The Perils Of Believing Lou Costello Labor Math

Letting The Fed Chase Its Own Tail On Interest Rates Will Lead To More Inflation, Not Less

The great sin of the Bureau of Labor Statistics is putting out a sloppy, goal-seeking, manipulated, tainted, corrupt, and functionally useless Employment Situation Summary.

The greater sin, however, is failing to realize what (mis)use the Federal Reserve is sure to make of this garbage report.

In fact, a consensus poll of 81 economists expected job gains to land at around 185,000, according to Refinitiv. After 11 months of aggressive rate hikes from the Federal Reserve, the experts were naturally expecting the economy’s job gains to slow as higher borrowing costs percolated through the economy, slowing investment and growth and pushing companies to pull back on spending and hiring.

For 11 months, we are being told, the Federal Reserve has specifically (one might even say brazenly) sought to undermine American workers by making their jobs progressively more expensive through successive interest rate hikes. Even the corporate media is saying that quiet part out loud.

We must always be mindful that, to the brahmins of the Federal Reserve, the audacity of workers to seek higher real wages lies at the core of the recent high inflation that has been undermining the US economy.

Addressing the Annual Economic Forecast Luncheon in Phoenix, Arizona, Christopher Waller, a member of the Federal Reserve Board Of Governors, claimed that wage inflation was helping drive up consumer price inflation.

Christopher Waller, one of six members of the Fed's board, used a speech in Phoenix, Arizona to urge bosses to take into account inflation when looking at their labor force.

He pointed out that there are now almost two jobs for every person looking for work, and that wages were rising faster than they have in decades - making the target of 2 percent inflation even tougher to reach.

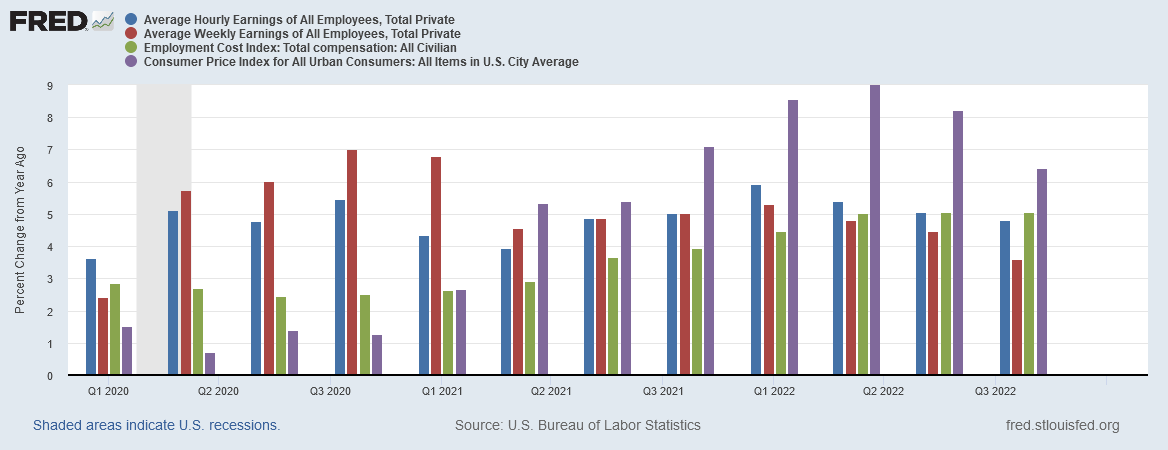

What Christopher Waller failed to mention is that, while wage inflation did surge in 2020 after the pandemic-induced lunatic lockdowns, when consumer price inflation began to seriously heat up starting in 2021, wage inflation began declining, and currently is running several percentage points below consumer price inflation.

The notion that wages are growing is demonstrably pure horse hockey, for while nominal wage growth did exceed inflation during 2020 and the first quarter of 2021, ever since nominal wage growth has lagged behind inflation—meaning in real terms wages have been shrinking for the past 22 months.

Yet the Federal Reserve is still targeting workers—and, by extension, their paychecks.

Jay Powell said as much in his prepared statement to the press after the FOMC raised the Federal Funds Rate on February 1.

