But For Hamas, Wall Street Might Have Stayed Positive

Between Iran and Interest Rates, Equities Took A Beating

Once again, Wall Street crashed last week into that immovable object known as reality.

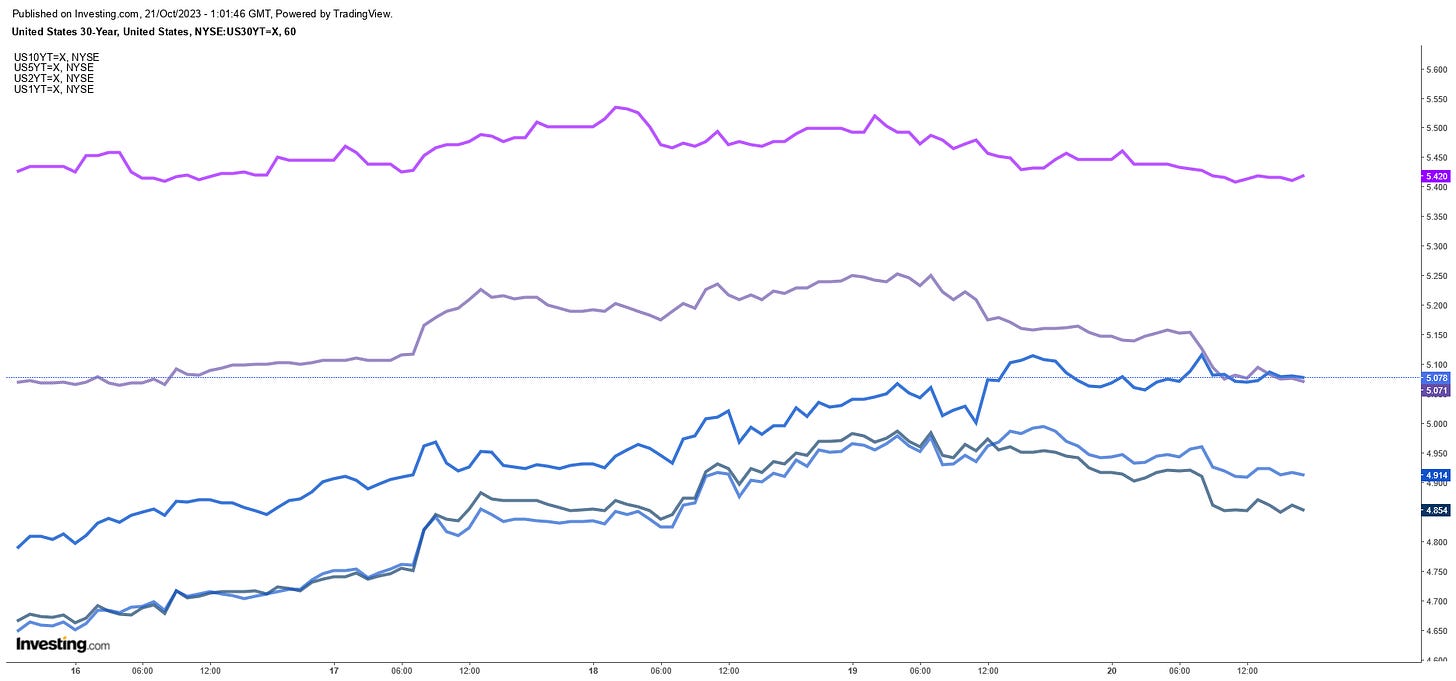

US stocks ended Friday's trading session in the red, as the benchmark 10-year Treasury yield hovered just below 5% in the wake of comments by Federal Reserve Chair Jerome Powell.

Jay Powell’s Thursday speech to the Economic Club of New York1 confirmed yet again that the Federal Reserve was not about to take any steps to lower interest rates—something Wall Street should have known all along would be the case, but had doggedly if naively hoped that events would force Powell’s hand.

Yet if bond portfolios have been losing value since early 2021, then we are left with the question of how Wall Street bankers and bond fund managers are, in late 2023, left worrying about collapsing values of Treasuries and funds invested in Treasuries?

The answer, ultimately, is a simple one: Wall Street keeps drinking its own Kool-Aid and has refused to wean itself off low interest rates, low yields, and cheap money courtesy of the Federal Reserve.

