Is China’s real estate sector on the verge of a complete meltdown?

That has been a question rumbling through global media over the past week, as China Vanke, China’s number 2 property developer, has been battling rumors of a metastasizing liquidity crisis, with concerns mounting over its large debt burdens.

China Vanke, the country’s second-largest property developer, has pledged to repay its outstanding offshore debts that are coming due soon, as its shares and bonds tumbled amid rumours about liquidity distress.

The company has prepared all the funds needed for the repayment of a US$630 million bond due next Monday, and is pushing forward with the process of repaying its debts in an “orderly” fashion, it said in a statement to the Post on Tuesday.

The statement came amid market rumours that Vanke is facing a liquidity crisis and has started a new round of negotiations with state insurers to extend the maturities of some private funds it borrowed.

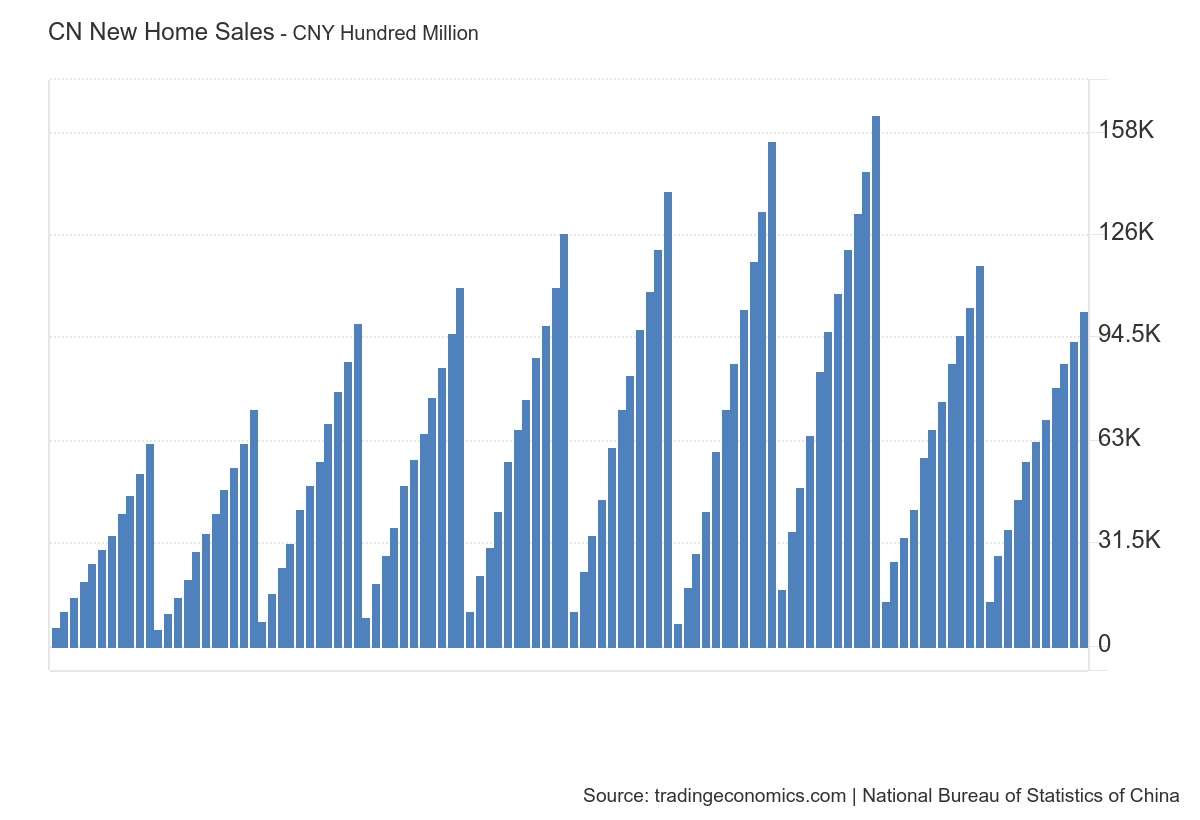

The concerns began to mount as China posted its tenth straight month of declining property sales in February.

