As I noted earlier, the May Consumer Price Index Summary was something of a pleasant surprise.

There simply is not much that is negative in the May report.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent on a seasonally adjusted basis in May, after rising 0.2 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.4 percent before seasonal adjustment.

With core inflation remaining steady year on year, and headline inflation moving up only incrementally, the May inflation numbers clearly beat expectations.

Even month on month, May’s numbers continued the recent disinflationary trend.

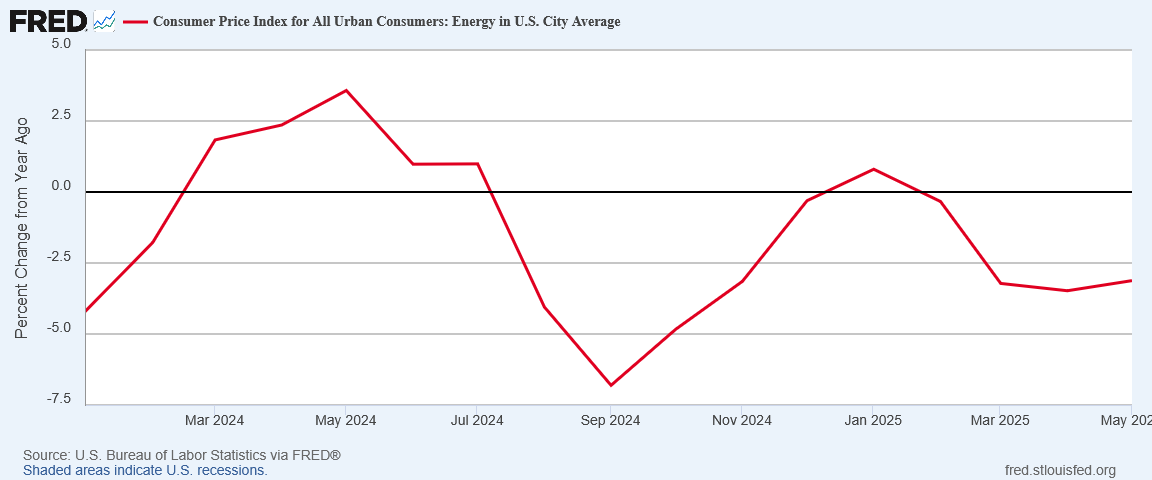

Peeling back the layers, the trend towards disinflation continued, with energy deflation year on year continuing.

Month on month, April’s surge into energy inflation proved not to last, with deflation returning to energy markets.

Even for gas being delivered to residences May saw a return to deflation.

Food was the only area that showed a marked inflationary increase. Month on month food prices went from marginal deflation in April to noticeable inflation in May.

Within core inflation, however, disinflation as the universal theme.

