Everyone Is Hopeful On The Economy. Should They Be?

Is The Economy About To Turn? Which Way—Up Or Down?

Is the US economy getting better? Is it getting worse?

Is President Trump delivering on Agenda 47? Is he failing to do so?

The frustrating answer to all of these questions is “Maybe.”

That answer is frustrating because there are data points to support both narrative arcs.

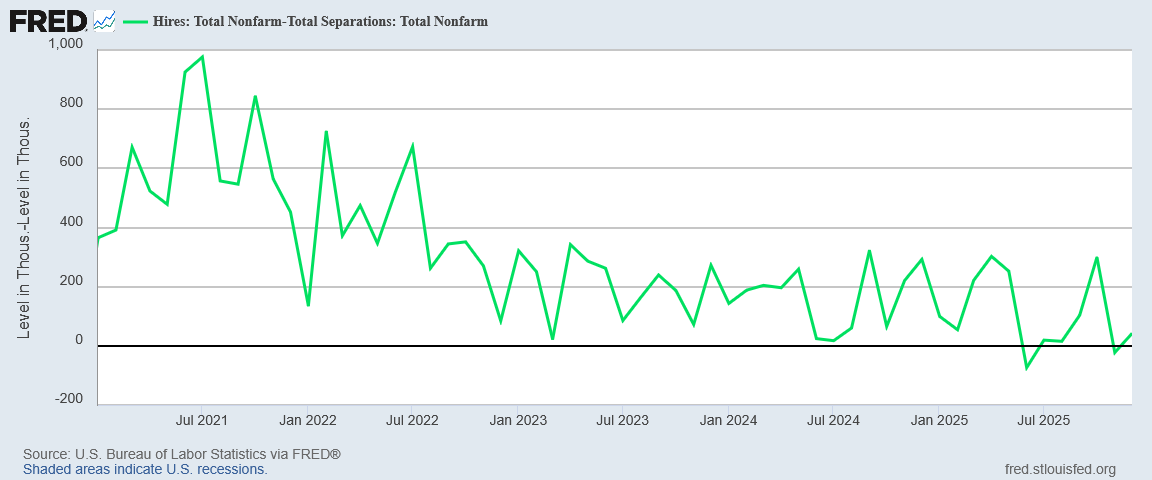

We have jobs data which support a thesis that the jobs recession is getting worse, which is not a narrative of either economic or Trumpian success.

We have inflation data which support a thesis that the Liberation Day tariffs have not engendered renewed consumer price inflation.

We have manufacturing survey data which could suggest a turnaround in manufacturing is underway.

We have stock market data which chart Wall Street enthusiasm for the economy.

We have stock sell-off data surrounding Big Tech which could confirm the existence of a stock bubble in artificial intelligence as well as the bursting of that bubble.

All of these narratives have solid factual support. These are not corporate media fables, but arguably viable economic narratives.

All of these narratives suggest the economy may be reaching a turning point. Will the economy turn up or will it turn down?

Schizoid Wall Street Stories

We are compelled to ask such questions because even Wall Street is presenting divergent and even schizoid stories regarding the latest convolutions within financial markets.

Most notable in this regard has been Big Tech darling Amazon’s abrupt shedding of 9% of its market cap last Friday, as it led the way in a $1 Trillion stock market route of Big Tech stocks.

Amazon, Alphabet, Microsoft and Meta reported about $120 billion in capital expenditures in the fourth quarter alone. That figure could exceed more than $660 billion this year, the Financial Times reported, which is higher than the gross domestic product of countries like the United Arab Emirates, Singapore and Israel.

Wall Street has responded differently to the companies’ spending plans, cheering Meta and Alphabet’s forecasts, while punishing Amazon and Microsoft.

Amazon, Microsoft, Nvidia, Meta, Google and Oracle collectively shed more than $1 trillion from their valuations over the past week, according to FactSet data.

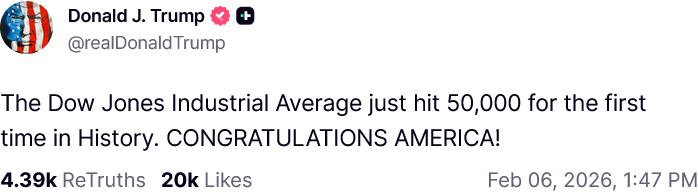

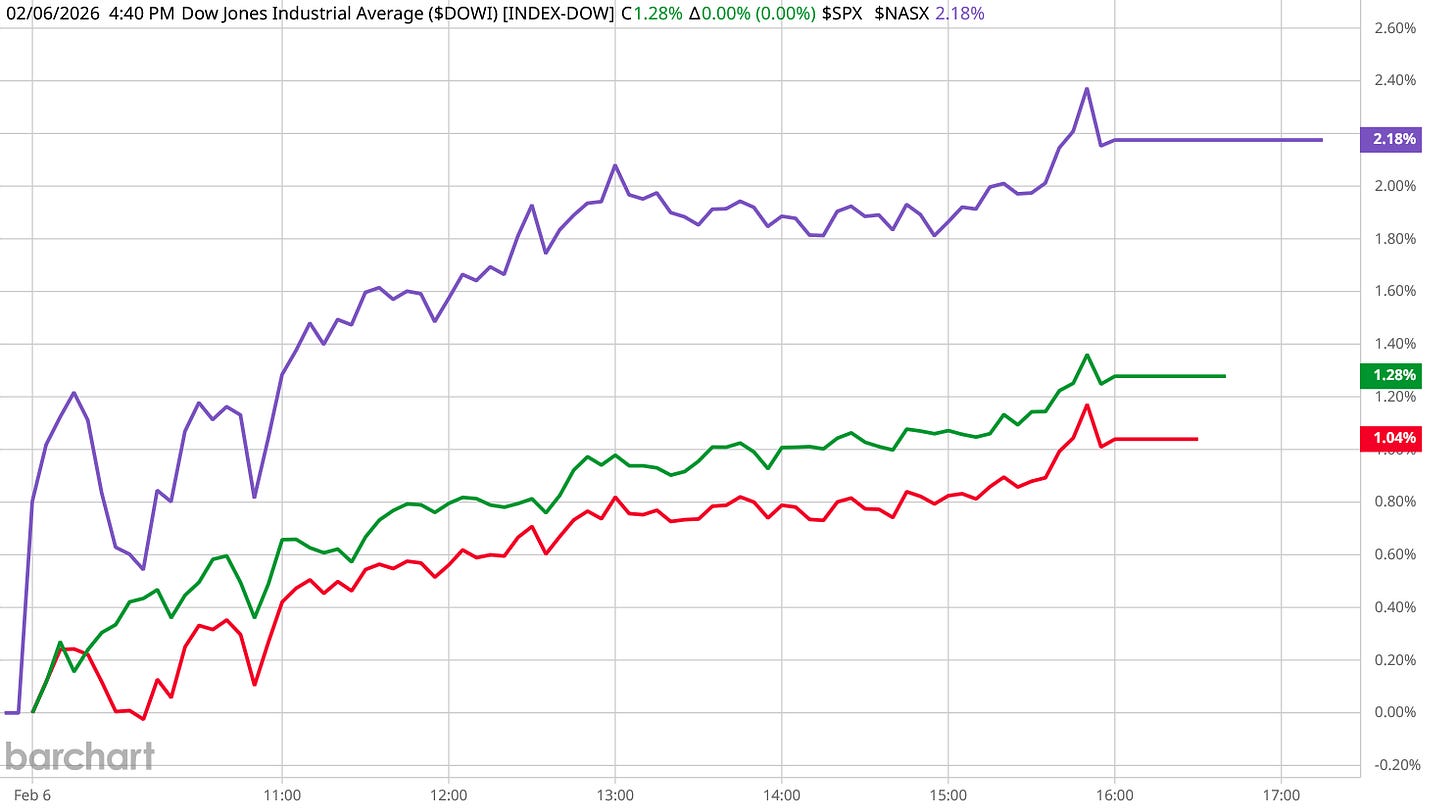

At the same time, the Dow Jones closed above 50,000 for the first time ever.

