3.2% GDP Growth? Are You Sure About That?

One Positive Number Obscures A Whole Lot Of Negative Numbers

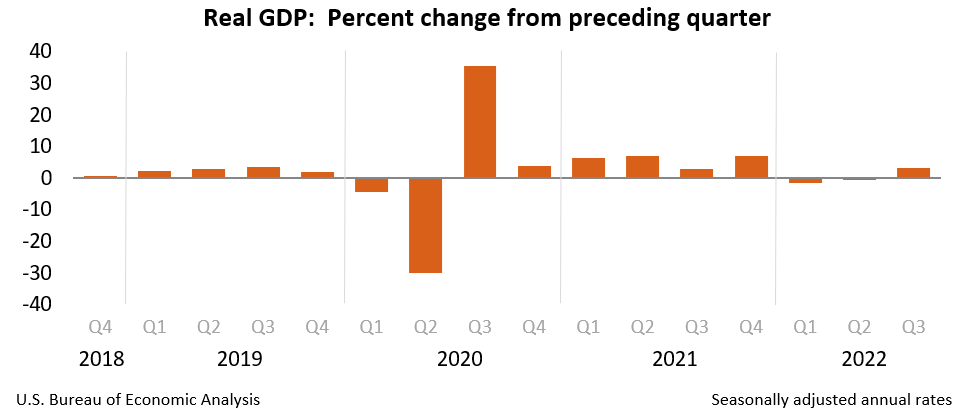

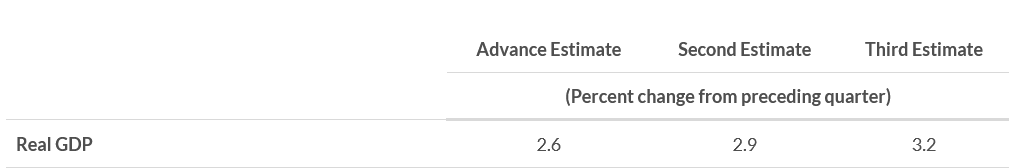

Yesterday the Bureau of Economic Analysis released its final estimate for 3rd Quarter GDP growth in the United States. Coming in at 3.2%, it was a significant improvement over the prior estimate.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. For more information, refer to "Updates to GDP."

Hooray! The economy is growing again….right? Well, perhaps not. There are more than a few disconcerting negatives hiding behind that 3.2% growth estimate.

It is remarkable that the estimates for 3rd Quarter GDP growth have improved steadily with each revision. None of the late data has thrown any cold water on the numbers.

Presumably, all the economic news during the 3rd quarter was good news. Except for the news that wasn’t good.

