How much did consumer price inflation change in the December Consumer Price Index Summary from our favorite data provider, the Bureau of Labor Statistics?

In broad strokes, not much. Year on year inflation barely changed in December. Month on month was not so wonderful, as the inflation rate did move up at both the headline and core levels, but even that was far from the highest monthly inflation rate in 2025.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

We should note that the monthly percentage changes in particular are a little problematic for October and November, as an artifact of the Silly Schumer Shutdown, which left the BLS with an incomplete October data set.

The challenge is not insurmountable. To allow for complete graphs what I have done is interpolate CPI values for October as the midpoint between the September and November values. While the graphing engine on the Federal Reserve Economic Data (FRED) data warehouse does not support such methods, the data is fully downloadable. Thus for the second month in a row the graphs are produced locally rather than pulled straight from the FRED website.

What this anomalous situation also forces is more comparisons between December and September’s inflation numbers, which reveals that there is truly not much change in the data. Consumer price inflation, broadly speaking, has been neither heating up nor cooling down.

Winter is still coming for inflation. Winter is simply taking a bit longer to arrive.

Headline Numbers Did Not Move Much

December was one of those months when the BLS’ favorite stock phrase “changed little” very much applied. The headline inflation numbers simply did not move much.

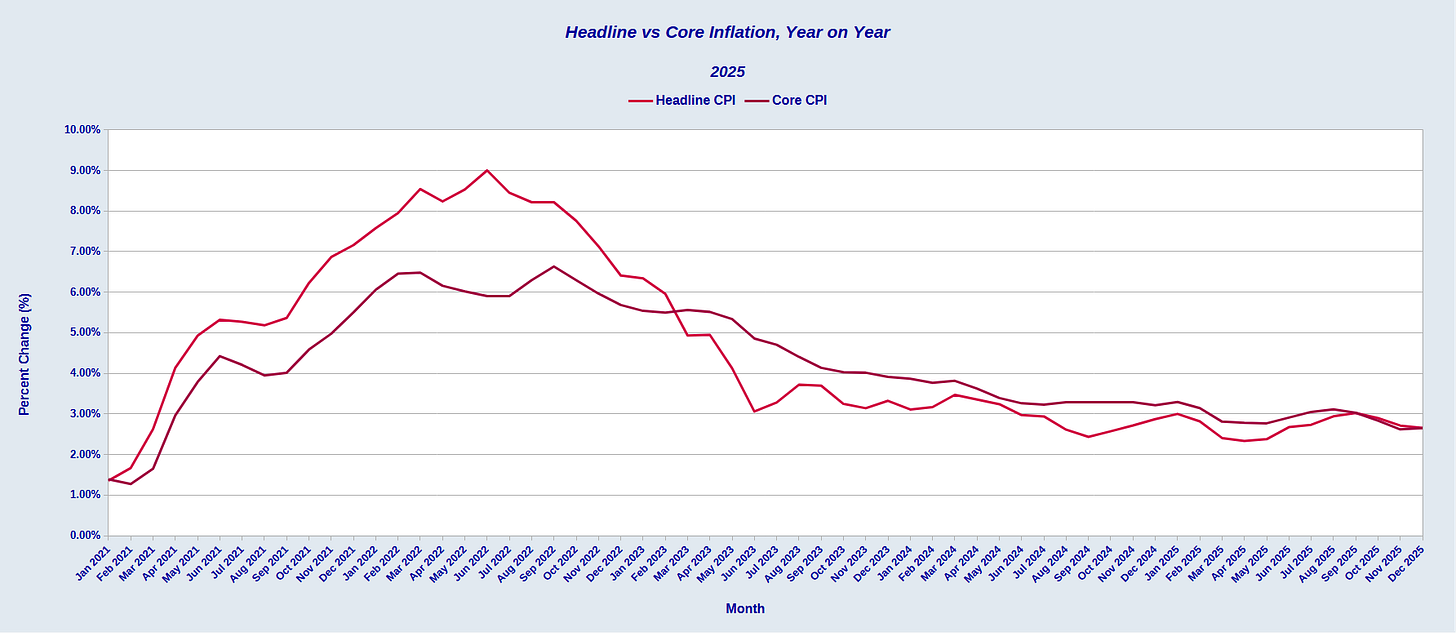

Year on year, the inflation rate was nearly identical.

What is most intriguing about the year on year percentage change is that it has stabilized considerably over the past year. Consumer price inflation, at both the headline and the core levels, simply has not displayed large movements up or down all year.

Price stability is one of the Federal Reserve’s stated mission objectives. Has that objective finally been achieved after the chaos of the 2022 hyperinflation cycle? That is certainly a possibility.

