The BLS Jobs Data Is All Over The Place

How Many Jobs Were Created In March? There Is No Way To Know

There are times in dealing with government data sets that we must remember that the data could be wrong.

Then there are times when we do better to assume that the data is, in fact, completely wrong.

The March Employment Situation Summary from the Bureau of Labor Statistics is one of those times when we should just assume the data is completely wrong. The headline number might be glowing, but it simply does not make any sense at all.

Total nonfarm payroll employment rose by 303,000 in March, and the unemployment rate changed little at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, government, and construction.

There is little doubt that 300K+ jobs is something to crow about. Naturally, Dementia Joe’s handlers did just that on Twitter.

Yet beneath the headline numbers once again lay a tangle of contradictory numbers.

The two surveys that go into the monthly jobs report from the BLS, the Household Survey and the Estabishment Survey, simply do not agree on any of the numbers.

For their part, the corporate media narrative duly picked up on the “good news” of the jobs report and touted the strength of labor markets and the economy overall.

Forecasts for the March jobs report show another month of strong gains, continuing to defy expectations that companies would start to pull back on hiring.

With the jobs report predicted to confirm that the economy remains healthy even as inflation pressures have again turned sticky, expectations have been diminishing for Federal Reserve rate cuts in 2024. However, though it’s believed the March data will show a strong job market, the central bank is seen as likely to cut rates in June.

Late Thursday, the expectations for the jobs report were considerably less than what was published.

The March jobs report is expected to show some signs of cooling in the labor market after two months of robust job gains shocked Wall Street to start the year.

The monthly report from the Bureau of Labor Statistics, slated for release at 8:30 a.m. ET on Friday, is expected to show nonfarm payrolls rose by 213,000 in March while the unemployment rate fell to 3.8% from the previous month, according to consensus estimates compiled by Bloomberg. In February, the US economy added 275,000 jobs, while the unemployment rate unexpectedly rose to 3.9%.

Naturally, corporate media also highlighted the likelihood that the strong jobs report would serve to delay the eventual Fed rate cuts even longer.

U.S. employers added 303,000 jobs in March, far surpassing economists' predictions and signaling the labor market remains strong.

Analysts surveyed by FactSet expected businesses had added 200,000 jobs last month. The unemployment rate held steady at 3.8%, the U.S. Department of Labor said on Friday.

The latest data, which continues the trend of scorching hot hiring earlier this year, is likely to play into the Federal Reserve's decision on whether to cut its benchmark interest rate this year, and by how much. On Thursday, a Fed official warned that interest rate cuts may not materialize in 2024, contrary to expectations of many economists, given the strong labor market and stubbornly high inflation.

What is surprising about the corporate media’s blind acceptance of the BLS data is that it is sharp contrast to the ADP National Payroll Report which came outlast Wednesday, and showed “only” 184,000 jobs.

Private sector employment increased by 184,000 jobs in March and annual pay was up 5.1 percent year-over-year, according to the March ADP® National Employment Report

The BLS reported close to double the number of jobs claimed by the ADP report—and no one thought this was noseworthy!

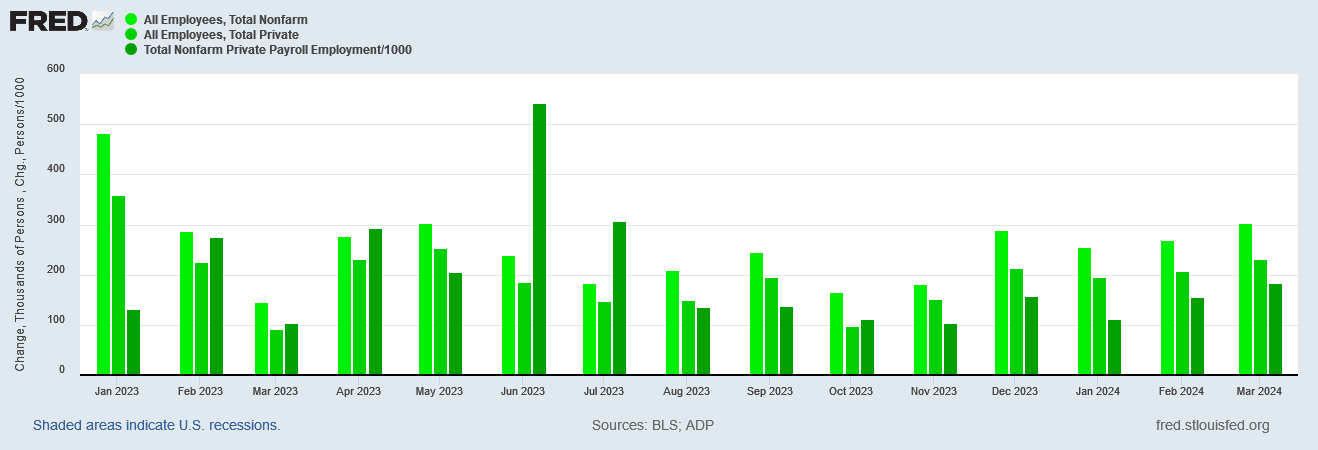

One thing that the multiple sources of jobs reporting do show is that there does appear to be an upward trend in jobs over the past few months.

