Economy Sends Warning: Prices Up, Spending Down in May

This Is the Report President Trump Didn’t Want

There is no getting around the reality that the May Personal Income and Outlays Report is not good news. In particular, consumer price inflation rose according to the Federal Reserve’s preferred inflation metric.

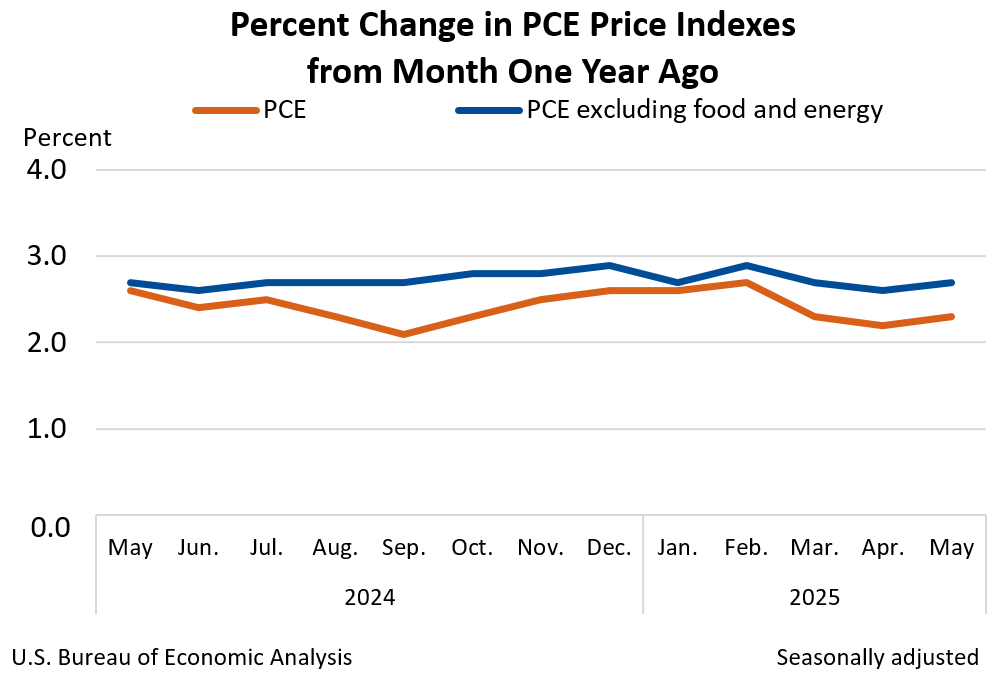

From the preceding month, the PCE price index for May increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

From the same month one year ago, the PCE price index for May increased 2.3 percent. Excluding food and energy, the PCE price index increased 2.7 percent from one year ago.

Yet with falling incomes and declining consumption, the return of consumer price inflation is hardly the only negative dimension to the May report.

While there are some bright spots in the report, overall, there is little joy to be found within, as a close examination of the data shows.