The Dow Jones Industrial Average advanced 1,206.95 points, or 2.47%, closing at 50,115.67. Friday marked the first time the Dow exceeded the 50,000 level. The S&P 500 jumped 1.97% and ended at 6,932.30, while the Nasdaq Composite advanced 2.18% to 23,031.21. With those moves, the S&P 500 climbed back into the green for 2026.

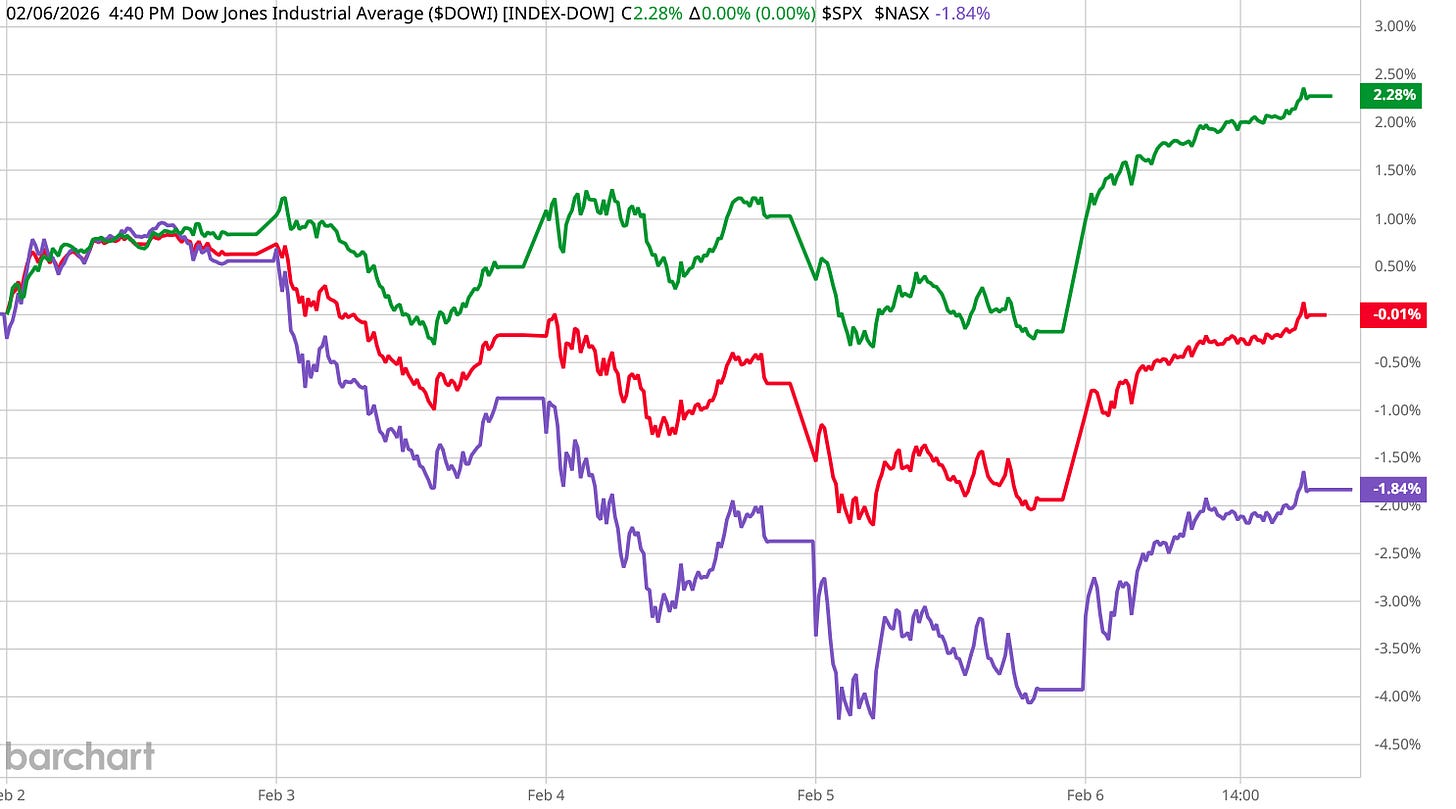

Even with Friday’s pop, the S&P 500 posted a 0.1% decline for the week, while the Nasdaq fell 1.8% on the week. The 30-stock Dow rose 2.5% week to date, benefiting from some rotation into some economically cyclical stocks even as the overall market was weighed down by tech selling.

Elsewhere, speculation floated on Friday that the Artificial Intelligence stock market “bubble” had both been confirmed and potentially burst.

The immediate spark for the Friday sell-off was the Amazon fourth-quarter earnings report. The e-commerce giant projected that its capital expenditures would reach $200 billion in 2026. CNBC reported that Amazon’s Capex figure was $50 billion higher than expected, and the stock market reacted accordingly.

Speaking to CNBC, GAM Investments’ investment director Paul Markham explained why AI would affect these companies on the stock market.

“Questions over the extent of capex [capital expenditures] as a result of LLM build-outs, the eventual return on that, and the fear of eventual over-expansion of capacity will be persistent,” Markham told CNBC.

These were all stories which posted to various media outlets on Friday (February 6, 2026). On the same day we have reporting that Big Tech is crashing because of the AI bubble bursting and that equities overall are soaring to new highs.

How can both narratives occupy the same logical or even evidentiary space?

This is one moment when the underlying data does not show a clear trend.

Stocks Moving Up And Down

There is a psychological significance that Wall Street as well as most media attaches to the Dow Jones Industrial Average crossing a 10K threshold. As it is the oldest stock market index in the United States (as well as the world), its movements up and down have long been seen as charting the growth of equity markets overall.

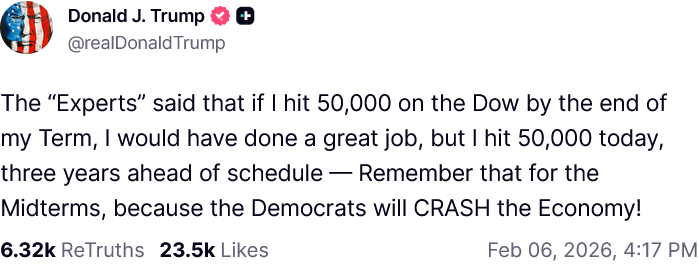

Thus even Presidents feel obliged to comment when the Dow crosses into new heights. President Trump was certainly no exception when the Dow pushed through 50,000.

While the Dow is the oldest index of US stocks, it is not the only one—and other leading indices did not print outcomes quite as optimistic as the Dow.

Both the S&P 500 and the NASDAQ Composite indices closed Friday down on the week.

While all three indices showed the same broad movement trends, the Dow was fortunate enough last week to have lost the least, leaving it up on the week even as the NASDAQ Composite gained the most on Friday.

