Of all the many artless and foolish things to emanate from President Asterisk’s Regime, the most darkly comical have been the tweets prepared by his handlers crowing about the “strong” US economy.

Last year was presumably a year of “strong” economic recovery.

The fourth quarter of 2022 was presumably “solid”.

And then came the 1st Quarter GDP growth estimates for 2023.

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 0.7 percent on January 27. The initial estimate of fourth-quarter real GDP growth released by the US Bureau of Economic Analysis on January 26 was 2.9 percent, 0.6 percentage points below the final GDPNow model nowcast released on January 20. Beginning with this update, we are including some technical adjustments to GDPNow, and we document those adjustments here. (You can also read about the adjustments under the Related Resources tab, in the link named Modifications to GDPNow Model Forecast.)

The nowcast projection did not change in the February 1 update, and remains at a near non-existent 0.7%

If the GDPNow nowcast is as accurate as the BEA GDP estimates for 2022, a full 2 percentage points of GDP growth are set to evaporate as we move into a new economic year.

That’s not quite the economic recovery the White House was selling. Rather, it’s more like reality setting in.

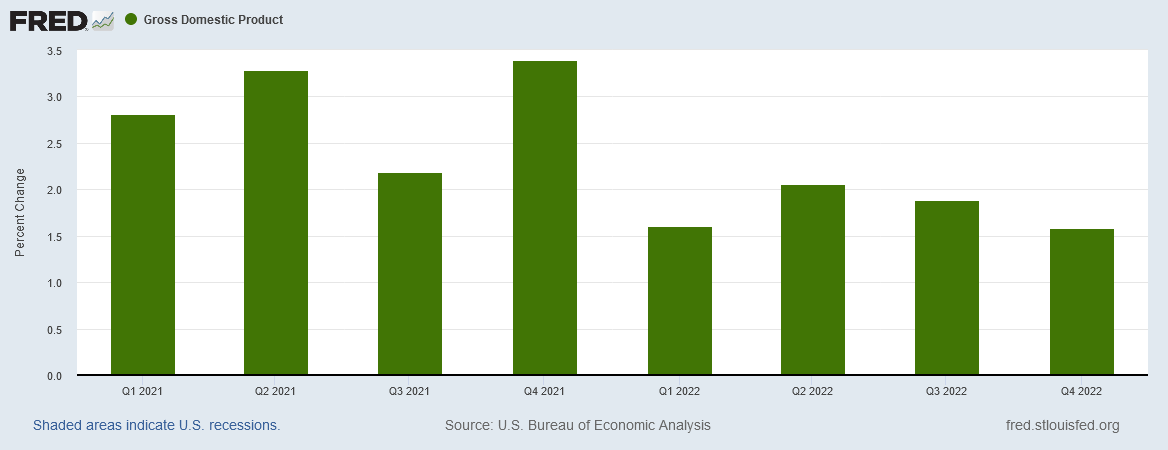

What the White House refuses to acknowledge is that the year of supposed “strong” economic growth was in fact a year of economic deterioration from 2021. There is a significant deterioration in quarterly GDP growth estimates between 2021 and 2022.

