China's Economic Fate Is Fixed. It Is Deflation

Even Corporate Media Can No Longer Ignore The Obvious

China’s economy is shrinking. China’s economy has been shrinking. China’s economy is going to keep shrinking.

Even the corporate media was no longer able to ignore the obvious about China after it posted its latest consumer price index and producer price index data last week.

China's consumer prices swung back into contraction and factory-gate deflation persisted in October as domestic demand struggled, weighing on the outlook for any broader-based recovery in the world's second-largest economy.

The corporate media narrative is still pinning its hopes on China’s economic “recovery”, but that hope is increasingly looking like a pipe dream. It makes the hopium over Federal Reserve monetary policy seem almost realistic by comparison!

China is sliding into deflation and it is increasingly unlikely that Beijing has any capacity to halt the descent.

Before Beijing published its latest inflation numbers, corporate media was predicting there would be some slowing of inflation—i.e., “disinflation”—but that outright consumer price deflation would be avoided.

Attention in Asia on Wednesday turns to Chinese inflation data, with investors expecting disinflationary pressures to have picked up in October but not at such a pace that would deflate the recent rebound in optimism about the economic recovery.

Corporate media was profoundly disappointed. Consumer prices are down quite literally across the board in China, let primarily by food prices. At a time when much of the world is grappling with food price inflation and its attendant food price insecurity, China is facing in many instances food price deflation.

That is certainly the case for most forms of meat sold in China.

Prices on foodstuffs such as rice, wheat, corn, and soybean have also retreated as of late.

Even cash crops such as cotton have been showing deflation for most of the year, and crops which have not have recently been showing disinflation.

With essentials such as food plummeting in price, it is a foregone conclusion that demand is sufficiently soft so as to ensure other consumer prices go along for the ride, which they very much have done in China.

It is a measure of how delusional (and deluded) corporate media has become to have been talking about a China “recovery”. If we look at the broader Consumer Price Index for China, it is readily apparent their economy has been stuck in the doldrums for quite a while now. This current episode of deflation is the second one to hit China since the COVID-19 pandemic in 2020.

Year on year inflation literally collapsed in 2020, plummeting from a high of over 5.4% in January of 2020 (right before the first of China’s many lockdowns) to -0.5% by November

Now that same deflation has returned, and might even end up going deeper than that first bout of inflation.

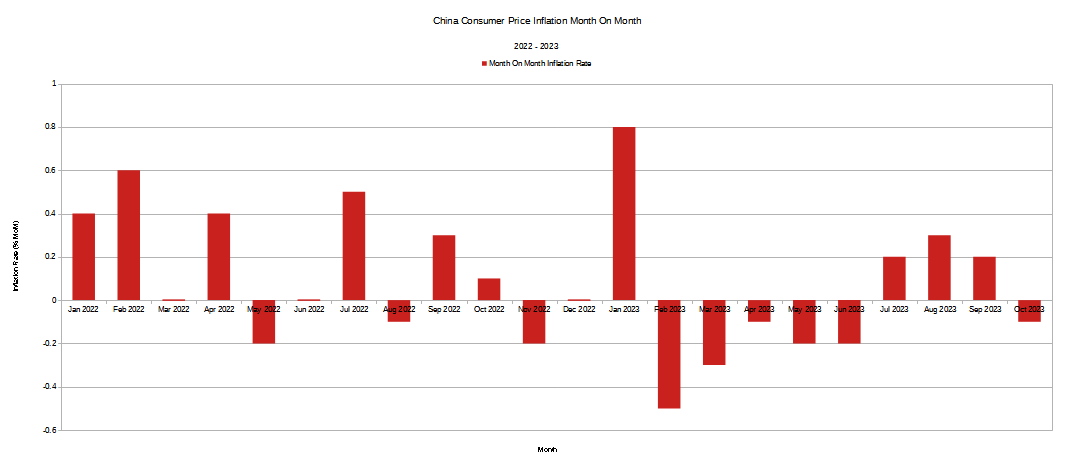

Indeed, if we zoom in to focus on 2022 and 2023, we see China experiencing another collapse in price levels starting in September of last year.

China’s “recovery” from its Zero COVID lunacy lasted maybe one month—January of this year, and then prices simply began retreating.

We see confirmation of this when we look at China’s consumer price inflation data month on month. January there was a surge in prices, and then a retreat which has not yet stopped.