Contents

Prices Rose In May

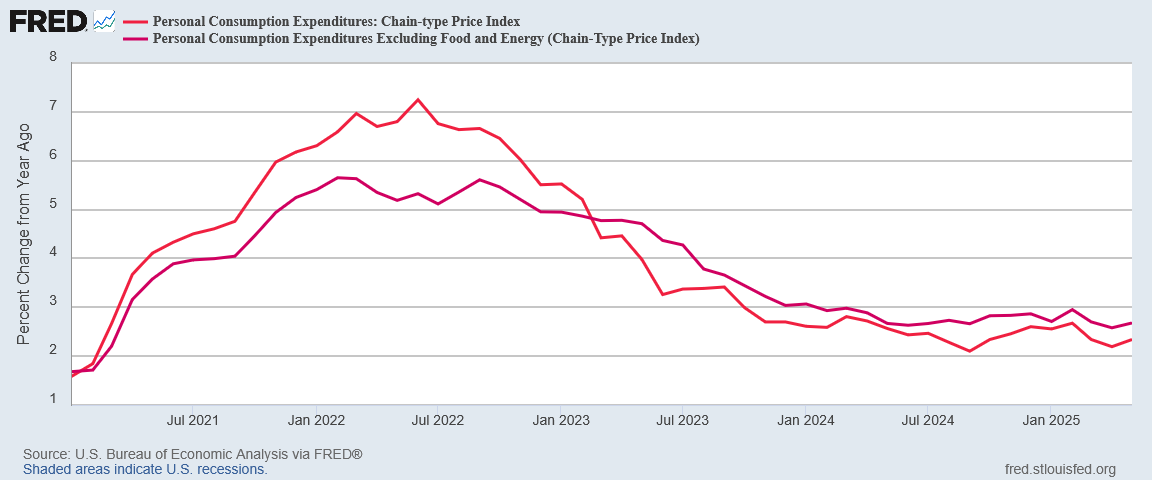

As already stated, the most notable negative in the May PCE report is that inflation rose, with headline inflation rising above 2.3% year on year and core inflation rising to 2.7% year on year.

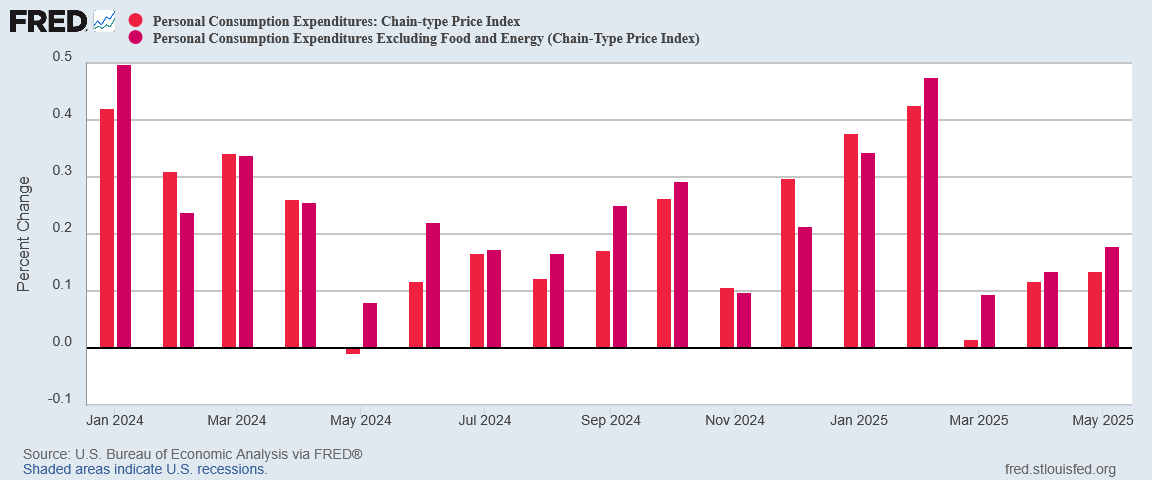

Even month on month there were price rises in both headline and core inflation.

Of particular concern is that core inflation has been rising faster than headline inflation, suggesting that the inflationary forces in play are broader and more nuanced than simply energy prices or tariffs.

