine, and the alienation from Europe that war has spawned.

Whether Putin wins or loses in Ukraine, that is a very high and unavoidable price to pay for what has from the beginning been an extremely avoidable war.

Too bad the Biden regime blew up the Nord pipeline..need to get the clown out of office before he gets us in a war with someone....

Look for Chine to offer to build more pipeline capacity in and around Russia. Gaining control in countries’ infrastructure is a key to China’s global expansion and control. Russia may have to capitulate. China could stand to benefit more than anyone by the sabotage in nordstream while keeping Western Europe in a huge energy crisis. Sustainable energy like solar and Ev will keep Western Europe in the China-sphere as well. More energy infrastructure control. Difference between Russia and Europe is that Europe has chosen its sustainable energy path hence its reliance on China. Where we are I. The US is a huge fight for our sovereign natural resources to keep us independent of China’s international totalitarian nightmare. Drill baby drill!!!!