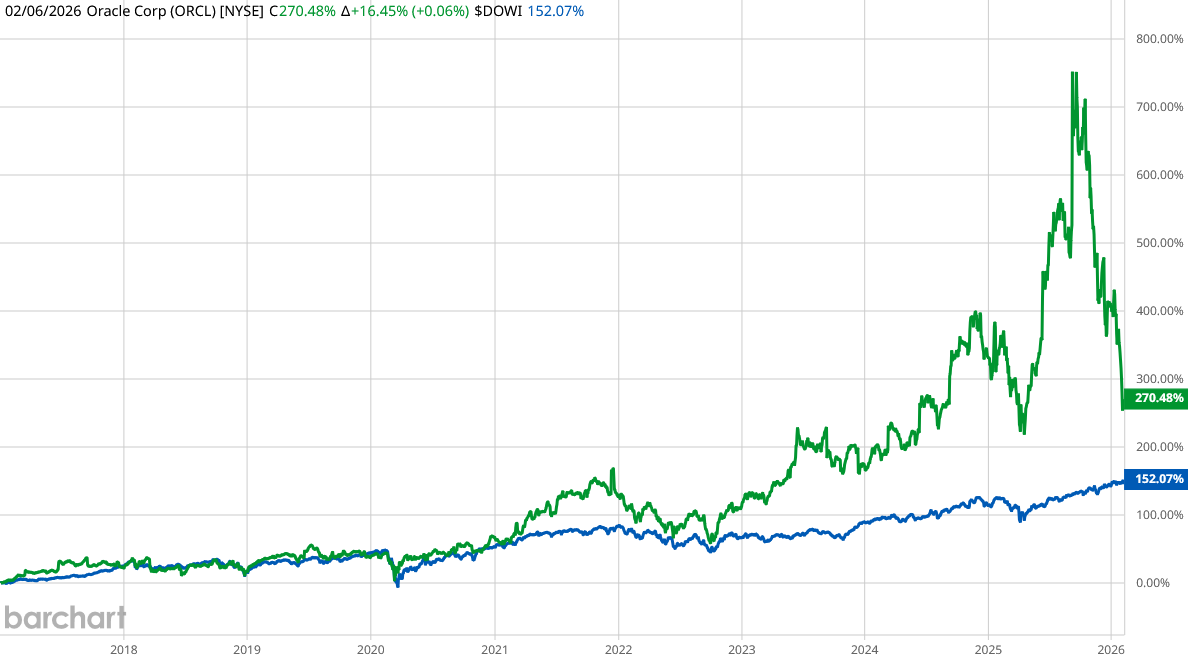

The NASDAQ’s gain is itself somewhat counterintuitive, as Amazon, Google, and NVidia—all part of the AI oligopoly—trade on the NASDAQ exchange, with Oracle among the few trading on the New York Stock Exchange.

Last week we were thus presented with a pardoxical movement of major stocks such as Amazon moving down, even as the broader indices moved up.

While this is not impossible, over the longer timelines, individual stock movements are far more likely to reflect the broader index movements even in times when individual gains outpace broad index gains. We see this exemplified in Oracle’s historical price movements vs the Dow since 2017.

Oracle’s recent movements contrary to the broader stock market trends are decidedly anomalous, as are Amazon’s and even Google’s to a degree.

These contrarian movements among major stocks force us to qualify any presumed economic signal Wall Street might be sending by moving the Dow to a record close. With the Dow up on the week and the S&P 500 and NASDAQ down on the week, market optimism is far from untrammeled.

Jobs Recession Is Still A Thing

The immediate contrast to last week’s apparent burst of Wall Street somewhat guarded optimism is naturally the data which shows the jobs recession in this country getting steadily worse.

Wall Street’s heady movements on Friday do not alter the employment situation printed in ADP’s latest National Employment Report, which showed unequivocally the jobs recession has been getting worse.

Yet it was scarcely a week prior to the ADP report that we had to consider the possibility that the jobs recession might at long last be coming to an end.

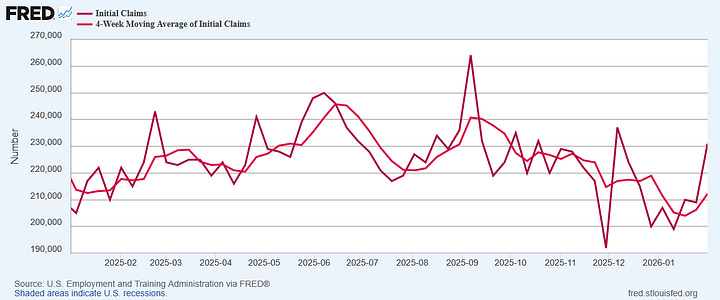

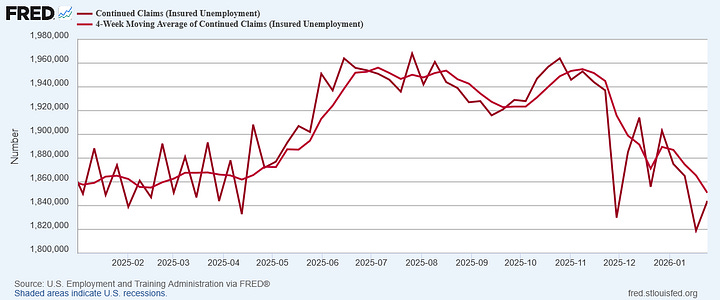

Ironically, right after that we saw both initial and continuing claims move sharply up again, confounding the optimistic narrative on jobs.

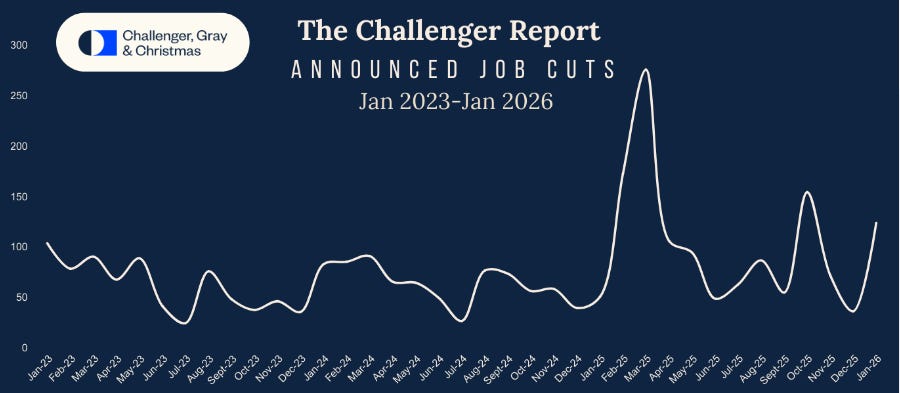

At the same time, executive placement firm Challenger, Gray, and Christmas announced that January, 2026 was one of the worst layoff months in years, and the worst hiring month on record.

January’s total is the highest for the month since 2009, when 241,749 job cuts were announced. It is the highest monthly total since October 2025, when 153,074 cuts were recorded.

“Generally, we see a high number of job cuts in the first quarter, but this is a high total for January. It means most of these plans were set at the end of 2025, signaling employers are less-than-optimistic about the outlook for 2026,” said Andy Challenger, workplace expert and chief revenue officer for Challenger, Gray & Christmas.

The Challenger Report confirms the steady decline in net hiring we have seen in this country since 2021.

Whatever optimism Wall Street may have about the economy is further tempered by the preponderance of evidence that the jobs recession is not yet ending.