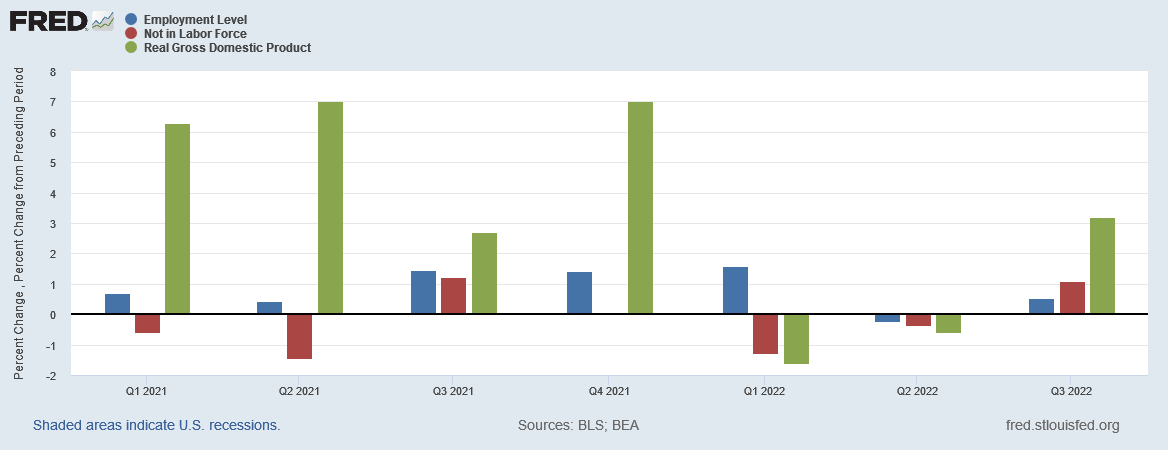

While it is good news that the employment level (Household Survey) increased by 0.5% during the quarter, it is hardly good news that the population not in the labor force increased by more than 1% at the same time.

Yet these evolutions in the nation’s employment produced 3.2% GDP growth.

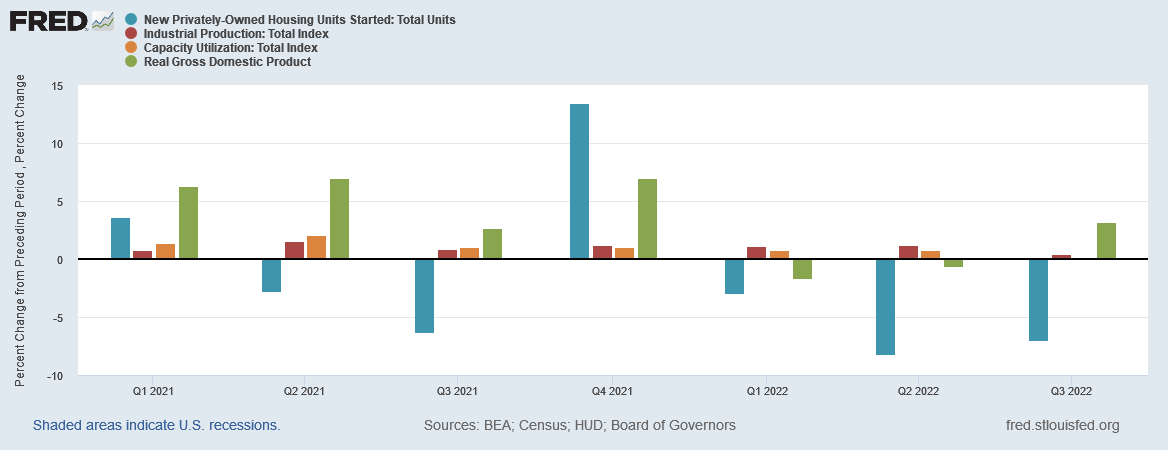

While it is surely good news that industrial production increased by 0.4% during the quarter, it is hardly good news that industrial capacity utilization decreased by 0.01% during that period, and it is very bad news that new housing starts plummeted 6.9% during the quarter.

Yet these evolutions in the nation’s productive output produced 3.2% GDP growth.