Events have not forced Powell’s hand—at least, not yet. Powell is still convinced the Fed’s interest rate-hike strategy will cure inflation, and is still convinced that higher interest rates will stave off energy price inflation in the face of a widening Middle Eastern war.

My colleagues and I remain resolute in our commitment to returning inflation to 2 percent over time. A range of uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little. Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy.

Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully. We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.

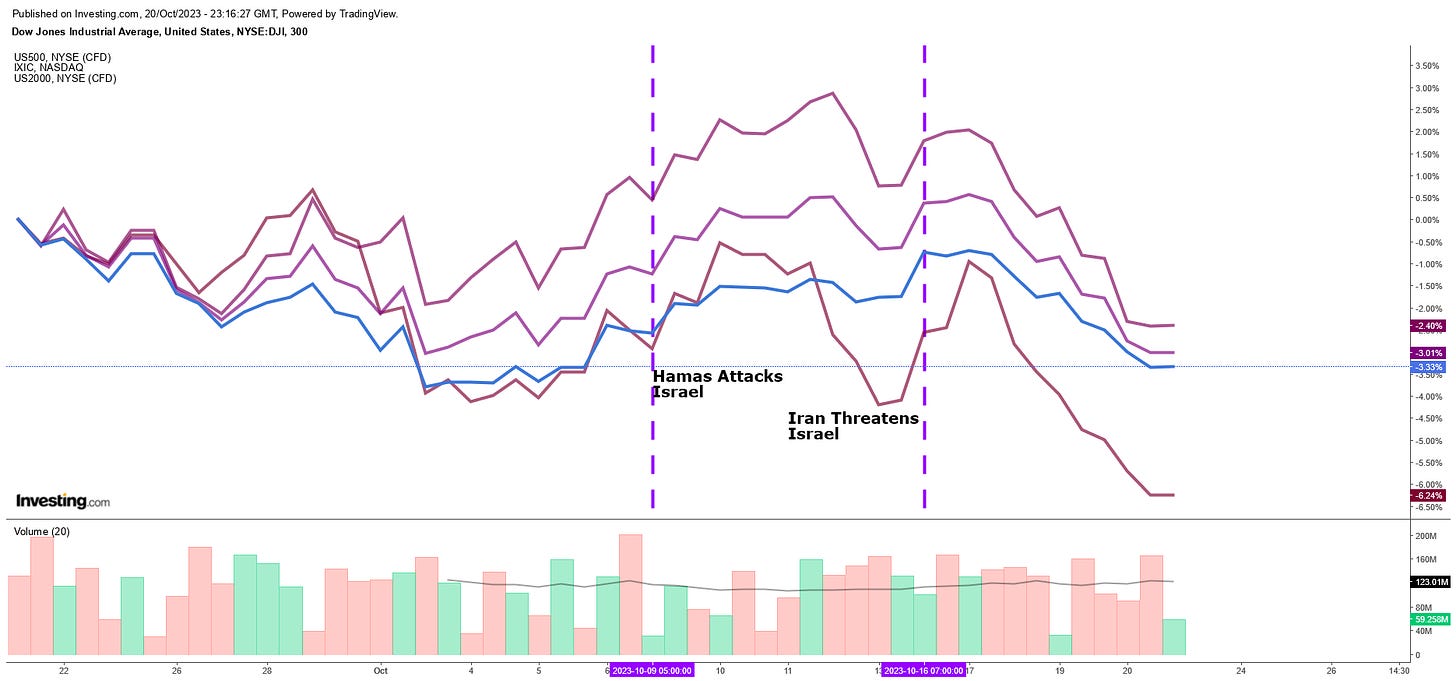

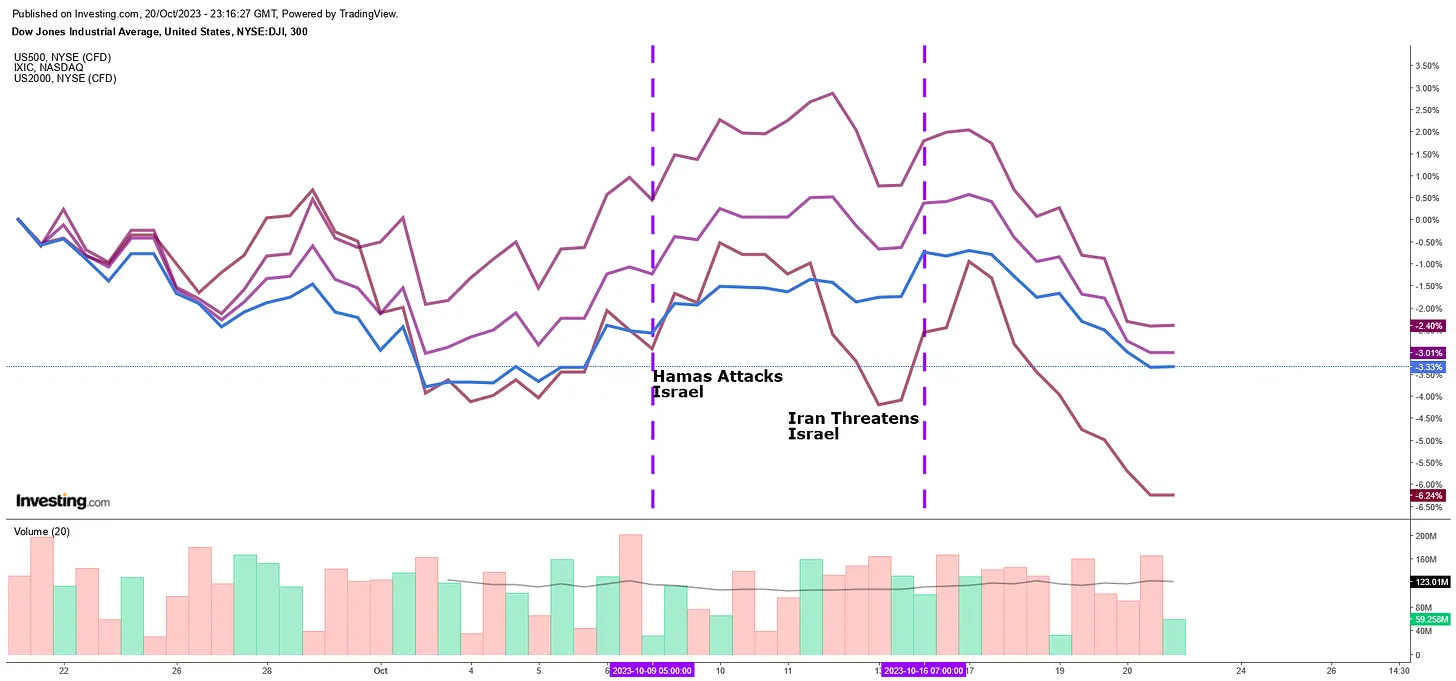

Ironically, despite Jay Powell’s dose of cold water to wake Wall Street up, but for the steadily deteriorating situation in Gaza, Wall Street actually had a chance of closing the week on a positive note. Instead, thanks to Iran and her proxies spreading war and chaos across the region, Wall Street finished the week down hard.

Wall Street has been on track for a rough month regardless of what Hamas, Iran, or Jay Powell did last week. However, despite the rocky past few weeks, up until mid-week, equities were posting a significant gain on the week, even though the month was still very much in the red.

It is against the backdrop of Israel’s intensifying war with Hamas that Jay Powell reaffirmed his stance to keeping interest rates high until inflation was back under 2%—not what Wall Street wanted to hear.

Turning to monetary policy, the FOMC has tightened policy substantially over the past 18 months, increasing the federal funds rate by 525 basis points at a historically fast pace and decreasing our securities holdings by roughly $1 trillion. The stance of policy is restrictive, meaning that tight policy is putting downward pressure on economic activity and inflation. Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.

My colleagues and I are committed to achieving a stance of policy that is sufficiently restrictive to bring inflation sustainably down to 2 percent over time, and to keeping policy restrictive until we are confident that inflation is on a path to that objective. We are attentive to recent data showing the resilience of economic growth and demand for labor. Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.

The irony of Powell’s remarks to the Economic Club of New York is that in the question-and-answer period after his remarks he all but admitted that the Fed’s setting of the federal funds rate was not the driving force behind the current rise in market interest rates.

Powell made it clear Thursday the central bank is closely watching a recent surge in long-term bond yields, which have risen more than 50 basis points since the Fed’s last policy meeting on Sept. 20. Other Fed officials have said in recent days that if long-term interest rates remain elevated there may be less need for the Fed to act.

"We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy," Powell said.