No Inflation Now, Nor Later

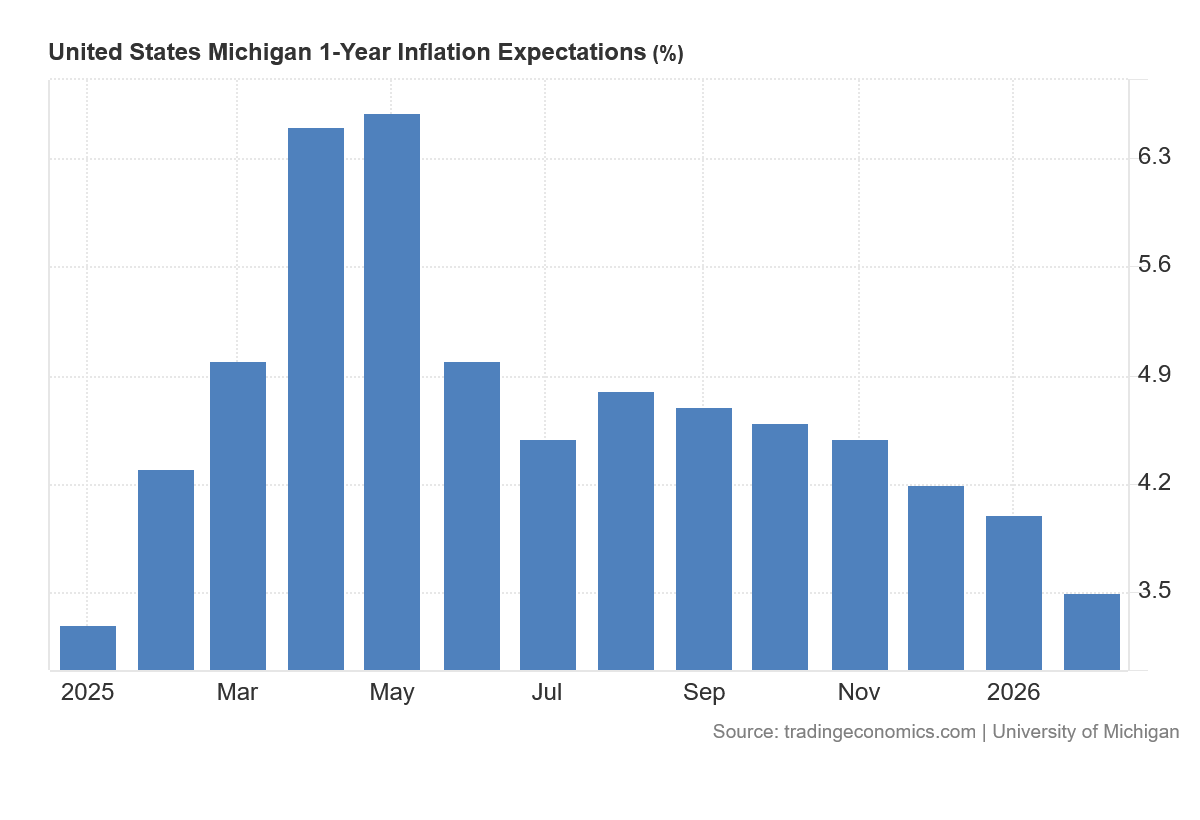

While the jobs outlook is far from optimistic, the inflation outlook in this country has been improving for several months. In the most recent survey by the University of Michigan, consumer expectations for inflation 12 months from now dropped to 3.5%.

While inflation expectations had surged during the first part of 2025, and especially on the heels of President Trump’s announcement of the Liberation Day tariffs, consumer expectations on inflation have been trending down ever since.

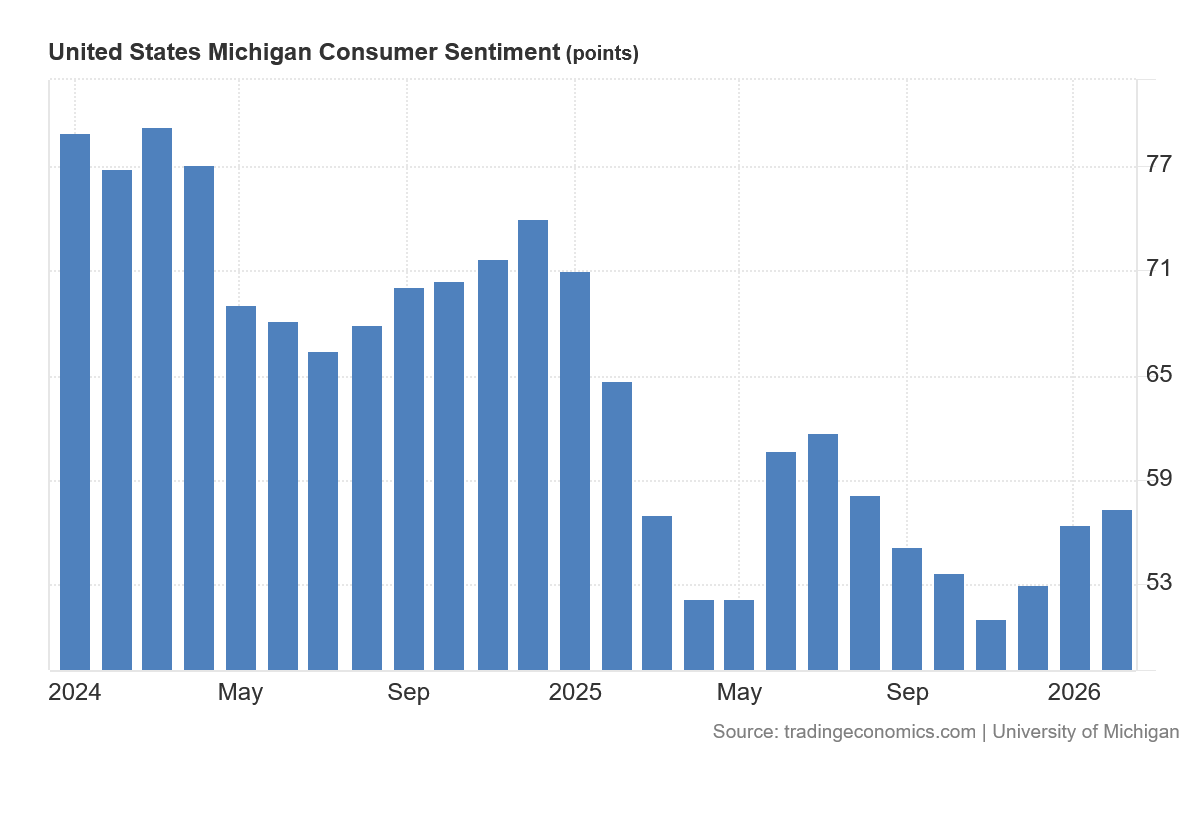

At the same time, the survey found consumer sentiment trending up overall.

While consumer sentiment remains lower than it was in 2024, over the past few months the trend has been positive. People appear to be feeling better about where their purchasing power will be one year from now.

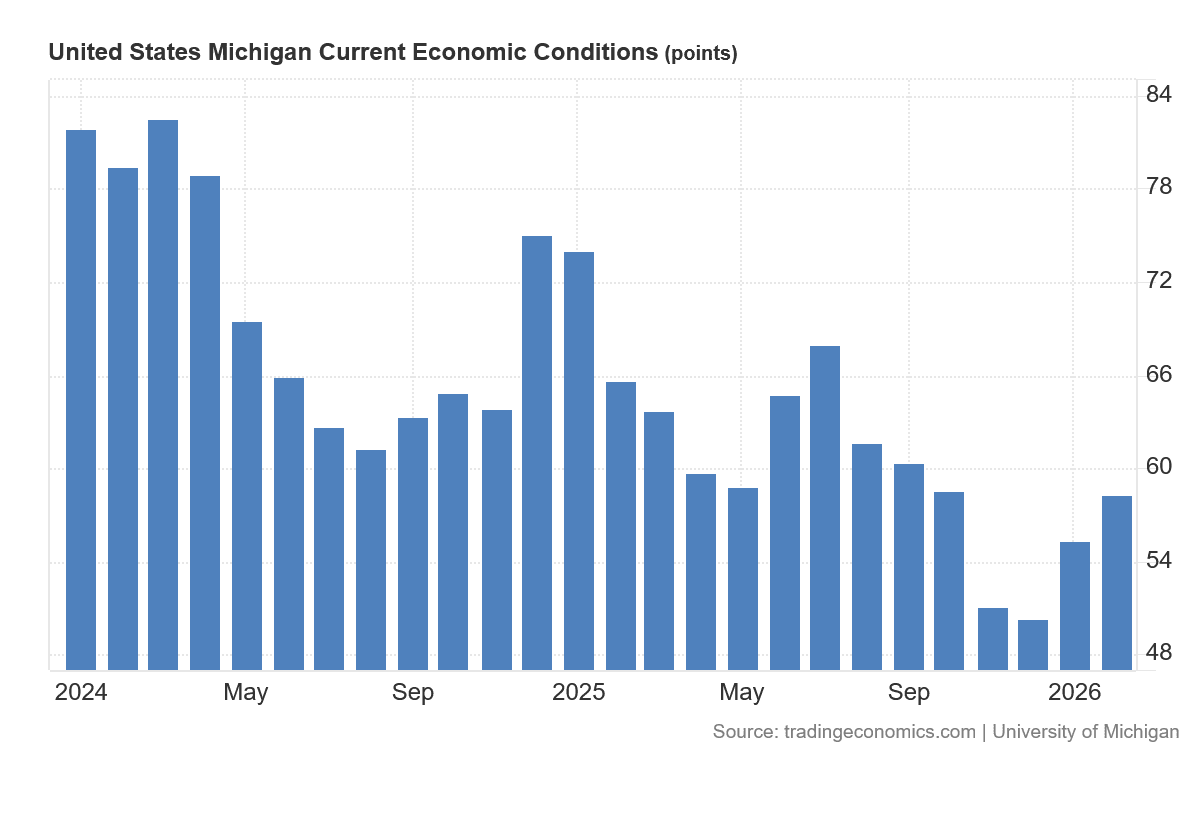

This is expectation by the consumer is bolstered by the UMich survey also showing consumer appraisal of the economy is improving as well.