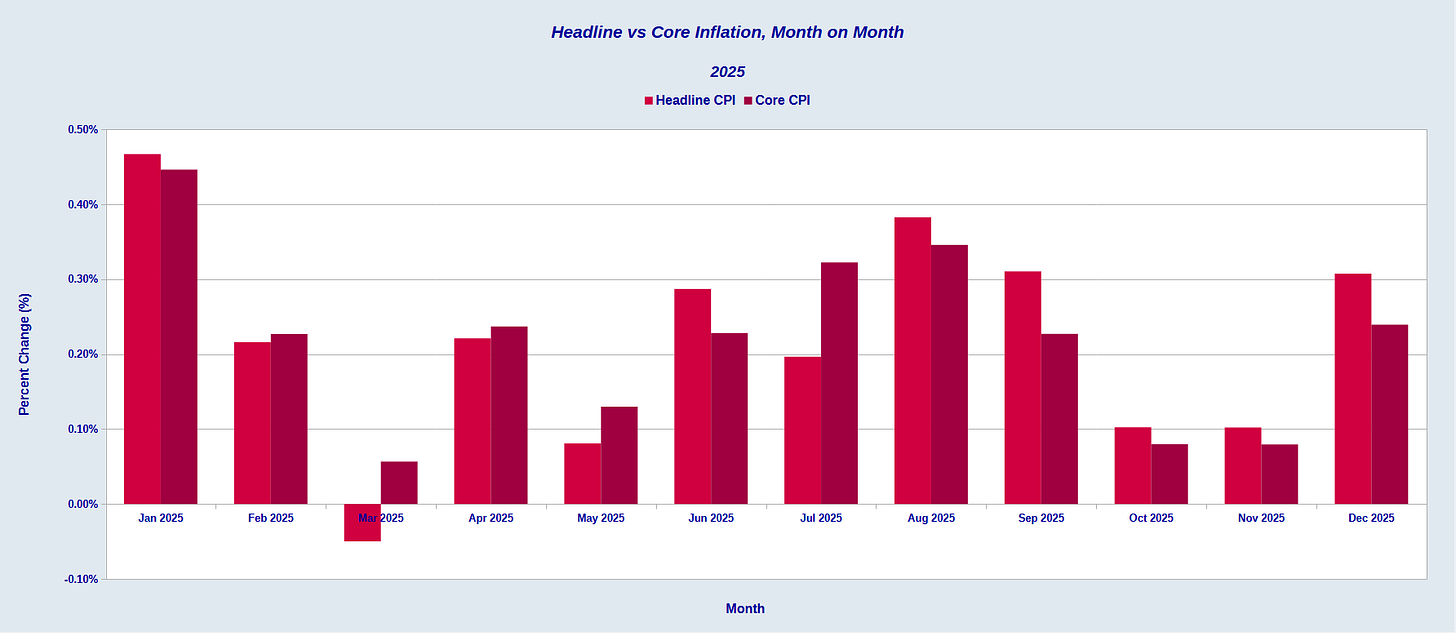

Even month on month inflation was not all that surprising.

While October and November were extremely low, December compares favorably to the September print. From September to December there month on month barely move at all.

This, incidentally, is one of the Federal Reserve’s stated primary mission objectives. Is that objective actually getting met? While we will have to see more months’ worth of data before we may definitively draw that conclusion, there is no denying that the past few months have shown considerable stability.

Detail Data Still Good News

Once again, the trajectory of the data remained largely unchanged in December, even when drilling down into the detail. For the most part, disinflation and/or deflation continued from November.