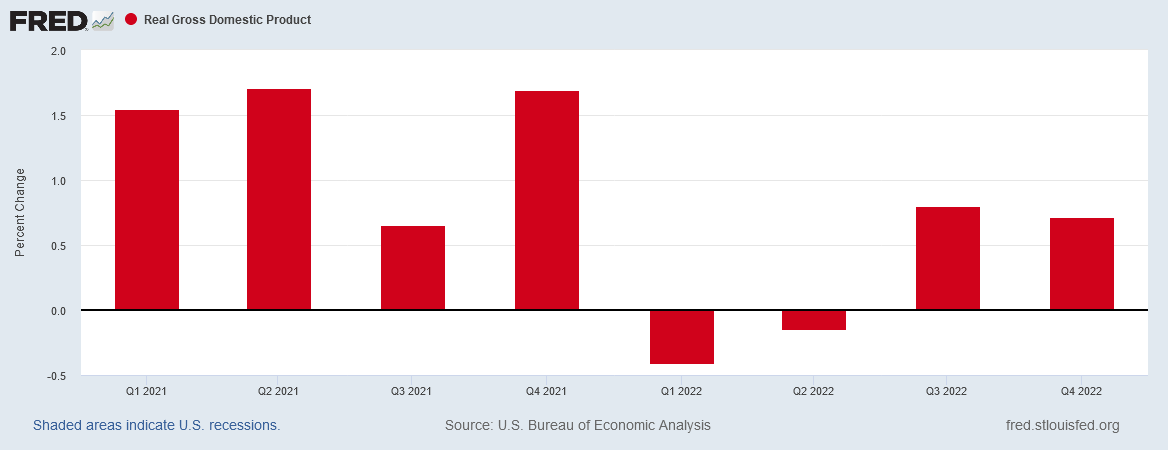

The deterioration was more pronounced in the Real GDP estimates, given the technical recession indicated by the first two quarters of 2022, where Real GDP growth turned negative.

Even the nowcast data picked up on the worsening state of the economy in 2022.

None of this suggests that 2022 was a year of “strong” economic anything, which means that whichever one of President Asterisk’s handlers composed those tweets has less grasp on economic reality than Dementia Joe himself (and that’s saying something!).

The corporate media, of course, continues to parrot the official party line about the economy getting a “soft landing” from the Fed’s self-declared but ultimately ineffectual “war” on inflation, with former Treasury Secretary Larry Summers weighing in that the Federal Reserve may yet engineer a victory over inflation without triggering a recession (ignoring the reality that the recession has already begun, making the soft-landing narrative pure delusion).

The Fed once hiked interest rates less aggressively this week, reflecting a sense inflation is cooling. It brings up the question: Can the United States pull off a soft landing, bringing down inflation without triggering a recession?

Summers said it “looks more possible that we’ll have a soft landing than it did a few months ago,” but he has continued fears about inflation indicators that have come back to earth, but are still too high for his liking.

“They’re still unimaginably high from the perspective of two or three years ago, and that getting the rest of the way back to target inflation may still prove to be quite difficult,” Summers said.

Regardless of the tea-leaf readers’ hopes for a “soft landing” based on jobs data, one persistent reality about jobs has been that while initial unemployment claims have remained fairly consistent throughout 2022, continued claims have been steadily rising for the past several months.

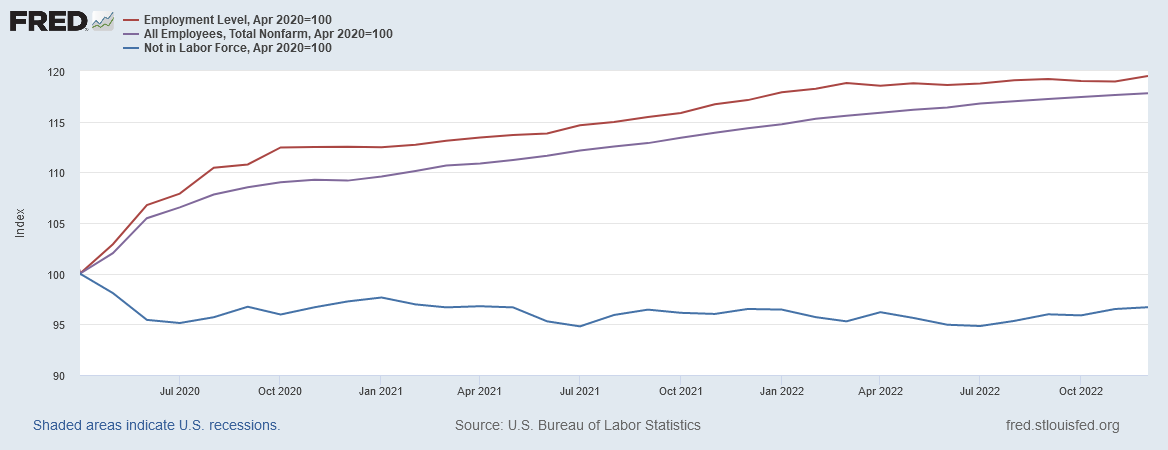

It is hardly a positive economic indicator for the same number of people to become unemployed each week while a growing number remain unemployed week to week, yet that is what the unemployment benefits claims data shows, and has been showing throughout last year’s economic “recovery.” It is, however, consistent with a stagnating employment situation, which is what the total employment data have consistently shown since March of 2022.