The University of Michigan survey is significant because it tells us how Main Street view the US economy, broadly speaking. Consumer behavior is driven as much by perceptions as by the realities charted by the hard data, and growing consumer optimism is an ironic but essential ingredient in initiating any economic recovery or expansion.

Despite the Democrats’ best efforts to weaponize the issue of “affordability”, their narratives on this topic are not being believed by the broader electorate. The improving consumer sentiment charted by the University of Michigan survey shows the Democrats message is largely falling on deaf ears. If the survey is at all accurate, the Democrats will have to majorly overhaul their campaign messaging as we move closer to the November mid-term elections.

Inflation Hedges Hedging

On the off chance that the economic outlook is still insufficiently muddled, we must also look briefly at the odd behaviors of Wall Street’s two preferred inflation “hedges”: Gold and Bitcoin.

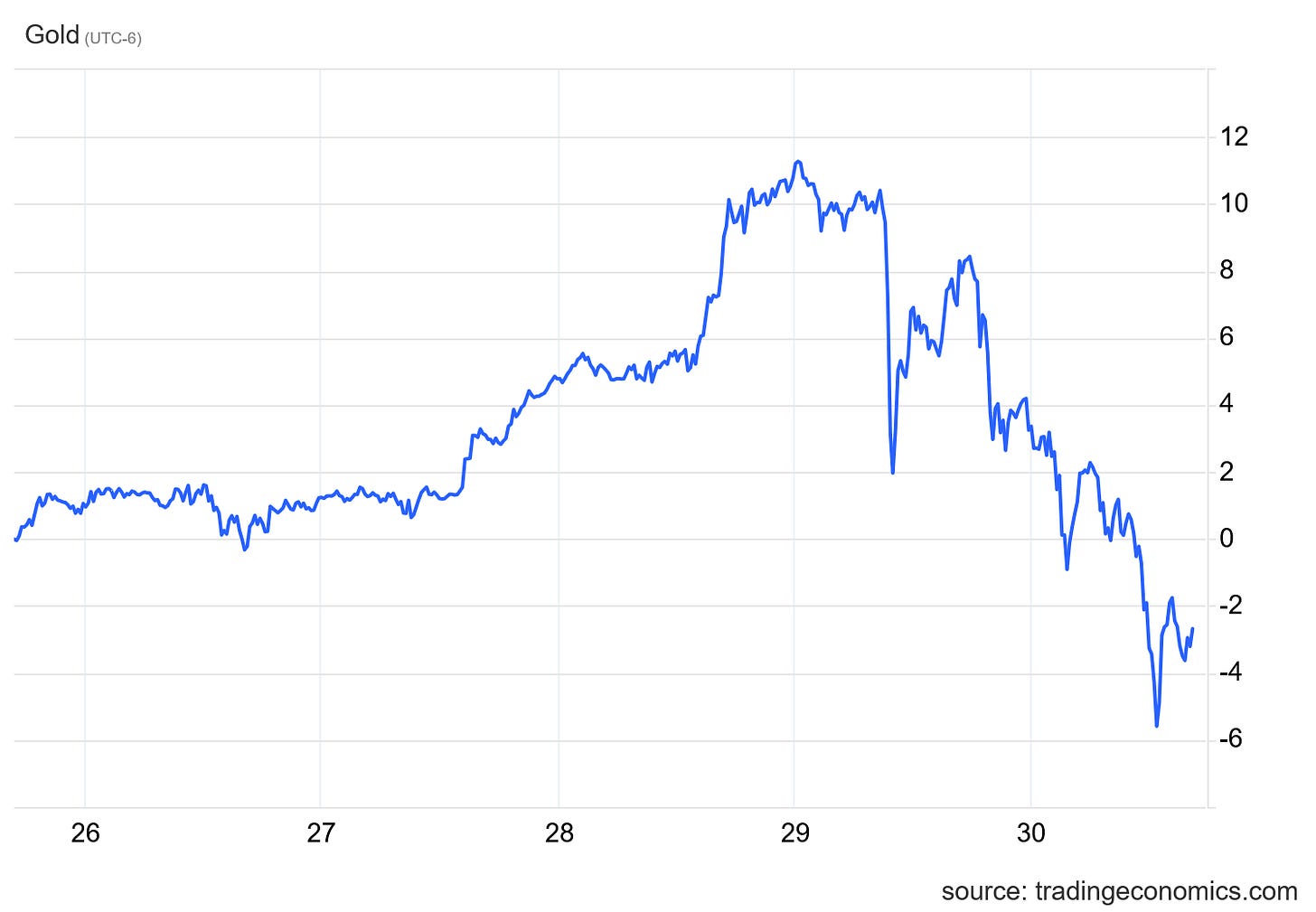

Gold had been enjoying a surge in value in recent weeks, but reversed when the Trump Administration announced it would be nominating Kevin Warsh to replace Jerome “Too Late” Powell as Chairman of the Federal Reserve.