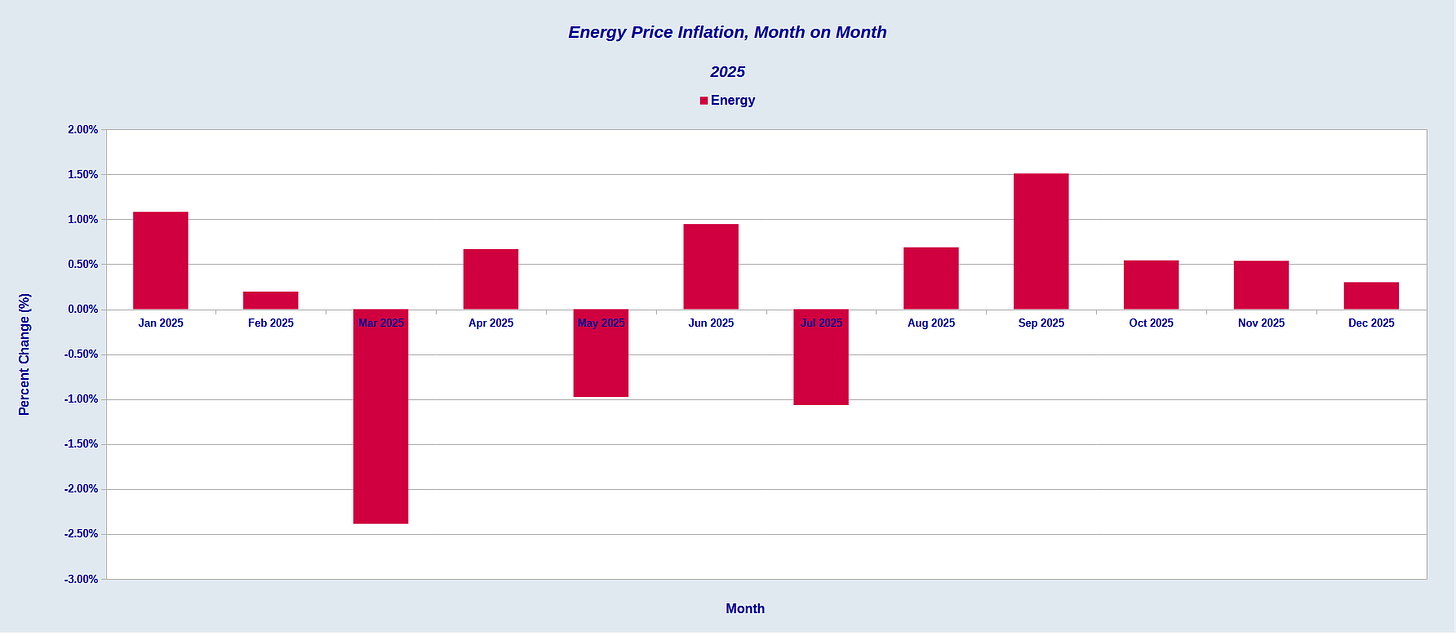

Energy price inflation retreated in December, coming in just below 0.3% month on month.

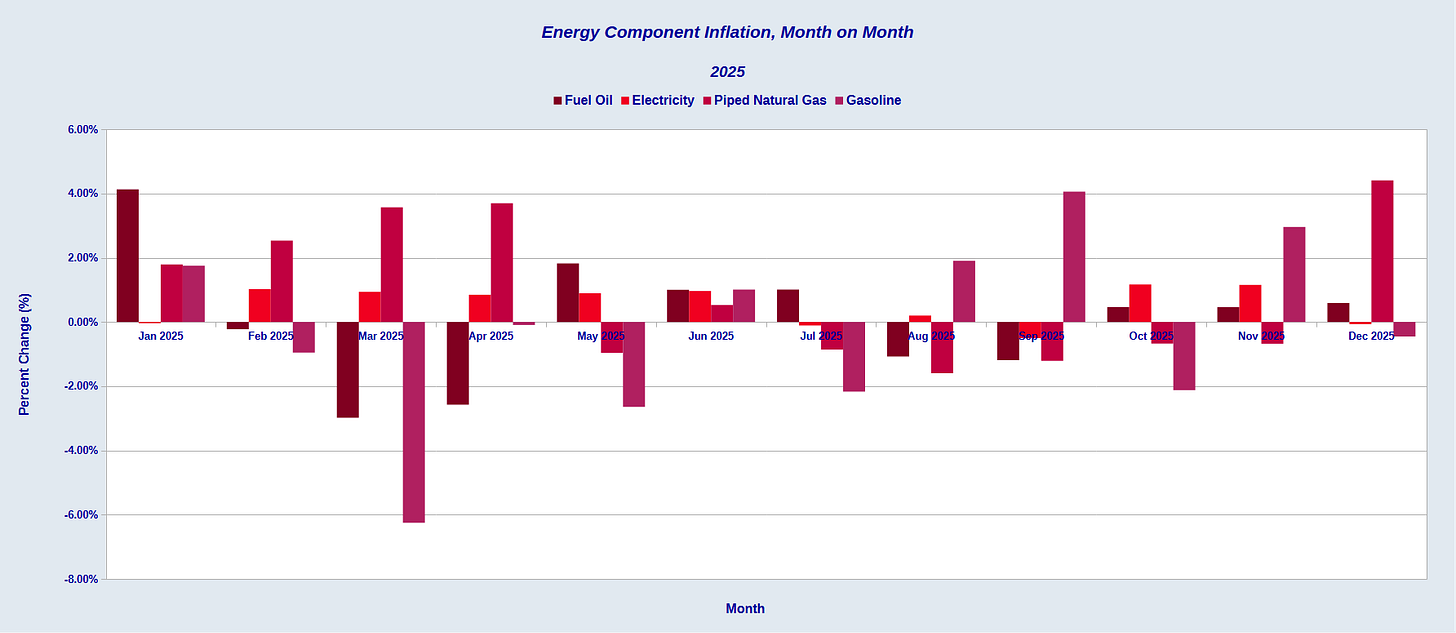

The energy index would probably have been even better if it were not for the seasonal reality of December. The one component of the energy CPI that showed a significant increase was piped natural gas.