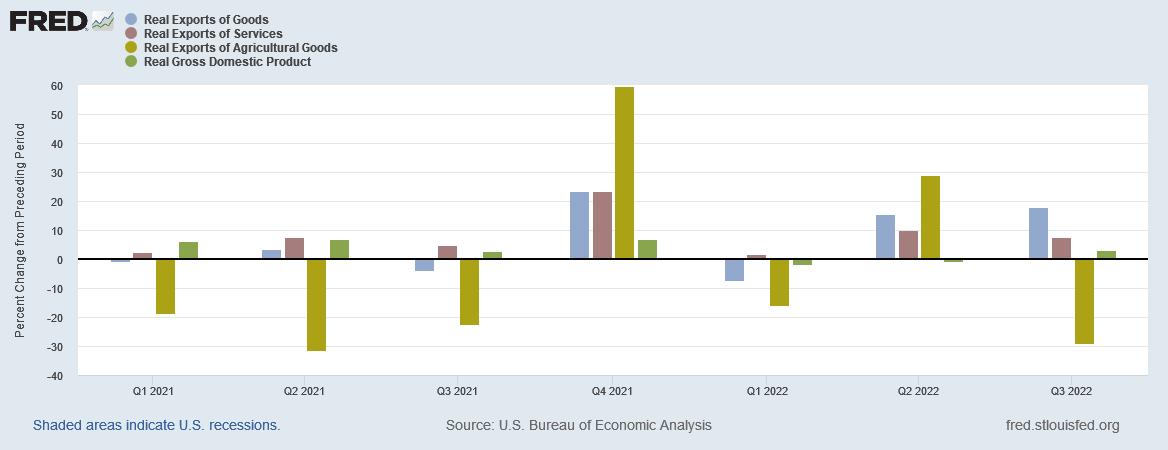

It is good news that the nation’s real exports of goods increased by 17.8% during the quarter, and also good news that the nation’s real exports of services increased by 7.5%. It is not at all good news that the nation’s real exports of agricultural goods fell 28.9% during the quarter.

According to the BEA, these evolutions in the nation’s exports produced 3.2% growth.

That’s a lot of growth riding on just a few positive numbers.

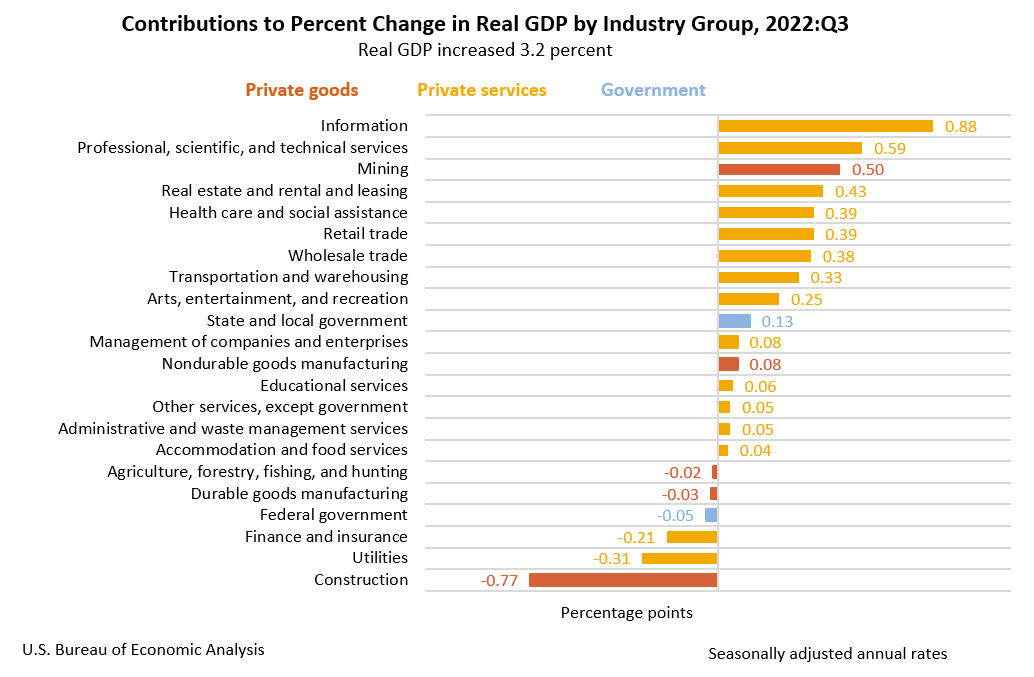

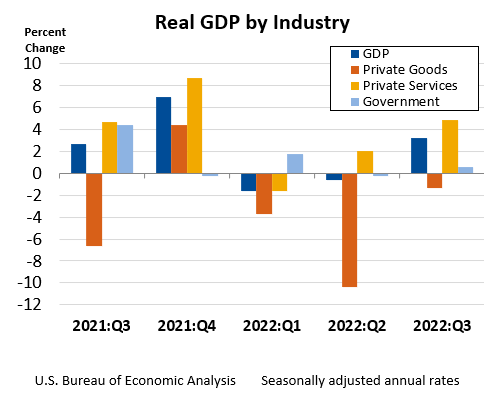

Service growth appears to have been the widest distribution of sector gains.