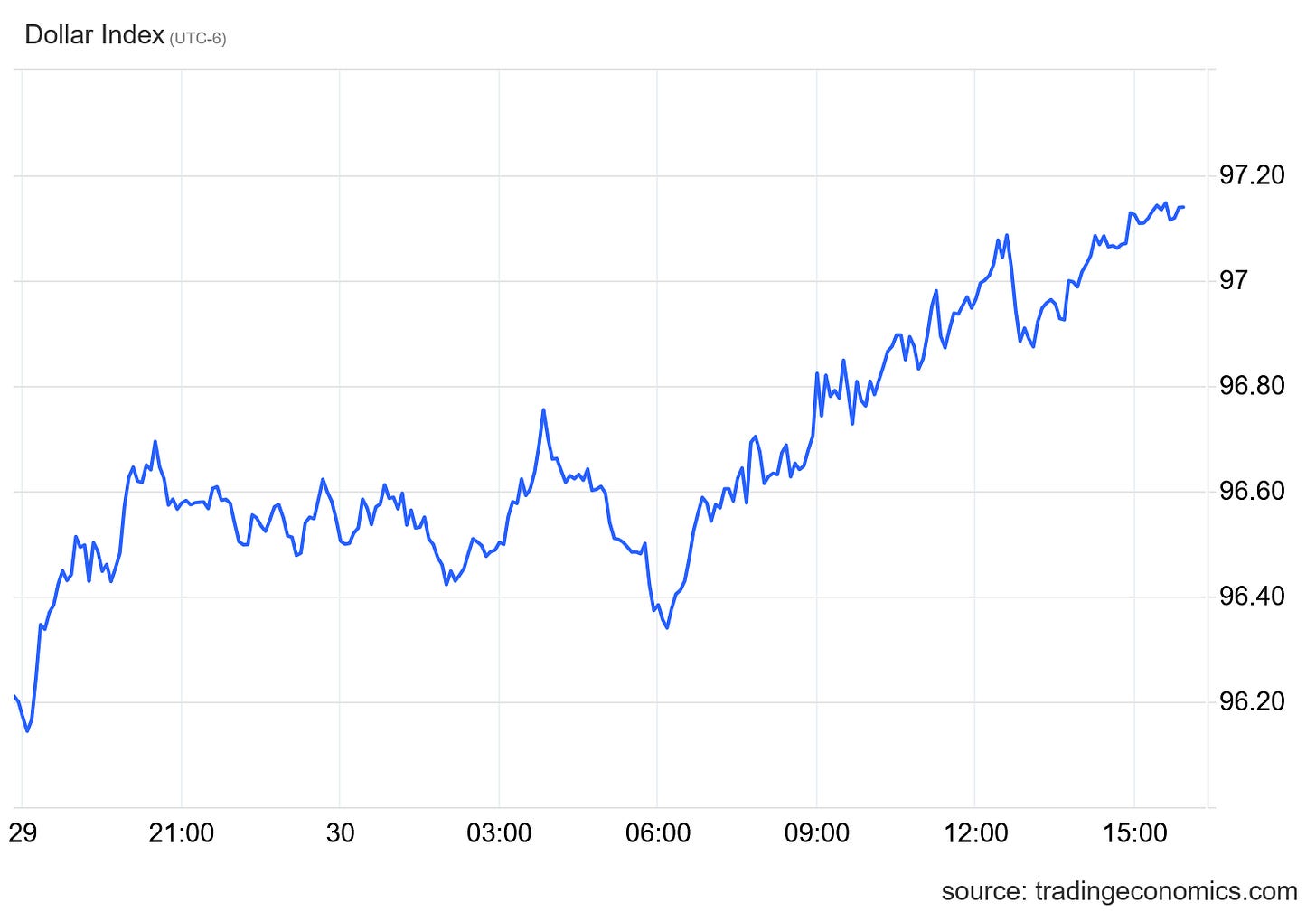

The concurrent recovery in the Dollar Index on forex markets was a further confirmation that the Warsh nomination was well received on Wall Street.

We should note that gold had also reached an apparent plateau the night before the nomination announcement. While the Kevin Warsh nomination has been broadly seen as reassuring financial markets that a relatively hawkish Federal Reserve chair would be taking Powell’s place, we should not discount the potentials for profit-taking by investors as additional forces leading to the price of gold dropping precipitously. As I noted at the time, the selling pressures were already there, and the Warsh announcement was quite possibly merely the signal needed to release those pressures.

Bitcoin had a similar response as gold to the Warsh announcement, shedding considerable value on January 30 and 31.

What is remarkable about Bitcoin, however, is that it has been declining for some months now, having peaked back in October. Its behavior since then has been distinctly contrary to the trend in gold prices.

This is remarkable because both Bitcoin and gold are widely viewed as “hedges” against inflation in the dollar. Theoretically, as concerns over inflation and overall dollar strength increase, investors look to precious metals such as gold as well as crypto to preserve investment value. For this reason, gold and Bitcoin arguably should move broadly along similar trend lines.

As I observed in a Substack Note last week, that theory has been put to the test of late.

Even finance Substack Quoth The Raven has suggested “this time may be different.”

So if adoption was the rocket fuel, a fair question now is: how much is left in the tank?

That’s the core of the bearish argument. If nearly everyone who wants Bitcoin in the United States already has easy access to it, then where does the next wave of buyers come from? When your barber, your dentist, and your aunt’s financial advisor all know how to buy BTC, you’re not early anymore. You’re late-stage. If demand has peaked, then the recent crash isn’t just noise. It’s the market quietly admitting that the story may be running out of new chapters.

In that scenario, the downside could be ugly. Not just another dip-and-rip cycle, but something more structural. A slow bleed. A loss of cultural relevance. A gradual realization that Bitcoin might survive, but mostly as a niche asset rather than a world-changing revolution. Gold bugs would feel vindicated. Crypto Twitter would feel tired. Venture capital would move on to the next shiny thing…probably some AI-related bullshit.

In the short term, we are not seeing the apocalyptic scenario for Bitcoin play out (yet). It surely is instructive that Bitcoin reached its floor at the same time gold as well as silver reached theirs.

By week’s end, Bitcoin retained its status vis-a-vis gold as a hedge against inflation (and fiat currencies more broadly), although the relative valuations appear to have shifted dramatically in favor of gold.

The significance of these shifts lie in the narratives underpinning the investment cases for both gold and Bitcoin. If these assets are hedges against inflation, or even if they are merely regarded as hedges against inflation, a decline in the price of gold and/or crypto is a market signal that inflation is not a serious concern to investors over at least the near term. Lowered inflation concerns, catalyzed presumably by President Trump’s nomination of Kevin Warsh to replace Jay Powell, in turn catalyze investors to move out of the hedging assets such as gold and crypto and into other assets. Easing the inflation concern reduces the relative attractiveness of “safe” assets.

What does this portend for the overall economy? Along with surging stock valuations the decline in gold and Bitcoin pricing is a strong signal that Wall Street is not anticipating inflation heating up in the short term at least. Although the corporate media narrative has long been that President Trump’s tariff strategies would result in elevated levels of consumer price inflation, Wall Street is apparently no longer as worried. Not only have the elevated inflation rates not materialized, Wall Street is much less concerned about them materializing in the future.

Wall Street is echoing the same sentiment on inflation that Main Street showed in the University of Michigan survey. Whether because of Trump’s policies or in spite of them, the broad assessment of the United States on the future of the US economy is that there will not be much inflation.

These are positive economic signals for any economy, and they are a reason to lean towards more optimistic narratives on the US economy overall.

Positive Signs In Manufacturing

Longtime readers will know that I put particular emphasis on manufacturing. My view of economic prosperity is that we do better overall when we are able to make more “things”. Improvements to the manufacturing sector of the economy deliver comparatively greater macroeconomic benefits than improvements in any of the service sectors.