March, 2022, readers will recall, is the month where job creation in this country more or less stopped, and overall employment in this country has hardly grown since then.

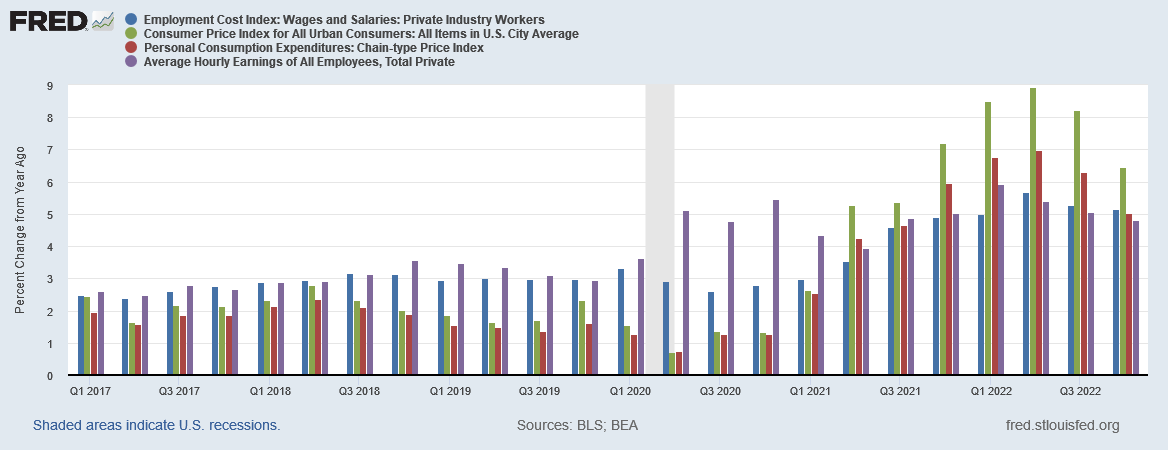

Nor is it a positive economic indicator when the Bureau of Labor Statistics Employment Cost Index shows labor cost growth lagging far behind consumer price inflation post-pandemic.

The lunacy of the government spin on the economy is illustrated by the persistent fear at the Fed of wages somehow driving inflation.

Stubbornly high inflation is finally easing as supply chain disruptions fade and interest rates at 15-year highs put the brakes on demand. Now, Federal Reserve officials have voiced unease that prices could reaccelerate because labor markets are so tight.

Reality check, both the Employment Cost Index and the Average Hourly Earnings from the Current Employment Statistics (Establishment Survey) grew at month on month percentages in excess of month on on month consumer price inflation (both CPI and PCE indices) throughout much of the Trump Presidency without producing any notable upward pressure on inflation.

Not only are the labor metrics not signalling economic strength, one of the mainstays of the US economy, housing, is also not signalling economic strength.