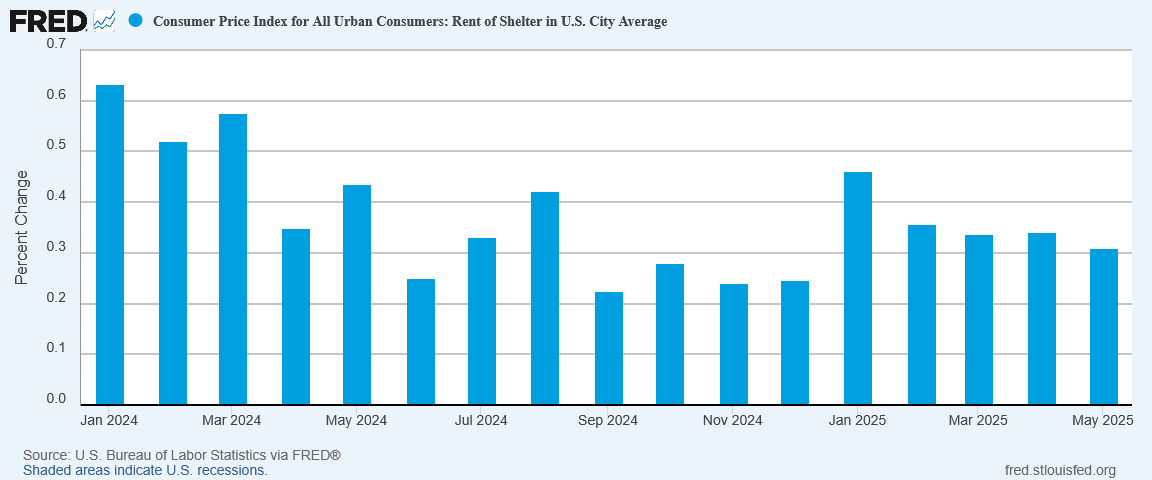

Shelter moved incrementally lower in May.

Even the more forward-looking Zillow Observed Rent Index showed disinflation for May.

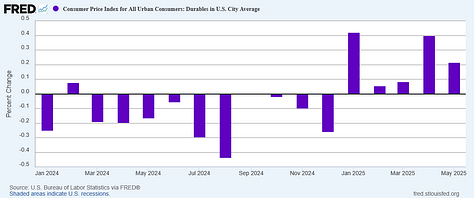

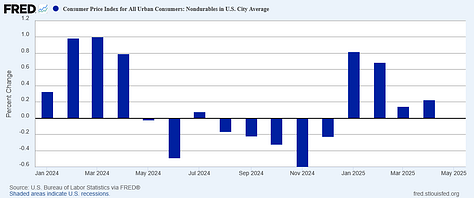

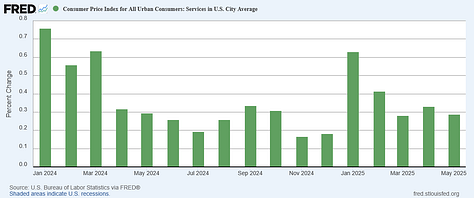

Durable goods, nondurable goods, and services all printed disinflation on the month.

There just is not much inflation in the May inflation report.

Perhaps the most relevant question now is whether or not the inflation numbers will continue to beat expectations.

Unfortunately, there are reasons to believe that they won’t.

As I noted yesterday, market oil prices have recently begun rising.

Commodity prices have also started trending up.

While these are not clear guarantors of higher inflation, energy and commodities are inputs into production processes. When these prices move higher, an inflationary pressure is created across the breadth of the Consumer Price Index.

However, these are the only inflation indicators we see at the moment. Even import prices through April are not yet showing significant moves upwward.

At present, the strongest indicator we have of future inflation is the Cleveland Fed’s inflation nowcast, which is projecting year on year headline inflation of 2.61% and year on year core inflation of 2.95% for June.

We should also note that the Cleveland Fed’s nowcast overestimated inflation again in May. With a full month yet before we have the inflation numbers for June, there is considerable room for the nowcast to shift.

Despite all the naysayers in corporate media that have been insisting that President Trump’s tariff and trade policies were going to produce significant inflation, after nearly five months of the Trump Presidency that significant inflation has yet to materialize. We are seeing some signs that inflation will rise over the summer, in energy and commodities pricing, but those indicators are not backed up by other indicators just yet.

Tomorrow we will get the Producer Price Index data for May, and as the PPI tends to be a leading indicator for the CPI, it may support the possibility of inflation rising over the near term.

Yet for now the assessment of whether we will have higher inflation over the summer or not is still being answered with a non-committal “not yet.”

This is simply a good inflation report, one that does not show the US economy grappling with rising inflation. While it is unlikely to remain that way indefinitely, at present we are not seeing many indicators that there will be a future rise in inflation.

That is good news for the US economy and great news for Donald Trump.

Are you seeing inflation easing off where you are? Leave a comment below or drop one in chat and let me know!

Definitely food prices are not lowering around me. I drive 7 miles to fill my tank in another state that is 50 to 60 cents cheaper per gallon. I also shop a grocery store there. Midwest.

And yet not a single mainstream media outlet will point this out. Shocking.