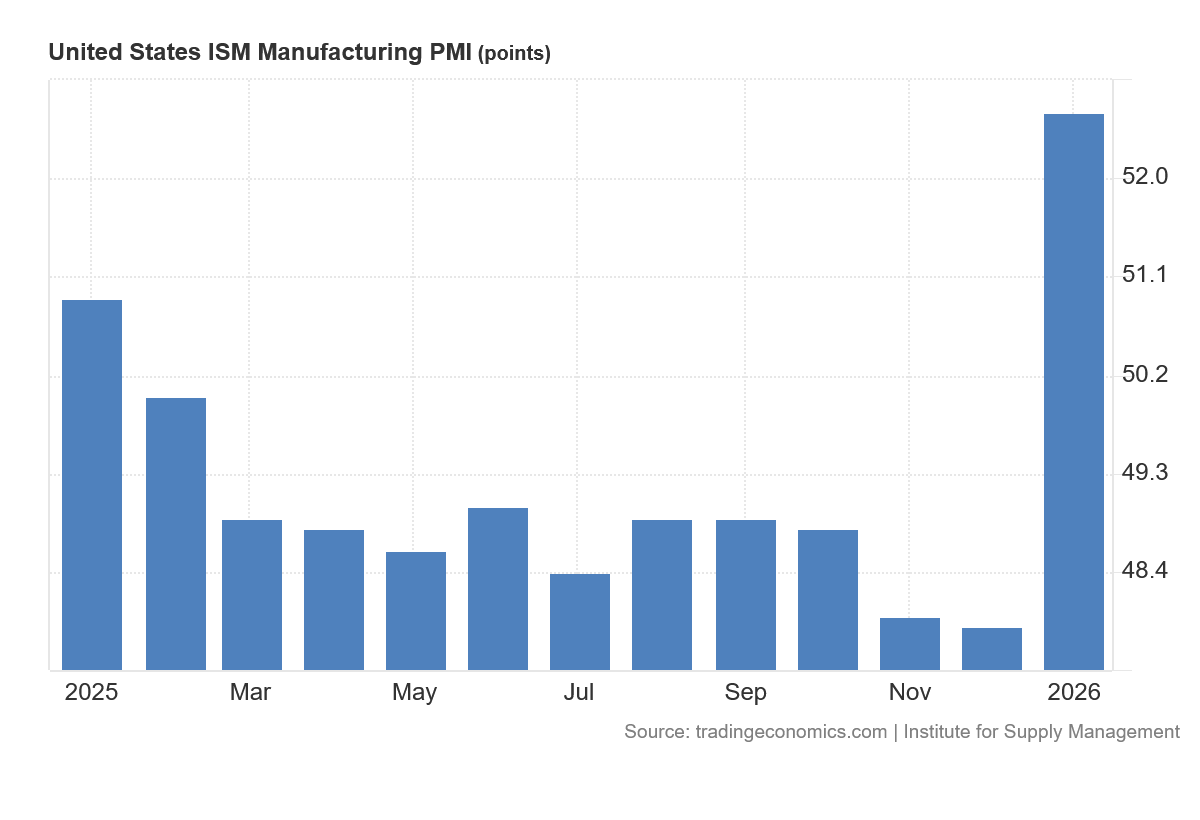

We definitely are seeing a preliminary sign of resurgent manufacturing health in this country when the Institute for Supply Management’s Manufacturing Purchaser’s Management Index surged back into expansion territory, rising to 52.6.

Note that, in PMI reporting, any number above 50 indicates expansion, while any number 50 or below indicates contraction.

While the surge in the ISM PMI could quite easily prove “too good to be true,” there is no escaping that it is good news.

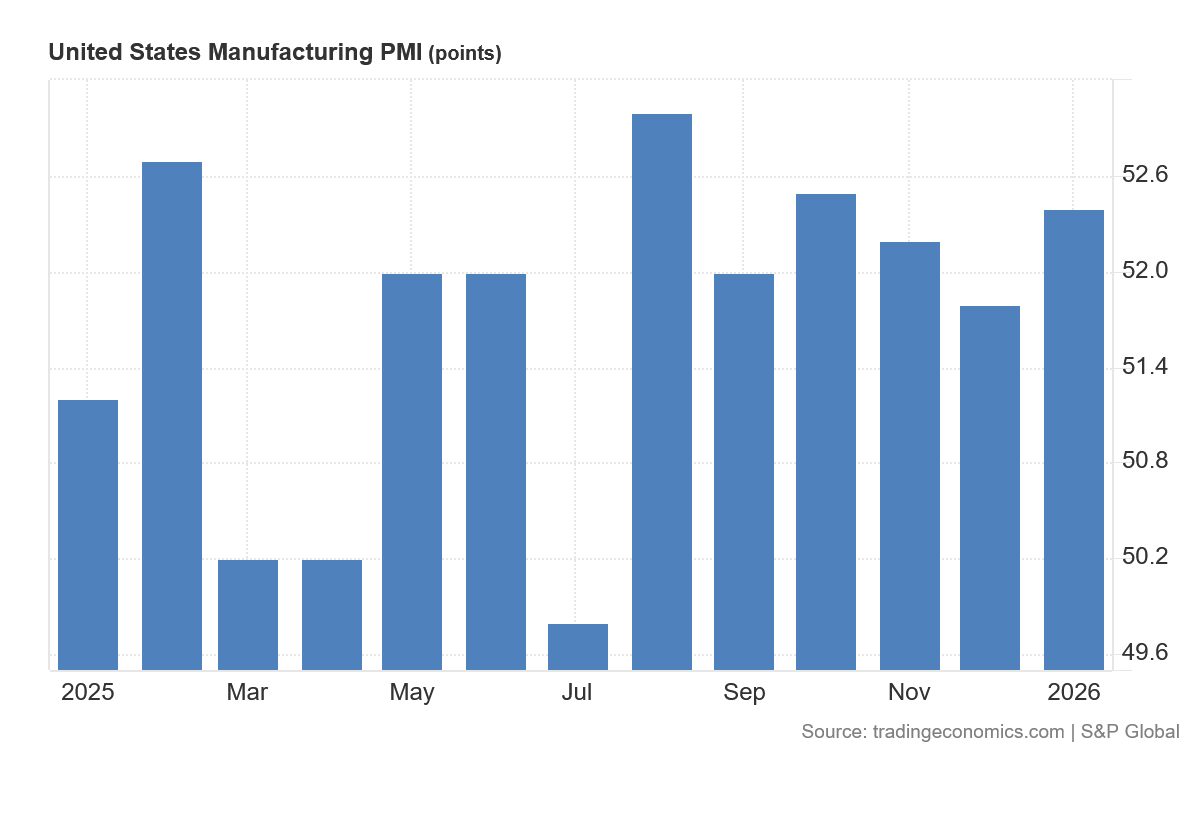

The ISM PMI is backed up by the S&P Global PMI, which charts a similar PMI value, confirming expansion for the sector.

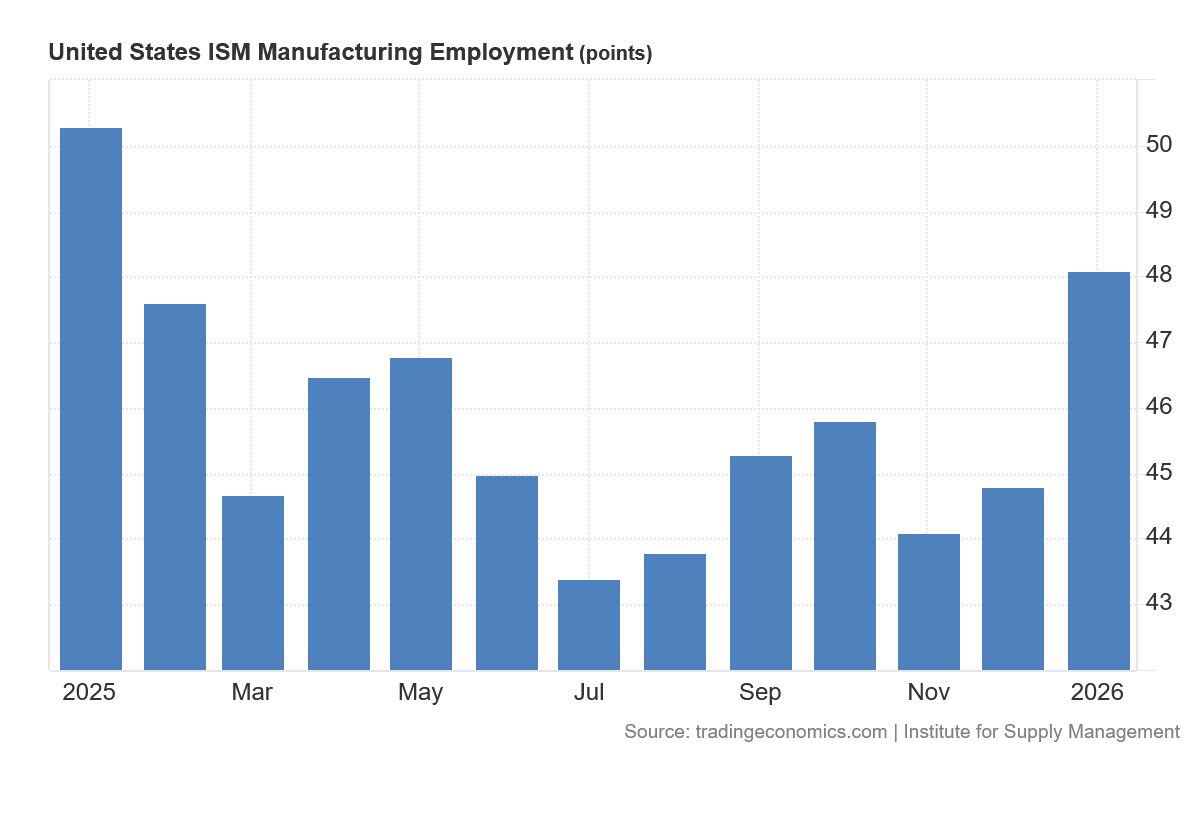

The ISM manufacturing employment data also hints at a bit of optimism with its rise to 48.1 for January.