It’s not hard to fathom why piped natural gas showed significant price increase in December: the northeast in particular has had numerous cold snaps already this winter. Piped natural gas is used a lot in home heating—given the cold weather in some parts of the country, that price surge is not at all unexpected.

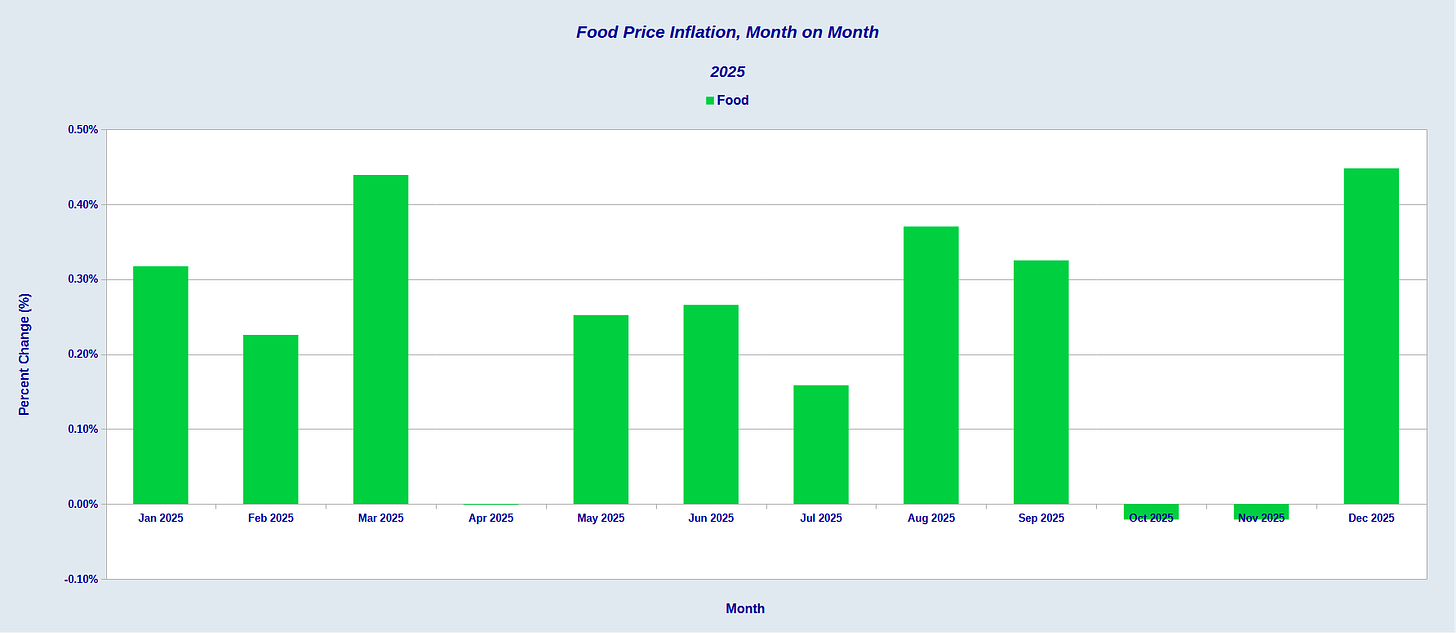

One disappointing metric for December was food, which printed the highest month on month inflation for all of 2025.

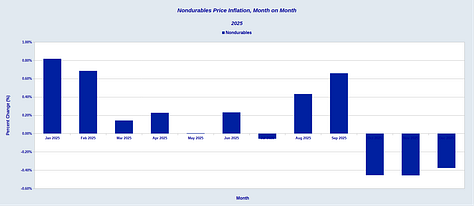

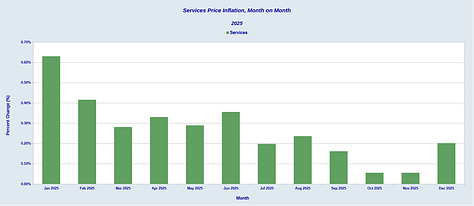

For both durable and nondurable goods, outright deflation remained the order of the day. While services saw a small uptick in month on month inflation, the trend across the entire year was still a disinflationary one.