Within productive output, mining was the major contributor to GDP growth during the quarter.

While the BEA touted increased consumption spending, even they had to acknowledge that spending on physical goods has declined in four of the last five quarters.

Has enough negative data from the second quarter turned positive to justify an estimate of 3.2% GDP growth? The BEA certainly thinks so, and the BEA certainly wants you to think so. However, despite the robust estimate, there is still more negative news than positive news within the GDP growth report.

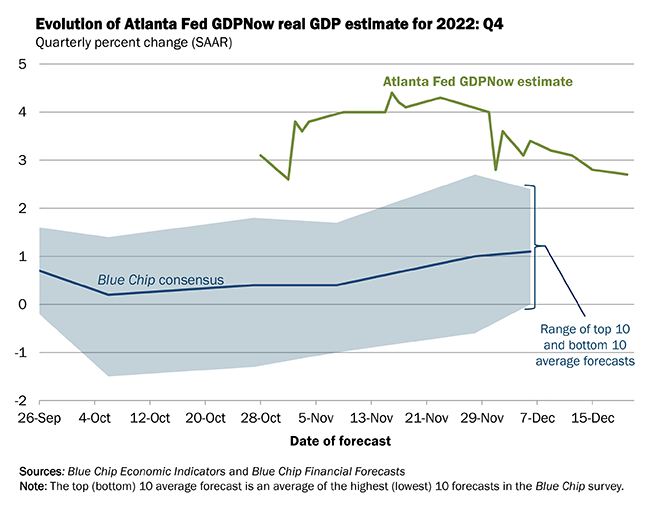

Moreover, the Atlanta Fed’s GDPNow nowcast anticipates the good news will continue, with only a modest reduction in GDP growth for the 4th quarter.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 2.7 percent on December 20, down from 2.8 percent on December 15. After this morning’s housing starts report from the US Census Bureau, the nowcast of fourth-quarter real residential investment growth decreased from -21.2 percent to -21.5 percent.

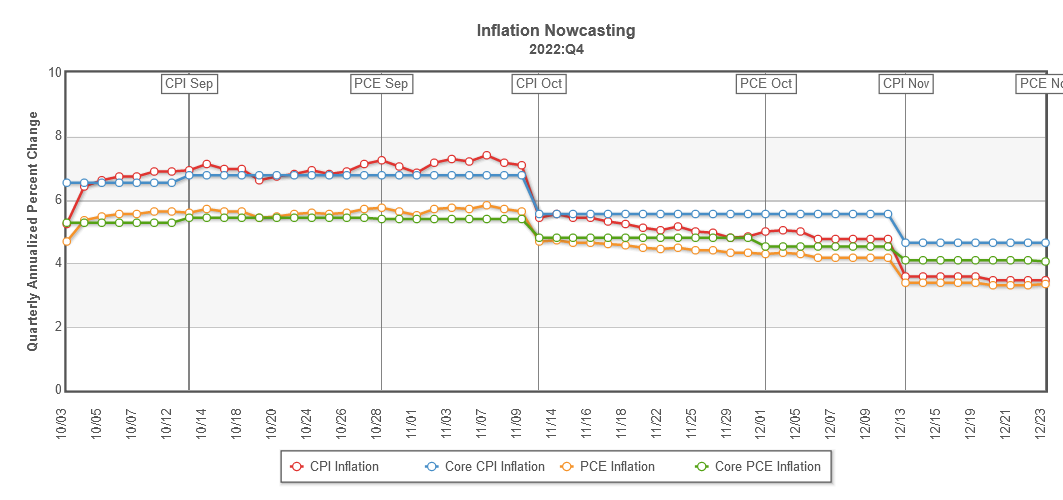

The Cleveland Fed is also projecting hopeful energies on the inflation front, with their nowcast projecting 3.47% inflation for the fourth quarter.