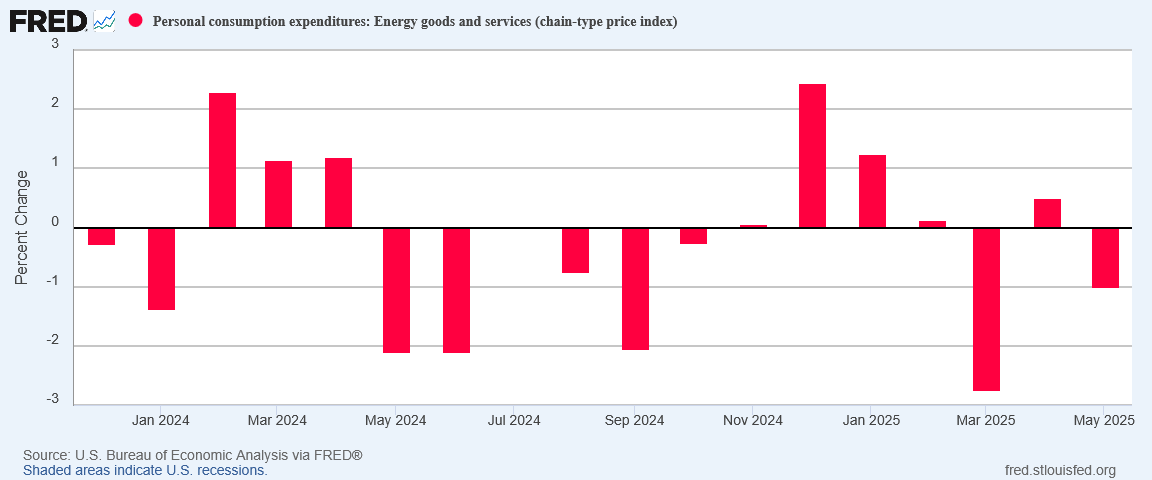

Indeed, energy prices were one of the bright spots in the May PCE data, as we saw a return to energy price deflation.

Yet food prices notched increases in May, according to the PCE report.

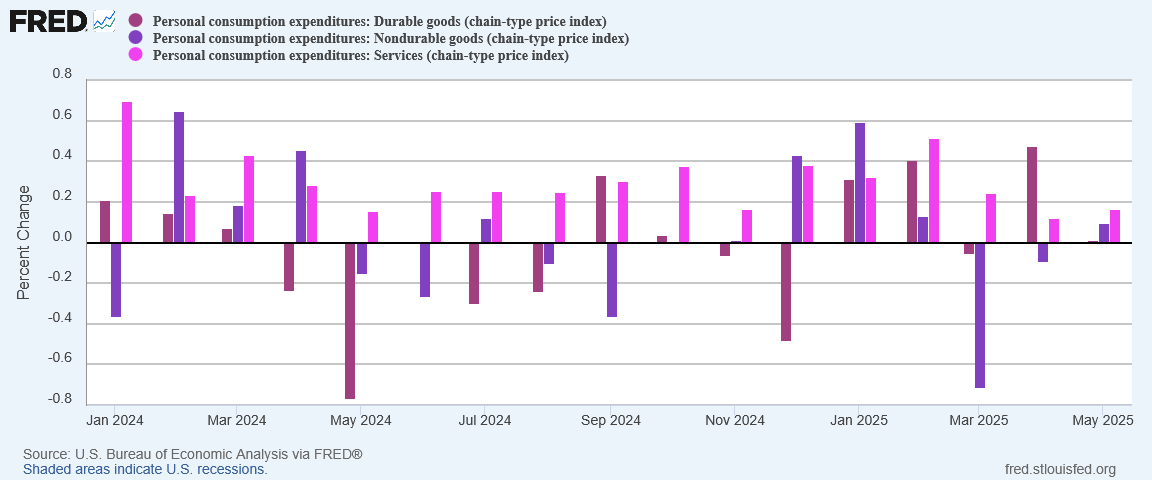

While prices for durable goods barely increased, non-durable goods returned to price inflation and services increased their rate of inflation.

The breadth of these prices rises is much more significant than the magnitude. While the overall increase in prices is fairly minor, it is driven by price increases across nearly every principal economic sector.

That’s a scenario which speaks to multiple pricing pressures coming into focus. This is more than energy prices, more than tariffs, more than supply chain hiccups and glitches.

When inflationary forces converge in this fashion, that is a significant red flag we should not overlook.

