Someone should teach the “experts” at the Federal Reserve some basic math, because apparently they suck at it.

Addressing the Annual Economic Forecast Luncheon in Phoenix, Arizona, Christopher Waller, a member of the Federal Reserve Board Of Governors, claimed that wage inflation was helping drive up consumer price inflation.

Christopher Waller, one of six members of the Fed's board, used a speech in Phoenix, Arizona to urge bosses to take into account inflation when looking at their labor force.

He pointed out that there are now almost two jobs for every person looking for work, and that wages were rising faster than they have in decades - making the target of 2 percent inflation even tougher to reach.

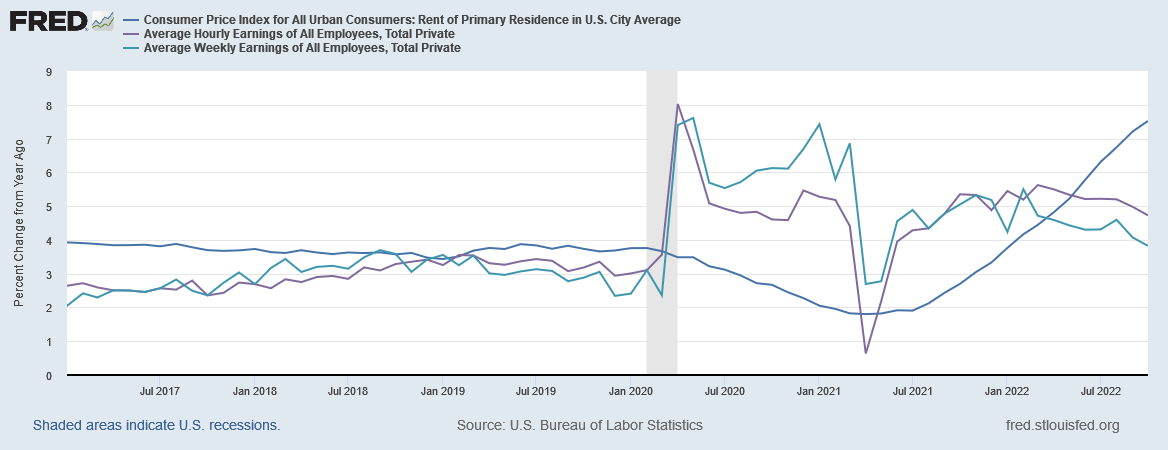

What Christopher Waller failed to mention is that, while wage inflation did surge in 2020 after the pandemic-induced lunatic lockdowns, when consumer price inflation began to seriously heat up starting in 2021, wage inflation began declining, and currently is running several percentage points below consumer price inflation.

In other words, right now real wages are falling, not rising. Workers are being hurt by consumer price inflation. They are not causing it.

Moreover, while the number of job openings presumably is running double the number of unemployed workers, the rates of actual hires and separations has, since 2021, largely remained at or near historical levels.

Apparently, COVID killed employers’ ability to fill job vacancies.

