Last month I examined the economic state of both the US and China, with particular scrutiny to both country’s central bank monetary policies. My initial conclusion then was that neither central bank was managing their brief well.

Both the Federal Reserve and the People’s Bank of China have failed in their fundamental mission of shepherding the national economy for their respective countries. The relevant question going forward is going to be which central bank has failed the most and done the greatest damage.

With a month having gone by, it is appropriate to take another look at the situation, to see what has changed and to see if there are any new lessons to be learned.

Financial Picture Is Still Grim

As the Year-To-Date results for US and China stock market indices show, the financial picture for both countries is still pretty grim, with all indices down significantly.

Yet China has for the second month had a better time of it than the US. China’s markets have posted steady if slight growth, while the US markets have continued to decline.

As an economics professor of mine used to say (sardonically): “when you have two points…that’s a trend!” This may very well be a trend forming, where the Chinese markets outperform, at least nominally, their US counterparts in the short term.

Why might this be happening?

Recession Is Key

As most of my readers are already aware, the dominant economic news story in the US lately has been our inexorable slide into recession and ultimately economic contraction, due in no small part to the Federal Reserve’s ultimately misguided approach to interest rates.

For years the Fed has been kicking the economic can down the road, always looking to postpone the inevitable economic reckoning for its deficient stewardship of the money supply.

The Fed has finally run out of road. The reckoning—the contraction, the recession, the deflation—is here.

The “experts” at the Fed might hope to still postpone that reckoning. Sane people know they no longer can.

As the Fed has reacted to red-hot inflation rates by raising interest rates, the economy is poised to enter a “technical recession”—two successive quarters of no GDP growth—with the Atlanta Federal Reserve projecting zero GDP growth for the second quarter.

While it would be an extreme exaggeration to suggest that the whole of the economic contraction lies at the feet of the Fed and its interest rate hikes, the fact is the Fed has raised rates significantly since the beginning of the year.

China, on the other hand, has kept its interest rates steady, after having lowered them dramatically in previous months.

China Is Goosing Its Money Supply

China’s lowered interest rates speak to a looser monetary policy. We see this in the money supply of both countries. For both the M1 and M2 money supply metrics, the US money supply has declined in recent months.

At the same time, China’s money supply has grown for both the M1 and the M2.

China’s looser monetary policies appear to have been well received by the stock markets—at least for now—based on the indices presented above.

Intriguingly, while China has pursued a policy of low interest rates and an expanded money supply, it has done so while actually reducing its central bank balance sheet, while the Fed’s balance sheet has yet to decline.