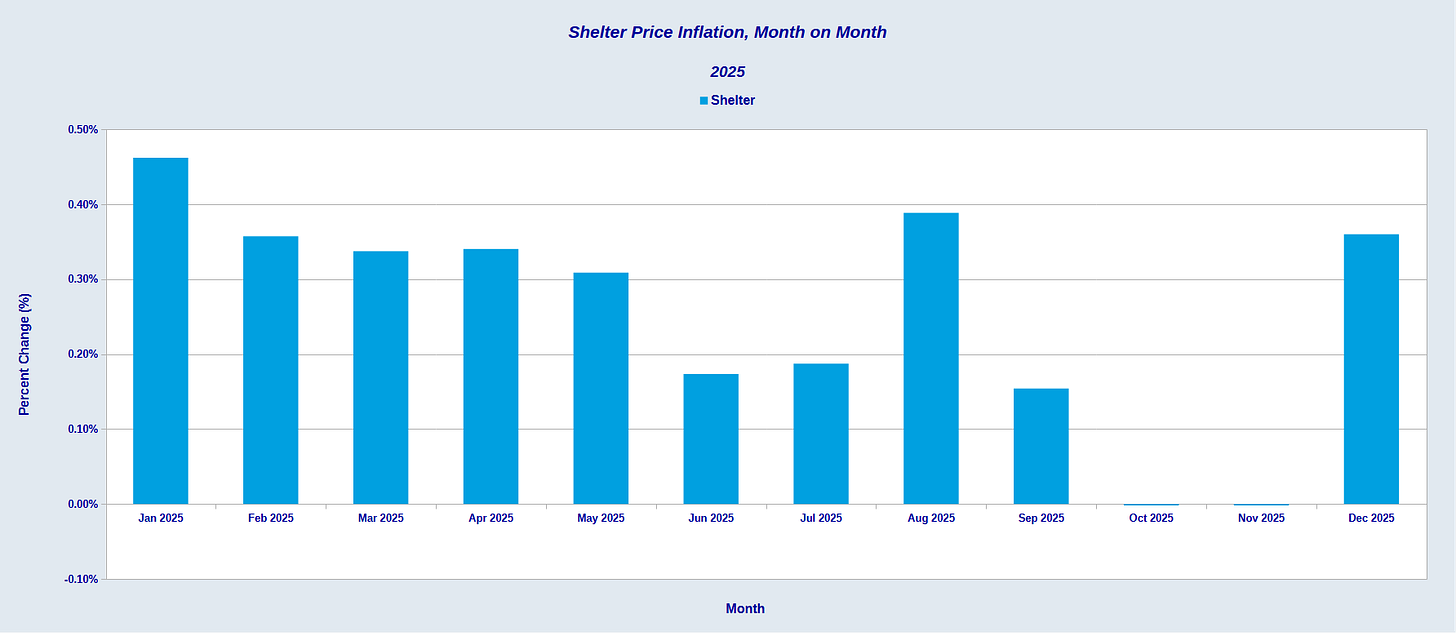

Shelter became the other disappointing inflation metric for December, as it saw a noticeable increase month on month.

However, this upward shift may be more an artifact of the Silly Schumer Shutdown and its incomplete data. We won’t know that for a few more months, yet.