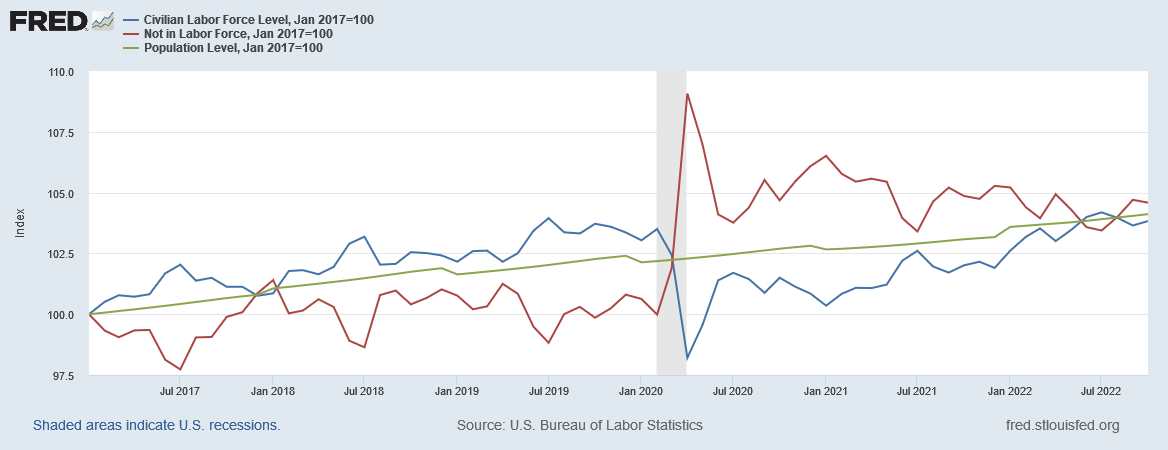

More likely, however, is that the lunatic lockdowns and other insane responses to the COVID-19 “pandemic” killed worker enthusiasm for the labor status quo. How else to explain the growth of people not in the labor force exceeding the growth of both the labor force and the civilian noninstitutional population since the lunatic lockdowns in 2020?

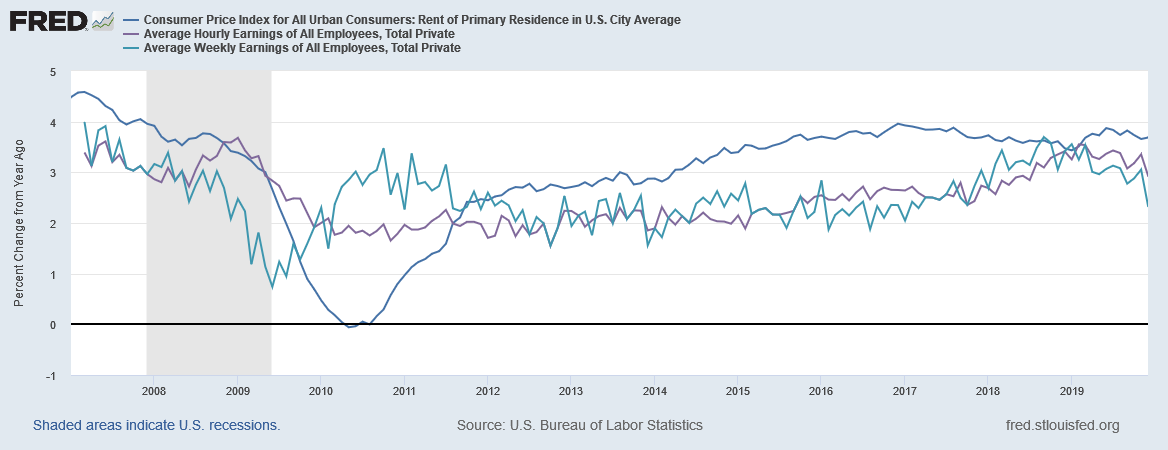

Nor should we overlook what the pre-pandemic status quo was: an economic environment where wage price inflation has consistently lagged rent inflation since at least 2007.

A status quo that has returned in 2022 after a brief interlude in 2020 and 2021 where wage inflation managed to exceed rent inflation.

Remember, as I have said numerous times before, the damage of inflation is not that prices rise, but that relative prices change and distort.

Rent inflation exceeding wage inflation is a prime example of this.

Government lockdown policies created a labor supply shock, causing labor prices—that is, wages and earnings—to briefly surge. Push enough people to the labor force sidelines and those that are left are soon going to realize they have been made relatively more valuable.

Scarcity tends to do that.

Government created the mess of inflation, and now government wants workers to pay to clean it up.

Before the lunatic lockdown, the average hours wage I paid my employees was $15 (Canadian). When our benevolent buffoon masters opened up what was not theirs to close, it shot up to $19. It continues to wreak havoc on my cost flow and structure. It's as if employees noticed there was a labour shortage and leveraged it to their advantage. We had to pay.

Few are worth the $19 and I wonder if there will be a price wage adjustment.

What a bunch of tools.