When asked during a question-and-answer session whether higher yields could reduce the impetus for the Fed to continue to raise rates at the margin, Powell said, "It could ... that remains to be seen."

He added, “By the way, I'm not blessing any particular level of longer-term rates, but just in principle, that's right."

Indeed, Wall Street appeared to realize that, as Wall Street was unable to mount any clear direction on Treasury yields in the wake of his remarks.

Unsurprisingly while the corporate media wanted to blame Powell for the decline in equities, the data shows that equities were declining well before Powell’s speech—by a couple of days.

It is almost cliche at this point that corporate media analyses are reliably 180 degrees from reality.

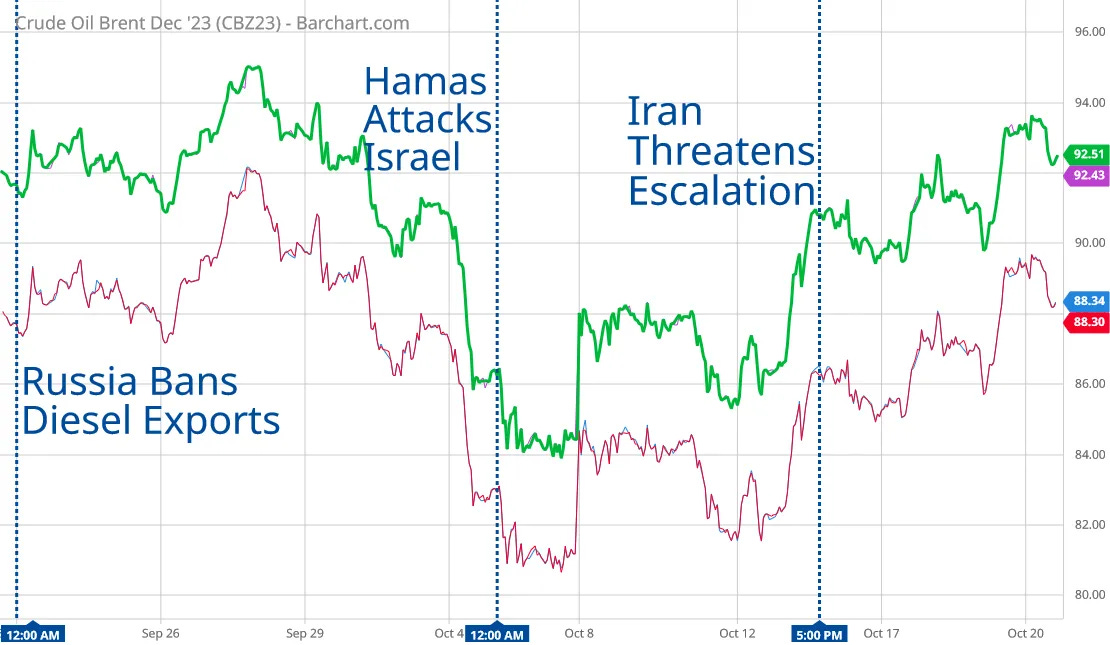

While Powell is not a likely cause of market reversals this week, the widening war in the Middle East most certainly is. As I discussed on Saturday, the growing conflict is pushing oil prices closer and closer to the psychologically important $100/bbl threshold.

Combat analyst Paul Lewandoski’s assessment of events unfolding in the Middle East also is very much in line with a pattern of escalation, more by Iranian proxies at this point than by Israel.

Paul’s assessment is in line with that of the Israeli military, which views the events in the West Bank in particular with a fair bit of concern.

The violence poses a challenge to both Israel and to the Palestinian Authority (PA), the only Palestinian governing body recognised internationally which is headquartered there.

The Israeli military said it was on high alert and bracing for attacks including by Hamas militants in the West Bank.

Hamas was trying to "engulf Israel in a two- or three-front war", including the Lebanese border and the West Bank, military spokesperson Lieutenant Colonel Jonathan Conricus told Reuters. "The threat is elevated," he said.

Indeed, the threat is elevated quite literally everywhere in the Middle East at the moment.

While it could be mere coincidence that the increases in Hezbollah rocket attacks on Israel, drone attacks on US bases in Syria and Iraq, and a cruise missile attack along the Red Sea from Yemen coincide with a market reversal and decline at the tail end of the week, it seems far more probable that what was on display last week was not a “pain trade” with respect to interest rates, but a “fear trade” with respect to the Middle East. Wars which disrupt the flow of oil from the Persian Gulf tend to be bad for share prices, and the risk of war disrupting the flow of oil from the Persian Gulf is demonstrably rising.