At 48.1, manufacturing employment is still in contraction, but the December reading could indicate that a recession bottom has been reached, and that manufacturing may be on course to see some rising employment for a change.

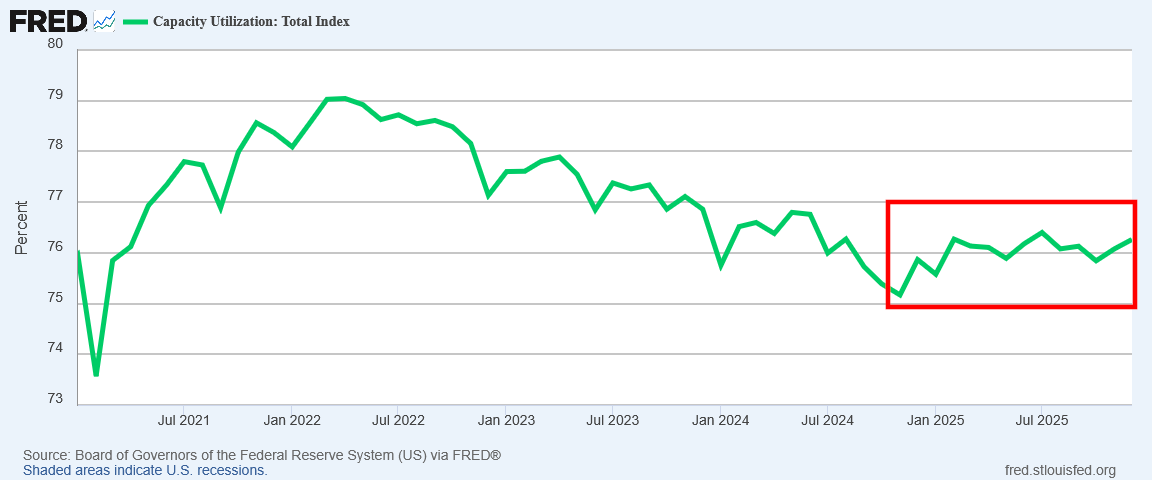

Further bolstering an optimistic outlook in manufacturing especially is the Federal Reserve’s data showing a steady rise in capacity utilization throughout 2025.

While this increase in capacity utilization has not translated (yet) into an improved employment outlook, the more industrial capacity is put to use the greater the demand should be for manufacturing labor. If this trend continues we should expect to see improvements in manufacturing employment at some point.

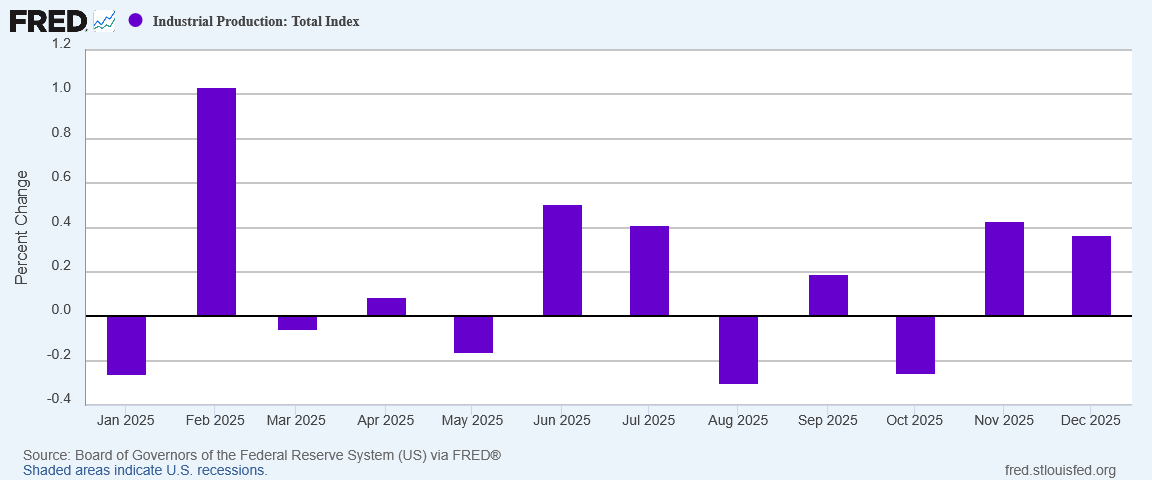

The upward trend in capacity utilization is further amplified as a positive signal in the economy by the rising industrial production index, which in December printed a 0.4% month on month gain for the second month in a row.

Recalling that Donald Trump made making the United States a manufacturing superpower part of Agenda 47, these data points indicate that he may be making substantive progress on achieving that agenda item. This does not make the jobs recession any less of a reality, or mitigate the employment bloodbath that we have been seeing in manufacturing throughout all of 2025, but if these positive trends in manufacturing continue, we should see them translate into employment gains for manufacturing.

Ending manufacturing job loss will go a long way to ending the jobs recession in this country.

Turning The Corner?

A principal challenge in analyzing economic data is identifying when there is a trend reversal—when expansion genuinely turns into contraction and vice versa. We have to always be open to the possibility of the trend reversal, because if we are not, we are no longer looking objectively at the data. Instead, we are subscribing to one narrative or another—and that never ends well.

Is the data showing a trend reversal in the economy? Is the jobs recession about to turn into a jobs expansion?

For months we have seen manufacturing present a worsening outlook in the ISM PMI, and even the S&P Global PMI, which generally shows a more optimistic perspective, has been showing a weakening sector in recent months.

While manufacturing employment is still shrinking, according to the ISM data, the sharp move up in the index value suggests that manufacturing employment may have finally found an employment bottom, which would suggest that future expansion is coming sooner rather than later.

If manufacturing employment is about to turn a corner from contraction back into sustained expansion, we may also be about to turn a corner where the jobs recession ends and a sustained jobs expansion begins.

The jobs data itself does not show an end to the jobs recession. If we look just at the jobs data we have no good reasons for economic optimism. If we look at just the jobs data, we are reminded that President Trump’s “Golden Age” has not yet been felt by most of Main Street.

Despite this, however, Wall Street and Main Street broadly are showing greater optimism about the economy going forward. While the correlation between stock indices and the state of the overall economy has always been problematic at best, what is true is that rising share prices are an optimistic economic bet by Wall Street. The University of Michigan survey of consumer sentiment shows that Main Street increasingly shares Wall Street’s optimism.

Does the data prove either Wall Street or Main Street right? Are there genuinely good reasons to be optimistic about the country’s economic future?

There are some, principally in the capacity utilization and industrial production data. The rising manufacturing PMI data is another indicator that key sectors are starting to improve, or have been improving. These are not as compelling as sustained demonstrable job growth would be, but they are not meaningless data points either.

The jobs data says the jobs recession is still getting worse. Capacity utilization and industrial production data says the economy is poised to turn a corner.

Whether because of the data or in spite of the data, Wall Street and Main Street are in agreement that the bet to make is on the economy turning a corner.

Are they right? We won’t have a clear answer for several weeks yet, and perhaps not even for a few months. We could easily be well into the summer before we have clear indicators on where the economy is headed next.

Right now Wall Street and Main Street want to be hopeful. Hopefully, they’ll be proven right.

It’s truly wonderful how you always seem to address the topics that are on my mind, Peter - thank you! I was very perplexed last week when I saw that tech stocks lost one TRILLION dollars in value, at the same time that the Dow hit an all-time high. What the heck? Am I that stupid about finance? It’s reassuring that the geniuses are also scratching their heads. You’ve given us a smart and concise roundup on which to base our figuring going forward.

While we’re on the subject of finance, I’m been wanting to ask you what you think of the new Trump accounts for newborns. On the one hand, they may shore up the stock markets for decades, and prevent a collapse. On the other hand, are they just a new form of asset inflation?