Property sales in mainland China declined for the tenth straight month in February, as lower demand during the Spring Festival holidays weighed and expectations are the beleaguered sector’s woes will continue, pressured by low homebuyer confidence.

China’s top 100 developers posted total contracted sales of 185.7 billion yuan (US$25.8 billion) in February, a decline of more than 60 per cent year on year, and a fall of close to 21 per cent month on month, according a report published on February 29 by the China Real Estate Information Corp (CRIC), a research firm.

Those concerns reached a fever pitch earlier this week, as Moody’s cut China Vanke’s credit rating to junk status. Moody’s fundamentally has lost faith that the developer can successfully restructure and manage its debt.

“The rating actions reflect Moody’s expectation that China Vanke’s credit metrics, financial flexibility and liquidity buffer will weaken over the next 12-18 months because of its declining contracted sales and the rising uncertainties over its access to funding amid the prolonged property market downturn in China,” said Kaven Tsang, a senior vice-president at Moody’s.

While the developer has managed to make a required $630 million payment on its debt, it apparently has used up most if not all of its available cash—and there are future debt payments yet to be covered.

While a Chinese property developer slowly being strangled by its own debt load is nothing remarkable—after Evergrande and China Garden that narrative has already become something of a cliche—what is noteworthy about China Vanke is that the government is part owner. China Vanke is one of the China’s “state-owned” firms.

The more significant asset that it has relative to other developers, however, is that it is more than 27 per cent owned by the Shenzhen local government, which is its largest shareholder. It has had a lengthy and successful relationship with the dynamic technology hub, with Shenzhen directly involved in the negotiations to refinance the property group.

That state presence on its register is a major differentiator from the other big billionaire-controlled developers that Beijing has steered clear of.

It is comparatively easy for Beijing to leave Evergrande and Country Garden twisting in the financial wind. The propaganda necessary to spin the blame for those developers’ woes on their billionaire owners is childishly easy to devise.

It is rather more tricky to explain how a government owned entity falls victim to the same corporate mismanagement as the private sector firms. Yet that is quite possibly an explanation Beijing may soon have to make.

Unlike Evergrande, which Beijing ultimately allowed to fall into default and bankruptcy, and is now facing liquidation, government officials are reported to be working behind the scenes with several Chinese state-owned banks to rework the company’s tremendous debt burden.

Investors have been dumping Vanke's shares and bonds this month after reports that the company was seeking to extend the maturity of its debt with insurers — an indication it's in a cash crunch.

On Friday, Vanke said it had deposited funds to repay $630 billion in notes due on Monday. Beijing has also asked banks to boost financing for Vanke and called on creditors to extend debt maturity, Reuters reported on Monday, citing two unnamed sources with knowledge of the matter.

Authorities are coordinating Vanke's discussions with banks to help the developer avert a default, Bloomberg reported on Tuesday, citing unnamed people familiar with the matter.

There are certain advantages to government ownership—and a cadre of bureaucrats willing to put pressure on banks to renegotiate and restructure debt is definitely among them.

However, government influence may not be enough, as two of China’s largest banks, Industrial & Commercial Bank of China and China Construction Bank, are pushing back on completing a syndicated loan of HK$1.5 Billion to help bail out the developer.

Industrial & Commercial Bank of China Ltd. and China Construction Bank Corp. had yet to sign off on the syndicated loan as of last week even as smaller rival Bank of China Ltd. has internally approved its own HK$1.5 billion portion, said the people, asking not to be identified discussing a private matter.

ICBC and Construction Bank have asked Vanke to provide sufficient collateral to back the new loan but the developer was unwilling to do so, one of the people said. Without collateral or other forms of credit enhancement, the lenders would need clearing from regulators to proceed, the person added.

The reluctance of ICBC and Construction Bank to complete the bailout loan is particularly ironic, given that the banks are themselves state-owned enterprises.

What does it say of a state-owned firm when state-owned firms don’t want to do business with it?