Despite the slowdown in growth, the labor market remains extremely tight, with the

unemployment rate at a 50-year low, job vacancies still very high, and wage growth elevated.

Not only is this nonsense due to the decline of real wages, but in nominal terms average hourly wage growth peaked immediately after the 2020 recession, collapsed to near zero in April of 2021, achieved a secondary peak in March of 2022 (the month in which actual job growth stopped in the US), and has been trending down ever since.

Average weekly earnings have broadly followed a similar trajectory, before moving upwards in January.

March, 2021 was the last month either hourly wage growth or weekly earnings growth exceeded consumer price inflation year on year.

As a result, while prices have risen 13.7% since January of 2021, nominal wages have risen only 10.1%, with the difference being the real wages lost to inflation.

Despite this reality, the January Employment Situation Summary, as functionally worthless as it is from the perspective of assessing the state of employment in this country, nevertheless provides the Federal Reserve with ample ammunition to continue attempting to undermine the American worker and shrink workers’ paychecks.

In fact, following the corporate media narrative and their preferred “experts”, the “complexity” of the BLS’ fudging seasonal adjustments and benchmarking is ultimately irrelevant—the Fed will keep targeting jobs regardless.

January’s jobs report came with added complexity, because it included annual updates to populations estimates and revisions to employer survey data.

“Now we know both [2021 and 2022] had faster job growth than we previously realized,” said University of Michigan economists Betsey Stevenson and Benny Doctor in a statement Friday. “The patterns remain the same: Job growth accelerated in the second half of 2021 before slowing in the first half of 2022 and slowing further in the second half of 2022.”

The January reports also bring with them “seasonal noise,” said Joe Brusuelas, principal and chief economist for RSM US.

“I’m advising policymakers and clients to ignore the topline number [of 517,000],” he said, noting it’s likely a function of seasonal adjustments and a reflection of swings in hiring activity and traditional cutbacks that take place from mid-December to mid-January.

“That being said, even if a downward revision takes away 200,000 or so off the top, you still are sitting at around 300,000,” he added.

“The job market is clearly too robust at this time to re-establish price stability; therefore, the Federal Reserve is going to have to not only hike by 25 basis points at its March meeting, it’s going to have to do so at the May meeting,” he predicted.

If the “topline number” should be ignored, then it is impossible for any expert to claim that job growth was faster than previously realized. However, for the purposes of the narrative (and the Fed’s war on workers), such empirical realities count for nothing. The jobs report presents an appearance of a robust jobs market and that is all the cover the Fed needs to keep targeting workers.

Larry Summers, Treasury Secretary under Bill Clinton, is still cheerleading for more recession and less employment. Pancaking paychecks is still the “expert” recipe for economic prosperity.

Summers said it’s a trade-off between short run reductions in unemployment, and permanent changes in inflation.

“The benefit we can get from pushing unemployment low is on almost all economic theories and likely not to be a permanent one,” Summers said. “But if we push inflation up and those issues become entrenched, we’re going to live with that inflation for a long time.”

The US has about 3 million people who have just stopped looking for work. Summers attributed it to older people who decided to retire earlier than normal patterns would suggest during COVID.

Summers is, of course, demonstrably wrong, for if his assessment of those not in the labor force were correct, the alternate unemployment measures the U-4 and U-6 would not have risen in January.

Wall Street has gone all in on the narrative, to the extent that stock analysts and the markets themselves are clearly ignoring a growing number of companies with weak earnings and weaker guidance going forward, basing their market making behaviors instead on what they believe the Fed is going to do next to kneecap workers.

There remains considerable uncertainty about the direction of the economy, especially with Friday’s rapid job growth numbers suggesting it’s still expanding at a solid pace. Overall, however, economists broadly expect growth to slow or even contract due to tighter financial conditions.

“We’re starting to see some of these companies come out and give less than ideal guidance on growth,” said Brian Jankowski, senior investment analyst at Fort Pitt Capital Group. “We’re starting to see those business forecasts for growth line up better with GDP, which is predicted to be very little to flat.”

