This being the end of the second quarter of 2022, it’s a busy day on the economics front.

Earlier we had the BEA’s relase of the May Personal Income And Expenditures Data, which notionally show inflation “cooling” (if you look at the headline numbers and ignore the major things people buy), but actually show growing imbalances within the economy while economic activity itself is declining.

For everyone outside of the Federal Reserve, that means we’re in a recession.

Also today were the BEA updates on first quarter GDP—in other words, admitting what it wanted to avoid back in April, which is that the suckage factor in the economy is high and getting higher.

Real gross domestic product (GDP) decreased at an annual rate of 1.6 percent in the first quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2021, real GDP increased 6.9 percent.

For everyone outside of the Federal Reserve, that means the first quarter was worse than they first said. In April, the BEA said first quarter GDP was down by 1.4%. In May, during the second revision, the BEA put first quarter GDP decline at 1.5%.

Inflation Was Worse Than First Thought

I’ve said before that inflation is tantamount to recession, and the BEA’s 1Q GDP numbers bear that out.

While “real” GDP decreased by 1.6% in the first quarter, nominal (current-dollar) GDP actually rose 6.6%. The difference between the “real” GDP decline and the nominal GDP increase is, of course, inflation.

The price index for gross domestic purchases increased 8.0 percent (revised) in the first quarter, compared with an increase of 7.0 percent in the fourth quarter (table 4). The PCE price index increased 7.1 percent (revised), compared with an increase of 6.4 percent. Excluding food and energy prices, the PCE price index increased 5.2 percent (revised), compared with an increase of 5.0 percent.

Again, note the word “revised”. The BEA’s initial take on the first quarter was a 7.8% increase in the price index for gross domestic purchases and a 7% increase in the PCE index. Oddly enough, “core” PCE (PCE ex food and energy) remained unchanged—which means that food price inflation was worse than first thought, as was energy price inflation.

Everyone who sees the official stats and says “no, inflation is worse than that” was right. It is worse. It just takes the government a while to (sort of) acknowledge that. Because politics. Because bureaucracy. Because reasons.

People Are Spending More And Getting Less

Inflation invariably means people pay more to buy less, and the first quarter numbers are no exception. Not only did personal income drop during the first quarter, personal savings declined as well.

Disposable personal income decreased $58.8 billion (revised), or 1.3 percent, in the first quarter, in contrast to an increase of $72.4 billion, or 1.6 percent, in the fourth quarter. Real disposable personal income decreased 7.8 percent (revised), compared with a decrease of 4.5 percent. Personal saving was $1.02 trillion in the first quarter (revised), compared with $1.45 trillion in the fourth quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 5.6 percent (revised) in the first quarter, compared with 7.9 percent in the fourth quarter.

Yet while people have less money to spend and are saving less of it, businesses are not getting more of it.

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $63.8 billion (revised) in the first quarter, in contrast to an increase of $20.4 billion in the fourth quarter (table 10).

Profits of domestic financial corporations decreased $51.1 billion (revised) in the first quarter, compared with a decrease of $1.3 billion in the fourth quarter. Profits of domestic nonfinancial corporations decreased $4.8 billion (revised), in contrast to an increase of $5.0 billion. Rest-of-the-world profits decreased $7.9 billion (revised), in contrast to an increase of $16.8 billion. In the first quarter, receipts increased $17.7 billion, and payments increased $25.6 billion.