The issue is clouded even further after China’s housing minister Ni Hong, during the “two sessions” meeting of the National People’s Congress, declared Beijing’s willingness to let insolvent developers go bust.

Last week, Ni Hong, China’s housing minister, told reporters during the National People’s Congress that regulators will support the “reasonable” financing needs of real estate developers.

He reiterated a “whitelist” mechanism that was recently established to inject liquidity into the crisis-hit sector. More than 6,000 property projects across the country have been matched with development loans by banks.

But he also said Beijing will not bail out developers that are “seriously” in trouble.

“For real estate companies that are seriously insolvent and have lost their operating capabilities, [we should] let them go bankrupt or be restructured,” he said.

With a Hong Kong court having already ordered Evergrande’s liquidation in January, Ni Hong’s words about letting developers collapse take on even greater relevance.

Yet the government stake in China Vanke rather raises the bankruptcy stakes considerably. Will the government and the CCP dare allow a state-owned company to fail?

While the answer to that question may not be exactly “yes”, that the government so far has not led with even a loan guarantee suggests that Beijing either won’t or can’t prevent China Vanke from defaulting and sliding into bankruptcy.

China Vanke’s woes are by now a familiar narrative. While Vanke’s balance sheet suggests the firm was somewhat better run than Evergrande, at the same time Xi Jinping’s imposition of the “three red lines” for developers seriously reduced Vanke’s market capitalization, which has hurt its ability to roll over its debt load.

At its last available balance date it had about 1.75 trillion yuan of assets and 1.3 trillion yuan of liabilities. While its market capitalisation has fallen dramatically since the “three red lines” restrictions on developers’ leverage was imposed in 2021 – from the equivalent of about $13.3 billion to about $2.7 billion – investors are betting with their Hong Kong dollars that it still has substantial value.

While Vanke’s balance sheet nominally looks good, with CNY101 Billion of cash against CNY34 Billion of short term debt, like many other developers it has significant liabilities in the form pre-payments made by homebuyers on homes Vanke has not yet finished..

As of September, Vanke had 101 billion yuan of unrestricted cash, which should be sufficient to cover its short-term debt. It will have around 34 billion yuan of bonds due before June 2025, according to Moody’s. However, just like everyone else, Vanke relies heavily on pre-sales, where apartments are bought before they are built. As of September, it had about 408 billion yuan in contract liabilities, mostly comprised of deposits consumers had paid for unfinished homes. Seen in that light, Vanke’s cash position is not so sound.

This is where China’s real estate sector runs into an insurmountable problem. The business model driving the real estate sector is that of the “pre-sale”. Chinese home buyers put down their down payment and make mortgage payments while the home is being built. At most if not all real estate developers in China, those pre-sales funds have largely been spent, and many housing units ostensibly purchased with those funds have not been completed.

This was how the “three red lines” policy tripped up developers and started the bursting of the China real estate bubble. With limited ability to raise fresh capital as debt, first Evergrande, then Country Garden, and now Vanke did not have the capital to complete housing projects that had already been sold. There are no good scenarios that unfold when a developer “sells” homes and then fails to build them, and yet that is what has been happening in China on a fairly large scale.

That developers would fall like dominoes after Evergrande was an easy prediction to make in 2021, and Vanke is showing how true that prediction is.

This is ultimately the real crisis brought into focus by Evergrande: China’s real estate firms are over-extended, underwater, and with or without an Evergrande bankruptcy face existential threats from loss of financing and liquidity resources. Many of these firms will follow Evergrande into bankruptcy.

There is a straight line that can be traced from Evergrande’s initial liquidity woes to Vanke’s current cash crisis.

A big part of why Vanke’s cash crunch is not easily resolved is the reality that, as developers have proven unable to deliver on previously sold projects, home buyers are increasingly reluctant to purchase new housing, which is driving down housing revenue along with housing prices.

With the exception of two months last summer, China’s housing prices have been falling since May of 2022.

Falling prices naturally leads to reduced sales, which is exactly what China has experienced over the past two years.