That has largely been brushed aside in the stock market by speculation that interest rates are nearing their peaks of the cycle, a view that was supported by the Fed’s decision Wednesday to dial back the pace of its move. Sell-side analysts who cover the S&P 500 companies — and already skew bullish — have responded by raising their share-price estimates at the fastest pace since the spring of 2021.

Publicly traded companies are telling Wall Street 2023 is going to have a massive amount of suckage in it—and, frankly, Wall Street does not give a damn.

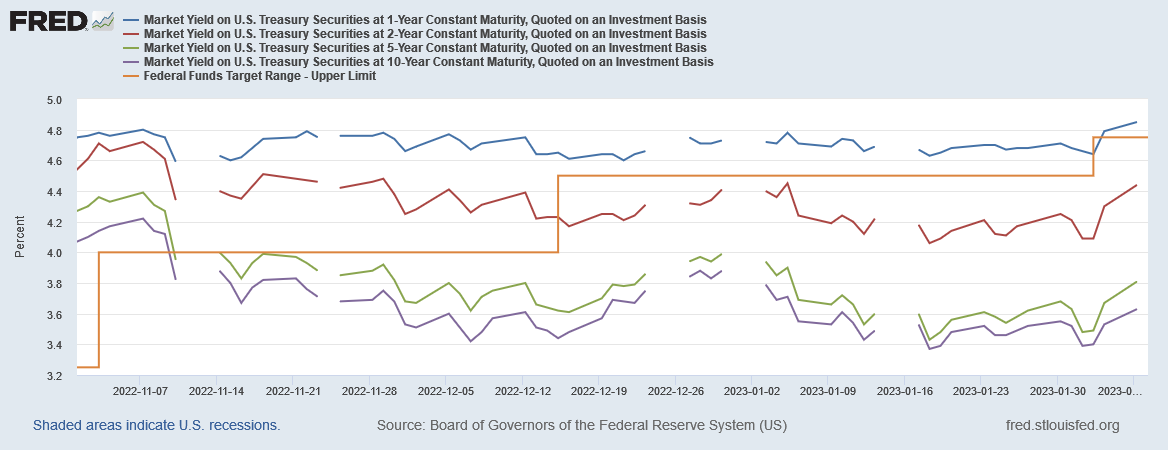

Once Wall Street realized that the BLS jobs numbers, garbage or not, meant that the Federal Reserve was going to keep raising interest rates at least through the next FOMC meeting in March, yields finally began moving higher.

Despite the rises, however, maturities greater than one year still have yields significantly less than the new upper limit of the Federal Funds Rate—the Federal Reserve may be determined to push interest rates up to 5% and beyond, but the market is still having none of it for longer term yields.

The upward movement in Treasury yields, marginal though it was, sufficed to push the equity indices down.

The movement on yields was enough to also push the dollar up against the yuan in forex markets.

The dollar also gained on the euro and the pound sterling.

Marginal movement on yields and the strengthening of the dollar in forex markets is, however, unlikely to have significant impact on overall financial conditions, which remain far looser than stated Fed monetary policy would suggest.

With the Fed chasing what are ultimately false jobs and wage growth numbers, hoping that denting those will bring consumer price inflation back down within 2% year on year, the markets are increasingly demonstrating the degree to which the Federal Reserve has lost control over interest rates, and even over financial conditions more broadly, as financial conditions have actually loosened over the past few Fed rate hikes.

If this trend continues, the Fed will be left chasing its own tail on interest rates, while Wall Street pushes interest rates in whatever direction it desires, and inflation moves however it will.

With the overall money supply slowly shrinking, however, the likelihood that future inflation will be the result of money growth—i.e., demand driven—is slim. Instead, rising prices for inputs is far more likely to generate supply-side inflation—i.e., scarcity—which the Federal Reserve is powerless to address.