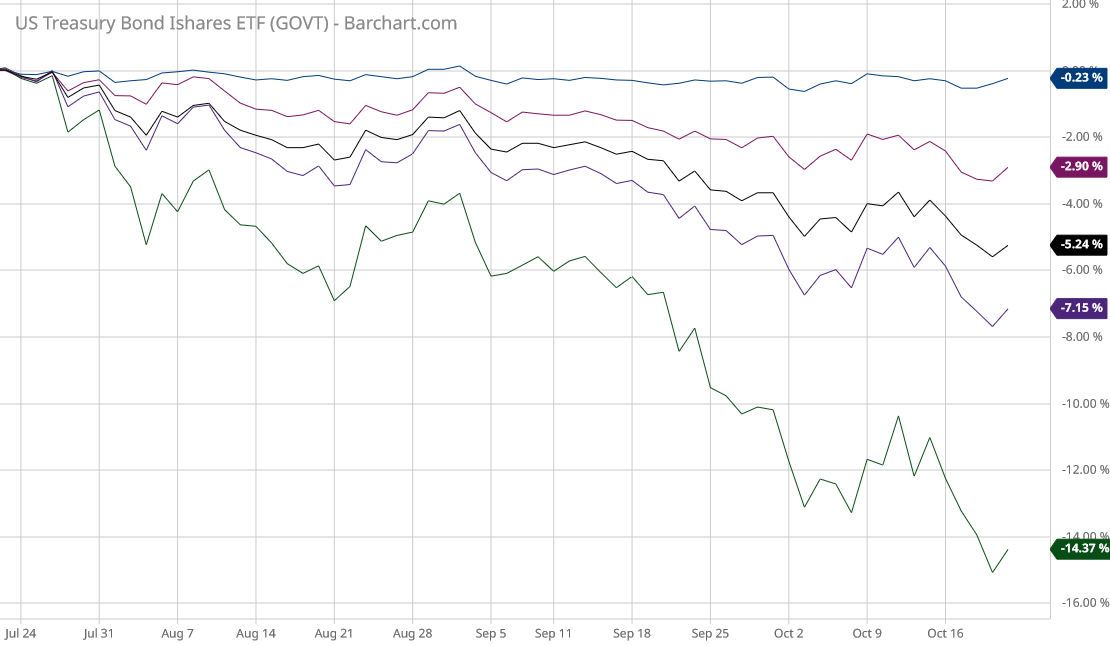

Wall Street’s bigger problem by far is that elevated and rising yields on fixed income assets (especially Treasuries) is running headlong into that fear trade which drives down share prices and stock indices. While Treasury ETFs did mount a small recovery on Friday, the ongoing rise in yields has been pushing Treasury portfolio values ever lower.

Eventually, this decline in Treasury values is going to trigger a rout among bond funds and bond investment portfolios. The ETFs are already taking a beating, and it is only a matter of time before this contagion spreads.

With equities on the decline as well, that leaves Wall Street with precious few options for any sort of “flight to safety.”

The irony of the media focusing on Powell’s remarks is that it completely misses the larger dynamic at play: Interest rates and inflation are making fixed income investments less attractive, which under normal circumstances would incent money flowing into equities; unfortunately, war and rumors of war in the Middle East are making equities unattractive as well, upsetting the normal market dynamic.

Interest rates and inflation are making financial markets particularly fragile at the moment. Any shock at all could be enough to trigger a serious market reversal. The escalations we are seeing in the Middle East have not yet proven that shocking—but they are getting closer to doing just that.

Wall Street is in trouble. Unfortunately, so are we.

Powell, J. H. Speech by Chair Powell on the Economic Outlook. 19 Oct. 2023, https://www.federalreserve.gov/newsevents/speech/powell20231019a.htm.

"...he all but admitted that the Fed’s setting of the federal funds rate was not the driving force behind the current rise in current interest rates."

*This* is what scares the Statists (of all stripe, neo-lib *and* neo-con alike). *This* is what threatens their revenue confidence game.

*This* Capitalism will defeat them, when yhey cannot control the People's free markets.