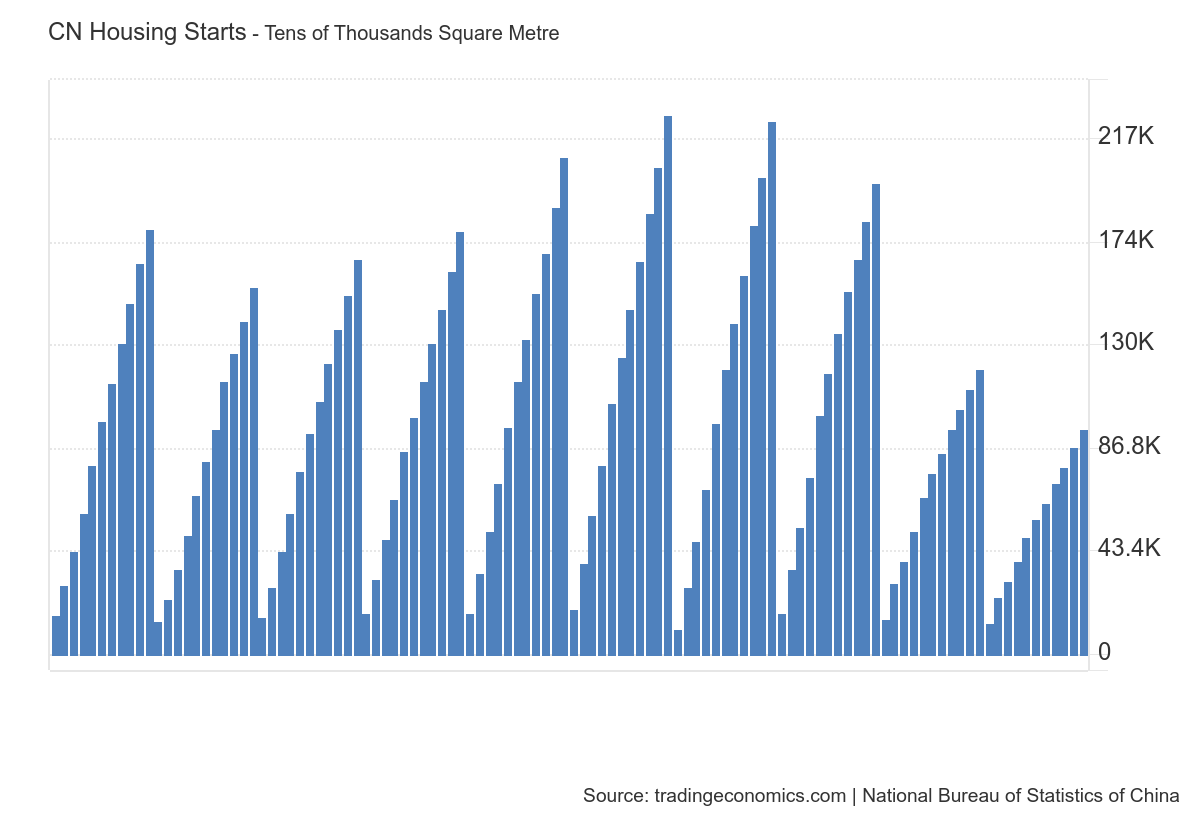

Between home buyer reluctance and developer lack of capital, China’s property markets are also seeing a tremendous slowdown in new housing starts since 2020.

Thus we see how China’s property markets are collapsing. It is not merely that prices are falling, nor that overall revenues from home sales are falling. Developers are building less because home buyers are less interested or less able to purchase homes in the economic aftermath of Xi Jinping’s “Zero COVID” polices.

Reduced construction activity is reducing China’s demand for steel, which is being reported as leading to a decline in iron ore prices.

Futures for iron ore have been sliding last week in Singapore, as have Chinese futures and steel contracts in Shanghai. Inventories at major Chinese steel mills jumped more than a quarter over the past few weeks.

Overcapacity has long been a problem, despite Beijing’s efforts to limit steel production, with about 500 steel mills in the country. Demand from the local property sector — which, as the hungriest sector, accounts for over a third of China’s total steel consumption — remains depressed with no end to the real estate crisis in sight.