Consumption Fell In May

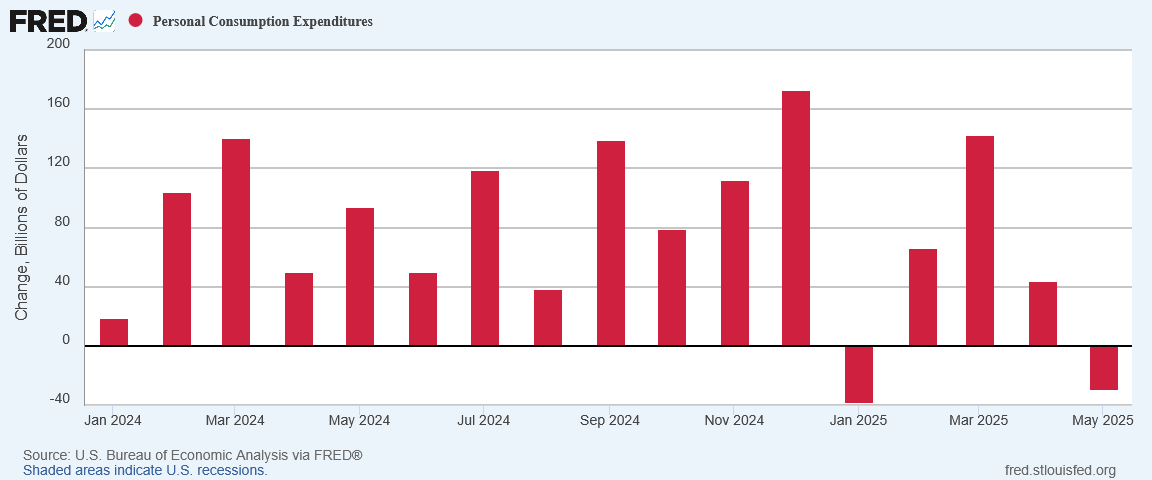

Complicating the inflation assessment is the somewhat contrarian reality that consumption fell in May.

People simply spent less money on things.

Some of this is to be expected, as extended fallout from the March consumption surge, which represented a clear front-loading of consumer demand in response to corporate media tariff hysterics, a point I made last month.

Still, a continued drop in consumption is significant, for if the March consumption surge represented this much front-loading of demand, there is considerably less demand overall than has been previously anticipated. While the price indices are showing inflation, a drop in consumption is generally a precursor to deflation.

In line with the consumption decline being an extended reaction from March, people primarily cut back on purchasing both durable and non-durable goods, although even spending on services rose far more slowly than last month.

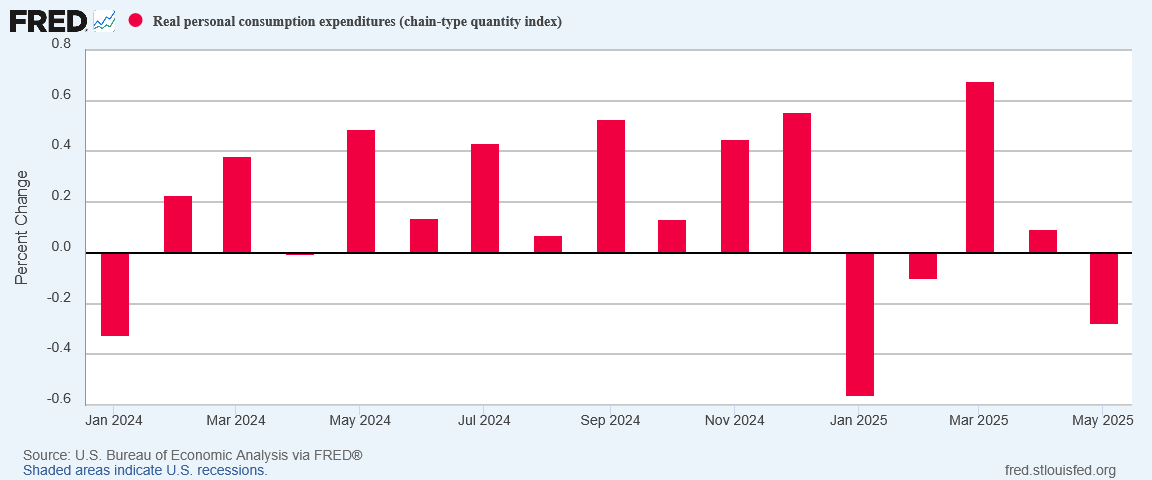

Even in real terms, the decline in consumption was significant.

Just as the price rises were nearly ubiquitous, so too were the consumption declines, with consumption among “core” goods and services (goods and services less food and energy) posting a significant decline.

That energy consumption fell is understandable, given the fall in energy prices.

Far less comprehensible is the fall in food consumption, owing to the rise in food prices.

We should remember that consumption demand is the primary catalyst for pushing prices up and pulling them down. An across the board decrease in consumer demand arguably should have been met with across the board decreases in consumer prices. Instead we are seeing the exact opposite.

