The World Is Shedding Its Wealth

Chaos Is Coming

It scarcely warrants saying that the world as a whole is heading into a very turbulent time. One would have to be either asleep or part of the zombie apocalypse not to realize that given the nature of today's headlines.

Yet it does warrant attention when virtually all of the world's major stock market indices suffer absolutely abysmal performances during the past month. When wealth is literally vanishing from around the world, that's noteworthy.

Exhibit A: The Dow

Between supply chain disruptions, war in Ukraine, and a feckless Federal Reserve, it comes as no surprise that America's Dow Jones stock index, as well as other major indices--Nasdaq and S&P, for starters—have retreated significantly through the month of April.

The Dow is actually the best performer among American stock indices. For the month it's the tech-heavy Nasdaq that has entered correction territory (-10% or more).

For a time mid month, the Dow was in positive territory. However, the inexorable trend is still very much down.

Europe: Slightly Better But Still Down

Broadly speaking, Europe is the best performer over the past month, with its indices down ~1-3% across the board.

Yet the trend is still very much heading down, with little to suggest a reversal in the near future. In fact, European markets actually reversed already mid month, heading negative for the last half of the month while slightly rising during the first half.

That this stock performance occurs in the second month of the Russo-Ukrainian War is somewhat surprising.

China: All Bad

As was the case the last time I visited the world's major market indices, China is once again in last place behind Europe and the US.

Shenzhen is in correction territory, with Shanghai and Hong Kong not far from it. Unlike Europe and the US, the Chinese indices have been consistently negative for the entire month, with no index showing even a brief upward trend.

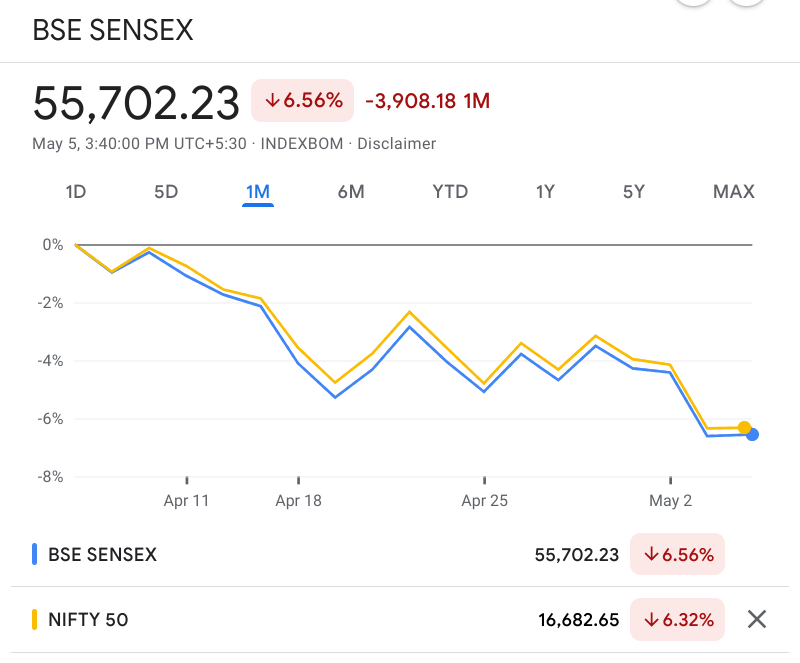

Russia And India

While the bulk of world finance is captured by the markets in the US, Europe, and China, it would be a mistake to overlook the world's second most populous country, India. Like its neighbor across the Himalayas, the Indian bourses have not fared well this past month.

Unlike China, however, there is indication the downward trend may be bottoming out, and the worst of the market decline may be behind it.

Russia, on the other hand, is a split decision, with the dollar-denominated RTS index actually in the green for the month, while the ruble-based MOEX is down.

Fans of the ruble will be disappointed to learn that the dollar's demise is not happening just yet.

No Single Cause

While the general trends of all these stock indices is down, it would be dangerously oversimplistic to ascribe a single cause or group of causes to the decline. There are multiple factors in play for every financial market: inflation, the COVID-19 pandemic, and Russia’s war with Ukraine are but a few of the significant forces at work, with innumerable smaller influences involved as well.

To say the world is a complex place is an understatement!

Yet while there are many forces at work, and while not all forces impact each market in the same way and to the same degree, it is still possible for the net impact of all such forces to result in a confluence of outcomes. When we look at the major market indices of the world, we are seeing just that confluence.

We are seeing a global set of indicators of global economic contraction. Recession is coming around the world. Economic stress is increasing around the world. Wealth, as I said at the beginning, is quite literally vanishing from around the world—when all the markets decline more or less at the same time, the possibility of money and wealth flowing between markets in arbitrage fashion is eliminated, and so the wealth represented by index metrics has, in this case, simply disappeared.

The world is shedding its paper wealth. That is the unmistakable alarm being raised by global market declines. Where there is paper wealth destruction, soon to follow will be increases in poverty, with all the added societal stresses that entails.

Global recession is upon us. Global chaos lies in its wake.

You might be correct but I'm not so sure. There have been many times when the index markets are struggling and it "feels like the big one" this time. It's like a Fred Sanford routine.

I trade but don't really do a lot of "investing" I do look for places to stash some money and hope it won't go lower. The SPY is generally good for this. I still like the idea of buying the indices by proxy, so SPY, QQQ and DIA. Every time it's looked bad or different we end up rallying. Every time something fundamentally is different, but the story still ends the same way. Those who bet against the index markets are habitual losers while those who buy the dips, especially the panic driven, fear induced, VIX spiking dips, keep getting fatter.

I went heavily into UNG and USO after Biden got 81 million votes (and after declaring war on fossil fuels). Putin has helped those plays a bit but they were already doing great on Brandon's watch. I continue to add to these, it seems likely that gas and oil prices will continue to increase for the next few years and there is plenty of upside potential.

Still lots of potential in a lot of things out there, including the index markets IMO.