Not only is demand for construction inputs such as steel falling, but land sales are diminishing, dropping by more than 13% in 2023 alone.

Revenue from the sale of land-use rights in China, a critical source of income for local governments, fell by 13.2% in 2023 as the country's deep real estate recession hit municipal finances hard.

The data, released Thursday by China's Finance Ministry, shows that sales dipped to their lowest since 2017. Sales declined for a second consecutive year for the first time since 2012, the earliest data available.

Lack of land sales is eviscerating local government finances, and even financial hub Hong Kong is facing mounting budget deficits as a direct result, according to Hong Kong finance minister Paul Chan.

The minister had predicted the city would record a deficit of HK$54.4 billion during last year’s budget, but he updated the figure to HK$101.6 billion on Wednesday. The government’s revised revenue stood at HK$554.6 billion, which was HK$87.8 billion – or 13.7 per cent – lower than the original estimates.

“Revenue from land premium is HK$19.4 billion, substantially lower than the original estimate by HK$65.6 billion and also far lower than the previous year,” he said.

China’s housing slump is having contagion effects that are moving throughout China’s economy, and Beijing has no way to prevent it.

This, then, is the challenge for Beijing that China Vanke’s liquidity issues poses: as a state-owned enterprise, if Vanke defaults on its debt, Beijing will be seen as effectively defaulting on government debt. Already China Vanke’s crisis is creating a new crisis of confidence in China’s property developers, this time including even the state-owned firms.

If Beijing does nothing to bail out Vanke, and the firm collapses a la Evergrande, real estate activity is almost sure to dry up, as home buyers become increasingly reluctant to buy homes on pre-sale.

If Beijing does step in to bail out Vanke, the central government will have to take on significant additional debt—at a time when central government debt already outpaces that of the United States.

Coming so soon on the heels of Evergrande’s forced liquidation, Vanke’s debt troubles are in many respects far more serious to China.

Vanke’s cash crunch is coming after the real estate crisis has been unfolding for multiple years; Vanke amplifies and extends that crisis. Because of Vanke, the world has positive confirmation that not only is the real estate crisis nowhere near ending, the worst of the crisis has yet to unfold.

Without fresh capital, Vanke will leave multiple housing projects unfinished in the same manner Evergrande has—a situation that is a property crisis all on its own. Even with fresh capital to resolve its outstanding debts, as with Evergrande more capital on top of that is needed to complete unfinished projects.

No matter how China Vanke’s debt crisis resolves—as a state-owned enterprise it is unlikely Vanke will be forced into bankruptcy—that the crisis is happening at all is the strongest signal yet that China’s economy is not merely slowing, but is quite literally falling apart.

There is no talk of “soft landings” for China’s economy. China Vanke proves that none are even remotely possible. That landing is going to be hard, is going to be painful, and is going to do lasting damage.

China needs to consult the 'experts' in the Biden Administration.

Peter, this is downright exciting, and “insurmountable problem” sums it up! Here we are watching in real time as the world’s second-largest economy accelerates its complete unraveling. You can just imagine the scrambling behind the scenes in China, as local officials and bankers try to prevent from being blamed as the scapegoat, and financially ruined in the process. Suppose you are a banker, being pressured by all-powerful Authorities to bail out billions of dollars of really bad loans. If you do so, your bank will take a huge loss and YOU will get the blame - ruined! If you refuse to lead your bank into financial destruction, the Authorities will literally take you to prison, and vilify you - ruined! The upper classes of China are probably scheming ways to get their families and wealth out of the country as fast as they can. (This is what happened in Venezuela, by the way, as the country accelerated to economic ruin - those who could, got out!)

Another thing that astounds me is that the average American has no idea this unraveling is happening. The MSM is busy giving Americans fluff news about which pop star is dating which athlete - while epic, historic changes are happening in countries like China and Argentina. I am indebted to you, Peter, for succinctly giving us all the hard data and details which make us actually informed and able to truly understand. Once again, thank you!