This, of course, is not likely to sit well with the Federal Reserve, as it wants to see economic contraction rather than economic growth, as part of its inflation-fighting strategy (although, if the Cleveland Fed nowcast is on target, there won’t be much inflation left to fight by the quarter’s end).

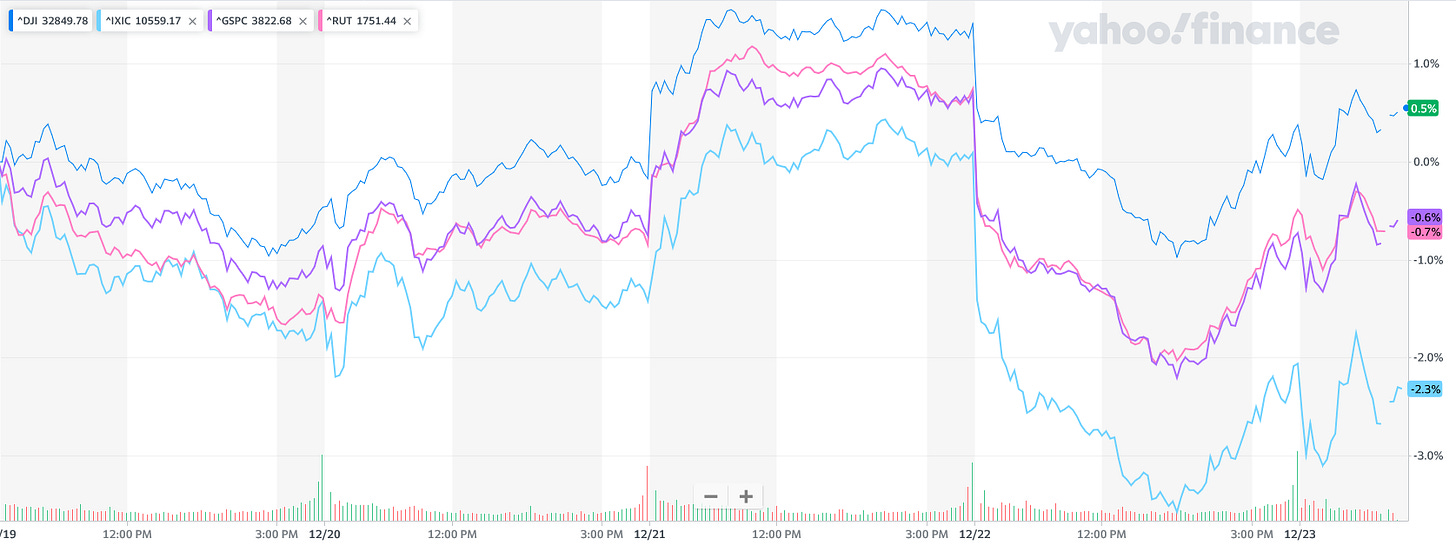

Nor did it sit well with Wall Street, which trended down yesterday on the news.

Why is Wall Street glum on news of robust economic growth in the 3rd Quarter? More than likely, it has to do with the Fed’s fixation on stopping economic growth with interest rate hikes, as was reaffirmed in last week’s FOMC announcement.

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Of course, job gains are nonexistent, as the Philadelphia Fed confirmed.

While unemployment may be down technically, the rise in people not in the labor force still translates into an increasing number of workers sitting on the sidelines.

It’s hard to feel good about economic growth that no one gets to enjoy.

The BEA may be positing robust economic growth for the 3rd quarter, with anticipations of economic growth for the 4th quarter, but, as has been the case so often this year, that one positive number obscures quite a few negative numbers. No matter how robust overall economic growth appears to be, there are multiple sectors of the US economy that are not growing, but contracting. There are multiple sectors of the economy that are experiencing recession, not expansion.

How well is the economy doing? That depends mightily on where you stand within it—a context to which the BEA is completely oblivious.

Scamdemic... Scaminflation...Scamjab....Scamrecession...ScamGDPgrowth... if it weren’t Scams, there’d be no events at all!