Wages Rose, Incomes Fell

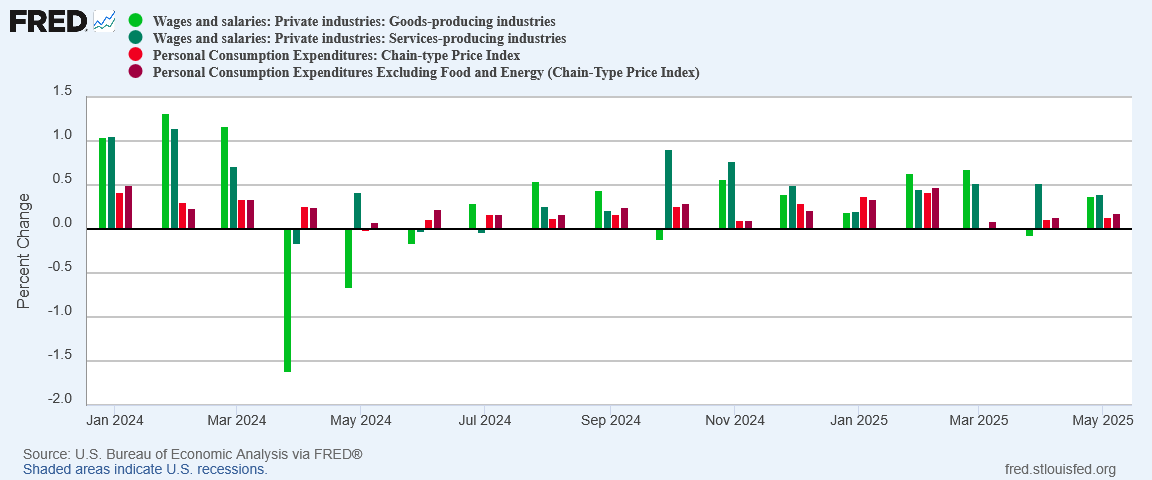

One of the other few bright spots in the PCE report is that wages rose in May faster than inflation.

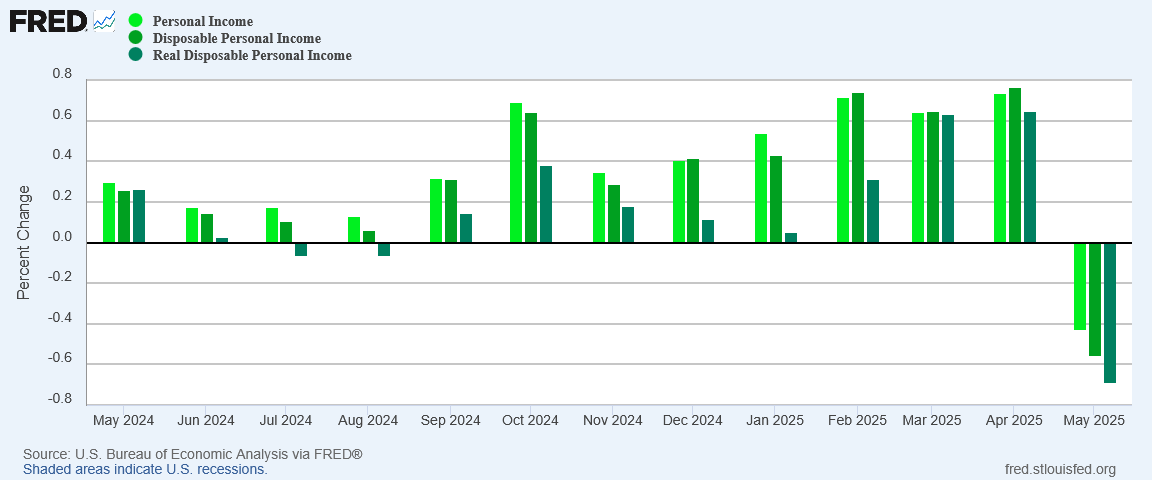

However, that is where the good news on incomes largely ends, for despite the rising wages, personal income, disposable personal income, and real disposable personal income all fell dramatically last month.

This is a stark reminder that Americans’ incomes are comprised of much more than simply wages. Proprietors’ income and rental income are two income sources that suffered significantly in May.