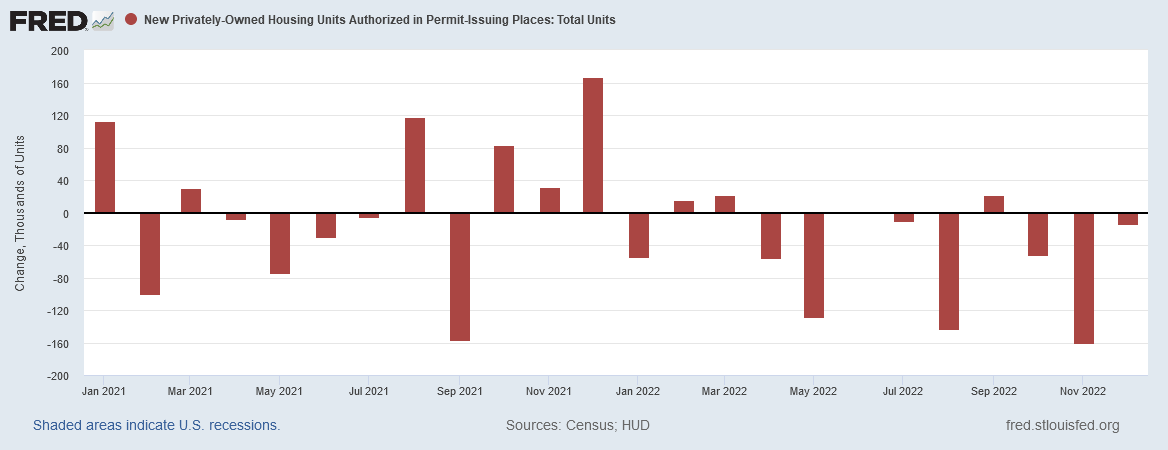

When newly-issued housing permits are in decline for almost all of 2022, that is not a sign of economic growth.

Statistics such as that are what produce abysmal housing sales figures, such as were recorded in December.

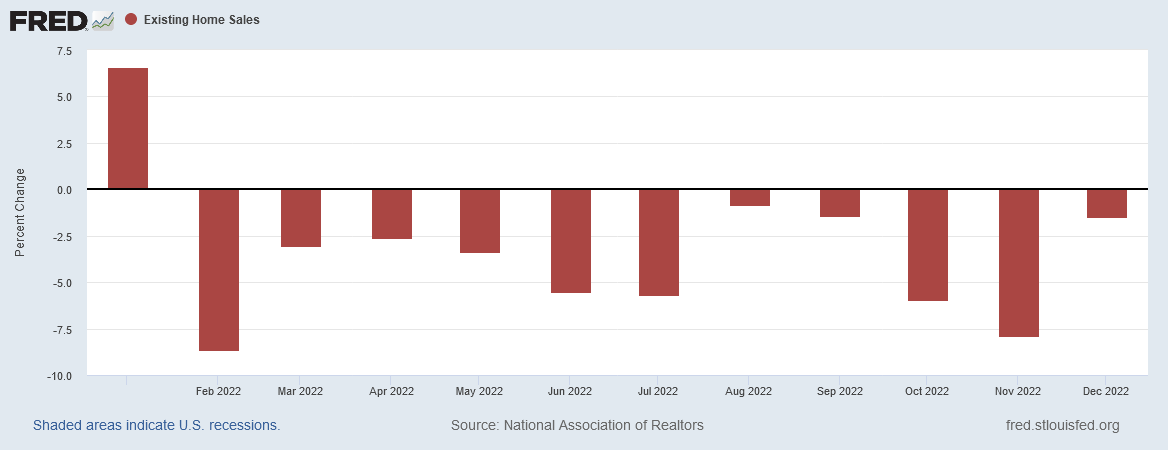

Sales of previously owned homes dropped 1.5% in December from the previous month, according to the National Association of Realtors.

Sales ended the year at a seasonally adjusted, annualized pace of 4.02 million units, which was 34% lower than December 2021. It is the slowest pace since November 2010, when the nation was struggling through a housing crisis brought on by faulty subprime mortgages.

Housing sales declined throughout the year.

Housing sales declined even as housing prices fell even further, with the Case-Shiller Home Price Index and the Zillow Home Value Index having peaked early in 2022, trending down ever since.

Falling prices, falling sales, and falling new housing starts taken altogether signal economic contraction, not economic growth.

None of the details behind the headline numbers for any of the government’s favorite economic statistics show economic growth, and certainly not “strong” economic growth. Stagnation and contraction are by far the more common signal within the detailed data sets. Only the greatly massaged headline numbers give any illusion of economic growth for this country.

Yet even goal-seeking for the headline numbers can only push a metric so far. Eventually there must be real growth or actual expansion or the detail data will break through and show the real state of the economy.

In the Atlanta Fed’s GDP nowcast, the detail data has finally managed to peak through the layers of unreality that have been prior GDP projections, revealing the true state of the US economy: it is not expanding but contracting, not robust but stagnant.

Pandemic policy and fear drove people to "push-button" shopping and trusting anyone on the news. I'm part of the "main street" contingent who shops locally and I get a pit in my stomach every time I go into a store, the prices (pet food!!!), the disarray, the cry for applications for help yet I know people trying to get jobs thru temp agencies and companies are pulling back on labour big time. People are in a virtual reality propped up by the quotes you referenced from the WH and federal agencies. Tick-tick-tick....