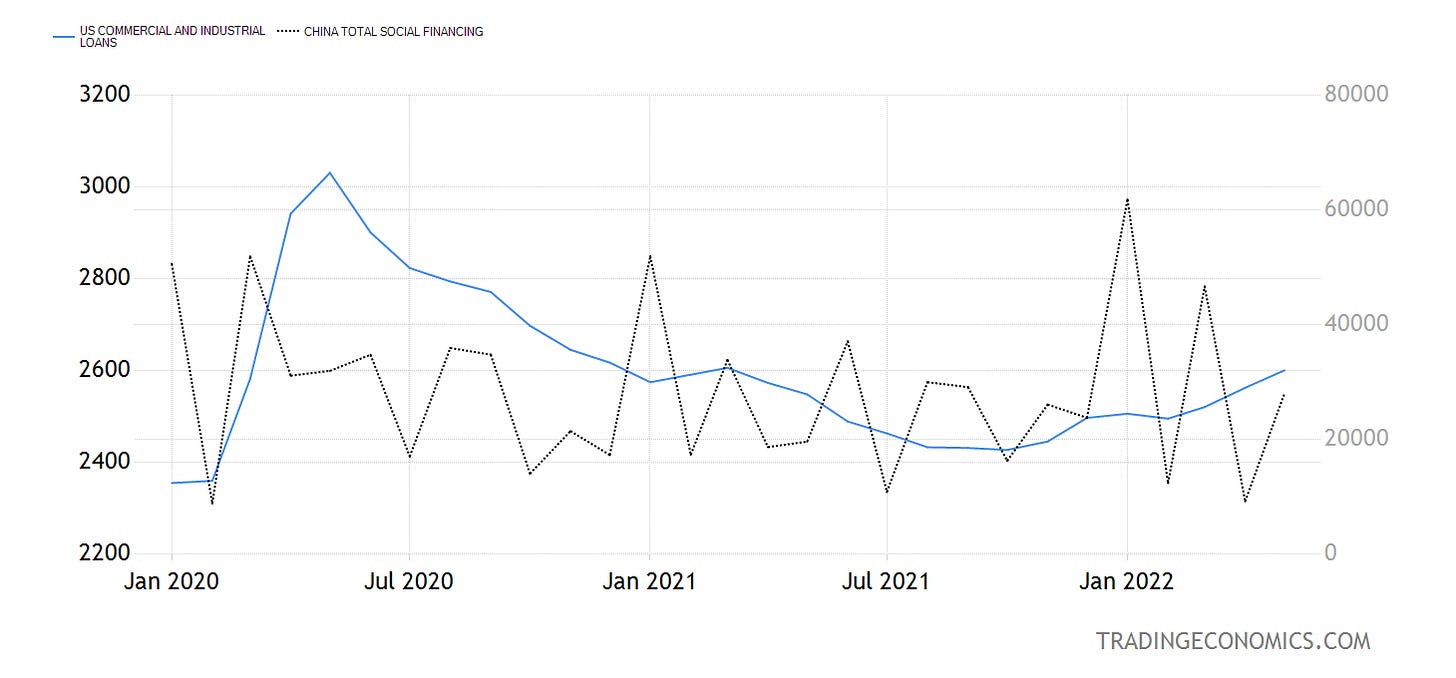

As was noted last month, the net effect of the Fed’s policies has been steady growth in private commercial loans since late last year, while the PBOC has had far more uneven results.