While the decline in transfer payments (welfare) is music to the ears of MAGA and DOGE aficionados, there is no escaping the deflationary effects of less money being put in consumers’ hands, and that is what happens when government welfare payments are reduced.

However, even with a significant drop in overall personal income, wages are at least on the verge of finally catching up to inflation.

We should note that one reason the Fed prefers the PCEPI inflation index is because it does tend to print a few points lower than the CPI, which is why compared to inflation growth within the PCEPI average earnings surpassed the inflation index early last year. It is also why the CPI shows goods-related wages just now having caught up to inflation, and service-related wages still have a ways to go.

Will There Be More?

After months of the data showing disinflation, the May PCE report is a notable turnaround. Is this report merely a single blip within a larger trend of easing and falling prices? Or is this a sign that inflation is starting to rise at last?

While previous inflation reports have consistently defied expectations and not produced the inflation Wall Street and Washington “experts” have insisted should be there, the constant caveat on those outcomes has always been “not yet”.

We especially should not overlook that the Consumer Price Index data for May did not show significant inflation on the month.

While the Personal Income and Outlays Report is by no means a good report for May, in many respects it is still the outlier, given the inflation reports we have had so far this year.

We should not ignore that there have always been concerns which could at any time push prices back up again—most notably the recently-ended Twelve Days War, which has roiled energy prices especially.

In the war’s aftermath, there is no way to tell if for June and July we will see energy price inflation or deflation.

Nor can we completely ignore the inflationary potential of the Liberation Day tariffs. While the tariffs have yet to produce any inflation, despite the apocalyptic predictions of corporate media, there is no denying that every tariff is by definition an upward (inflationary) pressure on prices. This could be especially relevant given President Trump’s abrupt suspending of trade talks with Canada over their Digital Services Tariff Tax.

Of far greater concern is the rise in prices even as overall consumption fell. When people buy less, prices generally tend to move down, not up. Is this a sign of a stagflation scenario emerging within the US economy, where inflationary and deflationary pressures converge in the worst possible way? At present, we can only ask the question. We have to wait for price trends to unfold however they will over the next few months to know if this report is merely one bad report or the start of a more sustained economic reversal.

That is where this report presents the greatest political risk for President Trump. While Trump has so far defied corporate media expectations on the economy, that is not the same as having decisively slain any of the economy’s lurking dragons. In particular we have yet to see conclusive evidence that the jobs recession which has been the great albatross around the economy’s neck has ended.

President Trump’s economic successes thus far have all been largely superficial, and while they are clear wins for the President, they have not produced the economic momentum necessary to grow the economy convincingly over the longer term. The May Personal Income and Outlays Report is for Donald Trump an inconvenient reminder of just how fragile his good economic track record is thus far.

Will there be more inflation throughout the summer? That is definitely a possibility. We must also consider the possibility that there will be stagflation and further economic doldrums settling over the economy as well.

This was not a good inflation report, yet its greatest importance is that it is a warning that more bad reports may be heading our way.

That would be a political reversal for Donald Trump and an economic reversal for the United States.

This is a bit surprising. At least where I live in Texas, I am seeing prices go down. I definitely have noticed fewer people shopping and at restaurants in town. Do you think they are doing their usual , reporting false numbers ?

Lurking dragons, indeed. Let’s hope Trump is the dragon-slayer! (What a great meme that would make.)

“Of far greater concern is the rise in prices even as overall consumption fell. When people buy less, prices generally tend to move down, not up. Is this a sign of a stagflation scenario emerging within the US economy, where inflationary and deflationary pressures converge in the worst possible way?” Peter, I’ve never known if the government bureaucrats who put out these economic reports adjust in any way for demographic bumps. For example, right now the huge Baby Boomer demographic is retiring, living on fixed incomes, and spending less. When I go grocery shopping, as I did this morning, and find that the store selling cherries on sale for $3.99/lb is out of stock, and the other store I stop at is selling cherries for $9.99/lb, well, duh, I just don’t buy cherries. This is the reality of fixed incomes during rising prices - you just do without. When economists are issuing data, is this data statistically adjusted somehow to reflect these demographic bumps, for year-on-year comparisons?

Thanks, Peter, for consistently giving us the best information and interpretations!