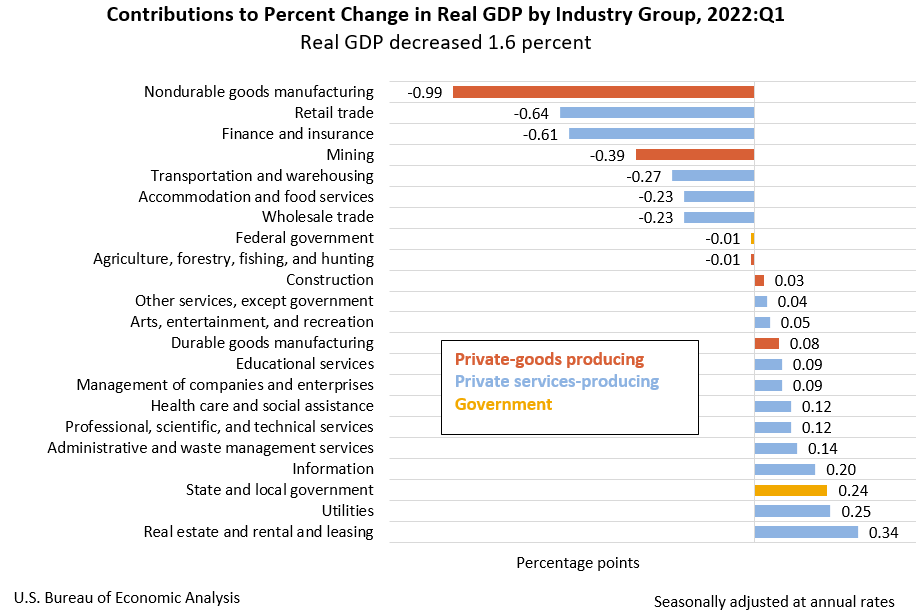

So where are people spending their money? According to the BEA, the top contributors to 1Q GDP were government, utilities (energy) and housing.

The Fed Is Completely Clueless

Despite the tide of negative news about the economy, the Fed still “just doesn’t get it.” As recently as June 21, in a speech to the Richmond, Virginia, Risk Management Association, Richmond Fed President Tom Barkin put his economic illiteracy and mastery of doublespeak on full display.

Barkin began with the now standard Fed mantra to do “whatever it takes” on inflation.

So, first: “Will inflation return to normal?” That answer is simple: yes. Inflation is too high. But the Fed has the tools to contain inflation over the medium-term, and we are committed to returning inflation to our target. You’ve likely seen that over our last three meetings we have raised rates 150 basis points, started shrinking our balance sheet and signaled there are more rate increases to come. We are meeting the test we face and have made clear we will do what it takes.

However, further on down, Barkin said the quiet part out loud about what “whatever it takes” really means (emphasis mine).

Barring an unanticipated event, I see rising rates stabilizing any drift in inflation expectations and in so doing, increasing real interest rates and quieting demand. Companies will slow down their hiring. Revenge spending will settle. Savings will be held a little tighter. At the same time, supply chains will ease; you have to believe chips will get back into cars at some point. That means inflation should come down over time — but it will take time.

Let that bit sink in. The reason rate hikes “work” to cure inflation is that rising interest rates make the cost of credit (aka, the “cost” of money) too high for consumers to utilize. Consumers are forced to spend less. Along the way, a few jobs are wiped out, a few workers are laid off, and eventually prices come down.

That’s essentially what Fed Chairman Paul Volcker did when he took interest rates to 20% between 1979 and 1981. Inflation was tamed, but only through a two-year downturn.

Who are the consumers whose demand is being “quieted”? You are.

Who are the workers whose jobs will be sacrificed? You are.

Who pays for the recession? You will.

Barkin says it straight out without any hint of irony or self awareness.

Meanwhile, the notion of savings being held “a little tighter” doesn’t stand up to the reality of the first quarter numbers—savings declined. Barkin’s assessment is already wrong and the recession by his thinking hasn’t even started!

But that actually wasn’t the worst of Barkin’s multiple lunacies. Consider his take on consumer spending:

Consumer spending is about two-thirds of the economy, and it remains quite healthy, supported by strong personal balance sheets, excess savings accrued during the pandemic and freedom from COVID-19 restrictions. Just try to book a trip this summer. We are seeing spending pivot from goods to services (affecting some retailers), and early signs of stress for those with lower incomes — but not enough to affect the overall numbers. The negative first quarter GDP was driven by one-time reversals in inventories and net exports and should rebound this quarter. The unemployment rate is historically low at 3.6 percent, and there are still 1.9 job openings for every unemployed person. While rates are rising expeditiously, they have not yet reached the level which constrains the economy. I have noted pullbacks in auto and home sales, but — with prices still rising — attribute both mostly to continuing supply shortages.