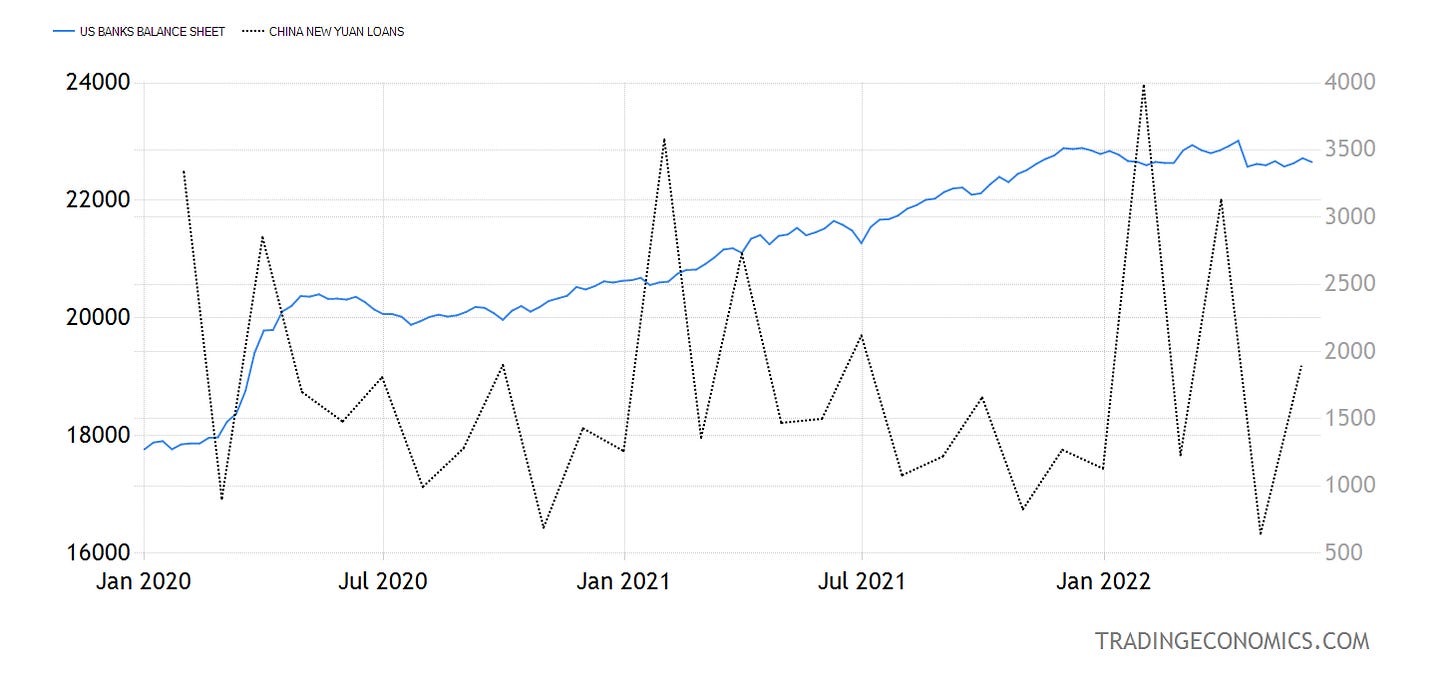

Likewise, Chinese banks continue their roller-coaster behavior of expanding and contracting their balance sheets, staging a rebound last month, while US banks have only modestly declined, after sustained and mostly steady expansion during the past two years.

Short Term Trend, But Not A Long Term One

While over the past two months China’s monetary policies have been conducive to better market performance for their stock markets, the singular characteristic about banking activity in China is that it is prone to abrupt and extreme reversals. While the Fed’s policies invite many criticisms, one thing that can be fairly said in its defense is that its policies produce more stable banking activity.

Thus while China is having some seeming success today with its looser monetary policies, the tendency of banking activity in China to experience sharp rises and falls month to month makes that success an unlikely long-term trend. Indeed, only three times since the start of 2020 has China shown back-to-back months of increasing commercial loans, making the prospect of a downturn in loan activity next month a significant probability.

Similarly, the Fed has been rather aggressive on interest rates, after months of being nearly comatose. Thus while the Fed’s policies have historically produced a more stable banking climate, it will be yet another month before we see the impact of the Fed’s most recent 75bps rise in interest rates on US banking activity, which makes further decline in banking activity for the US also a distinct probability.

This murkiness about what the future holds for either the US or China may be one reason the dollar has mostly moved sideways with respect to the yuan over the past month.

No Long Term Stability

While the Fed’s policies have produced more sustainable trends for private enterprise than the PBOC methods, neither insitution has ultimately provided the long term macroeeconomic stability that is the only justification for a central bank’s existence. The PBOC’s more brazen manipulations are patently destabilizing, but even the Fed’s approach has left it in the position of having to deliberately force a reduction in banking activity simply for the sake of its own credibility.

On that basis, central bank intervention must still be seen ultimately as a failure. Whether strong or subtle, central bank manipulations of a country’s money invariably produce their own problems rather than solutions to whatever economic shortfall a country might be experiencing. Far from delivering long term stability, central bank intrusions into the economy inject their own destabilizing consequences which cannot be avoided even by further central bank intrusions.

What all central bankers fail to apprehend is that, with or without their manipulations, markets happen. This was true when Adam Smith wrote Wealth of Nations and it is true today—in fact, Smith’s key realization was that market dynamics will continue despite any efforts by governments or bureaucrats to steal their thunder.

Adam Smith’s “invisible hand” is, in the end, the only winning hand in any economy.

Ultimately, central banks fail because central bankers fail to understand that not only are they not needed, they are invariably unhelpful. The best thing any central bank—and by extension any government—can do for its economy is to simply step aside and let markets function freely. The moment they intervene in those markets, they diminish the very economy they purport to grow.

PNK, we saw Justin 'DooDoo" attempt to seize accounts & property in Canada relative to the trucker protest, which engineered a sharp push back presumably by the WEF.

Do you expect similar broad action in the US by the Fifth Column Biden Administration perhaps against not only Donald Trump but his supporters and other 'members' of the vaunted 'insurrection' such as Russian and some Ukrainian Oligarchs, certain Republican politicians, former cabinet members, secretaries of state, defense, energy, interior, HUD, as well as political appointees, former & current 'conservative' judges, DAs, Attorney Generals, Supreme Court Justices, and literally any political operative 'on the other side' whether in the US or some other country as well as private business such as any which has ever made a donation to the Trump campaign.

If you wanted to finish off the US dollar as the world reserve currency this would certainly do it!

It would also be in line with a full blown "Crony Capitalism Communist" takeover.