November PPI Confirms Stabilization Trend

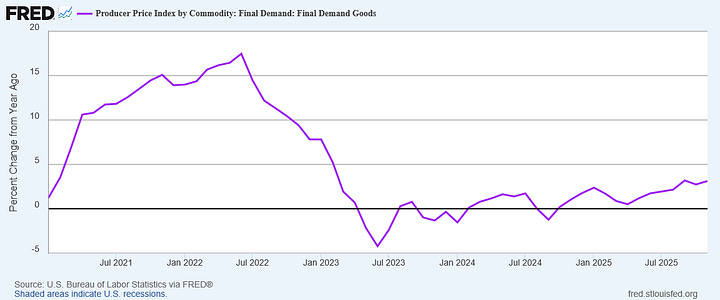

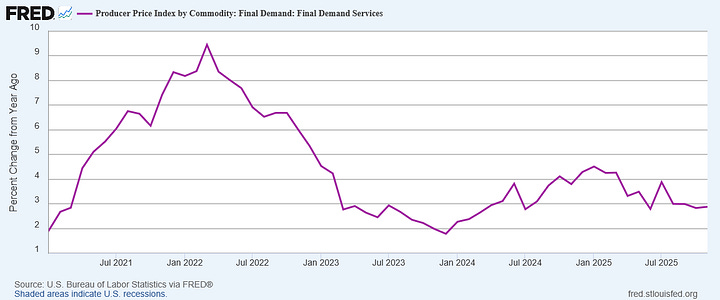

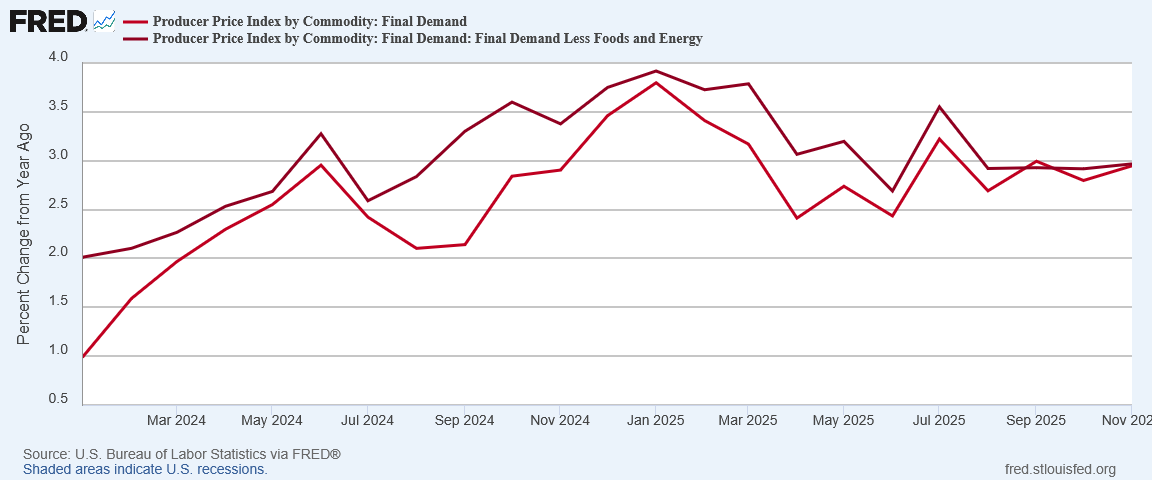

When we look at the November Producer Price Index data, we see a confirmation of this stabilization trend.

The Producer Price Index for final demand increased 0.2 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices edged up 0.1 percent in October and advanced 0.6 percent in September. (See table A.) On an unadjusted basis, the index for final demand rose 3.0 percent for the 12 months ended in November.

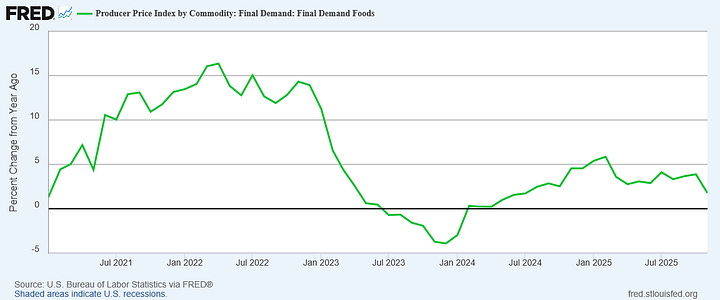

As we can see from the graphs, while there was more volatility in the headline PPI metric year on year, both the headline and core year on year changes have been minimal in recent months.