Spending on goods declined. Disposable income declined. Savings declined. This is what Barkin describes as “healthy” consumer spending and “strong personal balance sheets.”

Nor should we overlook his take on how we got into this mess:

And a slowdown from our current situation must be kept in perspective: We are out of balance today because stimulus-supported excess demand overwhelmed supply constrained by the pandemic and global commodity shocks. Returning to normal means products on shelves, restaurants fully staffed and cars at auto dealers. It doesn’t have to require a calamitous decline in activity. As for financial markets, they are hardly the whole economy, but even they could benefit from reaffirmation that trees don’t grow to the sky and a reminder that valuations are always worth a fresh look.

“Excess demand”…in other words, people wanted to keep buying the goods that were no longer available because governments decided it would be a good idea to shut everything down due to what statistically speaking is a bad case of the flu. It wasn’t the “pandemic” that created the supply shocks. It was how governments responded to it (i.e., very badly).

In short, since the government stomped on the supply side, the Fed will return the favor by stomping on the demand side, and that will bring everything back into balance as if by magic.

The scary part is that it ultimately is likely to work—at a brutally high price to the average worker/consumer.

The Markets Aren’t Buying It

One thing seems clear: the markets are not buying into the Federal Reserve’s view of things. In the wake of today’s releases of both the Personal Income and Expenditures data and the final revision on first quarter GDP, the major indices have all ended up lower.

On the yield front, the 10-Year, 30-Year, and 2-Year Treasury yields all declined.

The 10-Year Treasury Yield is, as of this writing, had dropped by as much 11bps before staging a late-day rally to just over 7bps down for the day.

The 30-Year Treasury Yield dropped just under 3bps.

The 2-Year Treasury Yield dropped just under 9bps.

The markets aren’t happy with the state of affairs and are starting to look for the Fed to back off the interest rate hikes that Barkin—and the rest of the Fed—are increasingly committed to instituting.

Someone is going to be disappointed—and soon.

Reality Approaches Even For The Fed

As I have said previously, whichever way the Fed turns on interest rates, economic turmoil ensues. They cannot avoid the oncoming reality check.

Continuing to hike interest rates will push the markets even lower, precipitating a new “bear market”, and give the financial media no end of grief. This was the case the last time the Fed raised rates back in 2018.

Fail to hike rates, or even lower rates at this point, keeps inflation high, pricing consumers steadily out of more and more markets, until demand craters on its own, sending markets lower, giving the financial media no end of grief.

Heads the Fed doesn’t win. Tails the Fed simply loses.

No matter what the Fed does or does not do from here on out, recession is going to keep happening, and keep getting worse. Bear in mind that interest rate hikes to contain inflation are designed to precipitate a recession—even if inflation hadn’t already triggered one (which it clearly has).

That’s what “quieting demand” is. That’s what slower hiring and job loss are. Both are the intended consequences of the Fed’s rate hikes—the Fed itself says so. Barkin said the quiet part out loud last week.

Raise rates, lower rates, leave rates alone—every scenario for the Fed creates greater market turmoil for the consumer. Every scenario leads to what is potentially a severe economic downturn—i.e., a “crash”. As Barkin’s comments last week demonstrated, the Fed doesn’t even see the downturn happening. When it becomes undeniable the Fed will be caught completely unawares. Their own statements prove this.

Brace for impact. The Fed has no power to stop what has been set in motion.

The Fed set this in motion long ago, arguably as early as 1987, and certainly by the early 2000's. Then they shifted up a gear in 2008/2009, and again in 2020.

The era of ever-declining interest rates since the early 1980s allowed the entire economy (as well as government) to lever up with more and more debt. The lower the interest rates, the more debt can be serviced. Raise rates high enough now to truly stop inflation and enough of that debt will end up in default that we won't have a recession, we'll have a depression. They've painted us into a corner.

Mark Wauck had an interesting take on this. He thinks the Fed is doing this to break WEF, using inflation as cover story.

If that is tbe case, I don't know that it's needed. The WEF/DAVOS war in Ukraine may do it nicely. No Russian or Chinese raw materials means no chips.🤷