The seasonally adjusted number of jobs per the Establishment Survey within the BLS report shows job growth has been accelerating since the beginning of the year.

The ADP data shows the same general trend, albeit at lower levels of job creation.

Where things get interesting is in the Employment Level from the Household Survey portion of the BLS jobs report. That metric showed March as the first month this year with actual job growth, although in January and February there has been decelerating job loss.

Still, the data sets are reporting wildly different levels of job creation.

The ADP report has shown consistently lower levels of job growth than the Establishment Survey since August of last year.

Yet in March, the seasonally adjusted Household Survey data showed more job growth than even the Establishment Survey.

Between the Establishment Survey, the Household Survey, and the ADP National Employment Report, we have three inconsistent metrics of job growth in the US.

Which data set do you believe is the most accurate? Within the available data we really do not have any good way to tell. We know the Establishment Survey has the lowest rate of response, but that still leaves the Household Survey data and the ADP data to determine which is the “real” job creation number—if either of them.

As I argued last month regarding the dumpster fire that was the February Employment Situation Survey, the BLS data is simply not to be trusted.

When it comes to the Employment Situation Summary, the headline numbers the BLS puts out for public consumption are simply not to be trusted. When they choose the least reliable data to make their most sweeping assessments, it’s a fair bet they are not using trustworthy data nor are they handling that data in a trustworthy fashion.

This month we have an even greater challenge putting any reliance on the Household Survey, because it has the most extravagant job growth data.

Yet even the ADP data is difficult to accept, because it undershoots the Establishment Survey data by nearly 50%. These metrics are not even close to each other, yet arguably they are measuring the same overall data.

Which one is accurate? There is no way to tell.

Are any of them accurate? There is no way to tell—which means we should assume the answer is “no”.

Not only do the various metrics not agree for the month of March, they haven’t even been close to agreeing for at least the past year. In the case of the Household Survey, even the overall trend is different. ADP reports different numbers than the Establishment Survey, but it broadly shows the same trends up and down as the Establishment Survey.

Yet all three metrics are supposed to be measuring the same data, without much in the way of variation. We might not expect the metrics to be exactly the same, but if the methodologies are sound and the data reliable, we should see at least some semblance of convergence among the three. We do not.

Was there job growth in March? Probably. The three metrics largely agree on that much.

How much job growth? That is unknown. It could be as low as 184,000 jobs (or lower), or it could be as high as 498,000 jobs. That the variance between the ADP gauge and the Household Survey gauge is larger than the amount of jobs reported on the Establishment Survey alone says none of this data can be trusted.

About the only thing more insane than the dysfunctional heap of non-information that is the BLS Employment Situation Survey is that the “experts” from Wall Street all the way to the Federal Reserve are prepared to trust it implicitly.

That is a mistake. This data is not to be trusted.

It doesn’t take a PhD in statistics to see that if the results from the data sets don’t agree, and no one is explaining why, then something’s fishy. WHO is manipulating this data crunch, and WHY? Is it just the bureaucrats kowtowing to the Biden administration because they fear for their jobs if Biden loses the Election, or are there additional explanations? WHAT is going on that is being willfully ignored? You’ve already explained to us, Peter, that irrational things happen in the world of finance because the players all expect to be bailed out. Is there some sort of economic crisis forming that once again is met with expectations of bailout? Inquiring minds are suspicious!

I so very much value your continual reliance on hard data. It makes all the difference in our ability to trust your analysis on every issue. I just read “American Refugees: The Untold Story of the Mass Exodus from Blue States to Red States”, by Roger L. Simon (2023). It had some worthwhile insights, but where was the data? I expected charts, graphs, comparisons of living costs, tax rates, growth rates, etc. from different cities, states, and regions. There was virtually no hard data enabling me to make a decision on where to move. I realized about 50 pages in that Peter’s style of concisely making sense of hard data has spoiled most other analysts for me. You’re the best, Peter! (My gushing for the day.)

BLS Super users.

https://www.zerohedge.com/markets/scandal-rocks-bidens-labor-dept-lying-about-sharing-non-public-inflation-data-secret-group