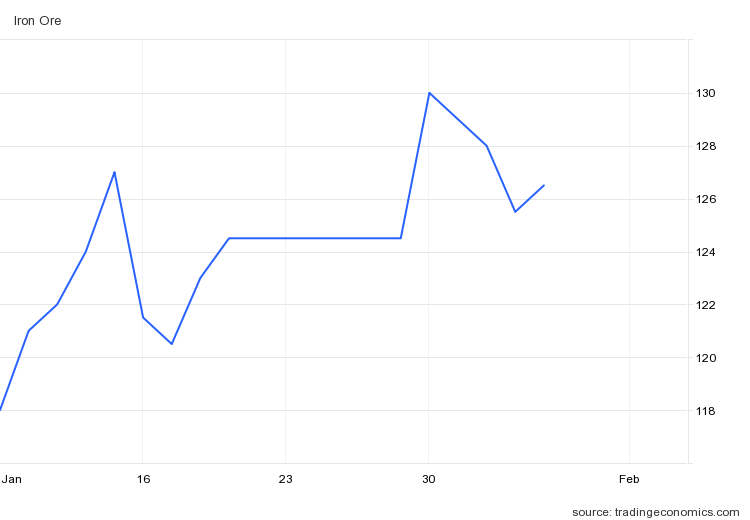

Input prices are rising, as the commodities markets clearly demonstrate. Iron ore has risen over $8 per metric ton during January.

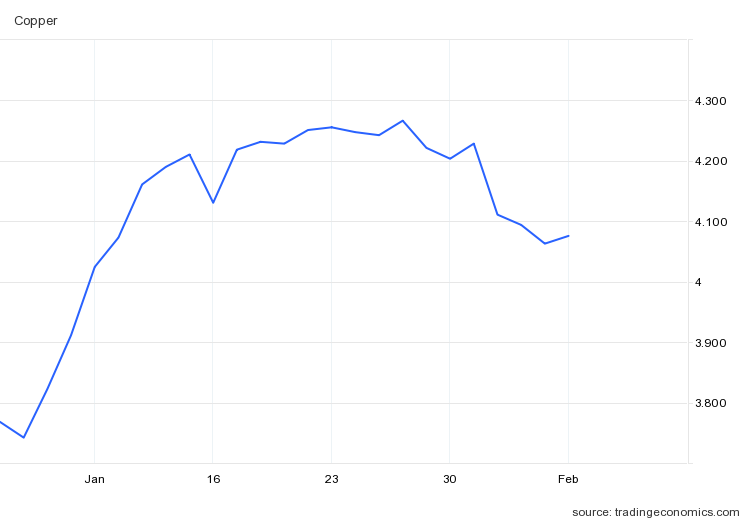

While copper has been trending down in price recently, since the beginning of the year it is still up nearly $0.30/lb.

If crude oil prices reverse the downward price trend begun last summer, commodity prices will reverse inflation’s declines thus far and force it back up again.

This is the great danger of relying on the Fed’s interest rate maneuvers with a view that destroying worker paychecks to choke off consumer demand will resolve all inflationary problems.

By leaving the heavy lifting to the Federal Reserve, even though the Fed’s chosen inflation-fighting tactics are proving less than impactful, Wall Street is utterly unprepared for what happens when those tactics fail and inflation moves higher regardless of the Fed’s actions. If commodity prices continue to rise, if oil prices decide to join them, supply chains the world over will feel the pain, and that pain will show itself in the form of consumer prices rising once more.

When inputs becomes scarce, consumer prices will be pushed up so long as inputs remain scarce. We are already seeing signs that some inputs, particularly metals such as copper, iron ore, and platinum, are rising in price. The longer these trends continue, and the more these trends become the norm in commodity markets, the greater the chance that consumer price inflation will not be tamed by the Fed, but will instead return with a vengeance—at which point the Fed will lose all credibility for keeping it under control.

The Federal Reserve has already lost control over interest rates and inflation. It is only a matter of time before Wall Street realizes this. What happens after that reality sets in remains an open question, but it is highly unlikely to be at all good.

Shopping at Costco last week vs yesterday...ground beef up 25%, $5/# when last week it was $4/#, so no purchase and regret not buying last week. Just one example, every single item I bought was higher than just last week. Vinegar has doubled. I think prices have risen far more than 13.1%, but maybe it's because I live in extreme democratic state. Gas prices are obscenely higher in poorer neighborhoods.