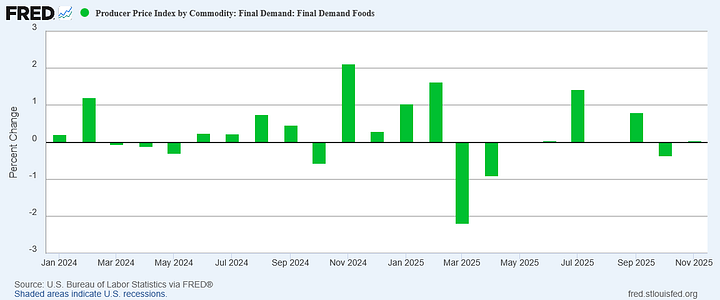

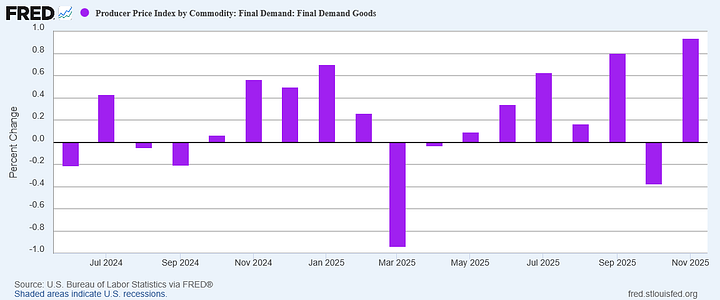

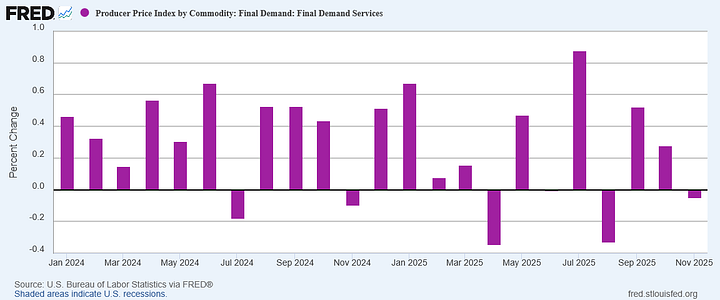

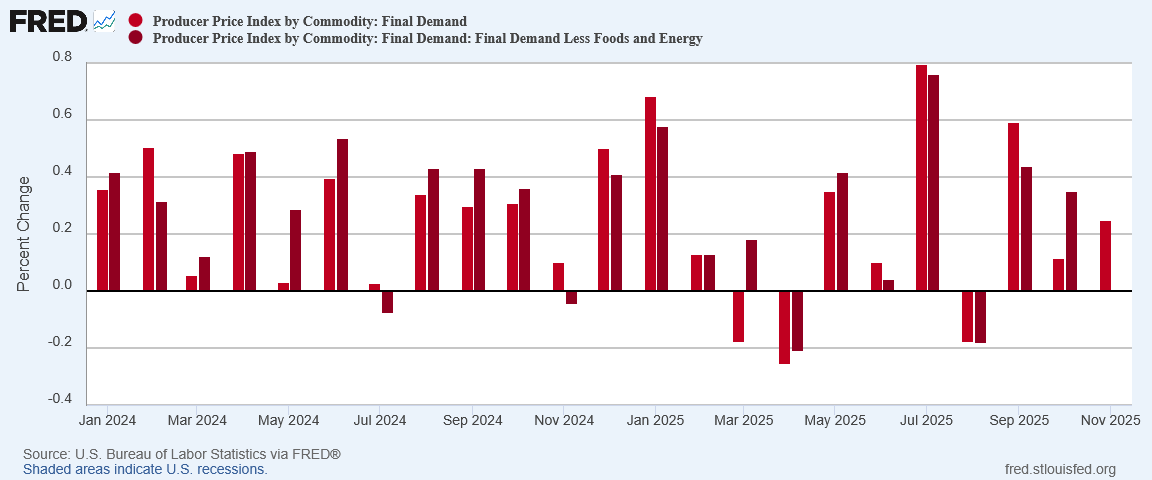

Month on month, the producer price index has been cooling overall since July.