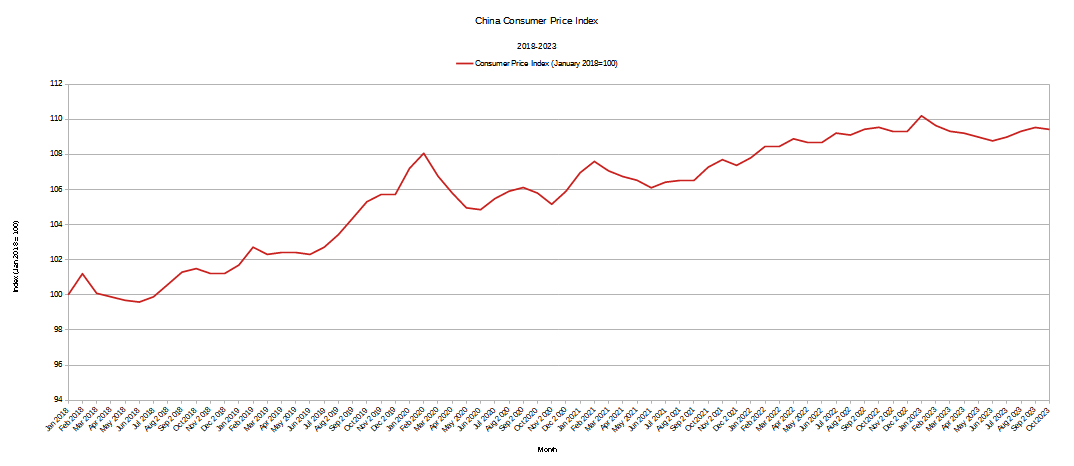

While it is tempting to ascribe China’s problems to the results of its Zero COVID policies following the initial outbreak of the SARS-CoV-2 virus, the reality of China’s economy is that it has been an uneven performer even before then. If we look at the broader Consumer Price Index, we see that China has had multiple bouts of deflation just since 2018.

In 2018 and 2019, China experienced at least three episodes of intermittent consumer price deflation. This was before COVID.

The first outbreak of COVID itself sent China’s consumer prices plummeting, and price levels did not recover until around January of 2022. Perversely, 2022, a year spent entirely in the thrall of Zero COVID lunacy, produced some of the most stable consumer price inflation China has had for years.

When Zero COVID ended, mild consumer price inflation became persistent consumer price deflation.

Yet even before Zero COVID ended, it was plain that Xi Jinping’s policies—both pertaining to the pandemic and to the country overall—were taking China over an economic cliff.

Zero COVID obscured the damage for a time, but as the population grew restive within Zero COVID’s confines, last November Xi was eventually obliged to abandon the policy, in large part because China could no longer afford to maintain it.

Zero COVID has been the nail in China’s economic coffin, but, as even the Manufacturing PMI data shows, China’s economy has been heading into rough waters since well before COVID.

Not only has the headling PMI data been showing a decline since 2018, but crucial sub-indices such as finished goods and “in hand orders” have been contracting since 2018 (for the PMI data, and index measurement below 50 indicates contraction).

When a manufacturing economy’s stock of finished goods, export orders, and in hand orders are all posting multi-year declines, that is a manufacturing economy that is not doing at all well.

Layer a collapsing real estate sector on top of a stagnating manufacturing sector and the result is an economy that has nowhere to go but down.

Earlier this fall I projected that China had two potential economic outcomes: outright deflation or slow steady stagnation.

It has been apparent just looking at China’s own data—and this data is all courtesy of China’s National Bureau of Statistics, and is the “official” economic data China releases to the world—that China’s economy has never been exactly healthy, and has not been on a path of recovery at any time since the start of the COVID-19 pandemic in 2020. Between declining manufacturing and an unstable real-estate sector, China’s economy has always been headed for a decline of some sort. It was always going to experience either outright economic contraction (deflation) or was simply going to go into “Japanification” stagnation.

With China’s latest consumer price index data and China’s persistent lack of any real consumer price inflation, it is becoming increasingly apparent that China’s economic horizon is deflation. China’s economy is not actually growing, and is not actually going to grow.

China’s economy is shrinking, and Xi Jinping is powerless to stop it.

Excellent information. Thanks.

Aging baby boomers and they discouraged more children for many years may not be helping. Didn’t they just change that policy to allow another child? If so, it will be scary what China will do in 20 years with millions of 20 year old men with no jobs. Odds are they will use them in military endeavours?

Immigration? Has china ever encouraged immigration? Lol. But the problem is…. Who would want to immigrate to China? Lol. North Koreans and that’s probably it. Lol.

China policies has also deterred new foreign businesses to go there? Who would want to invest in China anymore?

The CCP government did this to themselves and hopefully one day the good people of China catch on and expel their communist government. It would benefit world peace too.

Just my two cents for a laugh.

Do you think it will spiral & will the $$ follow ...