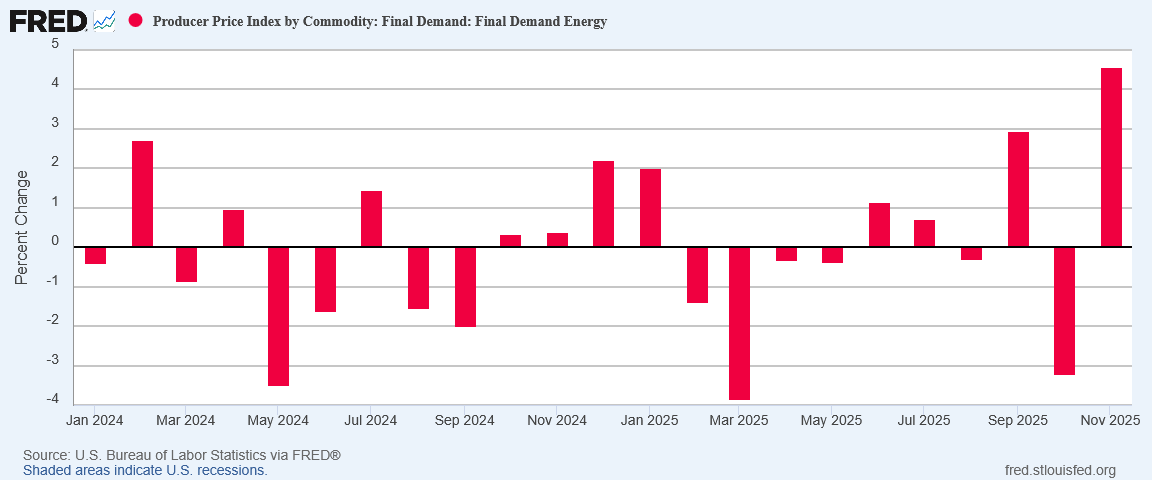

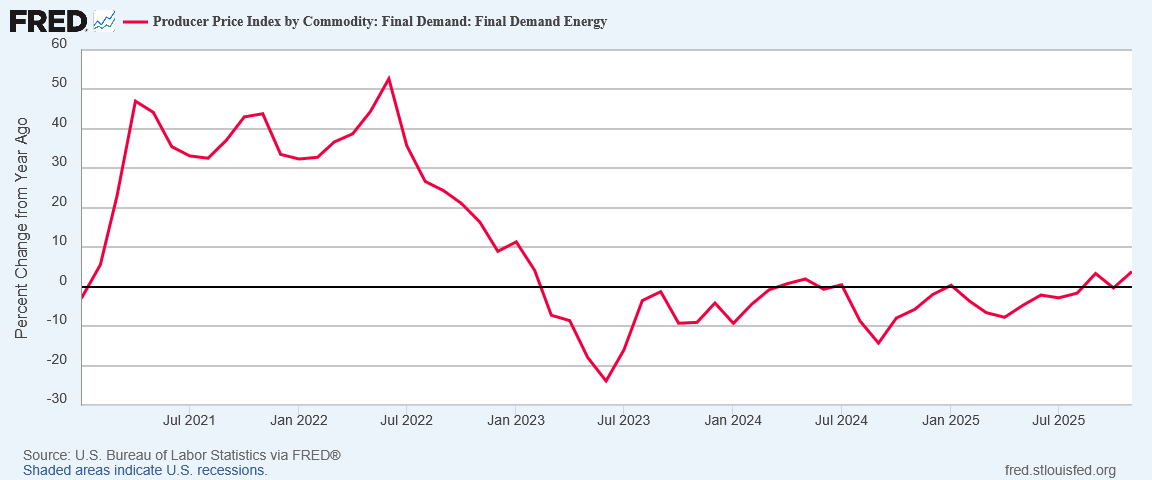

This is the case even though month on month factory gate inflation for energy rose in November to its highest levels all year.

That surge did not translate into a markedly higher year on year factory gate inflation rate for energy, however.

Factory gate inflation for food prices almost disappeared, both month on month and year on year.

While producer price inflation for goods rose both month on month and year on year in November, the presence of deflation month on month in October’s data means there still is not support for the much ballyhooed (and repeatedly debunked) claim that President Trump’s Liberation Day tariffs are driving inflation.

Even service prices continued a downward trajectory within the PPI, printing deflation both month on month and year on year in November.

As the Producer Price Index is broadly apprehended as a leading indicator of inflation trends for the Consumer Price Index. these across the board disinflationary and deflationary trends within the PPI is a strong signal that there is not a significant inflationary pulse to work through to the CPI over the next few months.

Barring sudden price shocks from geopolitical events, there is simply nothing on the horizon signalling greater inflation rather than less.

Reports Are More Affordability Wins For Donald Trump

One clear takeaway from the CPI and PPI prints is that President Trump has won again on affordability, just as he won on affordability last month.

Regardless of where prices are for any good or service, if those prices are largely stable, neither rising nor falling dramatically, it will over time become more affordable as rising wages make those prices a steadily shrinking relative burden.

Across the board, prices are largely stable. There are no major price surges lurking within the details of either the PPI or the CPI. So long as wage growth remains positive, these stabilization trends will have the effect of making goods and services more affordable as rising nominal wages overtake both the Consumer Price Index and the Producer Price Index.

These wins carry outsized political importance for President Trump, because he is not getting many wins from the BLS’ jobs reports. Since right before the Silly Schumer Shutdown, he has not gotten any wins on the jobs front.

That does not help the affordability argument for Trump. The jobs reports make clear that, despite Trump’s love of “Golden Age” rhetoric, America is not in an economic “Golden Age”. While we should not take that to mean that America is going through an economic trial akin to the Great Depression, we still do well to acknowledge that the US economy is not altogether healthy, and is not delivering broad-based prosperity.

Not yet, at any rate.

Overall, the December CPI and November PPI reports show prices becoming a good deal more stable than they have been. Although the CPI metrics are well above the 2% change year on year that is the “holy grail” of the Fed, stability even at a slightly higher rate means goods and services over time are going to become more affordable in real terms.

Unlike for the people of Westeros in George R. R. Martin’s Game of Thrones, for the inflation data “winter is coming” is fairly good news.

Winter is still coming for inflation in the US. The stabilization trends merely mean that winter is taking a longer time to get here.

It took time for the economy to rebound when President Reagan took office. I know that was a long time ago and under a different political climate, but both Reagan and Trump had huge messes to clean up. It’s barely been a year. I know President Trump’s hyperbole is a bit much, but patience is the key.